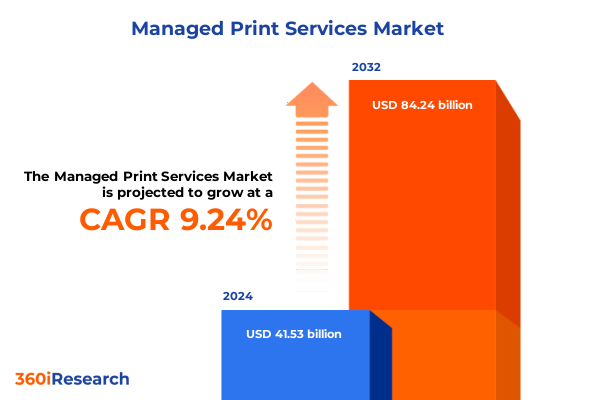

The Managed Print Services Market size was estimated at USD 45.26 billion in 2025 and expected to reach USD 49.39 billion in 2026, at a CAGR of 9.27% to reach USD 84.24 billion by 2032.

A strategic orientation that positions managed print services as an integrated enterprise capability linking security, procurement, sustainability, and hybrid work transformation

The pace of enterprise transformation in Asia‑Pacific has reframed how organizations view print: no longer a standalone cost center, printing capabilities are increasingly treated as an integrated part of secure information flows, hybrid workplace enablement, and sustainability commitments. This report opens with a concise orientation for leaders who must balance ongoing document-handling needs with tighter security postures, shifting procurement models, and evolving channel ecosystems across the region.

As organizations accelerate digital workflows, the role of managed print services (MPS) has expanded to include data‑driven analytics, continuous device management, and lifecycle stewardship that now touch IT, security, procurement, and sustainability teams. The introduction establishes the central premise that successful MPS strategies in Asia‑Pacific require coordinated governance across procurement, service delivery, and information security, and it lays out the analytical lenses used throughout the report: service composition, print technology alignment, contract design and pricing, channel dynamics, and vertical market nuances. With that foundation, subsequent sections explore how market forces and policy shifts are reshaping vendor selection, contract terms, and the technical design of print fleets so that readers can act with confidence rather than reacting to disruption.

Convergent technological, commercial, and sustainability shifts are remaking managed print services into security‑first, data‑driven, and outcome‑oriented enterprise solutions

The managed print landscape in Asia‑Pacific is being reconfigured by several convergent forces that together demand a fundamental rethink of service architecture and commercial models. Rapid digital adoption and the normalization of hybrid work have reduced routine print volumes in some segments while increasing demand for secure, audited printing workflows in others, particularly where regulation or confidentiality requirements remain stringent. At the same time, sustainability mandates and corporate ESG commitments are elevating the importance of supplies management and consumables forecasting as operational levers to reduce waste and lower lifecycle emissions.

Technological shifts are equally transformative: analytics and reporting capabilities have matured to the point where device telemetry can underpin predictive maintenance regimes and usage‑based pricing models, while secure printing features - from data loss prevention to device hardening and firmware management - are now central to commercial offers rather than optional add‑ons. Parallel to these product and service innovations, procurement behavior is changing. Buyers increasingly evaluate bundled offerings against modular, usage‑based subscriptions and tiered pricing that provide flexibility for uncertain print profiles. Channel dynamics are adapting accordingly, with independent vendors, system integrators, and OEM channels competing on service breadth and integration capabilities. Collectively, these shifts are creating a market where winners will be those who can combine robust device management and secure printing capabilities with flexible contract structures and demonstrable sustainability outcomes.

How 2025 tariff actions and clarifying executive guidance have added procurement complexity and reshaped risk allocation for print hardware and consumables sourcing

The trade policy landscape in 2025 introduced new cost and operational frictions that reverberate across hardware sourcing, supply‑chain resilience, and total cost of ownership calculations for print fleets. Targeted tariff increases announced for specific technology categories changed the input economics for certain components and finished goods, and policy guidance from the executive branch modified how tariffs interact when multiple duties could apply to the same imported article. These developments created immediate procurement complexity, increased emphasis on tariff classification and origin verification, and a renewed focus on alternative sourcing strategies within the region.

