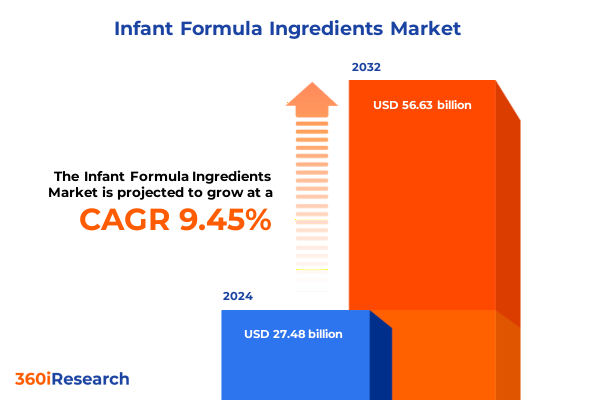

The Infant Formula Ingredients Market size was estimated at USD 29.82 billion in 2025 and expected to reach USD 32.34 billion in 2026, at a CAGR of 9.59% to reach USD 56.63 billion by 2032.

Navigating the Complexities of Infant Formula Ingredient Innovations Amid Shifting Consumer Demands and Global Regulatory Scrutiny

Global infant nutrition is experiencing an unprecedented period of transformation driven by evolving consumer expectations, heightened regulatory oversight, and rapid scientific innovation. As birth rates fluctuate across key markets, parents and caregivers are demanding premium products that replicate the protective and developmental benefits of breast milk. Industry leaders are responding by expanding their portfolios to include advanced ingredients such as human milk oligosaccharides, structured lipids, and specialized proteins that cater to digestibility and immunological support. This convergence of demographic shifts and nutritional science is redefining the competitive landscape, compelling manufacturers to balance safety, efficacy, and cost efficiency while maintaining stringent compliance with agencies such as the FDA and EFSA.

Simultaneously, market participants are embracing digital platforms to enhance transparency, enabling parents to trace ingredient sourcing and verify clinical substantiation. Premiumisation trends spearheaded by major players have led to differentiated product tiers that range from mass-market formulations to high-end specialty blends tailored for infants with specific health conditions. As a result, the infant formula segment is splitting into multiple strata, with both volume-driven and margin-rich categories thriving in tandem. The interplay of these forces underscores the critical need for actionable, data-driven intelligence to navigate regulatory frameworks, mitigate supply chain risks, and capture emerging growth vectors in this dynamic sector.

Emerging Scientific Breakthroughs and Market Disruptions Reshaping the Infant Formula Ingredients Landscape at a Pivotal Juncture

A wave of technological breakthroughs is reshaping the infant formula ingredients ecosystem, ushering in an era of precision fermentation, enzymatic protein modification, and digital formulation platforms. Manufacturers are leveraging biotechnology to produce human-identical milk oligosaccharides at scale, supporting gut microbiome development and immune function with rigorous clinical backing. These advancements are not only enhancing the nutritional profile of formulas but are also reducing dependency on traditional dairy supply chains, which have faced volatility due to tariffs and geopolitical disruptions.

In parallel, consumer-driven shifts toward whole-milk–based and plant-derived alternatives reflect broadening definitions of clean label and natural nutrition. Once sidelined for fat content concerns, full-fat dairy formulations are reemerging as parents prioritize bioavailable nutrient matrices that align with evolving dietary guidelines. Moreover, the surge of plant-based proteins such as soy and pea in hypoallergenic applications underscores a growing market for allergen-free and vegan-friendly products. These transformative dynamics are creating fertile ground for novel ingredient synergies, driving a recalibration of R&D investments and forging collaborative ventures between biotech startups and established multinationals.

Assessing the Ripple Effects of 2025 United States Import Tariffs on Infant Formula Ingredients and Global Supply Chain Dynamics

The 2025 increase in most-favored-nation tariffs on infant formula components, which range from 14.9% to 17.5% depending on classification, combined with tariff-rate quotas, has introduced new cost layers for U.S. manufacturers and importers. This cumulative tariff framework imposes a base duty of $1.035 per kilogram plus ad valorem rates once threshold volumes are exceeded, constraining the flow of key ingredients such as whey protein concentrates and specialty lipids. While certain free-trade agreement partners remain exempt, most entrants face financial burdens that reverberate through procurement and pricing strategies.

Abbott Laboratories has projected a direct impact of several hundred million dollars in 2025 due to these policies, highlighting the sustained nature of past tariff measures that have remained in place since 2017. Industry players are consequently exploring mitigation tactics, including supply chain diversification, nearshoring production capacities, and engaging in bipartisan advocacy to secure legislative relief such as the proposed Formula 3.0 Act. In the interim, U.S. producers must balance the trade-offs between absorbing incremental costs and passing them through to consumers, while safeguarding access to specialized ingredients essential for premium and hypoallergenic formula lines.

