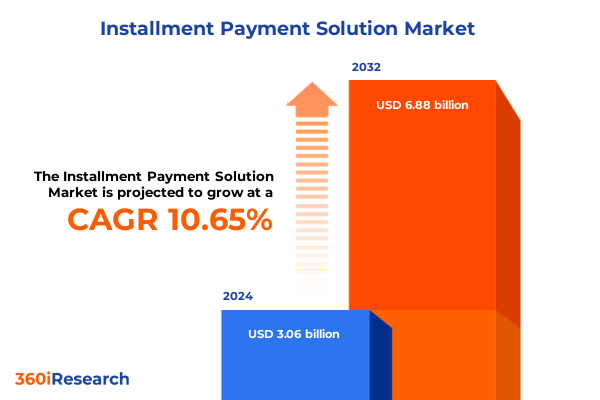

The Installment Payment Solution Market size was estimated at USD 3.35 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 10.79% to reach USD 6.88 billion by 2032.

Introduction to the Evolving Landscape of Installment Payment Solutions Underpinning Modern Consumer Buying Power and Business Financial Flexibility

Installment payment solutions have evolved from rudimentary layaway plans to sophisticated digital financing mechanisms that now underpin a significant portion of consumer and business transactions globally. Historically, consumers relied on in-store financing that demanded large deposits and rigid repayment schedules, but the proliferation of online platforms and mobile technology has democratized access to deferred payment options. This transformation has fundamentally shifted purchasing behavior, enabling higher-ticket acquisitions without immediate financial strain. Moreover, regulatory frameworks and enhanced underwriting capabilities have bolstered consumer trust, positioning installment options as a mainstream mode of payment rather than a niche alternative.

Transitioning beyond mere convenience, installment payments have become instrumental in shaping brand loyalty and market competitiveness. Retailers and service providers recognize that flexible payment structures can drive conversion rates, average order values, and repeat purchases. Financial institutions and fintech innovators continuously refine algorithms to assess consumer creditworthiness in real time, ensuring both accessibility and risk mitigation. Consequently, installment payment solutions serve as a bridge between consumer affordability and merchant revenue optimization, cementing their pivotal role in modern commerce.

How Technological Innovations and Shifting Consumer Expectations Are Transforming the Installment Payment Landscape Across Diverse Markets and Industries

The installment payment ecosystem is undergoing transformative shifts driven by rapid technological innovation and evolving consumer expectations. Artificial intelligence and machine learning now power dynamic risk assessments, enabling providers to offer personalized payment plans instantly. Simultaneously, embedded finance integrations allow retailers to present installment options directly at the point of sale, whether online or in-store, thereby streamlining the purchase journey. Mobile wallets and digital banking platforms have further broadened accessibility, ensuring that installment solutions are available at consumers’ fingertips and integrated seamlessly into daily financial activities.

Beyond technology, shifting regulatory landscapes are reshaping competitive dynamics. Enhanced consumer protection statutes and guidelines on transparent fee disclosures have elevated industry standards, compelling service providers to innovate responsibly while maintaining compliance. At the same time, strategic partnerships among fintechs, traditional banks, and major retailers are proliferating, reflecting a collaborative approach to scaling installment offerings. These alliances enable rapid geographic expansion and diversified product portfolios, meeting the demands of increasingly sophisticated consumers who seek flexibility, transparency, and seamless user experiences.

Analyzing the Cumulative Effects of U.S. Tariff Policies Implemented in 2025 on Installment Payment Solutions across Supply Chains and Consumer Pricing

In 2025, a new wave of U.S. tariff policies introduced increased duties on a range of imported goods, from electronics components to consumer products commonly financed through installment plans. These levies have contributed to elevated input costs for merchants, which in turn has affected the pricing models of installment payment providers. To preserve consumer affordability, many providers have absorbed marginal tariff-related cost increases, fine-tuned interest structures, or rebalanced fee schedules to mitigate the direct impact on end users.

Moreover, supply chain complexities arising from tariff-induced sourcing shifts have prompted installment firms to enhance supply-side financing solutions. By collaborating with suppliers and logistics partners, these companies have integrated early-payment and reverse-factoring features into their platforms, smoothing cash flow bottlenecks caused by elevated import costs. As a result, merchants can maintain competitive pricing and reliable inventory availability, while consumers continue to benefit from predictable installment schedules despite broader macroeconomic headwinds.

