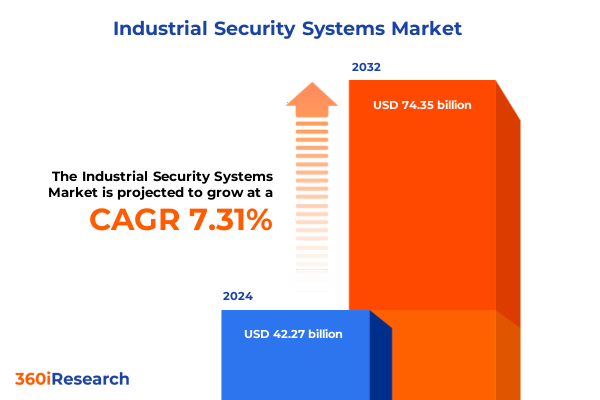

The Industrial Security Systems Market size was estimated at USD 45.26 billion in 2025 and expected to reach USD 48.47 billion in 2026, at a CAGR of 7.34% to reach USD 74.35 billion by 2032.

Setting the Context for Industrial Security Systems Market Evolution with a Comprehensive Exploration of Core Drivers and Emerging Dynamics

The industrial security systems sector has undergone rapid evolution in recent years, driven by an increasingly complex threat landscape and the convergence of physical and digital realms. As organizations grapple with the dual imperatives of protecting critical infrastructure and enabling operational efficiency, a nuanced understanding of system architectures, technology integrations, and emergent risks becomes indispensable. This introduction sets the stage by examining how modern security demands extend far beyond perimeter defenses, encompassing proactive threat detection, real-time analytics, and adaptive response mechanisms.

This research delves into the core drivers shaping the sector, including the proliferation of networked devices, heightened regulatory scrutiny, and the imperative for greater visibility across operations. It explores how advancements in sensor technologies, cloud-native platforms, and artificial intelligence converge to form multi-layered security ecosystems capable of addressing both conventional intrusions and sophisticated cyber-physical attacks. In this context, stakeholders must balance investment in innovative solutions with robust governance and interoperability to achieve comprehensive protection.

Furthermore, the introduction highlights the critical role of collaboration between security vendors, system integrators, and end users. Establishing shared frameworks for data exchange, threat intelligence, and incident response fosters a collective resilience that extends beyond individual facilities. This section frames the broader landscape, emphasizing the need for strategic alignment between technical capabilities and organizational objectives, thereby laying the foundation for subsequent analysis of transformative trends.

Unveiling the Fundamental Trends Reshaping Industrial Security Systems through Technological Breakthroughs and Market Realignments Influencing Operations

The industrial security systems landscape is witnessing transformative shifts as disruptive technologies and strategic realignments redefine what constitutes an effective defense posture. Artificial intelligence and machine learning have graduated from conceptual stages to mission-critical functions, empowering security platforms to autonomously identify anomalies within vast streams of sensor data. This level of insight accelerates incident detection and response while reducing false positives, enabling security teams to focus resources on genuine threats.

Parallel to the rise of intelligent analytics, the adoption of edge computing architectures has accelerated, mitigating latency issues and bolstering real-time decision-making at the facility level. Organizations now deploy distributed processing nodes to handle core security functions, ensuring uninterrupted operations even when connectivity to centralized systems fluctuates. This shift enhances resilience and supports advanced use cases, such as predictive maintenance of equipment and integration with industrial control systems.

Concurrently, the proliferation of the Industrial Internet of Things (IIoT) has catalyzed deep integration between operational and security technologies. IoT sensors embedded within manufacturing lines, power substations, and transportation hubs generate continuous streams of performance and security data. Integrating these streams with security orchestration platforms allows for holistic situational awareness, enabling proactive risk mitigation and cross-system correlation that can preempt cascading incidents.

These technological trends intersect with evolving regulatory frameworks that emphasize data protection, critical infrastructure resilience, and supply chain transparency. As authorities worldwide introduce stricter compliance requirements, security solution providers and end users must adapt governance models, implement auditable processes, and align their technology roadmaps with these mandates. The interplay of these transformative forces is reshaping the industrial security ecosystem, driving both innovation and strategic consolidation.

