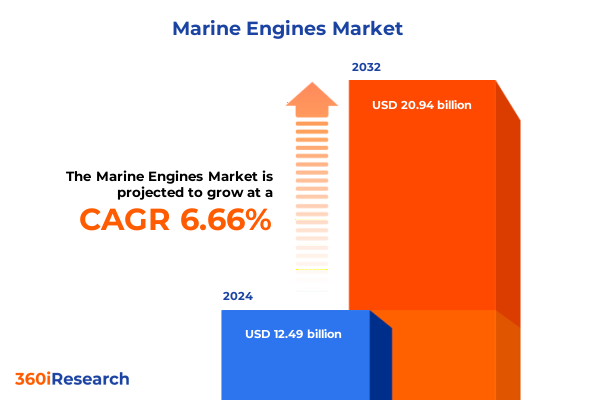

The Marine Engines Market size was estimated at USD 13.17 billion in 2025 and expected to reach USD 13.89 billion in 2026, at a CAGR of 6.84% to reach USD 20.94 billion by 2032.

Establishing the Foundation of the Marine Engines Market by Exploring Core Trends Influencing Technology Adoption and Industry Evolution

From heritage mechanical designs to modern intelligent propulsion systems, the marine engines market stands at a pivotal juncture marked by rapid technological innovation and evolving stakeholder expectations. Navigating this complex terrain requires a clear understanding of the core forces sculpting industry dynamics today. Heightened environmental regulations are accelerating the shift toward cleaner fuels, while maritime operators increasingly demand integrated digital solutions that optimize performance, reduce downtime, and lower operational costs.

Against this backdrop, supply chain resilience has emerged as a critical concern. Global disruptions in raw material availability have underscored the importance of diversified sourcing strategies and nimble manufacturing processes. Simultaneously, vessel owners are recalibrating procurement priorities to balance long-term sustainability goals with near-term financial pressures. Together, these factors set the stage for a market environment where innovation, agility, and strategic foresight will determine which players lead the next wave of growth and differentiation.

Analyzing Critical Transformative Forces Revolutionizing Marine Engine Technologies and Operational Strategies Across Vessel Ecosystems

The marine engines sector has been fundamentally reshaped by transformative forces that extend far beyond incremental upgrades. The rise of electrification has transcended mere product enhancement, triggering a holistic reevaluation of vessel design, energy storage solutions, and hybrid integration strategies. This electrification trend has been complemented by breakthroughs in digitalization, as advanced sensors and predictive analytics enable real-time performance monitoring, condition-based maintenance, and seamless connectivity between onboard systems and shore-based control centers.

In parallel, stringent emissions regulations have served as a catalyst for novel combustion technologies and alternative fuels, compelling manufacturers to innovate across both diesel and gasoline powertrains while accelerating investments in hydrogen and ammonia research. At the same time, strategic partnerships between engine makers, technology startups, and academic institutions have become the norm, fostering collaborative ecosystems that rapidly bring new solutions to market. As a result, marine propulsion has evolved into a platform for cross-industry convergence, where data-driven services and sustainable engineering converge to define the next generation of ocean-going vessels.

Examining the Cumulative Effects of United States Tariff Policies in 2025 on Cost Structures, Supply Chain Reliability, and Competitive Positioning

Since the implementation of new tariff measures, cumulative duties have progressively reshaped the cost architecture of marine engine manufacturing and distribution. Import levies on key components and finished propulsion systems have introduced additional layers of expense, prompting original equipment manufacturers and aftermarket suppliers to reassess sourcing footprints and negotiate revised supplier agreements. The compounded nature of these levies has also led to reallocations of capital expenditure and slowed new program launches for certain product segments.

Moreover, incremental tariff adjustments have reverberated through the supply chain, resulting in longer lead times as vendors adapt to evolving classification rules and regulatory requirements. In response, many stakeholders have begun to localize critical production phases, thereby mitigating exposure to fluctuating duties but often at the expense of economies of scale. These strategic supply chain shifts have realigned competitive positioning, compelling market participants to closely monitor tariff policy developments, leverage duty mitigation programs, and strengthen relationships with domestic foundries and fabrication facilities.

Deriving Actionable Insights from Product, Fuel, Application, and Distribution Channel Segmentations to Inform Strategic Decisions and Innovation Pathways

Insight into the market’s structure emerges when the landscape is viewed through the lens of product type, revealing distinct performance expectations and application-ready features across inboard, jet drive, outboard, and stern drive solutions. Inboard designs continue to cater to large commercial and military installations by prioritizing durability and high continuous power output, while jet drive technologies gain traction in shallow-draft recreational and specialized utility vessels that demand precision maneuverability. Conversely, outboard engines maintain popularity among smaller craft due to their modular simplicity, and stern drive configurations bridge the gap by offering a balance of compact footprint and responsive handling.

