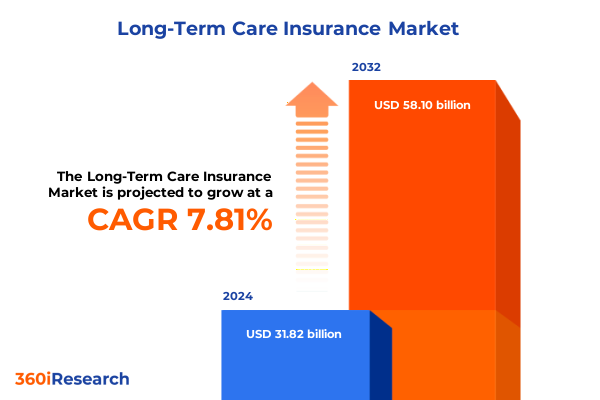

The Long-Term Care Insurance Market size was estimated at USD 34.33 billion in 2025 and expected to reach USD 36.80 billion in 2026, at a CAGR of 7.80% to reach USD 58.10 billion by 2032.

Discover How Long-Term Care Insurance Sets the Foundation for Financial Security Amid Shifting Demographic and Economic Trends

As the demographic fabric of the United States continues to evolve, long-term care insurance emerges as a pivotal instrument for financial resilience. The convergence of an aging population, extended life expectancies, and escalating long-term care costs has elevated the importance of securing reliable coverage. Consequently, policyholders are increasingly viewing these insurance solutions not merely as optional supplements but as fundamental components of comprehensive retirement and estate planning strategies.

In parallel, economic volatility and unexpected healthcare expenditures have underscored the necessity of proactive protection against chronic care needs. This dynamic environment has catalyzed heightened engagement among consumers and advisors alike, driving innovation in product design and underwriting approaches. Furthermore, insurers are responding with enhanced digital platforms that facilitate seamless enrollment, personalized risk assessments, and real-time policy management.

By understanding these foundational drivers, stakeholders can appreciate the strategic imperative of long-term care insurance in today’s context. In particular, the alignment between evolving consumer expectations and insurer capabilities sets the stage for transformative developments. This introduction thus lays the groundwork for a deeper examination of market shifts, regulatory influences, and strategic pathways that define the long-term care insurance landscape.

Uncover the Pivotal Transformative Shifts Redefining the Long-Term Care Insurance Landscape Through Innovation and Regulatory Evolution

Innovations in underwriting methodologies and the incorporation of predictive analytics are redefining risk assessment paradigms. Insurers are leveraging advanced data science techniques to forecast care trajectories more accurately, thus enabling premium structures that better reflect individual risk profiles. Alongside these developments, the proliferation of hybrid products-combining life insurance or annuities with long-term care benefits-has disrupted traditional offerings, presenting a more flexible value proposition to consumers.

Regulatory reforms have also played a critical role in reshaping the market. Recent legislative adjustments aimed at bolstering consumer protections and enhancing policy transparency have compelled carriers to revise policy language and streamline disclosure processes. Moreover, changes to tax incentives have triggered renewed interest in long-term care solutions that optimize fiscal advantages for both individual and employer-sponsored plans.

Consequently, these transformative shifts have fostered greater collaboration between technology providers, healthcare service networks, and insurers. As a result, distribution channels are becoming more integrated, with digital touchpoints facilitating deeper engagement at every stage of the policy lifecycle. Collectively, these trends underscore a pronounced departure from legacy models toward more agile, consumer-centric frameworks.

Analyze the Multifaceted Effects of 2025 United States Tariff Policies on Long-Term Care Insurance Cost Structures and Provider Economics

The cumulative impact of recent tariff measures in the United States has reverberated across the healthcare ecosystem, indirectly influencing long-term care insurance cost structures. Tariffs on imported medical equipment and pharmaceuticals have contributed to supply chain constraints, leading to increased operational expenses for care facilities. This escalation in underlying costs has, in turn, exerted upward pressure on benefit payment projections and reserve requirements for insurers.

Moreover, elevated costs have prompted providers to negotiate revised reimbursement rates with payers, affecting the actuarial assumptions that underpin premium calculations. As a result, carriers are recalibrating pricing models to accommodate the heightened volatility in care delivery expenses. These adjustments are especially pronounced in markets where reliance on imported medical devices is substantial, as assay cost fluctuations translate directly into claims experience.

In response, insurers are implementing proactive strategies to mitigate the ripple effects of tariff-induced cost pressures. This includes exploring alternative sourcing arrangements, forging strategic partnerships with domestic suppliers, and adopting telehealth-enabled care management programs that reduce reliance on high-cost in-patient services. Altogether, these approaches serve to preserve the affordability and sustainability of long-term care insurance offerings amid an evolving macroeconomic backdrop.

