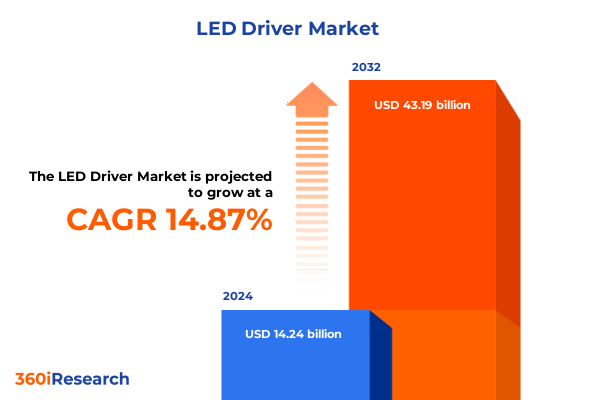

The LED Driver Market size was estimated at USD 16.34 billion in 2025 and expected to reach USD 18.75 billion in 2026, at a CAGR of 14.89% to reach USD 43.19 billion by 2032.

Revealing the Critical Role of LED Drivers in Shaping Modern Lighting Ecosystems with Unmatched Efficiency Performance and Design Flexibility

In an era where lighting systems are evolving into highly sophisticated ecosystems, LED drivers stand at the forefront of innovation by regulating current and voltage to ensure optimal performance, energy efficiency, and longevity of LED luminaires. These electronic control devices serve as the critical interface between power sources and LEDs, enabling consistent light output, precise dimming, and advanced protective features such as overvoltage and thermal shutdown. As market demand shifts toward smart buildings, connected infrastructure, and sustainable solutions, the LED driver emerges as a pivotal component that underpins both functionality and design flexibility in lighting applications ranging from architectural interiors to outdoor street systems.

Understanding this landscape requires a deep dive into technological advancements, evolving regulatory frameworks, and dynamic market drivers that are reshaping how LED drivers are designed, manufactured, and deployed. This report delivers a strategic overview of the LED driver sector by examining emerging trends, tariff influences, segmentation patterns, and regional market nuances. By synthesizing insights from industry leaders, engineering breakthroughs, and macroeconomic factors, the following sections provide a clear and actionable framework for decision makers, technical specialists, and executives seeking to harness the full potential of LED driver innovation.

Exploring the Transformative Technological and Market Driven Shifts Redefining the LED Driver Landscape toward Smarter Connectivity and Sustainable Solutions

The LED driver landscape is currently experiencing a wave of transformative shifts driven by rapid technological breakthroughs and evolving end-user priorities. Power electronics engineers are integrating gallium nitride (GaN) semiconductors to achieve higher efficiency and power density in compact footprints, while the adoption of digital control platforms is enabling real-time monitoring, remote dimming, and predictive maintenance. Consequently, the boundaries between discrete driver modules and fully integrated smart lighting systems are dissolving, giving rise to solutions that seamlessly interact with building management networks and Internet of Things (IoT) platforms.

Simultaneously, market dynamics are being redefined by sustainability mandates and decarbonization goals set by global regulatory bodies, which pressure manufacturers to reduce standby losses and maximize lumen-per-watt performance. These combined forces are encouraging silicon carbide and GaN device proliferation, along with the development of programmable drivers that support advanced dimming protocols such as digital addressable lighting interface (DALI) and pulse-width modulation (PWM) for granular control. As a result, lighting solution providers are positioning LED drivers not merely as power regulators but as strategic enablers of intelligent lighting ecosystems that deliver energy savings, occupant comfort, and data-driven insights.

Analyzing the Cumulative Consequences of Tariff Escalations on the United States Landscape and Their Multifaceted Impacts on Global Supply Chains

In two thousand twenty-five, the cumulative impact of escalated import tariffs on LED driver components has sent ripples throughout the global supply chain, influencing procurement strategies, manufacturing footprints, and final pricing structures. Initially enacted to address trade imbalances, these levies have raised costs on key semiconductor devices and passive components sourced from major manufacturing hubs. Lighting OEMs have responded by exploring alternative regional suppliers, renegotiating long-term contracts, and investing in domestic assembly capabilities to mitigate the financial burden imposed by cross-border duties.

