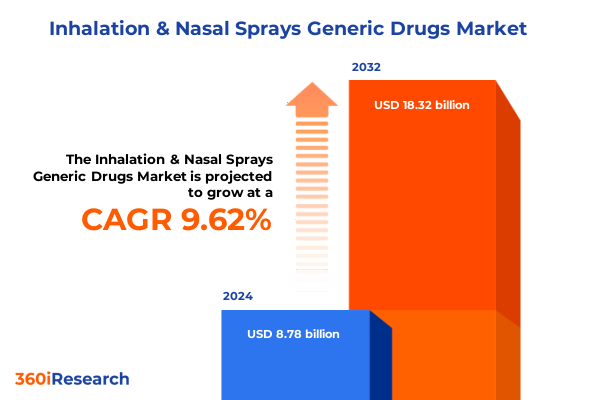

The Inhalation & Nasal Sprays Generic Drugs Market size was estimated at USD 9.56 billion in 2025 and expected to reach USD 10.42 billion in 2026, at a CAGR of 9.73% to reach USD 18.32 billion by 2032.

Comprehensive Introduction to the Dynamics Shaping the Inhalation and Nasal Sprays Generic Drugs Ecosystem in the United States

The generic drugs landscape for inhalation and nasal sprays has undergone a profound evolution in recent years, driven by heightened demand for cost-effective respiratory therapies and an expanding prevalence of conditions such as asthma and chronic obstructive pulmonary disease. Advances in device engineering and formulation technologies have enabled manufacturers to deliver consistent, high-quality generics that rival originator products in performance while offering significant savings to healthcare systems. Moreover, regulatory pathways have been refined to accelerate approvals for generic inhalation and nasal products, enhancing market access and intensifying competition.

Against this backdrop, market participants must navigate a multifaceted ecosystem shaped by diverse patient needs, regulatory frameworks, and technological innovations. Inhalation therapies span dry powder inhalers, metered dose inhalers, nebulizers, and soft mist inhalers, each with distinct performance characteristics and user preferences. Meanwhile, nasal sprays offer rapid systemic delivery and localized treatment for allergic rhinitis and other indications. Patient segments range from pediatric to adult and geriatric populations, underscoring the importance of age-appropriate formulations such as dry powders, solutions, and suspensions. Distribution channels encompass hospital pharmacy, online pharmacy, and retail pharmacy, reflecting varied procurement preferences across ambulatory care, home care, and hospital settings. Therapeutic applications include bronchodilators, combination therapies, and corticosteroids, each presenting unique formulation and device challenges.

This executive summary provides a strategic lens on the key drivers, emerging trends, and operational considerations shaping the inhalation and nasal sprays generics arena. Through systematic analysis and actionable recommendations, this report equips decision-makers with the insights necessary to thrive in an increasingly competitive and dynamic market environment.

Key Transformative Shifts Reshaping Market Dynamics and Driving Growth in Inhalation and Nasal Sprays Generic Drugs Segment

Innovation and competitive realignment have triggered transformative shifts within the inhalation and nasal sprays generic drugs market. Patent expirations for blockbuster respiratory therapies have unlocked a wave of generic entries, dramatically expanding the number of available inhalation and nasal products. This surge has pressured originator pricing structures and incentivized manufacturers to differentiate through advanced delivery platforms and proprietary device features.

Concurrently, digital health integration is redefining patient engagement and adherence. Smart inhalers equipped with dose counters and connected sensors are increasingly paired with generic formulations, fostering data-rich remote monitoring and personalized treatment adjustments. These hybrid offerings underscore a paradigm shift from traditional device-centric competition to solution-based value propositions that combine affordability with enhanced clinical outcomes.

Regulatory bodies have also streamlined abbreviated pathways for generic approvals, promoting faster market entry while ensuring product quality and therapeutic equivalence. Environmental imperatives are driving a transition away from chlorofluorocarbon propellants, spurring development of eco-friendly soft mist and dry powder options. In parallel, supply chain digitalization efforts are enhancing transparency and resilience, mitigating disruptions associated with global API sourcing. As these forces converge, stakeholders must adopt agile strategies that align device innovation, regulatory compliance, and digital capabilities to capture the next wave of generics-driven growth.

