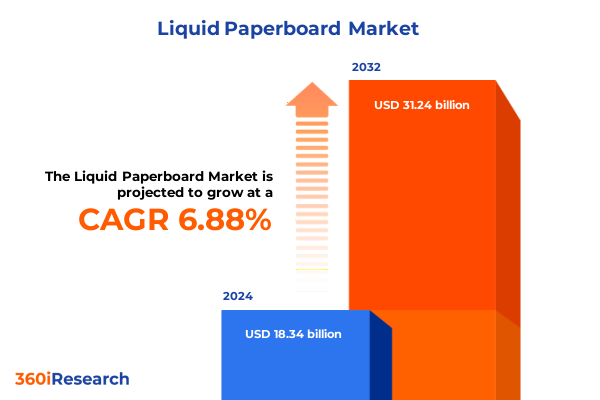

The Liquid Paperboard Market size was estimated at USD 19.32 billion in 2025 and expected to reach USD 20.35 billion in 2026, at a CAGR of 7.10% to reach USD 31.24 billion by 2032.

Revolutionizing Shelf-Stable Products: How Liquid Paperboard Packaging Combines Sustainability, Efficiency, and Consumer Convenience for Food and Beverage Brands

Liquid packaging board is a specialized multi-ply paperboard engineered for outstanding stiffness, wet strength, and barrier performance to safely contain a variety of liquids without leakage or spoilage. These boards pair virgin fiber layers with plastic and aluminum coatings-forming cartons that maintain sterility and prevent oxygen, light, and flavor migration across applications such as milk, juice, edible oils, and water

Beyond basic containment, liquid paperboard cartons deliver unparalleled versatility. Brick-shaped aseptic cartons and gable top designs accommodate ultra-high temperature (UHT) and pasteurized products alike, while flat-packed pre-sterilized blanks optimize logistics. From single-serve juice boxes to family-size milk cartons, this packaging solution underpins modern supply chains across the food and beverage industry.

Strategic Regulatory, Technological, and Behavioral Shifts Propelling the Liquid Paperboard Market Toward Cutting-Edge Innovation and Sustainable Practices

Recent shifts in materials science and regulatory landscapes are redefining strategic priorities for liquid paperboard producers and end-users. The monomaterial movement has gained remarkable momentum as manufacturers phase out complex multilayer laminates in favor of single-material constructions that enhance recyclability. On-pack monomaterial claims have surged seven-fold in the past two years, and industry showcases of simplified polyethylene-paper composites underscore a commitment to circular design principles

In parallel, digitalization is revolutionizing how brands and consumers interact with packaging. Advanced smart cartons equipped with QR codes, RFID tags, and environmental sensors offer real-time traceability, supply chain transparency, and personalized consumer engagement. Leading dairy and beverage companies report spoilage reductions of up to 20% through real-time monitoring, confirming that technological integration is no longer a novelty but a market imperative

Assessing the Cumulative Disruptions Wrought by 2025 United States Tariffs on Liquid Paperboard Supply Chains and Material Costs

In early 2025, the U.S. government invoked emergency trade authorities to layer new levies on packaging imports. A 10% IEEPA tariff on Chinese packaging goods was swiftly raised to 20%, while non-compliant imports from Canada and Mexico faced 25% duties under consecutive policy directives. Concurrently, Section 232 tariffs on steel and aluminum were reinstated, and a blanket 10% reciprocal tariff on all imports took effect, compounding the cost of raw materials and packaging components for U.S. manufacturers

These elevated duties triggered an industry-wide push for cost mitigation. Uncoated recycled paperboard producers announced Q2 2025 price increases, attributing the move to contracting fiber demand and heightened input costs. Food and beverage brands are actively exploring alternative formats-from monomaterial cartons to flexible pouches-to safeguard margins, though retooling investments and logistics surcharges limit rapid conversion. While global beverage giants can absorb these escalations, mid-sized and smaller brands face pronounced margin pressures