Illuminate Key Insights Derived from Comprehensive Segmentation of Long-Term Care Insurance by Product, Coverage, Payment, Term, Age, and Distribution Channels

A nuanced examination of product segmentation reveals distinct adoption patterns. Hybrid Plans, which integrate annuity or life insurance riders, have gained traction among consumers seeking versatility and enhanced financial guarantees. Within this category, annuity riders appeal to retirees anticipating fixed income streams, while life insurance riders resonate with those prioritizing death benefit protection alongside care coverage. Conversely, Traditional Plans-structured as indemnity or reimbursement options-continue to serve customers with straightforward benefit triggers and fewer contractual complexities.

Coverage options bifurcate into group and individual policies, with employer-sponsored group plans offering cost-sharing efficiencies and automatic enrollment benefits. Meanwhile, individual policies provide personalized underwriting and may be tailored to specific risk tolerances. Payment modalities play a crucial role in policy attractiveness; regular premium arrangements, available on annual, semiannual, quarterly, or monthly schedules, accommodate diverse budgetary preferences, whereas single premium solutions cater to affluent buyers seeking one-time capital deployment.

Duration choices span lifetime coverage and limited-term options, with longevity protection being central to policyholder decision-making. Younger purchasers often gravitate toward limited-term plans to lock in lower rates during peak earning years, whereas older segments predominantly opt for lifetime coverage to avoid the risk of coverage lapse. Age segmentation further underscores this dynamic: individuals aged 18 to 49 exhibit growing awareness but limited purchase rates, the 50 to 64 cohort demonstrates heightened conversion as retirement approaches, and the 65 to 74 and 75-and-above groups drive the highest claim frequencies and benefit utilization.

Distribution channels remain diverse, encompassing traditional agents and brokers, bancassurance alliances, direct sales forces, and digital marketplaces. Online platforms-both proprietary insurer websites and third-party portals-are rapidly evolving, leveraging AI-driven recommendation engines to match consumer profiles with optimal plan designs. This array of channels ensures that products are accessible across a broad spectrum of consumer touchpoints, reinforcing the critical role of segmentation in guiding strategy development.

This comprehensive research report categorizes the Long-Term Care Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coverage Type

- Payment Mode

- Policy Term

- Distribution Channel

Reveal Critical Regional Dynamics Shaping Long-Term Care Insurance Adoption and Growth Across Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics exhibit pronounced variability in policy preferences and regulatory frameworks. In the Americas, the United States leads with its sophisticated private insurance market, characterized by robust digital adoption and a strong emphasis on hybrid plan innovation. Canada presents a complementary landscape, where provincial healthcare provisions shape private long-term care uptake, prompting insurers to tailor benefits to augment government-supported services.

Across Europe, Middle East, and Africa, evolving policy environments and cultural attitudes toward elder care drive divergent market trajectories. Western European markets demonstrate moderate penetration rates underpinned by favorable tax treatments, while Eastern European and Middle Eastern regions are witnessing nascent growth fueled by rising personal wealth and government initiatives to incentivize private coverage. Africa remains largely underinsured, although emerging middle-class segments are beginning to explore risk management solutions associated with aging populations.

In the Asia-Pacific realm, demographic trends and evolving wellness ecosystems are accelerating demand for coverage. Japan and Australia exhibit mature long-term care insurance frameworks with established public-private partnerships, whereas Southeast Asian markets are witnessing the introduction of innovative hybrid models to address gaps in formal care infrastructure. China’s fee-for-service culture coexists with burgeoning demand for premium long-term care solutions, and regulatory shifts are progressively encouraging carrier participation to meet the needs of an aging society.

This comprehensive research report examines key regions that drive the evolution of the Long-Term Care Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distill Strategic Intelligence on Leading Enterprises Steering Innovation and Competitive Differentiation in the Long-Term Care Insurance Sector

Market leaders are deploying diverse strategies to secure competitive advantage. Insurers are increasingly investing in digital transformation programs that enhance customer engagement through intuitive policy portals, real-time claims processing, and AI-enabled care coordination. Companies that integrate predictive analytics into underwriting processes achieve accelerated decision cycles and improved risk selection, thereby optimizing loss ratios and customer satisfaction.

Strategic partnerships are another hallmark of industry frontrunners. Alliances with home healthcare providers, telemedicine platforms, and wellness startups have enabled providers to offer value-added services, such as remote monitoring and personalized care plans. Moreover, collaborations with financial institutions facilitate seamless bundling of long-term care products within retirement planning solutions, broadening distribution and cross-selling opportunities.

Innovation in product design remains a differentiator, with leading carriers offering modular benefits that adapt to evolving care needs. Policy enhancements, such as inflation protection riders and shared-care offerings, address long-standing consumer concerns about benefit adequacy and premium stability. In turn, these developments drive higher persistency rates and bolster lifetime customer value, reinforcing the strategic positioning of these enterprises within a competitive marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Long-Term Care Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aegon N.V.

- Allianz SE

- Aviva plc

- AXA S.A.

