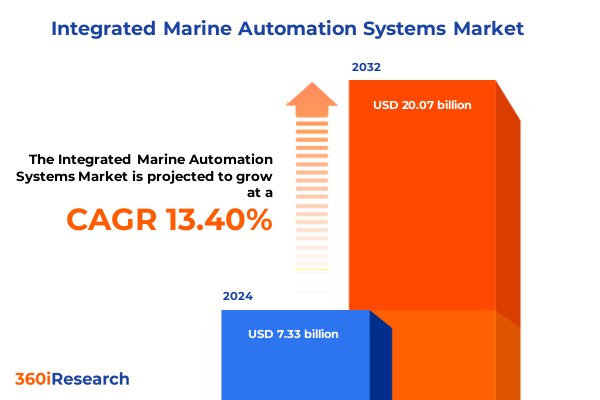

The Integrated Marine Automation Systems Market size was estimated at USD 8.30 billion in 2025 and expected to reach USD 9.40 billion in 2026, at a CAGR of 13.43% to reach USD 20.07 billion by 2032.

Setting the Stage for Integrated Marine Automation: Unveiling the Convergence of Connectivity, Safety, and Efficiency Transforming Maritime Operations Worldwide

The maritime industry stands at the cusp of a profound revolution driven by integrated marine automation systems that interlink connectivity, safety, and operational efficiency. As global trade volumes continue to rise, shipping lines and naval architects seek innovative solutions to optimize vessel performance, reduce human error, and uphold stringent regulatory requirements. This transformation is underpinned by advances in sensor technologies, real-time data analytics, and robust communication networks that collectively facilitate a seamless exchange of critical information across onboard systems and shore-based operations.

In this context, integrated marine automation extends beyond isolated control modules, evolving into intelligent ecosystems capable of self-diagnosis and predictive maintenance. Leaders in shipping, offshore support, and passenger transportation are increasingly recognizing the strategic value of interconnected platforms that monitor vessel health, automate routine tasks, and adapt dynamically to environmental conditions. Consequently, this shift is redefining traditional maritime workflows, forging new pathways for cost reduction, performance enhancement, and regulatory compliance.

Through this executive summary, we outline pivotal industry shifts, tariff implications, segmentation insights, and regional dynamics shaping the future of marine automation. Our goal is to equip stakeholders with the clarity required to navigate complexity, capitalize on emerging opportunities, and craft forward-looking strategies that drive sustainable growth in an increasingly competitive global market.

Navigating the Next Horizon: How Digitalization, Decarbonization, and Autonomous Technologies Are Redefining Marine Automation Ecosystems

Over the past decade, marine automation has undergone transformative shifts fueled by digitalization, decarbonization imperatives, and the rising prominence of autonomous technologies. Digital twins now mirror the physical vessel environment, enabling virtual testing of platform management systems and navigation protocols before deployment at sea. Simultaneously, stringent emissions regulations are prompting shipowners to integrate energy-efficient monitoring and control systems that optimize fuel consumption while meeting global decarbonization targets.

The integration of advanced communication systems has further reshaped operational paradigms. High-bandwidth satellite links and ship-to-shore IoT architectures are bridging data siloes, empowering decision-makers to act on real-time insights. This continuous flow of information enhances situational awareness and drives process automation, ultimately reducing downtime and enhancing safety margins. Moreover, the convergence of hardware, software, and services in unified platforms is fostering a collaborative ecosystem where original equipment manufacturers, software developers, and service providers co-innovate to address evolving market demands.

These developments signal a shift from reactive maintenance toward predictive strategies, underpinning a new era of resilience in maritime operations. As autonomous navigation systems gain regulatory acceptance, vessels are poised to benefit from enhanced route optimization, crew assistance modules, and reduced operational risk. Taken together, these trends illustrate how integrated automation is redefining value chains, paving the way for smarter, greener, and more connected fleets.

Assessing the Ripple Effects of 2025 US Tariff Measures on Marine Automation Supply Chains, Pricing Dynamics, and Strategic Procurement Decisions

In 2025, the implementation of targeted tariffs by the United States has created cascading effects across the marine automation supply chain. Components manufactured abroad, including specialized navigation sensors and platform management hardware, have experienced price adjustments that compel procurement teams to recalibrate sourcing strategies. Consequently, shipyards and retrofitting service providers are reevaluating vendor partnerships to mitigate cost pressures while preserving quality standards.

As a result, domestic manufacturing capabilities are increasingly prioritized. Shipbuilders and retrofit service entities are forging alliances with local hardware producers, seeking to reduce lead times and buffer against volatility in international trade policies. This strategic realignment has strengthened the domestic supplier base, yet it also underscores the need for continued investment in advanced manufacturing technologies to meet rigorous sector demands.