Analyzing the Broad Reach and Consequential Effects of United States Tariffs Enacted in 2025 on Supply Chains and Cost Structures within Industrial Security

The imposition of United States tariffs in 2025 has generated far-reaching consequences for the industrial security sector’s supply chains and cost structures. Tariffs targeting electronic components, including semiconductors and surveillance cameras, translated into immediate price escalations for hardware manufacturers and end users. Over time, organizations have grappled with recalibrating procurement strategies to mitigate these increased costs without compromising on system performance or reliability.

Many security integrators responded by diversifying their supplier portfolios, sourcing components from alternate regions to balance cost and quality. This realignment required rigorous vendor assessments and an enhanced focus on supply chain visibility, ensuring that alternative sources met stringent security and compliance standards. Furthermore, localized assembly and regional distribution centers emerged as strategic buffers, attenuating the impact of cross-border levies and reducing lead times for critical equipment deployments.

In parallel, the elevated costs associated with hardware prompted a shift toward software-centric value propositions. Security solution providers accelerated the roll-out of subscription-based analytics, cloud-native management platforms, and managed services offerings. By emphasizing software updates, remote monitoring capabilities, and predictive maintenance services, companies could recoup revenue streams while providing clients with scalable and cost-effective security solutions.

Despite these adaptations, operational budgets for security continued to face pressure. Decision-makers have increasingly prioritized modular designs and interoperable architectures, enabling incremental upgrades rather than wholesale replacements. This pragmatic approach facilitates financial resilience and ensures that systems remain agile in the face of ongoing policy changes and market volatility.

Illuminating Deep-Dive Insights into Core Segments of Industrial Security Systems Highlighting Nuanced Technologies Services and Integration Strategies

A detailed assessment of core segments within industrial security systems reveals distinct dynamics shaping each technology domain. Video surveillance deployments are transitioning from legacy analog installations toward networked IP camera ecosystems. Fixed IP cameras have become the backbone for routine monitoring, while pan-tilt-zoom variants address dynamic security requirements by enabling remote repositioning and high-resolution tracking. Concurrently, the shift from digital video recorders to networked video recorders underscores a broader migration toward centralized storage architectures and advanced analytics integration.

Access control portfolios demonstrate a parallel evolution, with biometric modalities gaining traction for high-security applications. Fingerprint readers and iris scanning solutions complement traditional card-based methods, which continue to evolve through advanced magnetic stripe and proximity card technologies. Networked controllers facilitate real-time credential management and audit trails, while standalone units offer streamlined installations for smaller facilities or satellite locations, highlighting the balance between centralized oversight and decentralized deployment flexibility.

Intrusion detection systems encapsulate a spectrum of sensor technologies designed to secure both internal areas and perimeter boundaries. Dual-technology and passive infrared sensors excel in interior motion detection, offering reliable performance in environments prone to environmental disturbances. For perimeter security, beam sensors create invisible detection barriers, while fence sensors provide direct physical intrusion alerts. The choice between these technologies often reflects specific site layouts, risk profiles, and integration requirements.

Fire detection strategies continue to rely on specialized detectors optimized for diverse hazard scenarios. Flame detectors deliver rapid response in high-risk settings, whereas heat and smoke detectors form the backbone of early warning systems. Complementing these hardware segments, software platforms such as access control management, video analytics suites, fire alarm management applications, intrusion detection software, and video management systems serve as critical enablers of unified operational oversight. Additionally, service models encompassing consulting, professional installation, maintenance and support, as well as managed services ensure that security systems remain optimized throughout their lifecycle, illustrating the interconnected nature of technology and services.

This comprehensive research report categorizes the Industrial Security Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Video Surveillance

- Access Control

- Intrusion Detection

- Fire Detection

- Software

- Services

Examining Critical Regional Dynamics Shaping the Growth Pathways of Industrial Security Systems across the Americas Europe Middle East Africa and Asia Pacific

Regional considerations exert a powerful influence on the deployment and evolution of industrial security systems, driven by economic conditions, regulatory mandates, and infrastructure maturity. In the Americas, high levels of digital infrastructure investment and stringent compliance frameworks have encouraged the adoption of integrated security architectures. Organizations in North America emphasize cybersecurity convergence and data privacy requirements, while Latin American markets exhibit growing appetite for turnkey solutions that balance cost sensitivity with robust performance.