Comprehensive Analysis of the Cumulative Impact of 2025 United States Tariffs on the Inhalation and Nasal Sprays Generic Drugs Supply Chain

The imposition of new tariffs in 2025 has introduced notable complexities into the inhalation and nasal sprays supply chain. In particular, increased duties on active pharmaceutical ingredients sourced from major exporting nations have elevated input costs for generic manufacturers. These adjustments have, in turn, exerted pressure on production margins and necessitated recalibration of procurement strategies to maintain competitive pricing against originator products.

Moreover, the cumulative effect of tariffs has extended lead times for critical raw materials, as companies reassess supplier networks to navigate higher duty burdens. This shift has underscored the strategic value of nearshoring and domestic API partnerships, prompting some stakeholders to invest in regional manufacturing capabilities. However, such transitions require substantial capital allocation and entail compliance with domestic regulatory standards, adding layers of operational complexity.

In response, industry leaders are pursuing mitigation measures, including leveraging free trade zones, renegotiating long-term supplier contracts, and exploring tariff exemption programs. These approaches aim to offset cost inflation while preserving supply chain agility. As companies adapt to the tariff environment, it is imperative to continuously monitor policy developments and adjust sourcing models to balance cost efficiency, regulatory adherence, and uninterrupted patient access to essential respiratory therapies.

In-Depth Key Segmentation Insights Unveiling Trends Across Administration Routes, Patient Demographics, Formulations, Channels, End Users, and Applications

Deep insights emerge when examining market segmentation across administration routes, patient demographics, formulation types, distribution channels, end-user settings, and therapeutic applications. Within route of administration, inhalation devices such as dry powder inhalers continue to gain favor due to their propellant-free operation and high stability, while metered dose inhalers maintain a strong presence in emergency care. Nebulizers serve specialized populations requiring high-dose delivery, and soft mist inhalers are recognized for their reproducible fine-particle generation that enhances lung deposition. Nasal sprays complement these offerings by providing systemic absorption pathways and targeted therapies for upper airway conditions.

Patient age groups further refine market dynamics. Adult users constitute the largest cohort for generic inhalation therapies, but geriatric patients are driving demand for user-friendly devices with minimal inspiratory flow requirements. Pediatric applications necessitate age-appropriate designs and flavor considerations to support adherence. Formulation preferences intersect with these needs: dry powders excel in stability and portability, solutions offer clear dosing for nasal applications, and suspensions enable sustained-release profiles for certain corticosteroid therapies.

Distribution patterns reveal that hospital pharmacies are critical for acute care settings, whereas the rise of online pharmacies addresses convenience for chronic users. Retail pharmacies remain the cornerstone of outpatient generics dispensation. End users span ambulatory care facilities deploying low-cost generics for routine management, home care environments emphasizing self-administration, and hospitals managing severe exacerbations with high-potency formulations. Finally, therapeutic applications such as bronchodilators dominate prescription volumes, but combination therapies and corticosteroid sprays are gaining share as maintenance treatments, reflecting the evolving clinical protocols in airway disease management.

This comprehensive research report categorizes the Inhalation & Nasal Sprays Generic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Route Of Administration

- Patient Age Group

- Formulation

- Distribution Channel

- End User

- Application

Crucial Regional Insights Highlighting the Americas, Europe Middle East and Africa, and Asia-Pacific Markets for Inhalation and Nasal Spray Generics

Regional variations significantly influence the strategic posture of inhalation and nasal sprays generics providers. In the Americas, a mature healthcare infrastructure and well-established reimbursement frameworks support rapid adoption of cost-effective generic inhalation therapies. The United States leverages an abbreviated FDA approval pathway that has accelerated market entry for numerous generic inhalers and nasal sprays, solidifying generics’ role in outpatient and chronic disease management.