Moreover, the ripple effects extend to software and service segments. With communication and monitoring platforms often bundled in global licensing agreements, tariff-induced cost variations have spurred license renegotiations and stimulated demand for modular, cloud-based alternatives. Offshore support vessel operators, passenger vessel owners, and tanker fleets alike are exploring pay-as-you-go subscriptions and platform-agnostic solutions to balance fiscal responsibility with high system reliability. Ultimately, the 2025 US tariff measures have served as a catalyst for supply chain localization, diversified procurement models, and renewed emphasis on cost-effective innovation.

Delving into Market Segmentation to Reveal How Vessel Types, System Architectures, and Application Verticals Shape Automation Solutions

A nuanced examination of market segmentation reveals how the nature of vessels, the architecture of automation systems, component breakdowns, varied application domains, installation approaches, and end-user typologies collectively shape strategic priorities across the industry. In terms of vessel type, the nuances between bulk carriers, container ships, offshore support vessels, passenger vessels, tankers, and superyachts drive differential demands for system resilience, scalability, and user interface complexity. Communication systems, monitoring and control systems, navigation suites, and platform management systems each carry specific requirements for integration and interoperability, guided by the vessel’s operational profile.

Components ranging from robust hardware modules and sensor arrays to sophisticated software platforms and specialized services form the backbone of these systems. Application-driven segmentation further refines market focus: cargo transport needs diverge between dry and liquid cargo vessels; offshore support encompasses both wind farm logistics and oil and gas operations; and passenger transport splits between luxury cruise experiences and high-frequency ferry operations. Installation type distinctions between new builds and retrofit projects underscore divergent capital expenditure considerations and timeline pressures. Finally, the end-user landscape-spanning retrofit service providers, ship owners, and leading shipbuilders-imbues the market with a dynamic interplay of technical expertise, budgetary frameworks, and long-term maintenance commitments. Together, these segmentation lenses offer a detailed understanding of where value is created and where innovation opportunities lie.

This comprehensive research report categorizes the Integrated Marine Automation Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vessel Type

- System Type

- Component

- Installation Type

- Application

- End User

Comparative Analysis of Regional Dynamics Uncovering How Americas, EMEA, and Asia-Pacific Markets Drive Distinct Automation Strategies

Regional dynamics in marine automation are characterized by distinct drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific markets that influence adoption, regulatory landscapes, and technology partnerships. In the Americas, strong emphasis on offshore oil and gas operations and expansive coastal trade corridors propels demand for robust monitoring and control systems. Concurrently, evolving environmental mandates reinforce investments in energy-efficient navigation systems and emissions monitoring platforms.

Europe, Middle East & Africa presents a multifaceted market where stringent EU decarbonization goals, burgeoning offshore wind projects, and rapidly growing cruise tourism converge. This environment fuels collaborations between software integrators and hardware providers to deliver turnkey solutions that adhere to strict safety and environmental standards. Meanwhile, in key Gulf ports, authorities are piloting autonomous ferry prototypes, underscoring a regional appetite for next-generation passenger transport technologies.

In Asia-Pacific, the interplay between high-volume container trade, emerging shipbuilding clusters, and government-backed digital maritime initiatives is accelerating the uptake of communication systems and platform management solutions. Market participants in this region are forging strategic alliances to localize production of hardware components while leveraging global software expertise. Altogether, these regional variances shape tailored market entry approaches and drive distinct innovation roadmaps for automation vendors across the globe.

This comprehensive research report examines key regions that drive the evolution of the Integrated Marine Automation Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders’ Strategic Moves and Innovation Portfolios Driving Competitive Advantage in Marine Automation Landscapes

Leading companies in the marine automation sphere are executing targeted strategies to fortify their market positions and cultivate innovation. Through strategic acquisitions of niche software houses and partnerships with component specialists, these firms are broadening their solution portfolios to deliver end-to-end integration capabilities. Embracing digital twin frameworks and cloud-native platforms distinguishes forward-thinking organizations, enabling them to provide predictive analytics modules that preemptively identify system anomalies and optimize maintenance schedules.

At the same time, hardware vendors are investing in modular architectures that streamline retrofitting on existing vessels, thereby tapping into the lucrative upgrade segment. Collaboration with retrofit service providers has become a cornerstone tactic, ensuring seamless integration of new sensors and control units into legacy infrastructure. Meanwhile, software developers are prioritizing open-architecture protocols to eliminate vendor lock-in and promote interoperability across the entire automation stack.

Furthermore, key players are spearheading industry consortia to influence emerging regulatory frameworks and establish interoperability standards. Active participation in global maritime forums and digital alliances accelerates best practice sharing and secures early access to pilot programs. By balancing organic research and development with strategic alliances, these companies are not only responding to market forces but actively shaping the trajectory of marine automation innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Integrated Marine Automation Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Danelec Marine A/S

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Navis Engineering LLC

- Northrop Grumman Corporation

- Rolls-Royce Holdings plc

- SAM Electronics GmbH

- Schneider Electric SE

- Siemens AG

- Thales Group

- Wärtsilä Corporation

Strategic Roadmap for Industry Leaders to Leverage Emerging Technologies and Policy Shifts in Marine Automation for Sustainable Growth

Industry leaders should adopt a multifaceted approach to capture emerging opportunities in marine automation. First, investing in scalable cloud architectures and modular hardware designs will facilitate seamless retrofits and future-proof vessel installations. By prioritizing open communication protocols and API-driven frameworks, stakeholders can minimize integration complexity and foster collaborative ecosystems.