Within Europe, Middle East, and Africa, diverse geopolitical and regulatory landscapes shape security strategies. Western European countries, guided by rigorous privacy and safety standards, prioritize advanced analytics, cloud-based management, and interoperability across national boundaries. In the Middle East, large-scale infrastructure projects and rapid urbanization drive demand for comprehensive security ecosystems incorporating video surveillance, access control, and centralized monitoring. Across Africa, emerging markets seek scalable solutions that accommodate both modern industrial hubs and decentralized operations, often leveraging mobile-enabled systems and managed service models to address resource constraints.

In the Asia Pacific region, heterogeneous market maturity levels yield a dynamic mix of technology adoption patterns. Highly industrialized nations continue to refine digital twins and predictive analytics to enhance security resilience, whereas fast-growing economies prioritize foundational deployments of IP surveillance and biometric access control. Supply chain integration with manufacturing powerhouses fuels local innovation, with original equipment manufacturers embedding advanced security features directly into critical infrastructure components. Across this region, the confluence of smart city initiatives and industrial automation creates unique opportunities for vendors to deliver end-to-end security solutions at scale.

This comprehensive research report examines key regions that drive the evolution of the Industrial Security Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Differentiation and Value Creation in the Industrial Security Systems Ecosystem

Leading players in the industrial security systems arena are distinguished by their ability to innovate across hardware, software, and service domains. Hardware manufacturers have broadened their portfolios to encompass end-to-end solutions, integrating advanced optics, sensor fusion, and ruggedized designs tailored for industrial conditions. Their strategic partnerships with semiconductor suppliers and system integrators enhance component availability and accelerate time to deployment.

On the software front, specialized analytics providers have sharpened their focus on AI-driven capabilities. These firms develop machine vision algorithms that detect subtle behavioral anomalies, enabling predictive threat mitigation and improved operational intelligence. They also establish strategic alliances with cloud platform operators to deliver scalable, multi-tenant environments while adhering to local data sovereignty regulations.

Service providers and system integrators are emerging as pivotal collaborators in the security ecosystem. By offering consulting, professional installation, and managed services, they ensure end users can navigate complex technology stacks without the need for extensive in-house expertise. These organizations have invested in training programs and certification frameworks to guarantee consistent quality across global projects.

Additionally, several leading conglomerates have embarked on mergers and acquisitions, consolidating complementary capabilities to expand geographic reach and streamline solution portfolios. This trend underscores the move toward comprehensive security platforms that blend video analytics, access control management, intrusion detection, and fire safety into unified operating environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Security Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Axis Communications AB

- Cisco Systems, Inc.

- Dahua Technology Co., Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls International plc

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens Aktiengesellschaft

Delivering Insightful Strategic Imperatives to Navigate Challenges and Seize Opportunities within the Industrial Security Systems Landscape

Industry leaders must embrace a proactive approach to technology modernization by prioritizing the integration of artificial intelligence and edge computing into their security architectures. This strategic imperative enables organizations to harness real-time insights and adaptive response mechanisms that can preempt emerging threats. Leaders should conduct comprehensive technology audits to identify legacy gaps and develop phased migration paths that align with both operational requirements and budgetary constraints.

Securing supply chains against geopolitical and policy uncertainties requires diversifying procurement strategies and strengthening vendor relationships. Organizations should map critical components and implement multi-tiered sourcing plans to mitigate disruptions. Collaborative partnerships with local distributors and value-added resellers can also streamline logistics and reduce dependency on single points of failure, building resilience into both manufacturing and deployment pipelines.

A heightened focus on cybersecurity convergence is paramount. Industry executives should foster interdisciplinary governance teams that oversee both IT and operational technology (OT) security. By adopting unified risk management frameworks, organizations can ensure consistent policy enforcement, streamline incident response protocols, and maintain compliance with evolving regulatory mandates. This integrated approach minimizes blind spots and fortifies overall security postures.