Discovering Nuanced Segment Profiles That Inform Product Development Strategies Across Diverse Infant Formula Ingredient Categories

The infant formula ingredients market exhibits distinct segment profiles that inform targeted product development strategies across its breadth. Protein source variations span cow milk, goat milk, plant-derived soy, and hydrolyzed proteins, with extensive and partial hydrolysates addressing allergenic concerns by pre-breaking peptide chains for enhanced digestibility. This diversity enables manufacturers to position formulations along a spectrum from standard to specialized allergy management solutions. In response to escalating demand for digestive comfort and immune support, players are intensifying investment in enzymatically processed hydrolysates backed by clinical efficacy studies to differentiate their offerings.

Form-driven segmentation reveals emerging preferences for powder formats housed in tins, sachets, and pouches, balancing convenience with shelf stability. Meanwhile, concentrated liquids and ready-to-drink variants packaged in both bottles and aseptic cartons cater to on-the-go consumption trends. The readiness of these liquid formats to meet immediate feeding needs without preparation underscores their value proposition, particularly in markets with higher urbanization rates. Across organic status, the delineation between conventional, EU-certified organic, and USDA-certified organic highlights the premium placed on clean-label validation, while additive-focused innovations in micronutrient fortification, prebiotics such as fructo- and galacto-oligosaccharides, and probiotic strains including bifidobacteria and lactobacilli are central to functional differentiation. Lactose-based and lactose-free options complete the landscape, ensuring comprehensive coverage of dietary sensitivities and parental preferences for tailored nutrition portfolios.

This comprehensive research report categorizes the Infant Formula Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Category

- Source Origin

- Physical Form

- Processing Technology

- Distribution Channel

- Customer Type

Unveiling Distinct Regional Trends Driving Demand and Innovation in Infant Formula Ingredients Across Key Markets From Americas to Asia-Pacific

Regional dynamics in the infant formula ingredients sector underscore distinct growth trajectories and innovation priorities across the Americas, Europe-Middle East-Africa (EMEA), and Asia-Pacific. In the Americas, consumer expectations for clean-label transparency and stringent safety standards are driving manufacturers to provide extensive sourcing information and third-party certifications. Government programs such as the Women, Infants, and Children (WIC) initiative, which accounts for roughly half of U.S. formula purchases, continue to shape the competitive environment by specifying allowable brands and spurring private-label development to address cost concerns during tightening tariff regimes.

Across EMEA, persistent price pressures and regulatory interventions are fostering a dual market structure of value-driven private labels alongside premium organic and specialty formulas. The Competition and Markets Authority in the UK has highlighted historic price highs, prompting supermarkets to stabilize pricing and enhance consumer access to first-stage formulas. Concurrently, Europe’s robust certification frameworks, particularly for organic status, incentivize manufacturers to secure EU organic accreditation and adopt fortification strategies aligned with regional health mandates. These measures are facilitating incremental premiumization within cost-sensitive market segments without compromising nutritional adequacy.

Asia-Pacific remains the largest regional contributor to global revenue, led by rapid urbanization, rising birth rates in select countries, and expanding middle-class populations. Governments in China, India, and Southeast Asia are implementing fortification mandates and public health campaigns that emphasize the importance of early-life nutrition, catalyzing demand for advanced ingredients such as DHA-enriched oils and precision-fermented HMOs. The region’s manufacturing hubs also support competitive export flows, although recent retaliatory tariffs on U.S. dairy exports have introduced new complexities for ingredient sourcing strategies. Innovation partnerships and localized R&D centers are emerging to accelerate market-responsive formulations that address diverse regulatory environments and consumer preferences across this vast region.

This comprehensive research report examines key regions that drive the evolution of the Infant Formula Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives That Are Reshaping Competitive Dynamics in the Infant Formula Ingredients Market

Major industry players are deploying multifaceted strategies to secure leadership positions in the infant formula ingredients landscape. Nestlé has embraced a premiumisation roadmap that leverages its global nutrition division to introduce high-performance brands such as Illuma, Sinergity, and NAN, while optimizing cost structures on mass-market lines to address socio-economic disparities in emerging economies. This dual approach enables Nestlé to capture market share across both value and premium segments, supported by strategic R&D investments and fortified supply chain integration.

Abbott Laboratories, confronted with tariff-induced cost pressures, is fortifying its resilience through geographic diversification of production sites and exploring nearshoring partnerships. The company’s investment in specialty proteins, including extensively hydrolyzed and amino acid-based formulations, is designed to serve infants with severe allergies and digestive sensitivities. Additionally, Abbott’s global manufacturing footprint and clinical trial infrastructure underpin its ability to navigate evolving trade policies and regulatory requirements while maintaining supply continuity.