Moreover, the tariff environment has accelerated strategic reengineering of product designs to reduce dependency on high-cost imported chips, with several firms increasing vertical integration of power supply modules. This shift has spurred targeted R&D initiatives aimed at optimizing bill-of-materials while preserving performance benchmarks. Ultimately, the cumulative effect of these measures is twofold: it has elevated near-term production costs but also catalyzed a renaissance in regional manufacturing that may yield resilient and agile supply networks, better insulated against future geopolitical and trade uncertainties.

Deriving Insightful Perspectives through Segmentation Analysis to Illuminate Diverse Market Dynamics Governing LED Driver Ecosystem Across Consumption Patterns

A nuanced understanding of the LED driver market emerges when one examines how variations in output current shape product utility and demand patterns. Drivers designed for constant current operation accommodate high-current applications such as industrial high-bay fixtures, where robust performance ensures uniform illumination, while medium-current solutions address office and retail spaces seeking a balance of efficiency and cost. Low-current variants are tailored for automotive and signage requirements, enabling safe operation under stringent thermal constraints. In contrast, constant voltage drivers facilitate flexible deployment across consumer electronics and architectural accent lighting, with five-volt modules powering compact LED strips, twelve-volt designs integrating seamlessly into panel lighting panels, and twenty-four-volt drivers supporting expansive outdoor installations.

Product type segmentation further reveals contrasting preferences between AC-DC and DC-DC drivers. AC-DC modules remain the backbone of general illumination, with non-programmable types serving straightforward retrofit luminaries and programmable counterparts powering smart building applications. DC-DC drivers excel in environments demanding electrical isolation, such as automotive safety systems, whereas non-isolated designs find traction in cost-sensitive consumer gadgets. Dimming capabilities also drive differentiation: conventional analog zero to ten volt drivers still dominate legacy commercial retrofits, even as digital interfaces such as DALI gain traction in premium office architectures. Entertainment venues continue to rely on DMX-protocol dimming for dynamic lighting effects, while PWM-based controls offer a low-cost solution for residential and small-scale applications.

Examining input type reveals that single-phase AC drivers are ubiquitous in residential and light commercial settings, while three-phase AC modules address the rigorous demands of large infrastructure and campus-wide installations. DC input drivers, fed by battery or solar arrays, are carving out new growth in off-grid and backup power scenarios. Application segmentation underscores the varied technical requirements across sectors: precision drivers for architectural installations demand tight output regulation to maintain color consistency; automotive lighting solutions require ruggedized designs capable of withstanding vibration and temperature extremes; backlighting applications prioritize compact form factors for LED panels in televisions and monitors; horticulture lighting drivers feature specialized spectral controls for greenhouse and indoor grow environments; panel lighting modules integrate seamlessly into drop ceilings; and street lighting demands durable drivers for both area and roadway lighting use cases.

In terms of end users, the automotive sector values reliability and long-life ratings, while commercial customers in hospitality, office, and retail prioritize programmable drivers that enhance ambience and operational flexibility. Industrial clients in manufacturing and warehouse contexts require high-current drivers capable of powering durable fixtures under continuous operation. Residential segments, driven by smart home adoption, gravitate toward constant voltage drivers with simple plug-and-play installation. Mounting preferences further refine choices: built-in integrated drivers enable ultra-slim fixture profiles and direct PCB mount modules cater to module-based luminaire factories; external enclosed drivers serve retrofitting needs, and open-frame designs appeal to original equipment manufacturers seeking customization. Distribution channels vary from direct sales agreements with large OEM customers to the extensive networks of electronics component distributors, and increasingly, online e-commerce platforms and manufacturer websites facilitate small-batch and customized orders.

