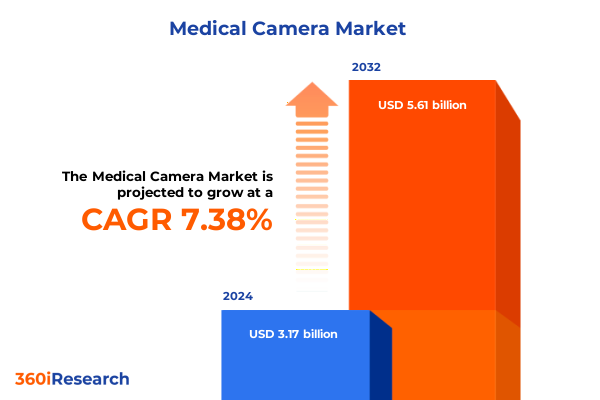

The Medical Camera Market size was estimated at USD 3.39 billion in 2025 and expected to reach USD 3.64 billion in 2026, at a CAGR of 7.44% to reach USD 5.61 billion by 2032.

Introduction to the Evolving Landscape of Medical Cameras Highlighting Technological Advances and Market Drivers Shaping Clinical Imaging Solutions

The medical camera market is experiencing a period of rapid transformation as advancements in optics, sensor technology, and data integration redefine the possibilities for clinical imaging. Fueled by the need for higher diagnostic precision, innovations in high-definition video capture and real-time imaging analytics have become integral components of modern healthcare delivery. Concurrently, the convergence of miniaturization trends and portable device capabilities is expanding the scope of point-of-care diagnostics, enabling practitioners to perform complex procedures outside of traditional hospital settings.

Regulatory agencies worldwide are adapting to the influx of digital imaging solutions by streamlining approval pathways and establishing rigorous quality standards. These evolving frameworks are encouraging manufacturers to invest in robust validation processes and pursue interoperability with existing electronic health record systems. Meanwhile, mounting pressure to reduce healthcare costs while improving patient outcomes is driving the adoption of endoscopic and minimally invasive surgical techniques. As a result, clinical end users are increasingly prioritizing imaging platforms that offer both operational efficiency and superior visual clarity.

Moreover, the integration of artificial intelligence and machine learning algorithms into imaging workflows is unlocking new avenues for automated anomaly detection and predictive analytics. By leveraging advanced software tools alongside hardware enhancements, medical professionals are witnessing transformative improvements in diagnostic confidence. In this context, understanding the interplay between technological maturation and evolving clinical requirements is essential for stakeholders seeking to capitalize on emerging opportunities within the medical camera landscape.

Emerging Innovations and Disruptive Technologies Are Redefining Medical Camera Capabilities Driving Enhanced Diagnostic Precision and Operational Efficiency

Over the past several years, the medical camera ecosystem has been reshaped by disruptive innovations that extend far beyond incremental refinements. Digital imaging platforms have grown in sophistication, offering resolutions that capture anatomical detail with unprecedented clarity. Infrared imaging has emerged as a powerful adjunct, permitting visualization of vascular patterns and thermal signatures in real time. Liquid lens technology, meanwhile, has introduced dynamic focus adjustment capabilities without the need for bulky mechanical components, thereby enhancing the usability of portable systems in resource-limited environments.

In addition, optical coherence tomography has transcended its origins in ophthalmology to become a versatile tool for subsurface tissue scanning in dermatology and surgical applications. This diversification of core imaging modalities is complemented by the rapid integration of wireless connectivity solutions, enabling secure transmission of high-definition video streams directly to cloud-based analytics engines. Collectively, these shifts are forging a new paradigm in which edge computing, remote diagnostics, and telemedicine converge to deliver patient-centric care models.

As healthcare providers worldwide seek to modernize their infrastructure, compatibility with artificial intelligence–driven diagnostic platforms is emerging as a key differentiator among device manufacturers. By embedding advanced algorithms into camera firmware, vendors can facilitate real-time decision support, reducing the cognitive burden on clinicians. This technological fusion has also catalyzed partnerships between imaging specialists and software developers, driving the co-creation of end-to-end solutions that address complex clinical workflows. Consequently, the medical camera sector is entering an era characterized by multidimensional innovation and cross-disciplinary collaboration.