Turning to Europe, Middle East, and Africa, regulatory harmonization efforts across the European Medicines Agency member states have streamlined cross-border approvals, though individual country reimbursement policies continue to shape local adoption rates. Within the Middle East and Africa, market access is uneven, with some regions constrained by limited healthcare budgets and logistical challenges, while others exhibit rapid uptake driven by public-private partnerships focused on respiratory health.

In the Asia-Pacific region, domestic manufacturing hubs in India and China serve as global suppliers of key starting materials, benefiting from cost efficiencies and scale. Simultaneously, rising middle-class populations in countries such as Japan, South Korea, and Australia are transitioning toward generics as a cost control measure. Regulatory agencies across Asia-Pacific are enhancing quality standards in line with international benchmarks, fostering greater confidence in locally produced inhalation and nasal spray generics. These regional dynamics collectively shape competitive strategy, supply chain design, and market entry decisions for stakeholders seeking to expand their global footprint.

This comprehensive research report examines key regions that drive the evolution of the Inhalation & Nasal Sprays Generic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Key Company Insights Illuminating the Competitive Landscape of Leading Generics Providers in Airway Drug Delivery

A focused evaluation of leading market players reveals distinct strategic imperatives. Global generics giants have prioritized expansion of their inhalation and nasal portfolios through targeted licensing agreements and in-house formulation capabilities. These companies are investing heavily in next-generation device platforms that optimize drug delivery efficiency and patient usability, recognizing that device differentiation can offset margin pressures inherent in commoditized generics.

Mid-tier and regional manufacturers are carving out niches by leveraging cost-competitive production in high-capacity facilities. They often support customized formulations and device modifications tailored to local regulatory and patient requirements. Strategic alliances with technology partners enable these players to integrate dose-tracking sensors, enhancing adherence monitoring and creating new revenue streams through digital health services.

Smaller specialized firms have adopted a precision-focused approach, targeting underserved patient segments such as pediatric and geriatric populations with bespoke device ergonomics and formulation profiles. Collaboration with academic research centers and contract development organizations accelerates innovation pipelines, allowing rapid iteration on formulation characteristics and device-user interface designs. As competition intensifies, the ability to synchronize formulation science, device engineering, and patient-centric features will distinguish the most successful companies in the inhalation and nasal generics arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inhalation & Nasal Sprays Generic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amneal Pharmaceuticals, Inc

- Cipla Ltd

- Dr. Reddy’s Laboratories Ltd

- Glenmark Pharmaceuticals Ltd

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Sandoz International GmbH

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Viatris Inc

Actionable Recommendations Empowering Industry Leaders to Navigate Challenges and Capitalize on Opportunities in the Inhalation and Nasal Sprays Market

To thrive amidst evolving market dynamics and regulatory complexities, industry leaders should prioritize device innovation by integrating advanced technologies such as breath-actuated mechanisms and connected sensors. Collaborative partnerships with device engineering firms and digital health platforms can accelerate development cycles and create compelling value propositions that differentiate generic offerings from originator drugs.

Simultaneously, companies must reinforce supply chain resilience by diversifying API sourcing strategies. Establishing manufacturing partnerships in tariff-exempt zones and pursuing vertical integration for critical intermediates will mitigate cost volatility associated with geopolitical shifts. Engaging in proactive tariff impact modeling and supplier contract optimization can further cushion margins against unexpected duty changes.

Expanding distribution capabilities across online pharmacy channels will enhance patient access, particularly for chronic care and home administration settings. Tailoring launch strategies to specific patient demographics-such as child-friendly inhaler designs or simplified adult devices for geriatric users-will foster higher adherence and clinician endorsement. Moreover, environmental sustainability should be woven into R&D roadmaps, with a focus on propellant-free formulations and recyclable device components.

Finally, forging strategic alliances with healthcare systems and payers to demonstrate real-world outcomes will strengthen positioning in value-based care frameworks. By aligning product development with clinical efficacy and cost-effectiveness, companies can secure formulary placements and drive broad adoption of generics in respiratory therapy.