This comprehensive research report categorizes the LED Driver market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Output Current

- Input Type

- Mounting

- Application

- End User

- Distribution Channel

Uncovering Regional Variations in Technological Adoption Market Trends and Competitive Intensity Shaping LED Driver Demand across Key Global Territories

Regional markets for LED drivers exhibit distinct characteristics shaped by regulatory frameworks, infrastructure trends, and investment priorities. In the Americas, energy efficiency incentives and rebate programs endorsed by federal and state entities have encouraged building owners to retrofit conventional lighting with LED systems paired with advanced drivers. The availability of tax credits and performance-based incentives has driven demand for high-efficiency modules with integrated connectivity features, accelerating uptake in both retrofit and new construction projects.

Europe, the Middle East, and Africa present a broad spectrum of opportunity profiles. In Western Europe, stringent ecodesign regulations and leadership in smart city initiatives support the adoption of programmable drivers compatible with open communication standards. The Middle East is witnessing substantial investment in large-scale outdoor lighting and hospitality projects, often specifying intelligent driver solutions to deliver dynamic lighting scenarios. Conversely, parts of Africa are at earlier stages of market development, where rural electrification programs and off-grid solar installations create demand for DC-input drivers tailored to remote locations with battery or solar charging configurations.

The Asia-Pacific region remains the manufacturing powerhouse for LED driver components, with key production clusters in East Asia driving economies of scale. Domestic demand in China and Japan is buoyed by national energy conservation mandates, while India’s burgeoning commercial real estate sector and rapidly expanding indoor farming operations are increasingly specifying horticulture-grade drivers. Southeast Asian countries, catalyzed by urbanization and infrastructure modernization, are gradually standardizing on programmable and IoT-enabled driver platforms to optimize asset management and reduce operational costs.

This comprehensive research report examines key regions that drive the evolution of the LED Driver market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Players and Their Strategic Innovations Driving Evolution of LED Power Solutions in a Competitive Landscape of Technologies

Several leading companies are steering the evolution of LED drivers through targeted investments in research, strategic partnerships, and portfolio diversification. A global lighting technology innovator has positioned itself at the forefront of IoT-enabled driver solutions by embedding connectivity modules and cloud-based control platforms into its product lines. This approach has allowed smart building integrators to manage lighting through unified dashboards and leverage occupancy analytics for energy savings.

Meanwhile, a heritage lighting components manufacturer has focused on scaling GaN-based drivers to deliver unprecedented power density at reduced system costs. By collaborating with semiconductor fabs and establishing co-development agreements, it has accelerated time-to-market for high-wattage modules suited for outdoor and industrial applications. Other prominent firms specializing in cost-effective power supplies have carved out leadership in low-voltage constant voltage segments, catering to consumer electronics and signage markets with plug-and-play simplicity.

Additionally, OEM-focused entities have introduced modular driver platforms that support broad output ranges, enabling fixture makers to adapt a single driver core to multiple luminaire designs. These platforms often feature programmable firmware and field-serviceable components, enhancing flexibility while minimizing inventory complexity. Collectively, these corporate strategies underscore a converging emphasis on intelligent controls, power density, and modularity as the key pillars driving competitive differentiation in the LED driver sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the LED Driver market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands Lighting, Inc.

- ams OSRAM GmbH

- Cree, Inc.

- Delta Electronics, Inc.

- Eaton Corporation plc

- ERP Power

- Guangdong Kegu Power Electronics Co., Ltd.

- Helvar Ltd.

- Hubbell Incorporated

- Inventronics Co., Ltd.

- Lifud Technology Co., Ltd.

- Lutron Electronics Co., Inc.

- MEAN WELL Enterprises Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Shenzhen Done Power Co., Ltd.

- Shenzhen Euchips Industrial Co., Ltd

- Shenzhen SOSEN Electronics Co., Ltd.

- Tridonic GmbH & Co KG

- Zhuhai LTECH Technology Co., Ltd.

