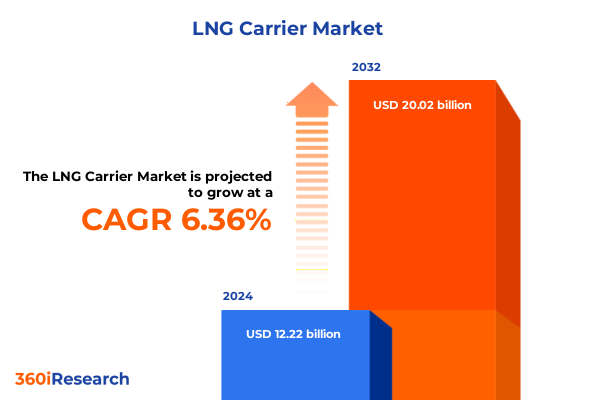

The LNG Carrier Market size was estimated at USD 13.01 billion in 2025 and expected to reach USD 13.77 billion in 2026, at a CAGR of 6.35% to reach USD 20.02 billion by 2032.

Understanding the Evolving Dynamics of LNG Maritime Transport in a Rapidly Transforming Energy Ecosystem

The global landscape of liquefied natural gas (LNG) marine transportation has undergone a rapid transformation in recent years, driven by evolving energy demand patterns, technological innovation, and shifting geopolitical priorities. An increasingly diversified energy mix and a heightened focus on security of supply have elevated the strategic importance of LNG carrier fleets, compelling stakeholders to re-evaluate traditional operating models and embrace dynamic partnerships across the value chain. As end users pursue cost-effective, reliable delivery solutions, carriers and charterers alike are investing in next-generation vessels, advanced multimodal hubs, and digital platforms to optimize voyage efficiency and minimize environmental footprints. This introduction sets the stage for a holistic examination of the forces redefining LNG maritime logistics and highlights the critical imperatives that industry decision-makers must address to sustain competitive advantage and regulatory compliance.

Identifying Key Technological and Market Drivers Transforming the Fundamentals of LNG Carrier Operations

Over the past decade, transformative shifts have reshaped the LNG carrier sector, pushing operators to adopt cleaner propulsion technologies, fortify supply chains, and diversify chartering strategies. The transition from conventional steam turbines to dual-fuel and ME-GI propulsion has significantly enhanced fuel flexibility and emissions performance, while X-DF engines have gained traction for their balance of operational reliability and carbon reduction potential. Digitally enabled voyage planning and real-time performance analytics have delivered unprecedented gains in fuel efficiency and asset utilization, reducing bunker consumption and voyage deviations. Furthermore, the emergence of spot market liquidity alongside traditional time and bareboat charter structures has granted charterers greater flexibility to capture arbitrage opportunities in response to fluctuating regional price spreads. Simultaneously, the maturation of floating storage and regasification units, coupled with expansion of mid-stream infrastructure, has underpinned new trade flows and shortened delivery timelines. Collectively, these shifts underscore a paradigm in which sustainability, agility, and data-driven decision-making are no longer optional but foundational to long-term growth and resilience.

Evaluating the Broad Ramifications of Newly Introduced United States LNG Export Tariffs on Maritime Trade Dynamics

In 2025, the cumulative impact of tariffs imposed by the United States on LNG shipments has exerted multifaceted pressures across the entire maritime supply chain. Originally introduced to safeguard domestic producers and narrow trade imbalances, these levies have elevated delivered cost structures, prompting charterers to re-negotiate voyage contracts and reassess route economics. As import terminals grapple with reduced throughput on U.S. exports and suppliers pivot toward alternative destinations, carriers have encountered surging ballast distances and longer laden voyages, leading to increased vessel idle days and higher fuel expenses. Offshore transshipment hubs have absorbed some of the diverted volumes, yet the additional handling stages have added complexity and incremental turnaround time. Meanwhile, interconnected service providers-from port operators and bunkering merchants to classification societies-have adjusted their fee schedules in response to shifting cargo origins, further amplifying cost pass-through effects. Amid these dynamics, strategic alliances between carriers and trading houses have emerged to mitigate tariff impacts through contractual hedges and optimized fleet deployment across global trade corridors.