Robust Research Methodology Detailing the Systematic Approach and Rigor Underpinning the Inhalation and Nasal Sprays Generic Drugs Market Analysis

The research underpinning this analysis employed a rigorous multi-layered approach. Initially, comprehensive secondary research was conducted, encompassing regulatory filings, published scientific literature, industry white papers, and publicly available company disclosures. This phase provided a foundational understanding of market drivers, device technologies, and regulatory frameworks.

Following the secondary analysis, extensive primary research was undertaken through in-depth interviews with key opinion leaders, including pulmonologists, pharmacists, device engineers, and supply chain executives. These discussions yielded qualitative insights into real-world device performance, patient preferences, and operational challenges within different healthcare settings.

Quantitative data was triangulated by cross-referencing findings from commercial databases, trade association reports, and proprietary shipment records. A robust segmentation framework was applied to dissect the market by administration route, patient age, formulation, distribution channel, end user, and therapeutic application. Supply chain mapping and tariff impact modeling tools were utilized to assess the implications of 2025 tariff changes.

All data underwent iterative validation to ensure accuracy and consistency, with detailed checks performed at each stage of analysis. The integration of qualitative expert feedback and quantitative metrics ensured a holistic view of the inhalation and nasal sprays generics market, providing a sound basis for the strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inhalation & Nasal Sprays Generic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inhalation & Nasal Sprays Generic Drugs Market, by Route Of Administration

- Inhalation & Nasal Sprays Generic Drugs Market, by Patient Age Group

- Inhalation & Nasal Sprays Generic Drugs Market, by Formulation

- Inhalation & Nasal Sprays Generic Drugs Market, by Distribution Channel

- Inhalation & Nasal Sprays Generic Drugs Market, by End User

- Inhalation & Nasal Sprays Generic Drugs Market, by Application

- Inhalation & Nasal Sprays Generic Drugs Market, by Region

- Inhalation & Nasal Sprays Generic Drugs Market, by Group

- Inhalation & Nasal Sprays Generic Drugs Market, by Country

- United States Inhalation & Nasal Sprays Generic Drugs Market

- China Inhalation & Nasal Sprays Generic Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Conclusive Insights Synthesizing the Critical Findings and Strategic Implications of the Inhalation and Nasal Sprays Generics Executive Summary

This executive summary has synthesized critical insights from the evolving generics landscape, highlighting the pivotal role of patent expirations in spurring device and formulation innovation. The analysis of tariff impacts underscores the necessity for resilient sourcing strategies and agility in supply chain operations under shifting trade policies. Segmentation insights reveal nuanced preferences across administration routes, patient demographics, formulation types, distribution channels, end users, and therapeutic applications.

Regional perspectives illuminate the strategic importance of market-specific regulatory, reimbursement, and manufacturing dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific. Key company profiles demonstrate how global leaders, regional manufacturers, and specialized firms are differentiating through device advancements, digital health integration, and customized solutions. The actionable recommendations presented equip stakeholders with a clear roadmap to enhance device innovation, supply chain robustness, patient-centric design, and collaborative partnerships with healthcare systems.

As the inhalation and nasal sprays generics sector continues to mature, ongoing monitoring of technology trends, policy shifts, and patient needs will be essential. Stakeholders who leverage this comprehensive analysis and embrace agile, forward-looking strategies will be best positioned to capture value and deliver high-quality respiratory therapies at scale.

Compelling Call to Action to Engage with Ketan Rohom for Acquiring the Comprehensive Inhalation and Nasal Sprays Generic Drugs Market Research Report

To explore the full spectrum of insights, analyses, and strategic recommendations outlined in this executive summary, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in guiding stakeholders through complex market landscapes ensures you will receive tailored support in leveraging data-driven findings for maximum impact. Engaging with Ketan will provide direct access to the comprehensive Inhalation and Nasal Sprays Generic Drugs Market Research Report, equipping your organization with the knowledge needed to stay ahead of emerging trends and competitive pressures. Contact Ketan Rohom today to secure your copy of the definitive industry guide and take decisive steps toward optimized growth and innovation in the generics airway delivery sector.

- How big is the Inhalation & Nasal Sprays Generic Drugs Market?

- What is the Inhalation & Nasal Sprays Generic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?