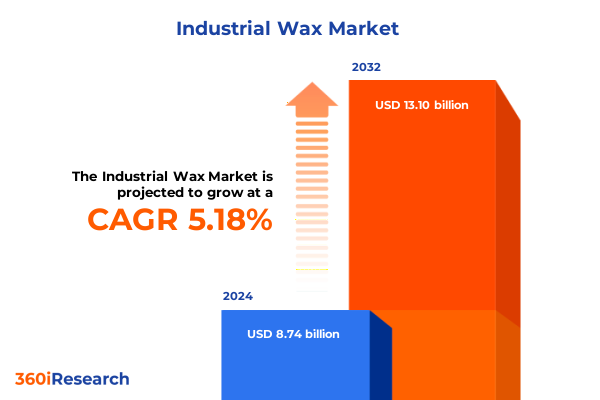

The Industrial Wax Market size was estimated at USD 9.17 billion in 2025 and expected to reach USD 9.63 billion in 2026, at a CAGR of 5.21% to reach USD 13.10 billion by 2032.

Unveiling the Critical Role of Industrial Wax Markets in Driving Innovation and Sustainability Across Diverse Manufacturing and Consumer Sectors

The global industrial wax landscape has evolved into a critical backbone for a spectrum of manufacturing processes and consumer products. From enhancing surface finishes to enabling advanced adhesive formulations, waxes now occupy a pivotal role amid rising demands for performance, sustainability, and regulatory compliance. In recent years, industrial wax producers have navigated a complex interplay of raw material availability, shifting end-user expectations, and emerging sustainability mandates that collectively reshape traditional value chains.

Against this backdrop, stakeholders must appreciate how texture, melting point, and additive compatibility drive product innovation across sectors ranging from cosmetics to automotive. Simultaneously, heightened consumer awareness around bio-based materials and circular economy principles has accelerated research into natural and synthetic alternatives. As a result, companies are investing in next-generation wax chemistries and refining process efficiencies to meet stringent environmental and performance criteria. This introduction sets the stage for a detailed exploration of transformative market shifts and strategic imperatives.

Navigating a Paradigm Shift as Technological Advances, Sustainable Solutions, and Evolving Consumer Preferences Reshape the Industrial Wax Ecosystem

Industrial wax markets are undergoing a profound metamorphosis driven by technological breakthroughs and shifting regulatory landscapes. Innovations in microencapsulation techniques allow waxes to deliver controlled release functionalities in coatings and personal care products, thereby opening new application frontiers. Concurrently, digitalization of supply chain processes-involving advanced analytics for inventory management and predictive quality control-has become indispensable for operational resilience.

Moreover, the drive toward sustainability has catalyzed the adoption of bio-derived waxes and hybrid formulations. Major players are collaborating with academia to biotechnologically engineer high-performance natural waxes that reduce carbon footprints without compromising key material properties. This pivot is complemented by stricter global regulations on VOC emissions, prompting formulators to replace solvent-based coatings with wax-enriched waterborne systems. Together, these trends signal a departure from commodity-centered markets toward more specialized, value-added product portfolios.

Assessing the Broad Consequences of Recent United States Trade Tariffs on Industrial Wax Supply Chains and Cost Structures in 2025

The introduction of new trade measures in early 2025 has exerted pronounced effects on industrial wax supply chains and cost structures. The imposition of additional duties on chemical imports from select regions prompted manufacturers to reassess sourcing strategies, particularly for microcrystalline and paraffin waxes traditionally imported from North America and the European Union. As an immediate response, procurement teams accelerated stockpiling efforts into the latter part of the prior year, hoping to shield operations from sudden cost escalations.

In parallel, firms that rely on specialty wax blends for candle and cosmetic applications faced increased landed costs, which eroded margin buffers. To mitigate this, several vertically integrated producers have explored nearshoring options, expanding domestic production capacities for natural and synthetic waxes. These strategic shifts have not only reduced exposure to tariff volatility but also fostered stronger collaboration between raw material suppliers and end-users, thereby setting new benchmarks for supply chain agility.