Practically, the net effect for operators and buyers is twofold: first, short‑term procurement cycles have grown more transactionally intensive as teams re‑assess vendor routing and freight strategies to manage landed cost volatility; second, there is greater appetite for contract structures that shift risk appropriately between service provider and customer, such as longer term supply agreements with fixed pricing components, or usage‑based subscriptions that enable operational flexibility during periods of input‑cost disruption. Policymakers also signaled that certain tariff actions would be refined to avoid compounding duties that exceed stated policy objectives, which mitigates some upside risk but does not eliminate the need for careful customs planning and duty management during vendor selection and contract negotiation. Given these policy dynamics, organizations operating in Asia‑Pacific should prioritize tariff‑aware procurement playbooks and incorporate customs, classification, and supplier localization assessments into their MPS evaluation frameworks.

Segmentation insights linking service composition, technology choices, contract design, channel dynamics, and vertical requirements to procurement and delivery decisions

Segmenting the managed print market reveals distinct commercial and technical imperatives that should shape vendor selection, contractual language, and operational design. When services are evaluated across analytics and reporting, device management services, document management services, maintenance and support services, secure printing services, and supplies management services, different priorities emerge: analytics and reporting investments drive transparency and enable usage‑based subscription models, while device management and maintenance components determine service continuity and cost predictability. Maintenance and support must be considered at a sub‑service level - break‑fix services, preventive maintenance, and spare parts management - because each element has unique implications for SLA design and spare parts logistics across diverse APAC geographies. Similarly, secure printing offerings - encompassing data loss prevention and device hardening and firmware management - have become prerequisites for compliance‑sensitive verticals and for buyers who place a premium on risk reduction.

Print technology choices - whether inkjet, laser, or thermal platforms - materially affect total cost of ownership, consumables management, and suitability for specific workflows such as high‑volume transactional printing, label and logistics applications, or high‑resolution graphic output. Contract term considerations (sub‑12 months, 12–36 months, or longer than 36 months) interact with pricing models where bundled, fixed price, tiered, and usage‑based subscription approaches each map to different buyer risk tolerances and operational needs. Channel type is an additional axis: independent vendors, printer and copier OEMs, and system integrators each bring distinct strengths, with OEMs offering tightly integrated device and firmware pathways, independents often providing flexible supply arrangements, and system integrators delivering broader workflow and IT alignment. Lastly, end‑use industry requirements across banking, financial services and insurance, education, government and public sector, healthcare, legal and professional services, manufacturing, media and entertainment, and telecom and IT require tailored combinations of the above segmentation dimensions, and this composite view should govern how RFPs are structured and how service capabilities are validated during procurement.

This comprehensive research report categorizes the Managed Print Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Contract Term

- Pricing Model

- Channel Type

- End-Use Industries

Regional dynamics and localized delivery imperatives that require differentiated go‑to‑market strategies across the Americas, EMEA, and Asia‑Pacific

Regional dynamics continue to shape strategic priorities for managed print services providers and buyers. In the Americas, mature procurement practices and high enterprise IT spend drive a demand profile centered on integration with broader IT service management, advanced analytics, and a premium on secure printing features for highly regulated industries. EMEA presents a patchwork of regulatory regimes and sustainability expectations that reward providers capable of delivering consistent global controls and localized compliance, especially for public sector and cross‑border financial services workloads.