Uncovering Strategic Segmentation Insights Driving the Installment Payment Market Dynamics across Types, Payment Structures, Frequencies, Applications, End Users, Industries, and Service Providers

Segmenting the installment payment market by installment type reveals differentiated consumer preferences and risk profiles. Down payment installments appeal to buyers seeking lower financing charges through larger initial outlays, whereas equal installments resonate with budget-conscious shoppers desiring consistent monthly payments. Unequal installments, meanwhile, offer a tailored cadence that aligns with seasonal cash flow fluctuations. When viewed through the lens of payment type, the market bifurcates into fixed interest rate plans offering certainty in cost, interest-free options that maximize short-term affordability, and variable interest rate products that accommodate varying risk appetites and market conditions.

Payment frequency segmentation underscores further diversity, as annual plans suit long-term financing vehicles such as automotive purchases, monthly schedules align with household budgeting cycles, on-demand arrangements cater to sporadic or emergency expenditures, and quarterly structures support small business cash flow management. Applications drive additional nuance, with budget management features designed for financial planning, cash flow management tools enabling real-time liquidity oversight, and purchase convenience integrations streamlining checkout experiences. The end user base spans business owners leveraging installment programs for capital equipment acquisition and individuals financing consumer goods. Industry vertical insights highlight distinct usage patterns within automotive financing, high-value consumer goods and retail, and healthcare service financing. Finally, service provider segmentation distinguishes the distinct capabilities of credit unions offering community-focused programs, fintech companies driving rapid innovation, and traditional banks leveraging established trust and regulatory expertise.

This comprehensive research report categorizes the Installment Payment Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installment Type

- Payment Type

- Payment Frequency

- Application

- End User

- Industry Vertical

- Service Providers

Examining Critical Regional Trends Shaping the Adoption and Evolution of Installment Payment Solutions within Americas, EMEA, and Asia-Pacific Markets

The Americas region continues to lead in consumer adoption of installment payment solutions, driven by a mature e-commerce environment and high smartphone penetration. North American markets have witnessed substantial collaboration between major retailers and fintech startups, resulting in integrated installment options at checkout that cater to a diverse demographic. In Latin America, the rise of digital wallets and the expansion of mobile network infrastructure have accelerated access to installment offerings, particularly among previously underserved segments that lack traditional credit access.

In Europe, Middle East & Africa, regulatory alignment and cross-border payment innovations are pivotal. European Union directives promoting open banking frameworks have empowered consumers to seamlessly connect bank accounts with installment providers, fostering competition and transparency. In the Middle East & Africa, installment payment penetration is buoyed by government initiatives to promote financial inclusion, with local banks and fintechs partnering to extend digital credit to small businesses and individual consumers in both urban and rural markets.

Asia-Pacific exhibits hypergrowth in installment financing, fueled by a large unbanked population and rapid digitization. In Southeast Asia, super-app ecosystems integrate installment features into ride-hailing and delivery services, while in Australia and New Zealand, established banking institutions and emerging fintechs co-create sophisticated installment products. Consumer preferences in the region emphasize mobile-first experiences and localized payment methods, prompting providers to invest in language support, regional regulatory compliance, and partnerships with local merchants.

This comprehensive research report examines key regions that drive the evolution of the Installment Payment Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Corporate Strategies and Partnerships Driving Innovation and Competitive Advantage among Top Players in the Installment Payment Industry

Leading fintech innovators have embraced modular technology architectures to deliver seamless installment experiences. Companies such as Affirm and Klarna focus on user-centric mobile interfaces and rapid underwriting decisions, enabling high conversion rates and data-driven personalization. Afterpay, now part of a larger payments ecosystem, leverages its merchant network to cross-sell value-added services and deepen customer loyalty. Meanwhile, PayPal’s “Pay in 4” offering integrates directly into existing wallet functionalities, capitalizing on an established user base and global reach.

Traditional banks and credit unions are also advancing their presence through strategic partnerships and acquisitions. By collaborating with white-label fintech platforms, these institutions can offer branded installment solutions without extensive in-house development. At the same time, emerging players like Sezzle and Square are expanding beyond domestic borders, investing in regulatory compliance capabilities and localized operations to penetrate new markets. The collective focus on building robust risk-management frameworks and omni-channel integration underscores a competitive environment where agility, security, and customer experience are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Installment Payment Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affirm, Inc.

- Afterpay US Services, LLC

- Apaylater Financials Pte. Ltd.

- AsiaPay Limited

- Billie GmbH

- Bread Financial Holdings, Inc.

- Bridge Fintech Solutions Private Limited

- Elavon Inc.

- Flo2Cash Limited

- Klarna Bank AB

- Kredivo Group

- Paloo Financing, Inc

- Partially, Inc.