Further granularity is achieved by considering fuel type, which delineates the strategic priorities for manufacturers of diesel, electric, and gasoline propulsion systems. Diesel platforms remain the backbone of long-haul commercial operations, celebrated for their fuel economy and robustness. Electric propulsion is rapidly advancing, with investments in battery energy density and fast-charging networks driving adoption in short-range and harbor applications. Gasoline engines, historically favored in recreational boating, continue to evolve through lightweight materials and noise-reduction features, addressing consumer demands for comfort and noise abatement.

Application-specific dynamics add another dimension to market segmentation. Commercial operators emphasize lifecycle value and maintenance predictability, fishing fleets focus on reliability under continuous duty cycles, military entities require hardened performance and digital security features, and recreational users seek seamless integration with onboard lifestyle systems. Distribution channel considerations complete the picture, where aftermarket suppliers support service-driven revenue streams and aftermarket parts availability, while OEM channels advance deep integration with vessel manufacturers to deliver turnkey propulsion packages. Together, these segmentation insights offer a holistic foundation for strategic decision-making and product innovation pathways.

This comprehensive research report categorizes the Marine Engines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fuel Type

- Application

- Distribution Channel

Highlighting Regional Dynamics and Demand Drivers across the Americas, Europe Middle East & Africa, and Asia Pacific Markets to Guide Market Penetration Strategies

A nuanced perspective on regional dynamics illuminates how market drivers differ across the Americas, Europe Middle East & Africa, and Asia Pacific territories. In the Americas, fleet modernization programs in North America converge with growing leisure boating in Latin America, creating a dual-market environment that prizes both large-scale commercial engines and versatile recreational platforms. Regulatory frameworks in the United States and Canada are particularly influential, spurring demand for emissions-compliant solutions and digital service offerings.

Across Europe, the Middle East, and Africa, diverse maritime traditions and infrastructure investments shape varied propulsion requirements. Northern Europe’s commitment to carbon neutrality has accelerated uptake of hybrid and electric propulsion in inland and coastal operations. Meanwhile, the Mediterranean and Gulf markets place a premium on speed and luxury for passenger and recreational vessels, and African coastal industries are poised for incremental growth as port modernization initiatives unfold.

In the Asia Pacific region, robust shipbuilding centers in East Asia drive substantial demand for high-power diesel and dual-fuel engines, while Southeast Asia’s archipelagic geographies support rapid adoption of small-scale outboards and efficient stern drives for inter-island transport. Growth in offshore energy exploration and naval modernization across the region also sustains interest in heavy-duty propulsion solutions and integrated digital platform capabilities, underscoring the importance of tailored strategies for each market cluster.

This comprehensive research report examines key regions that drive the evolution of the Marine Engines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Positioning of Leading Marine Engine Manufacturers Driving Market Innovation and Growth Trajectories

Leading engine manufacturers have pursued divergent strategies to solidify market leadership and capitalize on emerging technology trends. One global player has intensified research programs in alternative fuel compatibility, establishing dedicated test facilities for hydrogen-diesel blends and ammonia trials. Another prominent brand has unveiled a suite of IoT-enabled propulsion systems, integrating advanced analytics into factory-installed engine control units to enable predictive maintenance and remote diagnostics.

Further competitive differentiation arises from strategic acquisitions and partnerships. Certain legacy engine builders have formed joint ventures with battery technology startups to co-develop next-generation electric drivetrains, while others have aligned with digital software firms to enhance cybersecurity and data visualization capabilities. These collaborative models enable rapid time-to-market for new solutions and allow traditional manufacturers to leverage specialized expertise without diluting core competencies.

Simultaneously, innovative aftersales service strategies are reshaping value propositions. Several leading OEMs have launched subscription-based maintenance plans, bundling spare parts, digital monitoring, and field support under single agreements. This shift toward recurring revenue aligns service providers and end users more closely on performance goals, reinforcing brand loyalty and ensuring consistent uptime across critical maritime operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Marine Engines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo Penta

- ABB Ltd

- Anglo Belgian Corporation

- Bergen Engines

- Caterpillar Inc

- CNPC Jichai Power Company Limited

- Cummins Inc

- Daihatsu Diesel Mfg Co Ltd

- Deere & Company

- DEUTZ AG

- Fairbanks Morse Defense

- FPT Industrial

- General Electric Company

- HD Hyundai Heavy Industries Co Ltd

- Honda Motor Co Ltd

- IHI Power Systems Co Ltd

- Isuzu Motors Ltd

- Kawasaki Heavy Industries Ltd

- Kubota Corporation

- MAN Energy Solutions SE

- Mercury Marine

- Mitsubishi Heavy Industries Ltd

- Rolls-Royce Holdings plc

- Scania AB

- Weichai Holding Group Co Ltd

- WinGD Winterthur Gas & Diesel Ltd

- Wärtsilä Corporation

- Yanmar Holdings Co Ltd

Formulating Practical Recommendations for Industry Leaders to Navigate Disruption, Optimize Operations, and Capitalize on Emerging Opportunities in Marine Engines

Industry leaders should prioritize the integration of electrified and hybrid propulsion options into existing product portfolios to preempt regulatory constraints and capture emerging demand. Early investment in scalable battery technologies and modular power units will differentiate freight and passenger vessel operators seeking both low-emission solutions and minimized lifecycle costs. In parallel, executives must cultivate data-driven service offerings by deploying robust telematics platforms and fostering digital literacy within technical support teams to deliver predictive maintenance at scale.

