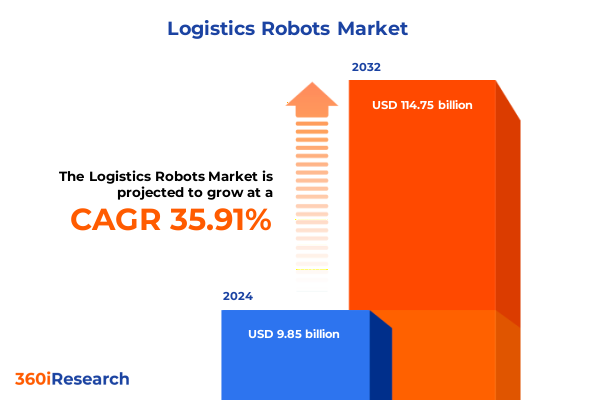

The Logistics Robots Market size was estimated at USD 13.03 billion in 2025 and expected to reach USD 17.42 billion in 2026, at a CAGR of 36.43% to reach USD 114.75 billion by 2032.

Pioneering the Integration of Robotics into Modern Logistics Networks to Achieve Unprecedented Efficiency and Resilience Across Global Supply Chains

The integration of robotics into logistics networks has evolved from a futuristic vision to a core enabler of operational excellence. As supply chains face rising complexity driven by globalization, e-commerce surges, and customer expectations for speed, businesses are turning to automation solutions to maintain competitiveness and resilience. Robotics technologies now serve as critical pillars for streamlining warehouse operations, optimizing last-mile delivery, and enhancing worker safety by automating repetitive tasks that were once labor intensive.

Throughout the industry, leaders are witnessing the transformative potential of automated guided vehicles and autonomous mobile robots working in concert with collaborative arms to create dynamic, flexible fulfillment environments. These systems harness advances in sensor fusion and machine learning to navigate ever-changing warehouse layouts with minimal human intervention. Meanwhile, the growing adoption of aerial drones and exoskeletons expands the frontier of robotics applications, enabling real-time inventory audits and reducing ergonomic risks for onsite personnel.

Given the accelerating pace of technological innovation and the intensifying pressure to fulfill orders with both speed and reliability, this report offers an executive perspective on the drivers reshaping logistics robotics. By examining the forces of change, regulatory influences, segmentation dynamics, and regional growth patterns, executives will be equipped with the insights needed to align strategic investments and partnerships with emerging opportunities.

Embracing Disruptive Innovations and Technological Advances That Are Reshaping the Logistics Robotics Landscape With Unmatched Speed and Precision

The logistics robotics landscape is undergoing disruptive change as breakthroughs in artificial intelligence, computer vision, and connectivity redefine how automated systems operate. Artificial intelligence algorithms enable robots to learn from operational data, anticipating inventory flows and adapting their routes to optimize throughput. Concurrently, advancements in collaborative robotics allow machines to safely interact with human workers, fostering hybrid workflows that combine the strengths of both parties.

Moreover, the proliferation of digital twin platforms offers logistics managers a virtual mirror of their facilities, empowering them to test automation strategies and forecast performance under varying demand scenarios. As 5G and edge computing roll out, robots gain access to high-bandwidth, low-latency networks that enhance coordination and support real-time analytics at the fleet level. These connective technologies facilitate predictive maintenance, minimizing downtime and extending equipment lifecycles.

Sustainability has also become a key impetus for innovation, prompting designs that optimize energy consumption and leverage alternative power sources. In this context, the convergence of these technological shifts is laying the groundwork for a more agile, intelligent, and environmentally responsible logistics ecosystem. Industry stakeholders must stay abreast of these trends to harness their full transformative potential.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on Robotics Components and International Trade Dynamics in Logistics

In 2025, tariff policies introduced by the United States have had a pronounced effect on the flow of robotics components and subsystems. These levies, targeting key imports used in automated guided vehicles, sensor modules, and electric drivetrains, have elevated landed costs and prompted supply chain reevaluations. As a result, companies are exploring diversified sourcing strategies, including nearshoring partnerships and domestic manufacturing collaborations, to mitigate exposure to external trade tensions.

The cumulative impact extends beyond material expenses to influence capital expenditure planning. Logistics providers and automation vendors are reassessing budget allocations, balancing the pursuit of cutting-edge robotics solutions with the imperative to manage total cost of ownership. Concurrently, strategic alliances between technology firms and component fabricators are gaining momentum, as integrated supply agreements ensure continuity of parts availability and align production roadmaps.

Looking ahead, the tariff environment underscores the importance of supply chain resilience. Stakeholders are increasingly adopting modular robot architectures that allow critical subsystems to be sourced from multiple geographies. This strategic elasticity provides a hedge against future policy shifts and supports uninterrupted deployment of advanced robotics across distribution centers and manufacturing hubs.