- Bankers Life

- Brighthouse Financial Inc

- Bupa Global

- China Life Insurance Company Limited

- Cigna

- Dai-ichi Life Holdings Inc

- Generali Group

- Genworth Financial Inc

- John Hancock

- LifeSecure Insurance Company

- Lincoln Financial Group

- MassMutual

- Mutual of Omaha

- National Guardian Life Insurance Company

- Nationwide Insurance

- New York Life Insurance Company

- Northwestern Mutual

- OneAmerica Financial Partners Inc

- Prudential Financial Inc

- Securian Financial

- Thrivent Financial

- Transamerica

- Unum Group

- Zurich Insurance Group Ltd

Empower Industry Leaders with Actionable Recommendations to Navigate Complex Market Challenges and Capitalize on Emerging Opportunities

To thrive amid escalating cost pressures and shifting consumer expectations, industry leaders should prioritize product diversification that aligns with emergent care modalities. By expanding hybrid offerings and embedding wellness incentives, carriers can capture broader segments and foster sustained engagement. Concurrently, firms must accelerate digital channel investments to deliver frictionless customer experiences, from underwriting to claims adjudication.

Furthermore, establishing deep partnerships across the healthcare continuum can unlock new value streams. Insurers should seek to integrate with home care networks, telehealth providers, and technology startups to deliver comprehensive care journeys that optimize outcomes while containing costs. These collaborations not only enhance product appeal but also generate critical data insights that inform continuous improvement.

Lastly, proactive risk management demands robust scenario planning and dynamic pricing frameworks. Organizations that employ advanced modeling techniques to simulate tariff-induced cost shifts, demographic inflections, and regulatory developments will be better positioned to adjust their portfolio strategies. Hence, embedding agility within operational and actuarial processes is paramount for sustaining profitability and market relevance.

Outline a Robust Research Methodology Incorporating Multifaceted Data Sources, Expert Interviews, and Rigorous Analytical Frameworks

The research methodology underpinning this analysis is grounded in a dual approach of primary and secondary investigations. Initially, in-depth interviews were conducted with senior executives at leading insurance carriers, benefits consultants, and care providers to garner firsthand insights into strategic priorities and operational challenges. These discussions were complemented by expert roundtables involving actuaries, healthcare policy specialists, and data scientists.

Secondary research encompassed a thorough review of regulatory filings, policy whitepapers, and trade publications to trace product evolution and legislative developments. Additionally, proprietary datasets on claims experience, premium trends, and distribution channel performance were analyzed using advanced statistical techniques, including regression modeling and scenario analysis.

To ensure the validity and reliability of findings, a cross-validation process triangulated data from multiple sources, and key assumptions were stress-tested against alternate economic and demographic scenarios. Ultimately, this rigorous framework provides an authoritative foundation for strategic decision-making and underscores the credibility of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Long-Term Care Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Long-Term Care Insurance Market, by Product Type

- Long-Term Care Insurance Market, by Coverage Type

- Long-Term Care Insurance Market, by Payment Mode

- Long-Term Care Insurance Market, by Policy Term

- Long-Term Care Insurance Market, by Distribution Channel

- Long-Term Care Insurance Market, by Region

- Long-Term Care Insurance Market, by Group

- Long-Term Care Insurance Market, by Country

- United States Long-Term Care Insurance Market

- China Long-Term Care Insurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesize Core Findings into a Cohesive Conclusion Emphasizing Strategic Implications for Long-Term Care Insurance Stakeholders

In synthesizing the core findings, it becomes evident that long-term care insurance is undergoing a significant metamorphosis driven by demographic imperatives, technological innovation, and regulatory realignment. Hybrid products have emerged as a central growth driver, while digital and strategic partnerships are reshaping distribution architectures. Meanwhile, external factors such as tariff policies and supply chain dynamics are exerting tangible influences on cost structures and pricing strategies.

Collectively, these insights carry profound implications for stakeholders across the ecosystem. Insurers must cultivate agility, embracing next-generation analytics and collaborative care models to safeguard profitability and customer trust. Advisors and distributors should capitalize on segmentation intelligence to deliver tailored solutions that resonate with distinct consumer cohorts. Meanwhile, policymakers and regulators play a crucial role in fostering an environment that balances market stability with consumer protection.

Ultimately, the confluence of these forces points toward a future where long-term care insurance not only serves as a financial safeguard but also as an integral component of holistic wellness and retirement planning. Organizations that anticipate and adapt to these shifts will secure a sustainable competitive edge and contribute to more resilient care ecosystems.

Prompt Strategic Engagement with Associate Director Sales & Marketing for Tailored Market Research Insights and Procurement of Comprehensive Report

To explore tailored market intelligence and secure a detailed report on long-term care insurance trends, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engaging directly with him will grant your organization privileged access to in-depth analyses, proprietary insights, and customized advisory support that align with your strategic objectives. By partnering with this resource, stakeholders can accelerate decision-making processes and confidently address evolving market demands.

Ketan’s expertise in unearthing nuanced data patterns and translating them into actionable strategies ensures that your team remains ahead of industry shifts. Whether your focus is on expanding product portfolios, refining distribution strategies, or leveraging emerging regional opportunities, his guidance will be instrumental in unlocking growth potential. Connect with Ketan today to initiate a dialogue centered on your priorities and secure the competitive edge that comes from comprehensive, expert-driven research.

- How big is the Long-Term Care Insurance Market?

- What is the Long-Term Care Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?