To address tariff-induced cost pressures, companies are advised to evaluate strategic insourcing opportunities for critical components and to negotiate multi-year agreements with domestic suppliers. Strengthening local partnerships can reduce lead times and stabilize production costs. Moreover, collaboration with policy makers and industry associations remains essential to advocate for duty mitigation programs and to shape future tariff dialogues.

Finally, adopting a customer-centric innovation framework will maximize value capture. By embedding cross-functional teams with representatives from sales, R&D, and aftersales, organizations can accelerate feedback loops and refine product development roadmaps. This collaborative approach not only ensures alignment with end-user performance requirements but also fosters a culture of continuous improvement that underpins long-term competitiveness.

Detailing Robust Research Methodology Incorporating Primary Interviews, Secondary Research, and Data Triangulation to Ensure Comprehensive Market Insights

This study employs a multi-tiered research framework designed to deliver robust, unbiased insights. Primary interviews were conducted with senior executives, engineering leads, and procurement specialists across engine manufacturers, vessel operators, and component suppliers, ensuring first-hand perspectives on emerging challenges and opportunities. These qualitative engagements were complemented by a thorough examination of regulatory filings, technical white papers, and industry consortium publications to validate the observed trends and contextualize them within broader technological and policy landscapes.

Secondary research encompassed the systematic collection of archival data from international maritime registries, patent databases, and trade association reports. Where possible, public disclosures and sustainability declarations from market participants helped triangulate information on alternative fuel trials, digital platform deployments, and aftersales service innovations. The data was then subjected to rigorous peer review by an internal panel of industry analysts to eliminate biases and to reconcile conflicting viewpoints.

Throughout the research process, adherence to strict quality controls-such as source verification, consistency checks, and analytical cross-referencing-ensured the integrity of all findings. The final insights were synthesized through collaborative workshops that aligned analytical hypotheses with real-world operational feedback, producing a comprehensive narrative that informs both strategic planning and tactical execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Marine Engines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Marine Engines Market, by Product Type

- Marine Engines Market, by Fuel Type

- Marine Engines Market, by Application

- Marine Engines Market, by Distribution Channel

- Marine Engines Market, by Region

- Marine Engines Market, by Group

- Marine Engines Market, by Country

- United States Marine Engines Market

- China Marine Engines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Implications for Stakeholders to Navigate the Evolving Marine Engines Landscape with Confidence and Foresight

The marine engines market is undergoing a profound transformation, driven by electrification, digitalization, and evolving regulatory frameworks. As tariff policies continue to reshape cost structures, manufacturers and operators alike must remain agile in their sourcing and production strategies. The segmentation analysis underscores the importance of customizing product offerings by powertrain type, fuel preference, usage scenario, and distribution approach to effectively meet diverse end-user requirements.

Regional dynamics further highlight that no single strategy fits all; instead, success will hinge on nuanced market approaches tailored to the Americas’ regulatory rigor, the EMEA’s sustainability focus, and the Asia Pacific’s technology-intensive shipbuilding hubs. The competitive landscape is marked by a dynamic interplay of legacy engine builders embracing digital partnerships, alongside innovative entrants advancing alternative fuels and subscription-based service models.

Looking ahead, the path to sustainable profitability requires a balanced emphasis on technological innovation, operational efficiency, and strategic collaboration. Stakeholders who proactively invest in advanced propulsion solutions, leverage data-centric service frameworks, and engage in constructive policy dialogues will be best positioned to capture the opportunities presented by a decarbonizing maritime economy. This report offers a clear lens on the trends at hand and a roadmap for navigating the next chapter of marine propulsion evolution.

Engage with Ketan Rohom to Leverage Insider Expertise and Secure Comprehensive Marine Engine Market Research Insights for Strategic Advantage

To deepen your strategic outlook and gain an operational edge, connect with Ketan Rohom, Associate Director, Sales & Marketing. His extensive experience in marine propulsion dynamics and proven track record supporting leading maritime clients provides an exceptional resource for aligning your growth initiatives with the most critical market intelligence. By engaging with Ketan, you will access tailored insights that address your unique technology requirements, tariff exposure, and regional priorities. Reach out today to secure a comprehensive, customized report that empowers your organization to make data-driven decisions, accelerate innovation, and outpace competitors in the rapidly evolving marine engines landscape. Empower your business growth with expert guidance and begin leveraging the full potential of actionable marine engine intelligence.

- How big is the Marine Engines Market?

- What is the Marine Engines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?