Looking ahead, the interplay of these tariffs with USMCA-aligned exemptions is reshaping global trade flows. European cartonboard exporters are reassessing capacity in the face of new U.S. levies, while Asian producers eye opportunities to fill emerging gaps. Domestic carton manufacturers are securing long-term supply agreements and expanding local capacity-strategic adjustments that underscore the cumulative cost and sourcing challenges permeating the 2025 tariff environment

Unveiling the Intricacies of Liquid Paperboard Market Segmentation and Key Insights Across Product Types, Packaging Formats, Fiber Sources, Sizes and Channels

Segmenting the liquid paperboard market by liquid type illuminates distinct consumption and innovation patterns. The edible oil category, broken down into olive and vegetable oil variants, benefits from consumer shifts toward heart-healthy and plant-based fats. Juice packaging, leveraging aseptic carton technology, extends shelf life and preserves nutritional integrity for premium and cold-pressed blends. Traditional and organic milk products remain anchored by gable top cartons, reflecting stable demand in mature markets, while the water segment-divided into flavored and plain offerings-capitalizes on convenience and premiumization of functional hydration solutions

Further differentiation by package type, fiber source, carton size, and sales channel underscores strategic production and distribution choices. High-speed aseptic lines dominate family-size formats above 1000 ml catering to hypermarkets, whereas recycled and virgin fiber cartons in 200-500 ml single-serve formats align with online, direct-to-consumer channels focused on portability and sustainability. Manufacturers adeptly balance production line flexibility-to switch between large-format volume runs and small, e-commerce-optimized batches-with tailored marketing strategies for in-store and digital platforms

This comprehensive research report categorizes the Liquid Paperboard market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Liquid Type

- Package Type

- Fiber Source

- Carton Size

- Sales Channel

Decoding Regional Dynamics: In-Depth Perspectives on Liquid Paperboard Demand, Infrastructure, and Growth Drivers in Americas, EMEA, and Asia-Pacific Markets

North American liquid paperboard markets leverage a mature recycling ecosystem and evolving Extended Producer Responsibility frameworks. Industry initiatives have increased household access to carton recycling from 29% to 62% between 2019 and 2023, facilitating brand commitments to U.S. sustainability goals. Pre-sterilized flat-packed aseptic cartons further optimize logistics, with major beverage companies citing transport emission reductions of up to 22% following format conversions

In Europe, Middle East & Africa, stringent regulatory rigor and substantial cartonboard manufacturing capacity shape market dynamics. EU tariffs on U.S. imports have prompted European mills-already contending with nearly 1 million tonnes of surplus capacity-to reevaluate export strategies amid evolving levy structures. The absence of U.S. folding boxboard producers positions Europe as a key supplier, though reciprocal trade measures under USMCA and broader duties introduce uncertainty into transatlantic flows

Asia-Pacific stands out for rapid urbanization, rising middle-class incomes, and expanding cold chain infrastructure driving aseptic carton adoption. In Australia, aseptic formats enabled UHT milk exports to Southeast Asia, cutting refrigeration-dependent shipping emissions by 40%. Simultaneously, strategic partnerships and capacity expansions across China, India, and ASEAN markets are accelerating the rollout of plant-based barrier innovations to comply with emerging regional sustainability mandates

This comprehensive research report examines key regions that drive the evolution of the Liquid Paperboard market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Players: Strategic Moves, Innovations, and Collaborative Initiatives Shaping the Competitive Landscape of Liquid Paperboard Packaging

Tetra Pak continues to set industry benchmarks with plant-based barrier layers, exemplified by its recent beverage carton that replaces traditional aluminum with paper-based alternatives-underscoring its circular economy commitment. SIG Combibloc is expanding Aseptic technology production lines in Asia to meet surging demand for shelf-stable juices, while Elopak’s Pure-Pak mono-material cartons earn accolades for seamless recyclability and improved carbon footprint profiles

Responding to raw material uncertainties, WestRock and Smurfit Kappa have blended recycled fiber into high-performance liquid packaging board and forged long-term supply pacts to stabilize feedstock. Concurrently, nano-coating innovators and digital printing specialists are collaborating with food and beverage brands to deliver bespoke packaging that balances brand aesthetics with functional performance-highlighting the rising influence of agile smaller players in reshaping competitive dynamics

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Paperboard market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BELLMER GmbH

- Billerud AB

- Borealis AG

- Carton Service, Inc.