Uncovering In-Depth Interpretations of Market Behavior Across Chartering Structures Propulsion Systems and Vessel Specifications

Insights across charter type reveal that spot contracts have surged in prominence as charterers seek to avoid rigid commitments under bareboat agreements or multi-year time charters, enabling rapid response to tariff-induced price arbitrage and evolving demand centers. However, vessel owners have shown a renewed preference for time charters to secure predictable revenue streams, particularly as financing costs escalate amid tighter credit markets. In the realm of propulsion, carriers equipped with versatile dual-fuel diesel-electric systems and advanced ME-GI engines are commanding premium charter rates, reflecting their superior fuel flexibility and ability to operate on both boil-off gas and low-sulfur marine diesel. Steam-propelled ships, once ubiquitous, are increasingly relegated to niche routes where cargo availability and port accessibility pose fewer operational constraints, while X-DF-powered vessels sit at the intersection of reliability and decarbonization ambition, attracting forward-looking clients. Turning to tank architecture, membrane containment systems retain their popularity for large-scale trades due to optimized cargo capacity, yet Moss spherical tanks continue to offer resilience in liquefaction pressures and are often specified for high-duty trading loops. The SPB type has emerged selectively among newbuilds incorporated within emerging fleet renewal programs. When assessing size, vessels in the 145,000-174,000 CBM bracket remain the workhorses of mainstream trades, balancing port compatibility with volume efficiency, whereas ultra-large capacity carriers above 174,000 CBM are positioned to exploit long-haul arbitrage opportunities between resource-rich exporters and distant markets. Under ownership structures, charterers collectively labeled as end users have pursued direct charter arrangements to secure supply chain clarity, while pools have consolidated idle tonnage to achieve economies of scale, and shipping companies have focused on asset light strategies, leasing high-spec vessels from specialized operators to maintain fleet flexibility.

This comprehensive research report categorizes the LNG Carrier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Charter Type

- Propulsion Type

- Capacity

- Tank Type

Dissecting Regional Trade Patterns and Infrastructure Developments Influencing the LNG Carrier Industry Globally

Regional dynamics illustrate a nuanced mosaic of demand drivers and infrastructural maturity. In the Americas, North American export growth has been underpinned by shale gas production and expanded Gulf Coast liquefaction capacity, yet recent tariffs have tempered export volumes to the U.S. East Coast, rerouting shipments toward Asia-Pacific via the Panama Canal and bolstering transshipment facility throughput in the Caribbean. South America’s burgeoning regasification infrastructure continues to absorb incremental LNG flows, particularly during seasonal peak consumption, offering carriers recurrent backhaul opportunities. In the Europe, Middle East & Africa corridor, Europe’s energy security imperatives have led to sustained interest in LNG imports from diverse suppliers, despite regional sanctions complexity and port congestion risks in Northern European terminals. The Middle East’s investment in floating LNG hubs is steadily capturing non-traditional cargoes, while African import markets remain sporadic yet exhibit growth potential as new regasification projects reach commissioning. Meanwhile, in the Asia-Pacific region, robust demand growth-fueled by industrial gas substitution policies and power generation diversification-has cemented the Asia market as the largest consumer of seaborne LNG, incentivizing carriers to deploy high-efficiency vessels on core Japan, Korea, and China routes, while emerging destinations such as India and Southeast Asia are steadily expanding their LNG terminal footprints.

This comprehensive research report examines key regions that drive the evolution of the LNG Carrier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Growth Approaches Employed by Leading and Emerging Players to Differentiate Their LNG Carrier Offerings

The competitive landscape features a blend of longstanding shipping conglomerates and specialized new entrants, each differentiating through fleet composition, service models, and strategic alliances. Leading operators have increasingly forged joint ventures with energy majors to co-invest in newbuild LNG carriers, sharing both construction risk and operational expertise. Others have leveraged digital platforms to offer value-added services-such as voyage optimization dashboards and emissions reporting-to charterers seeking transparency and compliance with evolving environmental regulations. Established names continue to invest in eco-innovations, retrofitting existing vessels with advanced heat-recovery units and catalytic converters, whereas agile challengers have commissioned state-of-the-art dual-fuel ships under long-term charters to secure guaranteed employment. Across the board, firms prioritizing sustainability credentials and operational reliability have successfully captured the attention of institutional investors and export credit agencies, thereby preserving favorable financing terms. Meanwhile, mid-sized players have pursued niche specializations-whether ultra-long range trades or short sea distribution-to sidestep direct competition and carve defensible market positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the LNG Carrier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP Shipping Limited

- BW LNG Pte. Ltd.

- China COSCO Shipping Corporation Limited

- Dynagas Ltd.