Asia‑Pacific is distinguished by its heterogeneity: markets range from highly digitalized urban centers where hybrid work and automation are mainstream to rapidly industrializing economies with expanding SME sectors. This diversity creates both opportunity and complexity for managed print providers. In several APAC countries, digital transformation programs and a surge in cloud adoption have accelerated adoption of device management services and cloud‑integrated document workflows, while other jurisdictions place stronger emphasis on on‑premise control due to data residency or regulatory requirements. Supply‑chain resilience is also a focal point across the region, with buyers increasingly evaluating regional spare‑parts networks, localized consumables fulfillment, and vendor capability to manage cross‑border logistics. Ultimately, regional strategy must be granular: global standards and platform capabilities are necessary but insufficient without localized service delivery, nuanced contract terms, and channel partnerships calibrated to each market’s operational realities.

This comprehensive research report examines key regions that drive the evolution of the Managed Print Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive differentiation requires integrated secure lifecycle controls, analytics-enabled orchestration, and flexible commercial models tailored to vertical and regional demands

Competitive positioning in the managed print services ecosystem now depends on at least three capabilities: secure device lifecycle management, analytics‑driven service orchestration, and flexible commercial terms that reflect client operational risk profiles. Market participants that integrate robust device hardening and firmware management into standard offers, embed analytics and reporting for fleet optimization, and provide a range of pricing models - from bundled to usage‑based subscriptions - are best positioned to meet the diverse needs of enterprise buyers across industries.

Beyond technology, capability in preventive maintenance and parts logistics is critical; providers that can demonstrate efficient break‑fix response times, structured preventive maintenance programs, and resilient spare‑parts management gain a measurable advantage in complex APAC environments. Channel strategies also matter: successful providers often maintain hybrid routes to market that combine direct OEM relationships with partnerships through independent vendors and systems integrators to achieve both scale and local agility. Equally important is a clear articulation of value in vertical contexts: security‑sensitive sectors such as banking, healthcare, and government require certified secure printing workflows and demonstrable evidence of data sanitization and lifecycle controls. Investors and strategic buyers evaluating the vendor landscape should prioritize firms that can showcase integrated offerings spanning secure printing, consumables forecasting, and analytics‑backed service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Managed Print Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adventus Pte Ltd.

- ARC Document Solutions LLC

- AsiaPac Technology Pte. Ltd.

- Blue Star Group (New Zealand) Limited

- Brother Industries, Ltd.

- Business Distributors Ltd

- Canon Inc.

- COMnet Solutions Private Limited

- DDS Group

- DocuConnex Pte Ltd

- ECI Software Solutions, Inc.

- Enabl Solutions Pty. Ltd.

- Flex Technology Group

- FUJIFILM Business Innovation Corp.

- Fujitsu Limited

- HP Inc.

- Konica Minolta, Inc.

- KYOCERA CORPORATION

- MBM Newtech Pvt. Ltd.

- Novatech, Inc.

- OfficeMax New Zealand Limited

- OKI Electric Industry Co., Ltd.

- Pitney Bowes Inc.

- Ricoh Company, Ltd.

- Seiko Epson Corporation

- Toshiba Corporation

- WeP Solutions Limited

- Wipro Limited

- Xerox Holdings Corporation

Practical actions for procurement, IT, security, and service providers to tighten security, optimize contracts, and future‑proof managed print operations

Leaders in both buying organizations and provider firms must take decisive, practical steps to convert market insight into measurable outcomes. First, procurement teams should embed security and lifecycle requirements directly into technical specifications and RFPs, demanding demonstrable capabilities in device hardening, firmware management, secure data erasure, and documented preventive maintenance processes. Second, legal and finance stakeholders should evaluate contract terms that balance flexibility with risk allocation, favoring pricing models and contract durations aligned with their business cycles and exposure to supply‑chain or tariff volatility.

Service providers should accelerate investments in analytics and remote device management to enable predictive maintenance and usage‑based billing, and they should formalize spare‑parts and consumables distribution networks across APAC to reduce downtime risks. Both buyers and suppliers should prioritize secure printing controls and firmware hygiene as non‑negotiable components of any modern print estate. Finally, organizations should develop a phased road map for print estate rationalization that begins with an audit of device security posture, consumables waste, and supplier concentration, and then sequences consolidation, contract renegotiation, and targeted technology refreshes so that efficiency gains and security improvements compound over time.