Analyzing the Cumulative Impact of United States Tariff Adjustments Introduced in 2025 on Medical Camera Supply Chains Pricing and Competitiveness

In 2025, the United States implemented revised tariff schedules targeting several categories of imaging components, introducing new duties on high-performance lenses, specialized camera sensors, and advanced lighting modules. These measures, aimed at protecting domestic manufacturing and encouraging local investment, have rippled throughout the global supply chain. Manufacturers reliant on imported optics and electronic assemblies have encountered increased production costs, which are gradually being transferred to end users through elevated price points.

To mitigate these headwinds, leading camera OEMs have accelerated efforts to diversify their supplier base by establishing strategic partnerships with regional producers in the Americas. Concurrently, some players have initiated nearshoring strategies, relocating critical assembly operations closer to key end-user markets. While these adaptations incur upfront capital expenditures, they also promise greater supply chain resilience against future trade policy fluctuations. Moreover, domestic component innovators are capitalizing on the tariffs by expanding their manufacturing footprints, thereby fostering an ecosystem of co-located design and production facilities.

Despite short-term cost pressures, the longer-term effect of the tariff realignment may be to stimulate technological self-sufficiency within the United States. Investment in advanced sensor fabrication and precision optics machining has gained momentum, underpinned by government incentives for semiconductor and photonics research. As a result, the medical camera industry is poised to benefit from improved localization of critical components, reduced lead times, and enhanced intellectual property control. Stakeholders that proactively adjust their sourcing and manufacturing approaches will be best positioned to sustain competitive pricing and maintain market share in a landscape defined by evolving trade dynamics.

Strategic Segmentation Analysis Reveals Distinct Trends Across Product Types Components Resolutions Technologies Operational Modes and Distribution Channels

A nuanced understanding of market segmentation reveals how varying customer requirements and application contexts drive unique product development trajectories. Cameras designed for dental procedures demand specialized form factors and ergonomic designs tailored to intraoral access, while dermatology devices prioritize high-resolution surface imaging to detect minute skin irregularities. In contrast, endoscopy systems emphasize comprehensive illumination and field-of-view optimization for minimally invasive surgical interventions. Ophthalmology cameras require ultra-fine optical coherence tomography modules to capture retinal cross-sections, and surgical microscopy platforms integrate multi-axis zoom and stabilized lighting to support intricate operative fields.

Beneath these product distinctions lies a component ecosystem where camera sensors and lenses coalesce with display monitors and advanced lighting modules to deliver robust imaging performance. High-definition resolution has become synonymous with diagnostic accuracy, yet standard-definition platforms persist in cost-sensitive environments where fundamental visualization suffices. Simultaneously, the rise of infrared imaging modalities and liquid lens assemblies underscores the importance of technology-driven differentiation. Some manufacturers are incorporating adaptive focus mechanisms and spectral filters to address specific clinical use cases, further illustrating the diversity of technology adoption.

The marketplace also differentiates devices by operational mode, where portable, battery-powered units empower mobile clinics and emergency response teams, while tabletop configurations remain the mainstay of hospitals and ambulatory centers seeking fixed installations. Distribution channels reflect this dichotomy: offline medical device distributors maintain an essential role in facilitating hands-on demonstrations and technical support, whereas online platforms offer expedited procurement and broadened geographic reach. Ultimately, the end-user profile-ranging from ambulatory surgical centers and specialty clinics to large hospital networks-dictates the convergence of these segmentation parameters into tailored imaging solutions.

This comprehensive research report categorizes the Medical Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Resolution

- Technology

- Operational Mode

- Application

- End-user

- Distribution Channel

Comprehensive Regional Insights Uncovering Market Dynamics and Adoption Patterns Across Americas Europe Middle East Africa and Asia Pacific Landscapes

Regional dynamics shape both the adoption and evolution of medical camera technologies, reflecting differences in healthcare infrastructure, regulatory environments, and reimbursement models. In the Americas, growing investments in minimally invasive surgery and outpatient procedural centers are driving demand for compact, high-definition imaging platforms. Clinical stakeholders are particularly interested in devices that integrate seamlessly with electronic health record systems and support telehealth initiatives, enabling remote consultations and postoperative monitoring.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and cross-border procurement policies are facilitating the entry of advanced imaging technologies into diverse healthcare systems. In Western Europe, stringent data protection and medical device regulations have spurred manufacturers to enhance cybersecurity features and validate interoperability with existing healthcare IT architectures. Meanwhile, markets in the Gulf region are expanding rapidly, supported by government-led healthcare modernization programs that prioritize digital transformation and advanced diagnostics.