- GasLog Ltd.

- Golar LNG Limited

- Höegh LNG Holdings Ltd.

- Kawasaki Kisen Kaisha, Ltd.

- Knutsen OAS Shipping AS

- Maran Gas Maritime Inc.

- MISC Berhad

- Mitsui O.S.K. Lines, Ltd.

- Nakilat Q.S.C.

- Nippon Yusen Kabushiki Kaisha

- Novatek PJSC

- QatarEnergy

- Seapeak plc

- Shell International Trading and Shipping Company Limited

- Sovcomflot PJSC

- Teekay LNG Partners L.P.

Formulating High-Impact Strategic Initiatives to Enhance Operational Agility Decarbonization and Commercial Flexibility

Industry stakeholders must prioritize integration of advanced propulsion technologies by accelerating retrofits across existing fleets and incorporating dual-fuel or ME-GI systems on all new orders to capitalize on fuel cost arbitrage and emissions incentives. Collaboration between ownership groups and charterers should pivot toward flexible contract frameworks that blend spot exposure with core time charter anchors, enabling adaptive allocation of tonnage in response to tariff swings and seasonal demand fluctuations. Investment in digital analytics platforms is non-negotiable, as real-time monitoring of fuel consumption, weather routing, and performance metrics will unlock operational efficiencies and reinforce environmental stewardship. Port authorities and service providers ought to engage in joint infrastructure planning to streamline bunkering logistics and minimize vessel turnaround times, particularly in emerging import hubs. Furthermore, trade associations and regulatory bodies should coalesce around standardized data-sharing protocols to facilitate transparent compliance reporting and accelerate decarbonization pathways through carbon intensity indices. Finally, carriers and financial partners must explore innovative funding mechanisms-such as green bonds and performance-linked loans-to underpin fleet renewal programs and signal commitment to sustainability principles.

Detailing the Integrated Research Approach Incorporating Stakeholder Engagement Data Triangulation and Robust Quality Control

This analysis is grounded in a rigorous methodology combining primary stakeholder engagement and comprehensive secondary research. In the primary phase, interviews were conducted with senior executives across shipping lines, chartering desks, and port operators, complemented by detailed discussions with naval architects and marine equipment suppliers. Secondary sources included industry journals, regulatory filings, port call data, and proprietary vessel tracking information, ensuring triangulation of trade flow patterns and fleet utilization metrics. Quantitative data analyses were validated through cross-referencing multiple open-source databases, while qualitative insights were synthesized to contextualize market sentiments and strategic objectives. The research lifecycle adhered to strict protocols for information security and data integrity, with iterative peer reviews ensuring accuracy and consistency. Stakeholder feedback loops further enhanced the reliability of findings, resulting in a robust, transparent examination of the LNG carrier market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LNG Carrier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LNG Carrier Market, by Charter Type

- LNG Carrier Market, by Propulsion Type

- LNG Carrier Market, by Capacity

- LNG Carrier Market, by Tank Type

- LNG Carrier Market, by Region

- LNG Carrier Market, by Group

- LNG Carrier Market, by Country

- United States LNG Carrier Market

- China LNG Carrier Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Strategic Takeaways for Navigating Future Opportunities Challenges and Partnerships in LNG Maritime Logistics

As the LNG carrier industry navigates a period of unprecedented change, the confluence of technology innovation, evolving charter models, shifting trade flows, and regulatory interventions demands strategic foresight and collaborative action. Operators who proactively retrofit existing fleets, prioritize fuel-efficient vessels, and embrace flexible commercial structures will be best positioned to capture emerging opportunities while mitigating tariff-induced headwinds. Regional trade realignments underscore the necessity for agile deployment strategies and infrastructure partnerships to sustain throughput and minimize idle tonnage. Meanwhile, strategic alliances between shipping companies, energy majors, and financial institutions will underpin the next wave of fleet modernization initiatives, driving incremental improvements in operational efficiency and environmental performance. Ultimately, success hinges on the ability of industry leaders to integrate data-driven decision-making, decarbonization imperatives, and resilient business models into a cohesive roadmap for sustainable growth.

Secure Your Expert LNG Carrier Market Report Now with Direct Access to Our Sales and Marketing Leadership

Explore tailored market insight packages and unlock in-depth analysis by connecting directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to secure your comprehensive LNG Carrier Market research report.

- How big is the LNG Carrier Market?

- What is the LNG Carrier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?