Dissecting Market Dynamics Through Product Types, Forms, Distribution, Applications, and End User Dynamics to Reveal Underlying Growth Drivers

A nuanced understanding of market segmentation provides the foundation for targeted growth strategies in the industrial wax sector. When viewed through the lens of product type, mineral-based waxes such as paraffin and microcrystalline continue to command volume demand for commodity applications, while synthetic waxes-ranging from Fischer-Tropsch derivatives to polyethylene waxes-cater to performance-driven segments requiring thermal stability and abrasion resistance. Natural waxes, including beeswax, carnauba, and soy variants, are carving out premium niches by leveraging eco-credentials and versatility in personal care formulations.

Equally important, form-based distinctions among liquid, powder, and solid wax offerings guide compatibility with processing technologies. Solid wax configurations, whether blocks or pellets, remain preferred in large-scale candle and coating operations, whereas powders and liquids enable precision dosing in adhesives and cosmetics. Distribution channels further influence market dynamics, as offline sales through industrial distributors ensure reliable bulk supply, while online platforms facilitate rapid sampling and small-batch customization for emerging end-users.

Finally, a closer look at applications reveals how wax selection aligns with performance requirements: adhesive formulators prize tack control and viscosity stability; coatings specialists seek scratch resistance and gloss retention; and the packaging industry increasingly demands waxes for moisture barriers and seal integrity. When paired with industry-specific end-user demands-from automotive component manufacturers to pharmaceutical packaging firms-these segmentation insights illuminate discrete value pools and inform strategic prioritization of R&D, marketing, and production investments.

This comprehensive research report categorizes the Industrial Wax market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- Application

- End User Industry

Delineating Diverse Regional Market Patterns and Emerging Opportunities Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Territories

Regional market behavior for industrial wax reflects a tapestry of demand drivers and regulatory contexts across three major territories. In the Americas, established petrochemical infrastructures underpin strong production of mineral and synthetic waxes, while rising interest in natural alternatives propels investment in beeswax and soy wax processing. This region’s proximity to large end-use industries in automotive and packaging also supports robust collaboration between producers and downstream manufacturers.

Meanwhile, the Europe, Middle East, and Africa region demonstrates a duality of mature markets with stringent environmental regulations and emerging economies seeking industrial expansion. European leaders are accelerating adoption of bio-derived waxes to comply with VOC and microplastic restrictions, whereas constituencies in the Middle East are investing in wax‐based formulations for oil and gas applications, leveraging local hydrocarbon feedstocks.

Asia-Pacific, by contrast, exhibits the most dynamic growth profile driven by infrastructure development and rapid urbanization. China and India lead in candle and rubber applications, while Japan and South Korea focus on high-performance synthetic waxes for electronics and semiconductor fabrication. Across the region, government incentives for sustainable manufacturing are fostering partnerships that blend traditional wax chemistries with cutting-edge bio-technologies.

This comprehensive research report examines key regions that drive the evolution of the Industrial Wax market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Strategic Partnerships that Are Steering Competitive Momentum and Innovation Trajectories in the Industrial Wax Arena

Key competitive players have sharpened their focus on innovation, integration, and strategic partnerships to consolidate their market positions. ExxonMobil and Sasol, for example, continue to leverage vast hydrocarbon feedstock networks to optimize mineral and synthetic wax production, while refining process efficiencies to improve cost competitiveness for commodity applications. Meanwhile, Altana AG and Clariant are intensifying their efforts in specialty wax formulations, collaborating with end-users to co-develop wax blends that meet exacting performance and sustainability criteria.

In parallel, smaller but highly specialized firms are carving out niches by concentrating on bio-based waxes and tailored additive technologies. Strategic collaborations among raw material suppliers, contract manufacturers, and R&D institutions are becoming commonplace, accelerating the commercial readiness of novel wax chemistries. In addition, several industry participants have expanded capabilities through acquisitions of regional wax producers, aiming to secure local supply while diversifying product portfolios for global customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Wax market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Alexandria Mineral Oils Company

- Calumet, Inc.

- CALWAX

- Clariant AG

- Compañía Espanola de Petróleos S.A.

- DEUREX AG

- Exxon Mobil Corporation

- Gandhar Oil Refinery (India) Limited

- HF Sinclair Corporation

- Indian Oil Corporation Ltd

- Innospec Leuna GmbH

- Kerax Wax

- King Honor International Ltd.