The Asia-Pacific region exhibits a broad spectrum of market maturity, from highly developed healthcare ecosystems with robust research capabilities to emerging economies balancing limited budgets against critical care needs. Large hospital networks in Northeast Asia are investing in state-of-the-art surgical microscopy and ophthalmic imaging systems, whereas Southeast Asian nations exhibit growing interest in portable camera platforms for rural outreach clinics. In parallel, local device makers are leveraging cost-efficient manufacturing bases to offer economically viable options, thereby intensifying competition and accelerating product customization for regional disease profiles.

This comprehensive research report examines key regions that drive the evolution of the Medical Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Insights Illuminate How Leading Medical Camera Manufacturers Are Innovating Strategically to Capture Diverse Clinical and Surgical Market Segments

Leading manufacturers have adopted diverse strategies to capitalize on evolving clinical and technological trends. Some incumbents have focused on incremental product enhancements, such as upgrading sensor sensitivity and streamlining sterilizable device surfaces to comply with rigorous infection control standards. Others have pursued aggressive consolidation, acquiring niche imaging specialists to broaden their technology portfolios and expand into adjacent application areas. Partnerships between optical component suppliers and software innovators have also gained prominence, reflecting the growing importance of integrated solutions that blend hardware performance with advanced analytics.

In addition to traditional camera OEMs, emerging players are challenging the status quo by offering modular platforms that can be reconfigured across multiple specialties. These entrants often prioritize open architecture designs, which facilitate third-party software integration and simplify system upgrades. Meanwhile, established brands are leveraging their clinical relationships to co-develop bespoke imaging packages, embedding proprietary AI algorithms for real-time diagnostic guidance. Investment in service and maintenance programs has likewise become a key competitive lever, as end users place a premium on uptime reliability and rapid field support.

Across the spectrum, sustainability initiatives are influencing manufacturing and packaging decisions. Companies are exploring recyclable materials for camera housings and collaborating with logistics partners to reduce carbon footprints associated with global distribution. By aligning product roadmaps with environmental stewardship goals, these firms are enhancing their brand equity among value-conscious healthcare providers and positioning themselves for long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Vision Technologies GmbH

- AMD Global Telemedicine

- Atmos Medizintechnik GmbH & Co. KG

- AVer Information Inc.

- B. Braun SE

- Basler AG

- Canfield Scientific, Inc.

- Canon Inc.

- Carestream Dental LLC by Envista Holdings Corporation

- Carl Zeiss AG

- ESC Medicams

- Haag-Streit AG

- Happersberger Otopront GmbH

- i-PRO Co., Ltd.

- IDS Imaging Development Systems GmbH

- IMPERX, Inc

- North-Southern Electronics Limited

- Olympus Corporation

- Optomed PLC

- Parallel Medical

- Pioneer Healthcare Technologies

- Richard Wolf GmbH

- S.I.M.E.O.N. Medical GmbH & Co. KG

- Smith & Nephew PLC

- Sony Corporation

- Stryker Corporation

- Topcon Corporation

- Videology Imaging Solutions, Inc. by inTEST Corporation

- Watec Co., Ltd.

- Zowietek Electronics, Ltd.

Actionable Recommendations Empower Industry Leaders to Embrace Innovation Strengthen Resilience and Elevate Patient Care through Medical Camera Solutions

Industry leaders should prioritize strategic investments in next-generation imaging technologies while managing the balance between innovation and cost containment. By embracing modular hardware architectures that accommodate both digital and infrared modalities, companies can streamline product development cycles and offer tailored solutions across multiple specialties. Simultaneously, fostering collaborative ecosystems with AI developers will enable the creation of turnkey platforms that deliver actionable diagnostic insights in real time.

To address supply chain vulnerabilities exposed by recent tariff shifts, organizations must diversify sourcing strategies and cultivate relationships with regional component suppliers. Establishing assembly and test operations in proximity to key end-user markets will reduce lead times and mitigate the impact of future trade policy changes. At the same time, organizations should enhance demand forecasting capabilities by leveraging advanced analytics, ensuring more accurate production planning and inventory management across global distribution networks.