- PAYFORT INTERNATIONAL FZ LLC by Amazon.com, Inc.

- PayPal, Inc.

- Perpay Inc.

- Scalapay S.R.L.

- Sezzle Inc.

- Social Money Ltd

- Splitit USA Inc.

- Streetcorner Lending Corp

- Tabby FZ LLC

- Upgrade, Inc.

- ViaBill DK

- ZIP CO US INC

Pragmatic Actionable Recommendations for Industry Leaders to Optimize Installment Payment Offerings, Enhance Customer Engagement, and Strengthen Resilience

Industry leaders should prioritize the development of flexible product architectures that allow real-time customization of installment plans based on consumer data signals. Investing in open application programming interfaces and partner ecosystems enables seamless integration with e-commerce platforms, point-of-sale systems, and digital wallets, thereby amplifying reach and relevance. Additionally, leveraging advanced analytics to monitor repayment patterns and identify latent repayment challenges can inform dynamic incentives, such as reduced fees for early repayments or tailored reminders to minimize delinquencies.

Strengthening operational resilience requires a dual focus on regulatory agility and cross-border scalability. Establishing dedicated compliance functions to monitor evolving tariffs, data privacy laws, and consumer protection regulations ensures proactive adaptation. Concurrently, forging strategic alliances with local financial institutions and payment processors facilitates market entry into new jurisdictions. Finally, enhancing user trust through transparent fee disclosures, robust data security protocols, and responsive customer support will differentiate leading providers in an increasingly crowded marketplace.

Transparent Research Methodology Outlining Data Collection, Source Triangulation, Qualitative Interviews, and Frameworks Informing the Installment Payment Market Study

This study employed a multi-pronged research methodology beginning with comprehensive secondary research to map the competitive landscape. Publicly available financial filings, regulatory reports, and industry news outlets provided foundational context. Complementing this, qualitative interviews were conducted with executives from leading fintechs, traditional banks, merchant partners, and regulatory bodies to capture firsthand perspectives on emerging challenges and opportunities.

Data triangulation involved cross-verifying insights from proprietary databases, anonymized transaction data, and survey responses obtained from merchants and consumers. Analytical frameworks, including thematic analysis and comparative benchmarking, were applied to distill strategic themes and identify best practices. Throughout the process, rigorous validation protocols ensured that findings reflect the most current industry dynamics and serve as a reliable basis for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Installment Payment Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Installment Payment Solution Market, by Installment Type

- Installment Payment Solution Market, by Payment Type

- Installment Payment Solution Market, by Payment Frequency

- Installment Payment Solution Market, by Application

- Installment Payment Solution Market, by End User

- Installment Payment Solution Market, by Industry Vertical

- Installment Payment Solution Market, by Service Providers

- Installment Payment Solution Market, by Region

- Installment Payment Solution Market, by Group

- Installment Payment Solution Market, by Country

- United States Installment Payment Solution Market

- China Installment Payment Solution Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Conclude the Comprehensive Analysis of Installment Payment Trends and Market Dynamics

This comprehensive analysis has illuminated the multifaceted nature of the installment payment market, from its technological underpinnings and regulatory context to the strategic segmentation that drives consumer and merchant adoption. Key transformative shifts, including AI-enabled underwriting, embedded finance, and the ripple effects of U.S. tariffs, underscore the imperative for agile, data-driven strategies. Regional insights further reveal that while maturity levels vary, the underlying demand for flexible payment options remains universal.

Moving forward, industry participants must balance innovation with compliance, leveraging partnerships and open ecosystems to accelerate growth. Understanding the nuanced preferences of diverse end users and tailoring solutions accordingly will be critical to capturing market share. Ultimately, the organizations that successfully integrate advanced analytics, transparent fee structures, and seamless user experiences will emerge as leaders in this dynamic landscape.

Immediate Next Steps and Exclusive Invitation to Engage with Ketan Rohom for Acquiring the Definitive Installment Payment Market Research Report

Engaging with Ketan Rohom presents an opportunity to secure unparalleled insights and a competitive edge through the purchase of the comprehensive market research report on installment payment solutions. By initiating dialogue, stakeholders can explore tailored options, request additional data breakdowns, and discuss customized licensing agreements. This collaborative engagement ensures that executives and decision-makers receive the precise intelligence needed to inform strategic planning, product development, and go-to-market initiatives. Connect directly to access exclusive appendices, detailed case studies, and expert commentary that will empower your organization to navigate evolving payment dynamics with confidence.

- How big is the Installment Payment Solution Market?

- What is the Installment Payment Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?