Methodology that combines primary stakeholder interviews, vendor capability assessment, policy review, and triangulation with third‑party security disclosures to ensure actionable findings

This research synthesizes primary interviews with procurement, IT and security decision‑makers across multiple industries in Asia‑Pacific, secondary industry literature, vendor technical documentation, and policy review. The methodology combined qualitative interviews to capture procurement and operational nuances with a structured assessment of service portfolios and contract models to identify recurring patterns and leading practices. Each vendor capability was assessed against technical criteria covering device management, secure printing, firmware update practices, maintenance modalities, and consumables management, while commercial evaluation focused on pricing model flexibility, contract term offerings, and channel coverage across the region.

To ensure robustness, the study triangulated vendor claims with third‑party vulnerability disclosures, public policy announcements affecting sourcing and customs, and representative buyer experiences to surface high‑confidence insights. Where policy‑level actions could materially affect procurement choices - for example changes to tariff treatment or executive guidance on duty stacking - the report integrates primary policy sources to align operational recommendations with the evolving regulatory environment. The combined approach is intended to provide readers with a practical, evidence‑based foundation for procurement strategy, vendor selection, and operational modernization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Managed Print Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Managed Print Services Market, by Service Type

- Managed Print Services Market, by Contract Term

- Managed Print Services Market, by Pricing Model

- Managed Print Services Market, by Channel Type

- Managed Print Services Market, by End-Use Industries

- Managed Print Services Market, by Region

- Managed Print Services Market, by Group

- Managed Print Services Market, by Country

- United States Managed Print Services Market

- China Managed Print Services Market

- Asia-Pacific Managed Print Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1440 ]

Conclusion synthesizing security, analytics, supply‑chain resilience, and contract flexibility as the pillars of modern managed print strategies in Asia‑Pacific

As organizations in Asia‑Pacific navigate hybrid work realities, heightened security expectations, and an increasingly complex trade policy environment, managed print services must be reimagined as a secure, analytics‑enabled, and commercially flexible capability. The conclusion synthesizes the report’s principal themes: security and firmware hygiene are non‑negotiable; analytics and predictive maintenance are differentiators that improve uptime and enable new pricing models; regional supply‑chain resilience and tariff awareness are now integral to procurement decisions; and contract design must be sufficiently flexible to manage episodic shocks while still delivering predictable service outcomes.

Leaders who treat managed print services as an area for cross‑functional collaboration - aligning procurement, IT, security, and sustainability objectives - will be best positioned to extract value and reduce operational risk. By prioritizing secure device lifecycle management, investing in analytics that translate telemetry into action, and calibrating commercial terms to reflect localized operational realities, organizations can transform a traditional support function into a strategic capability that supports compliance, productivity, and ESG commitments.

Access tailored briefings and a bespoke research package to convert managed print services insight into execution with a senior associate for sales and marketing

For decision-makers ready to convert insight into impact, a tailored research package and advisory briefing are available to accelerate procurement, security, and service-model decisions for managed print services across Asia-Pacific. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to arrange a confidential briefing that aligns the report’s findings to your strategic priorities, procurement cycles, and vendor negotiations. The briefing can be scoped to focus on contract design, pricing model optimization, secure device lifecycle controls, channel partner selection, or regulatory risk mitigation relevant to your operating markets.

Contacting Ketan will provide a pragmatic next step to translate the report’s analysis into an implementation roadmap, including a bespoke vendor short-list, prioritized action items for the next 90 to 180 days, and optional ongoing advisory support. The goal of this engagement is to reduce procurement friction, accelerate secure deployments, and position your organization to capture efficiency gains while managing supply‑chain and policy risks.

To request the research package, schedule the briefing, or explore custom consulting services tied to the report’s conclusions, please reach out to Ketan Rohom to secure availability and tailored deliverables aligned with your organization’s objectives.

- How big is the Managed Print Services Market?

- What is the Managed Print Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?