Moreover, market participants must align their go-to-market approaches with evolving clinical workflows. Engaging with ambulatory surgical centers and specialty clinics through tailored service offerings and bundled support packages can accelerate adoption of portable and tabletop camera systems. In high-potential regions, targeted pilot programs that demonstrate clinical efficacy and cost-benefit outcomes will build credibility among healthcare decision-makers. Ultimately, a holistic strategy that integrates technological leadership, supply chain resilience, and customer-centric engagement will be instrumental for capturing value in the dynamic medical camera landscape.

Transparent Research Methodology Explaining Data Collection Analytical Framework and Validation Processes Underpinning the Medical Camera Market Analysis

The research underlying this analysis was conducted through a combination of primary and secondary methodologies to ensure comprehensive coverage and data integrity. Primary data collection involved structured interviews with key opinion leaders, including imaging specialists, biomedical engineers, and procurement executives from diverse healthcare settings. These conversations provided qualitative insights into clinical requirements, purchasing criteria, and technology adoption drivers.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, and publicly available company reports. Government publications and trade association databases were consulted to verify macroeconomic indicators, tariff schedules, and healthcare expenditure trends. Market intelligence platforms offered complementary information on recent product launches, patent filings, and M&A activity, which was cross-verified through multiple sources to ensure accuracy.

Quantitative analysis methods included data triangulation, wherein information from different sources was reconciled to validate consistency. Scenario analysis was used to assess the potential impact of tariff changes and regulatory shifts on supply chains and pricing dynamics. The study also incorporated sensitivity testing to evaluate how variations in key parameters-such as component costs and adoption rates-could influence market behavior. Finally, a rigorous validation process, which included peer reviews by subject matter experts, guaranteed the robustness of the conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Camera Market, by Product Type

- Medical Camera Market, by Component

- Medical Camera Market, by Resolution

- Medical Camera Market, by Technology

- Medical Camera Market, by Operational Mode

- Medical Camera Market, by Application

- Medical Camera Market, by End-user

- Medical Camera Market, by Distribution Channel

- Medical Camera Market, by Region

- Medical Camera Market, by Group

- Medical Camera Market, by Country

- United States Medical Camera Market

- China Medical Camera Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Conclusion Highlighting the Strategic Imperatives and Future Outlook for Medical Camera Innovation Commercial Adoption and Market Resilience

In summary, the medical camera market stands at the crossroads of technological innovation and global market realignment. High-definition imaging, infrared modalities, and dynamic lens technologies are converging to redefine clinical workflows, while evolving trade policies and regional disparities are reshaping supply chain architectures. Stakeholders that embrace modularity, integrate advanced analytics, and diversify sourcing strategies will be best positioned to capitalize on emerging growth opportunities.

Looking ahead, the interplay between regulatory harmonization and digital health initiatives will create new avenues for telemedicine and remote procedure guidance. The proliferation of AI-driven diagnostic assistants promises to streamline decision-making processes, reduce clinical errors, and enhance patient outcomes. Furthermore, the growing emphasis on sustainability and service excellence will drive manufacturers to optimize product lifecycles and deliver differentiated support offerings.

Ultimately, organizations that adopt a proactive, multidisciplinary approach-combining hardware innovation, software integration, and strategic partnerships-will secure long-term resilience and market leadership in an increasingly competitive landscape. By focusing on customer-centric solutions and aligning with broader healthcare transformation goals, industry players can ensure that medical camera technologies continue to advance patient care and operational efficiency.

Act Now to Secure Comprehensive Medical Camera Market Insights and Drive Strategic Growth by Connecting with Ketan Rohom for Your Customized Research Report

To access the full breadth of analysis covering the medical camera market’s competitive landscape, segmentation dynamics, regional variations, and actionable strategies, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Securing this report will empower your organization with the insights needed to navigate evolving technologies, regulatory shifts, and supply chain complexities. Engage with Ketan to obtain a customized version that addresses your unique business objectives and ensures you stay ahead in a rapidly transforming clinical imaging environment.

- How big is the Medical Camera Market?

- What is the Medical Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?