- Koster Keunen

- Numaligarh Refinery Limited

- Paramelt B.V.

- RAHA GROUP

- Sasol Limited

- Shell PLC

- The Blayson Group Ltd.

- The Darent Wax Company Limited

- The International Group, Inc.

- Waxoils Private Limited

Strategic Roadmap for Executives to Capitalize on Emerging Trends, Mitigate Risks, and Foster Sustainable Growth in the Industrial Wax Sector

To capitalize on emerging opportunities and navigate residual trade uncertainties, industry leaders should adopt a multipronged approach. First, deepening partnerships with raw material suppliers will enable collaborative product development that aligns with customer performance needs and sustainability benchmarks. Second, investing in digital supply chain technologies-such as blockchain-enabled traceability and AI-driven demand forecasting-will enhance resilience against tariff fluctuations and inventory disruptions.

Furthermore, expanding capacities for bio-derived wax production can future-proof operations against tightening environmental regulations and shifting consumer preferences. This effort should be complemented by targeted marketing initiatives that highlight eco-credentials and performance advantages. Last but not least, regular scenario planning exercises-encompassing potential adjustments in trade policy and feedstock availability-will ensure that strategic roadmaps remain agile and responsive to global market shocks.

Demonstrating Rigorous Research Methodologies and Analytical Frameworks Ensuring Comprehensive, Data-Driven Insights into Industrial Wax Market Dynamics

This analysis draws upon a rigorous combination of primary and secondary research methodologies. Primary inputs were gathered through in-depth interviews with key stakeholders, including raw material suppliers, formulators, and end-user manufacturers. These interviews provided qualitative insights into emerging product requirements, supply chain pain points, and investment priorities. Complementing this, a structured survey of industry executives helped quantify sentiment on growth prospects, regulatory pressures, and technology adoption rates.

Secondary data sources included trade association reports, government trade databases, and corporate disclosures, which were triangulated to validate production and consumption trends. Advanced data analytics techniques were applied to historical time series data, enabling the identification of demand patterns and correlation analyses between regional trade dynamics and end-use sector performance. Finally, scenario modeling was conducted to assess the potential impact of tariff changes and sustainability mandates on cost structures and supply chain configurations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Wax market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Wax Market, by Product Type

- Industrial Wax Market, by Form

- Industrial Wax Market, by Distribution Channel

- Industrial Wax Market, by Application

- Industrial Wax Market, by End User Industry

- Industrial Wax Market, by Region

- Industrial Wax Market, by Group

- Industrial Wax Market, by Country

- United States Industrial Wax Market

- China Industrial Wax Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Converging Insights and Strategic Imperatives to Guide Decision Makers in Harnessing the Full Potential of the Industrial Wax Market Landscape

Through this executive summary, we have traced how the industrial wax market is transitioning toward specialized, performance-driven formulations underpinned by sustainability and technological innovation. The cascading effects of trade measures in 2025 have underscored the importance of flexible sourcing strategies and close supplier collaboration. Detailed segmentation insights reveal distinct value pools that can guide R&D prioritization, while regional analyses highlight heterogeneous demand drivers across the Americas, EMEA, and Asia-Pacific.

As competitive intensity escalates and regulatory expectations climb, companies that integrate digital capabilities, pursue eco-focused product development, and conduct proactive scenario planning will be best positioned to capture market share. The strategic roadmap and research frameworks outlined herein offer a blueprint for navigating this evolving landscape. Ultimately, the ability to anticipate shifts, align internal capabilities with external demands, and innovate at the intersection of performance and sustainability will determine long-term success.

Connect with Our Associate Director for Tailored Insights and Secure Your Comprehensive Industrial Wax Market Report Today with Expert Guidance

I invite executives and decision makers seeking an authoritative deep dive into the industrial wax market to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex market intelligence into actionable strategies ensures a tailored experience that addresses your specific industry challenges and growth objectives. By securing the comprehensive market research report, you gain exclusive access to proprietary data, in-depth analyses, and forward-looking scenarios that empower you to stay ahead of market shifts and maximize strategic advantages. Reach out to Ketan Rohom today to explore customizable research package options and to initiate a partnership that will drive your organization’s success in the competitive landscape of industrial wax.

- How big is the Industrial Wax Market?

- What is the Industrial Wax Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?