Innovative startups like Bobbie and ByHeart are challenging established paradigms by introducing whole-milk–based formulas that resonate with health-conscious consumers seeking minimally processed ingredients. Their direct-to-consumer models and digital engagement strategies exemplify a shift toward personalized nutrition and brand transparency. Collaborations with biotechnology firms for precision fermentation of functional oligosaccharides further position these challengers at the forefront of ingredient innovation, compelling legacy manufacturers to accelerate their own R&D roadmaps in response.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infant Formula Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABITEC Corporation

- Archer-Daniels-Midland Company

- Arla Foods amba

- BASF SE

- Bunge Limited

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- FMC Corporation

- Fonterra Co-operative Group Limited

- Glanbia plc

- Glycosyn LLC

- Ingredion Incorporated

- Kerry Group plc

- Lonza Group Ltd.

- Roquette Frères

- Royal DSM N.V.

- Symrise AG

- Tate & Lyle PLC

Implementing Forward-Looking Strategies and Best Practices to Drive Growth and Sustainability in the Infant Formula Ingredients Sector

To thrive in this complex environment, industry leaders should prioritize diversification of raw material sources by establishing strategic partnerships with alternative dairy and plant-based suppliers. By investing in dual-sourcing frameworks for key inputs such as whey proteins and HMOs, manufacturers can mitigate tariff exposures and supply chain disruptions. Moreover, accelerating regional production capabilities through joint ventures or contract manufacturing in low-tariff jurisdictions will enhance cost competitiveness and ensure faster market responsiveness.

Innovation roadmaps must also integrate emerging technologies such as precision fermentation, enzyme-assisted protein hydrolysis, and advanced lipid encapsulation to expand functional ingredient portfolios. Collaborating with biotech startups and academic institutions can unlock novel applications while sharing R&D risks. Additionally, optimizing product portfolios by aligning formulations with specific segment profiles-such as extensive hydrolysates for allergy management and ready-to-drink options for urban convenience-will reinforce market relevance and drive margin enhancement. Finally, proactive engagement with policymakers to advocate for sustainable tariff reform and supportive regulatory frameworks will safeguard long-term industry stability and foster a conducive environment for cross-border trade and innovation.

Detailing Our Comprehensive Research Approach That Ensures Robust Data Collection and Analysis for Infant Formula Ingredients Insights

Our research methodology combines rigorous secondary data analysis with targeted primary engagements across the infant nutrition ecosystem. We conducted a comprehensive review of regulatory filings, trade databases, and published clinical studies to map ingredient innovations and tariff implications. These insights were supplemented by in-depth interviews with industry executives, R&D scientists, and supply chain specialists to validate emerging trends and gauge market sentiment.

Quantitative data was aggregated from global customs statistics, patent registries, and financial disclosures to benchmark regional performance and competitor positioning. We applied a structured framework for segmentation, aligning protein sources, form factors, organic status, additives, and lactose content with consumer preferences and clinical evidence. This multi-layered approach ensures that our findings reflect both macroeconomic dynamics and nuanced product-level developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infant Formula Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infant Formula Ingredients Market, by Ingredient Category

- Infant Formula Ingredients Market, by Source Origin

- Infant Formula Ingredients Market, by Physical Form

- Infant Formula Ingredients Market, by Processing Technology

- Infant Formula Ingredients Market, by Distribution Channel

- Infant Formula Ingredients Market, by Customer Type

- Infant Formula Ingredients Market, by Region

- Infant Formula Ingredients Market, by Group

- Infant Formula Ingredients Market, by Country

- United States Infant Formula Ingredients Market

- China Infant Formula Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Illuminate Future Directions and Investment Opportunities in the Infant Formula Ingredients Domain Amid Evolving Consumer Needs and Regulatory Frameworks

Bringing together diverse strands of analysis, this executive summary highlights a market in flux, shaped by innovation, regulation, and evolving consumer values. The infusion of biotechnology into ingredient development, coupled with premiumisation and sustainable sourcing mandates, heralds a new era of tailored nutrition solutions. Simultaneously, tariff landscapes and regional disparities underscore the need for agile supply chain strategies and proactive policy engagement.

As the infant formula ingredients industry embraces greater complexity and specialization, stakeholders must harness data-driven insights to anticipate shifts and inform investment decisions. By synthesizing segment-specific growth drivers, regional nuances, and competitive moves, this report lays the groundwork for informed strategic planning. Moving forward, collaboration across industry, government, and research institutions will be critical to delivering safe, effective, and equitable nutrition to infants worldwide.

Contact Ketan Rohom for Exclusive Access to In-Depth Market Intelligence on Infant Formula Ingredients That Drives Strategic Advantage

Elevate your strategic decision-making by gaining unparalleled insights into the evolving infant formula ingredients market through a comprehensive, customized research report that translates complex data into actionable intelligence. Unlock proprietary analysis, detailed segmentation breakdowns, and expert recommendations that empower you to anticipate regulatory shifts, capitalize on innovation opportunities, and optimize your supply chain resilience. Partner directly with Ketan Rohom to secure tailored market intelligence that aligns with your business objectives and sets you ahead of competitors. Reach out today to discover how this in-depth report can inform your next strategic move and drive sustainable growth in the dynamic infant nutrition sector.

- How big is the Infant Formula Ingredients Market?

- What is the Infant Formula Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?