Illuminating Core Market Segmentation Insights to Reveal How Different Robot Types Functions Capacities and Power Sources Define Industry Opportunities

A granular examination of market segmentation reveals distinct growth drivers across various robot categories and operational roles. Automated guided vehicles and autonomous mobile robots are rapidly gaining favor in high-density warehouses where dynamic path planning and battery optimization are paramount. Collaborative arms are carving out a niche in precision assembly and palletizing tasks, working seamlessly alongside human operators to enhance throughput and quality control.

Functionally, logistics operations are leveraging specialized systems for picking and packing, where vision-guided robots deliver increased accuracy in order fulfillment. Sorting applications benefit from high-speed conveyors and intelligent sortation algorithms that adapt to fluctuating SKU profiles. Transportation and delivery robots, including unmanned aerial vehicles, are extending the reach of last-mile services, while warehouse management solutions orchestrate fleet scheduling and inventory positioning in real time.

Variations in payload capacity shape deployment choices, as high-capacity platforms handle heavy loads in cross-dock environments, and low-capacity units excel in fine-tuned order preparation. Power source considerations further influence adoption, with battery-powered systems dominating indoor operations and hydrogen fuel cells and solar hybrids gaining traction in outdoor and remote sites. Lastly, end-use nuances-from cold storage facilities demanding temperature-tolerant robotics to airport and port terminals requiring integrated security protocols-underscore the importance of tailored automation strategies.

This comprehensive research report categorizes the Logistics Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Function

- Payload Capacity

- Power Source

- Application

- End-Use

Uncovering Regional Trends and Growth Trajectories That Highlight How Americas Europe Middle East Africa and Asia Pacific Drive Robotics Adoption

Regional dynamics underscore a diversified trajectory for logistics robotics adoption. In the Americas, robust e-commerce demand and extensive warehousing infrastructure in the United States and Canada drive investments in autonomous mobile robots and collaborative solutions. Enterprises are focusing on retrofit projects to upgrade legacy facilities, while new fulfillment centers are designed with integrated robotics footprints from the outset.

Across Europe, the Middle East, and Africa, regulatory frameworks and labor considerations are steering interest toward flexible automation. Germany and the United Kingdom are leading the way in high-precision robotic arms for automotive and pharmaceutical applications, whereas emerging markets in the Middle East are prioritizing smart port initiatives. In Africa, pilot programs for solar-powered outdoor robots are demonstrating proof of concept in remote logistics corridors.

Meanwhile, the Asia-Pacific region remains a hotbed of innovation. Japan and South Korea continue to pioneer humanoid and collaborative platforms, while China’s vast distribution networks leverage unmanned aerial vehicles and exoskeletons to address labor shortages. Southeast Asian nations are emerging as key pilots for integrated robotics ecosystems that blend indoor and outdoor operations.

This comprehensive research report examines key regions that drive the evolution of the Logistics Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positioning and Strategic Initiatives of Leading Robotics Providers Shaping the Future of Automated Logistics Solutions Worldwide

Leading robotics providers are intensifying their focus on strategic partnerships and technology integration to capture share in logistics automation. Established industrial automation companies are extending their footprints through acquisitions of niche robotics startups, bolstering their portfolios with emerging capabilities in machine vision and AI analytics. This consolidation is fostering platforms that offer end-to-end solutions from fleet management software to end-effector design.

Innovative entrants are differentiating themselves through software-centric models, offering robotics-as-a-service frameworks that lower barriers to adoption and allow for rapid scalability. These providers emphasize interoperable architectures that integrate seamlessly with warehouse execution systems and enterprise resource planning platforms. At the same time, vertically integrated players in the e-commerce sphere are developing proprietary robotics fleets to optimize their internal logistics operations and set new benchmarks for throughput.

Across the competitive landscape, a common thread emerges: the race to deliver holistic automation ecosystems that combine hardware, software, and services. This shift reflects a recognition that customers seek turnkey solutions backed by lifecycle support, predictive maintenance, and continuous performance optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Logistics Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstef Group

- Amazon.com, Inc.

- Asic Robotics AG

- Clearpath Robotics, Inc. by Rockwell Automation Inc.

- Comau S.p.A.

- Daifuku Co., Ltd.

- FANUC CORPORATION

- Grenzebach Maschinenbau GmbH

- Hitachi, Ltd.

- Honeywell International Inc.

- Kawasaki Heavy Industries, Ltd.

- Kion Group AG

- Knapp AG

- Kollmorgen Corporation

- Krones AG

- Midea Group

- Omron Corporation

- Sidel Group

- Teradyne, Inc.

- Toshiba Corporation

- Toyota Material Handling, Inc.