Presenting Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Strengthen Position within the Evolving LED Driver Sector

To thrive in this rapidly evolving market, industry leaders should diversify their supply chains by qualifying multiple regional suppliers for critical semiconductor and passive components. This approach will reduce exposure to tariff-induced cost fluctuations and geopolitical disruptions. Equally important is the acceleration of in-house R&D investments focused on GaN and silicon carbide technologies, which promise superior efficiency and compactness vital for next-generation high-power applications.

Building partnerships with IoT and building automation platform providers will unlock the full value proposition of smart drivers, allowing lighting solutions to contribute to broader digital transformation initiatives. Firms should also prioritize compliance with emerging energy performance standards by designing drivers that satisfy the most stringent eco-design and energy star requirements. Incorporating over-the-air firmware update capabilities will ensure that installed driver fleets can adapt to protocol upgrades and security patches with minimal downtime.

Furthermore, companies should align product development roadmaps with growing segments such as horticulture and electric vehicle charging infrastructure, where specialized driver features and rigorous reliability testing are paramount. By leveraging modular design architectures, manufacturers can offer configuration flexibility to end users while streamlining inventory and reducing lead times. Finally, strengthening after-sales service, technical training, and digital support portals will fortify customer loyalty and create recurring revenue streams through maintenance contracts and software subscriptions.

Detailing Rigorous Research Methodologies Employed to Uncover Reliable Insights into Technological Trends Market Dynamics and Consumer Preferences in LED Driver

This analysis is rooted in a dual-track research methodology that combines primary interviews with luminaire OEMs, lighting designers, and component suppliers alongside secondary data review of technical papers, regulatory filings, and patent landscapes. Extensive discussions with power electronics engineers and procurement professionals provided firsthand insights into the challenges of sourcing critical components under shifting tariff regimes.

To validate these qualitative findings, a quantitative survey encompassing end-user facility managers, retrofit contractors, and electrical wholesalers was conducted to gauge preferences for driver features such as dimming protocols, power efficiency thresholds, and connectivity requirements. Data triangulation was achieved by cross-referencing reported shipment volumes, trademark filings, and public financial disclosures of leading market participants. Rigorous data cleansing and expert panel reviews ensured that the conclusions reflect both current market conditions and anticipated technological trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LED Driver market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LED Driver Market, by Product Type

- LED Driver Market, by Output Current

- LED Driver Market, by Input Type

- LED Driver Market, by Mounting

- LED Driver Market, by Application

- LED Driver Market, by End User

- LED Driver Market, by Distribution Channel

- LED Driver Market, by Region

- LED Driver Market, by Group

- LED Driver Market, by Country

- United States LED Driver Market

- China LED Driver Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3498 ]

Concluding Analysis Emphasizing Overarching Themes Key Findings and Strategic Implications for Future Innovation Trajectories within the LED Driver Domain

Through this comprehensive examination of technological innovations, tariff dynamics, segmentation nuances, and regional market variations, it becomes apparent that LED drivers are transitioning from passive power regulators into intelligent system enablers. The interplay of GaN adoption, programmable control architectures, and connectivity integration is forging a new paradigm in which drivers not only deliver energy savings but also provide actionable operational data that informs broader facility management strategies.

Looking ahead, companies that embrace modular architectures, cultivate resilient supply chain networks, and invest in software-driven feature enhancements will be best positioned to capture emerging market opportunities. By aligning product roadmaps with evolving sustainability mandates and end-user demand for customization, these organizations can accelerate innovation cycles and deliver differentiated value propositions. Ultimately, the LED driver will continue to be a central pillar in the global shift toward smarter, greener, and more adaptable lighting solutions.

Innovative Invitation Encouraging Decision Makers to Engage with Associate Director Sales and Marketing for Access to LED Driver Market Research Insights

To explore this comprehensive LED driver market research report and unlock the strategic insights tailored to your organization’s objectives, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through the detailed analysis, ensure the data aligns with your specific needs, and facilitate access to the full suite of findings. Engage with Ketan today to gain the competitive advantage needed to navigate the complex landscape of LED driver technology and drive your next phase of growth and innovation

- How big is the LED Driver Market?

- What is the LED Driver Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?