- Cascades, Inc.

- Clearwater Paper Corporation

- Elopak AS

- International Paper Company

- ITC Limited

- Kimberly-Clark Corporation

- Kraft Group LLC

- Liquibox Corporation

- Modi International

- Mondi PLC

- Ningbo Sure Paper Co., Ltd.

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Sustainable Growth in Liquid Paperboard Packaging

Industry leaders should channel investments into next-generation barrier technologies that eliminate aluminum layers and employ bio-based coatings-streamlining recyclability and lowering carbon footprints. Developing strategic partnerships with recycled fiber suppliers and diversifying raw material sourcing across multiple geographies can mitigate exposure to tariff volatility, while establishing on-site pilot lines for monomaterial and lightweight carton trials accelerates validation of sustainable solutions under real production conditions

To differentiate in crowded markets, executive teams should engage with leading e-commerce platforms to pilot smart aseptic cartons featuring QR-enabled traceability and interactive consumer experiences-unlocking first-party data streams. Collaborative initiatives with recycling councils and regulatory bodies can help standardize end-of-life protocols, and allocating R&D resources to automation and sensor integration will optimize quality control and operational efficiency in filling and packaging operations

Comprehensive Research Methodology Employed to Ensure Robust Insights, Data Reliability, and Thorough Coverage of the Liquid Paperboard Packaging Landscape

This analysis is grounded in a structured, multi-tiered methodology. It commences with primary qualitative interviews conducted with senior executives from leading liquid paperboard manufacturers, converters, and brand owners. These insights are complemented by a thorough secondary research phase, encompassing trade association publications, technical white papers, and regulatory documents to capture evolving policies and technological advancements. Each data point was rigorously cross-verified through triangulation against multiple credible sources to ensure validity and robustness.

Market segmentation was defined by liquid type, package format, fiber source, carton size, and sales channel. Regional insights leveraged trade flow and import-export data, while company profiling integrated financial disclosures, patent analyses, and strategic press releases. Draft findings underwent expert review by industry practitioners to refine perspectives and ensure alignment with on-the-ground realities, culminating in actionable recommendations tailored for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Paperboard market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Paperboard Market, by Liquid Type

- Liquid Paperboard Market, by Package Type

- Liquid Paperboard Market, by Fiber Source

- Liquid Paperboard Market, by Carton Size

- Liquid Paperboard Market, by Sales Channel

- Liquid Paperboard Market, by Region

- Liquid Paperboard Market, by Group

- Liquid Paperboard Market, by Country

- United States Liquid Paperboard Market

- China Liquid Paperboard Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing the Imperative of Sustainable Innovation and Strategic Adaptation for Future-Proofing Liquid Paperboard Packaging Ventures

In conclusion, the liquid paperboard packaging sector stands at the intersection of sustainability imperatives, technological innovation, and dynamic regulatory environments. Companies that invest in simplified, recyclable barrier solutions and resilient supply chains will emerge as frontrunners, while digital integration and smart packaging capabilities offer new avenues for consumer engagement and operational excellence. Strategic agility-supported by diversified sourcing, regulatory collaboration, and forward-looking R&D-will be essential to future-proof operations against trade shifts and environmental mandates. By embracing a holistic approach that balances material efficiency, consumer needs, and cost management, stakeholders can steer the liquid paperboard industry toward a more sustainable and profitable future.

Take the Next Step Today to Secure Comprehensive Market Intelligence on Liquid Paperboard Packaging with Expert Guidance from Ketan Rohom

Contact Ketan Rohom, Associate Director, Sales & Marketing, to access the full liquid paperboard market research report, gain deeper strategic insights, and secure a tailored briefing. With expert guidance and customized solutions, the report will empower your organization to navigate evolving market dynamics, capitalize on emerging opportunities, and strengthen competitive positioning. Reach out now to explore partnership options and purchase the definitive resource for informed decision-making in liquid paperboard packaging.

- How big is the Liquid Paperboard Market?

- What is the Liquid Paperboard Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?