- Vecna Robotics, Inc.

- Zebra Technologies Corporation

Offering Targeted Strategic Recommendations to Guide Industry Leaders in Harnessing Robotics Innovations for Competitive Advantage and Sustainable Growth

Industry leaders poised for success will place strategic emphasis on modular, interoperable robotics platforms that accommodate evolving operational requirements. By prioritizing open frameworks and standardized communication protocols, organizations can ensure that new technologies integrate seamlessly with existing infrastructure and minimize vendor lock-in. In parallel, a focus on workforce transformation and upskilling programs will enable employees to collaborate effectively with automated systems, enhancing both productivity and job satisfaction.

Additionally, investing in robust cybersecurity measures is essential to safeguard connected robotics fleets from emerging threats. Adopting advanced encryption standards, real-time monitoring, and rigorous incident response plans will ensure operational continuity and protect sensitive logistics data. Collaborations between robotics providers, IT security vendors, and industry consortia can further accelerate the development of best practices and compliance frameworks.

Finally, executives should pursue pilot projects in controlled environments to validate assumptions, measure key performance indicators, and refine deployment strategies. Through iterative testing and stakeholder alignment, organizations can de-risk large-scale rollouts and chart a clear roadmap for phased expansion. This disciplined approach will maximize return on investment and cement the role of robotics as a strategic differentiator.

Detailing a Robust Research Methodology That Ensures Comprehensive Data Integrity and Actionable Insights Through Multisource Analysis and Expert Validation

This report’s findings derive from a comprehensive methodology that synthesizes primary interviews, secondary research, and quantitative data triangulation. Primary research involved in-depth discussions with senior executives, operations managers, and R&D leaders across logistics, manufacturing, and technology sectors to capture experiential insights and validate market dynamics.

Secondary sources encompassed technical white papers, academic journals, regulatory filings, and press releases, all vetted to exclude duplicate data and ensure currency. Proprietary databases provided historical deployment benchmarks, while case studies illustrated practical applications and ROI outcomes. Data was rigorously cleansed and normalized to facilitate cross-functional analysis across segmentation criteria.

Quantitative models were developed to identify trends and correlations within the robotics ecosystem, but without projecting specific market sizing metrics. Throughout the research process, validation workshops with industry experts were conducted to challenge assumptions, refine categorizations, and affirm strategic interpretations. This multilayered approach ensures that the insights presented are robust, relevant, and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Logistics Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Logistics Robots Market, by Robot Type

- Logistics Robots Market, by Function

- Logistics Robots Market, by Payload Capacity

- Logistics Robots Market, by Power Source

- Logistics Robots Market, by Application

- Logistics Robots Market, by End-Use

- Logistics Robots Market, by Region

- Logistics Robots Market, by Group

- Logistics Robots Market, by Country

- United States Logistics Robots Market

- China Logistics Robots Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Strategic Reflections That Reinforce the Transformative Impact of Robotics in Logistics and Chart the Path Forward for Industry Stakeholders

The logistics robotics sector stands at a critical inflection point, driven by technological breakthroughs, shifting trade policies, and evolving customer demands. As organizations navigate the complexities of international tariffs and pursue supply chain resilience, robotics solutions offer a pathway to agility and cost containment. The segmentation and regional analyses underscore that success hinges on selecting the right mix of robot types, functionalities, and power modalities to suit specific operational contexts.

Competitive dynamics reveal that collaboration between incumbent automation firms and agile software-driven startups will shape the next generation of integrated platforms. Meanwhile, the recommendations outline a strategic playbook that balances modularity, cybersecurity, and workforce readiness, ensuring that deployments deliver sustainable value. Executives who embrace these imperatives will be well positioned to harness robotics as a true competitive differentiator.

Collectively, these reflections chart the trajectory for logistics robotics, from initial proof-of-concept trials to enterprise-wide digital transformation initiatives. Stakeholders are encouraged to leverage the insights herein to inform technology roadmaps, partnership strategies, and capital allocation decisions as they embark on their automation journeys.

Inviting Stakeholders to Engage Directly With Our Associate Director to Secure Comprehensive Market Intelligence That Fuels Informed Investment Decisions

You have explored the pivotal insights and strategic dimensions shaping the logistics robotics market. To gain full access to comprehensive data tables, proprietary analysis of technology trends, and detailed competitive intelligence, please connect directly with Associate Director, Sales & Marketing Ketan Rohom. He will guide you through tailored packages that align with your organization’s strategic imperatives and provide the market intelligence required to make informed investment and development decisions. Engage now to secure a bespoke briefing and unlock the actionable insights that will empower your next wave of automation initiatives.

- How big is the Logistics Robots Market?

- What is the Logistics Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?