Next, expanding partnerships with regional players in the Americas, EMEA, and Asia-Pacific will unlock localized expertise, ensure regulatory alignment, and reduce logistical friction. These alliances can accelerate time-to-market for advanced navigation and monitoring systems, while enabling shared risk-and-reward models for innovation pilots. Simultaneously, companies must strengthen internal research and development by incorporating digital twin simulations, enabling rapid prototyping and cost-effective testing of new automation modules.

Finally, fostering a service-oriented business model that combines hardware sales with subscription-based analytics and maintenance contracts will generate recurring revenue streams and enhance customer retention. By embedding predictive maintenance algorithms and real-time performance dashboards, providers can transition from transactional relationships to value-added partnerships. Collectively, these strategic imperatives will position industry leaders to navigate tariff-induced supply chain realignments, capture high-growth segments, and set new benchmarks for maritime operational excellence.

Transparent Research Approach Combining Primary Interviews, Secondary Intelligence, and Rigorous Validation Techniques to Ensure Robust Insights

This research implements a rigorous, multi-layered methodology to ensure the validity and relevance of the insights presented. Initially, an extensive review of secondary intelligence from government publications, industry white papers, and regulatory guidelines was conducted to map the macro-environmental drivers affecting marine automation. This desk research established foundational knowledge of technological trends, tariff policies, and regional regulatory frameworks.

Building on this, a series of in-depth interviews with senior executives, technical experts, and procurement managers across shipbuilders, retrofit service providers, and component manufacturers was undertaken. These conversations provided qualitative perspectives on technology adoption barriers, procurement strategies, and customer expectations. Complementary surveys captured quantitative data on spending priorities, system preferences, and project timeframes, enabling cross-validation of thematic insights.

To reinforce data integrity, all findings underwent triangulation through fact-checking against proprietary databases and validation workshops with domain specialists. Emerging patterns were stress-tested via scenario analyses to assess potential impacts of regulatory shifts, technological breakthroughs, and market realignments. This layered approach ensures a comprehensive, balanced view of the integrated marine automation arena, equipping stakeholders with actionable intelligence grounded in robust empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Integrated Marine Automation Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Integrated Marine Automation Systems Market, by Vessel Type

- Integrated Marine Automation Systems Market, by System Type

- Integrated Marine Automation Systems Market, by Component

- Integrated Marine Automation Systems Market, by Installation Type

- Integrated Marine Automation Systems Market, by Application

- Integrated Marine Automation Systems Market, by End User

- Integrated Marine Automation Systems Market, by Region

- Integrated Marine Automation Systems Market, by Group

- Integrated Marine Automation Systems Market, by Country

- United States Integrated Marine Automation Systems Market

- China Integrated Marine Automation Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Trends and Strategic Imperatives to Provide a Cohesive Perspective on the Future Trajectory of Marine Automation

Integrated marine automation is redefining maritime operations by fusing advanced digital architectures with robust control systems, thereby enhancing safety, efficiency, and environmental performance. Our analysis highlights how key industry shifts-from tariff-driven supply chain realignments to regional regulatory imperatives-are reshaping strategic priorities for vessel owners, shipbuilders, and service providers alike. Segmentation insights underscore the diverse requirements across vessel types, system categories, and application domains, while regional analysis reveals distinct market dynamics in the Americas, EMEA, and Asia-Pacific.

Leading companies are responding by bolstering innovation pipelines, forging strategic alliances, and embedding predictive analytics into their offerings. These initiatives reflect a broader trend toward service-oriented business models and open platforms that facilitate interoperability. As regulatory landscapes evolve and autonomous technologies mature, stakeholders equipped with integrated solutions will be better positioned to navigate complexity, mitigate risks, and drive sustainable growth.

Ultimately, the future of marine automation lies in the seamless convergence of hardware, software, and services, supported by collaborative ecosystems that embrace digital transformation. By leveraging the strategic recommendations outlined, industry participants can capitalize on emerging opportunities, optimize operational performance, and chart a forward-looking course in an increasingly competitive global market.

Unlock Exclusive Maritime Automation Intelligence by Engaging Ketan Rohom to Secure Your Customized Market Research Report Today

Engaging with Ketan Rohom empowers decision-makers to gain privileged access to a comprehensive market research report tailored specifically to the evolving needs of marine automation stakeholders. By collaborating with the Associate Director of Sales & Marketing, clients can secure customized insights, ensure strategic alignment, and expedite informed decision-making. Reach out today to explore bespoke data packages, unlock exclusive in-depth analyses, and transform your maritime technology roadmap with confidence.

- How big is the Integrated Marine Automation Systems Market?

- What is the Integrated Marine Automation Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?