Finally, investing in workforce readiness drives sustainable transformation. Continuous training initiatives, cross-functional drills, and simulated incident exercises enhance staff capabilities and institutionalize best practices. Industry leaders that cultivate a culture of security awareness and innovation will be best positioned to navigate dynamic market conditions and capitalize on emerging growth opportunities.

Detailing the Rigorous Research Framework and Methodological Approaches Used to Uphold Validity Reliability and Depth in Industrial Security Systems Evaluation

This research employs a robust mixed-methods framework to ensure comprehensive validity and depth. Primary data collection involved structured interviews with security architects, system integrators, and end-user executives, capturing qualitative insights into adoption drivers, operational challenges, and evolving risk perceptions. These interviews were complemented by on-site evaluations and technology demonstrations, providing direct visibility into real-world deployments and integration best practices.

Secondary research encompassed extensive review of technical whitepapers, regulatory publications, and industry reports, enabling triangulation of market narratives and technology roadmaps. Data points were cross-referenced with vendor disclosures, patent filings, and conference proceedings to validate emerging trends and competitive dynamics. This iterative process underscored the importance of grounding projections in documented innovation trajectories and policy frameworks.

Quantitative analysis leveraged survey responses from a global panel of security professionals, correlating investment priorities with satisfaction metrics and performance outcomes. Statistical techniques, including regression analysis and clustering, were applied to discern patterns in technology adoption and identify segmentation opportunities. These findings informed the nuanced breakdown across hardware, software, and service verticals.

Throughout the research process, rigorous quality controls-such as peer reviews, data consistency checks, and confidentiality agreements-ensured the integrity of insights and protected the anonymity of participants. This methodological rigor underpins the credibility of the research, delivering a holistic and actionable understanding of the industrial security systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Security Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Security Systems Market, by Video Surveillance

- Industrial Security Systems Market, by Access Control

- Industrial Security Systems Market, by Intrusion Detection

- Industrial Security Systems Market, by Fire Detection

- Industrial Security Systems Market, by Software

- Industrial Security Systems Market, by Services

- Industrial Security Systems Market, by Region

- Industrial Security Systems Market, by Group

- Industrial Security Systems Market, by Country

- United States Industrial Security Systems Market

- China Industrial Security Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Synthesis of Key Insights and Forward-Looking Reflections Guiding Strategic Decision-Making Innovation Trajectories in Industrial Security Systems

The synthesis of insights presented throughout this analysis underscores the multifaceted nature of modern security imperatives. Technological advancements-from AI-powered analytics to edge computing nodes-are catalyzing a paradigm shift in how organizations perceive and respond to threats. Simultaneously, policy developments and supply chain realignments, such as the recent tariff measures, continue to reshape cost structures and strategic choices.

By examining segment-specific dynamics, regional nuances, and leading competitor strategies, stakeholders gain a comprehensive view of the ecosystem’s interconnected elements. This holistic perspective reveals that success rests on the ability to integrate hardware and software solutions seamlessly, backed by service models that ensure continuous optimization and adaptability.

Moving forward, organizations must adopt a proactive posture that harmonizes technological innovation with governance frameworks and workforce preparedness. Embracing modular, interoperable architectures will facilitate incremental upgrades and future-proof investments. Meanwhile, fostering cross-disciplinary collaboration among IT, OT, and executive leadership will drive unified risk management and informed decision-making.

In closing, this analysis equips decision-makers with the clarity required to navigate an increasingly complex security landscape. By aligning strategic initiatives with the insights and recommendations herein, organizations can enhance resilience, capitalize on emerging opportunities, and chart a forward-looking security roadmap that withstands evolving challenges.

Engage with Ketan Rohom for a Tailored Consultation to Secure Comprehensive Industrial Security Systems Insights and Propel Informed Decision-Making

To explore how this comprehensive insight can directly empower your organization’s strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized discussion. His dedicated expertise will help tailor the findings to your unique operational environment and security challenges. Through this consultation, you will gain a clear understanding of how to leverage the research’s actionable intelligence to strengthen resilience, optimize technology investments, and align with evolving regulatory landscapes. Engage now to secure a competitive advantage and inform your decision-making with the depth and clarity that only this specialized study can deliver.

- How big is the Industrial Security Systems Market?

- What is the Industrial Security Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?