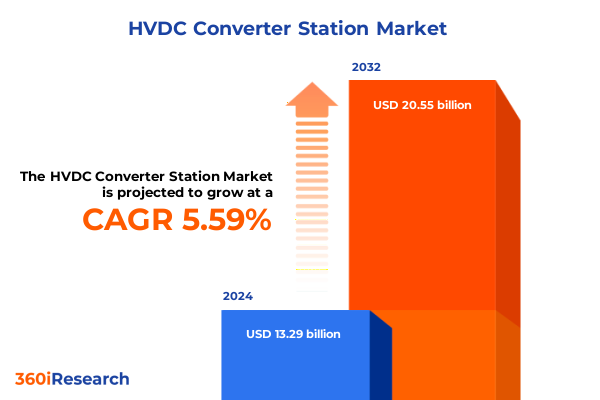

The HVDC Converter Station Market size was estimated at USD 14.00 billion in 2025 and expected to reach USD 14.75 billion in 2026, at a CAGR of 5.63% to reach USD 20.55 billion by 2032.

Introduction to Ultra-High Voltage Direct Current Converter Stations and Their Critical Role in Modern Power Transmission Infrastructure

High-voltage direct current converter stations represent a critical juncture in modern power transmission systems, serving as the essential interface where alternating current is transformed into direct current and vice versa to facilitate long-distance bulk energy transfer. These specialized substations enable operators to minimize losses over extensive transmission lines, stabilize asynchronous grids, and integrate diverse energy sources across disparate regions. Featuring sophisticated components such as converters housed within valve halls, reactive power equipment, and harmonic filters, these installations underpin the efficiency and reliability of ultra-high voltage interconnections across global power networks.

Transitioning from conventional alternating current solutions, HVDC converter stations have evolved through successive technological breakthroughs. From the early mercury-arc valve implementations to contemporary thyristor-based line-commutated converters and insulated-gate bipolar transistor–driven voltage source converters, each advancement has expanded the potential for enhanced power control, bidirectional energy flow, and reduced infrastructure footprint. As decarbonization and grid resilience demands intensify, these converter stations have emerged as strategic assets that enable seamless renewable integration, cross-border power trade, and the development of robust multi-terminal networks.

Emerging Technological, Regulatory, and Market Dynamics Redefining the Outlook for Ultra-High Voltage Direct Current Converter Infrastructure Deployment

Over the past decade, the HVDC converter station landscape has undergone transformative shifts driven by leaps in component innovation, system design, and market dynamics. The advent of modular multilevel converter topologies, exemplified by recent breakthroughs in commutation capacitor integration and tunable harmonic filtering, has unlocked new levels of efficiency and stability. These advanced modular solutions now offer scalable performance that adapts to weak or de-energized AC networks while reducing auxiliary compensation requirements and enhancing controllability.

Moreover, surging investment in ultra-high voltage direct current links has pushed voltage ratings beyond the 1,100 kV threshold, enabling interconnections that span thousands of kilometers with minimal electrical losses. Collaborative ventures between utilities and technology providers have accelerated the rollout of UHVDC transformer and valve systems capable of integrating multiple AC grids into unified energy corridors, thereby reinforcing resilience and facilitating large-scale renewable transfers. Simultaneously, digitalization initiatives-encompassing advanced control systems, predictive maintenance analytics, and real-time grid optimization-are reshaping the operational paradigm of converter stations, turning them into intelligent hubs that support dynamic power routing and automated fault management.

Assessing the Cumulative Impact of United States Section 232 and Section 301 Tariff Actions on High-Voltage Direct Current Converter Station Projects

The cumulative impact of United States tariff measures in 2025 presents multifaceted cost and supply chain challenges for HVDC converter station deployments. In January 2025, the United States International Trade Commission finalized elevated Section 301 duties on imported semiconductors, raising rates to 50 percent for direct imports of high-performance power electronics-an essential component of modern voltage source converters.

Further compounding cost pressures, the administration’s June 2025 proclamation under Section 232 doubled tariffs on steel and aluminum imports from 25 percent to 50 percent for most trading partners, with derivative components subject to ad valorem assessments based on content value. These heightened duties directly affect the procurement of converter shells, transformer cores, structural supports, and buswork materials.

Moreover, a baseline 10 percent universal tariff introduced via executive order in April 2025 applies to a wide array of imported goods unless specifically exempted, potentially layering additional levy increments onto specialized equipment sourced from global manufacturing hubs. As a result, project developers must reevaluate sourcing strategies, explore localized manufacturing partnerships, and reassess total landed costs to maintain financial viability in light of a more complex and layered tariff environment.

Key Segmentation Insights Revealing How Converter Type, Power Rating, Topology, and Application Influence High-Voltage Direct Current Converter Station Market

A nuanced understanding of market segmentation yields critical insights into the diverse drivers of demand and technology adoption across HVDC converter station projects. Converter type distinctions underscore this diversity: line-commutated systems, segmented into mercury-arc and thyristor valve implementations, contrast with voltage source solutions classified by their full bridge or half bridge modular arrangements. This segmentation reveals that each converter architecture aligns with specific network characteristics, such as robustness requirements for long-distance bulk transmission versus flexibility for weak or renewable-rich grids.

Power rating considerations further refine this landscape, with stations designed for sub-500 MW capacities, those engineered to support the 500–1000 MW band, and utility-scale installations exceeding 1000 MW. These tiers correspond to project scale, financial investment profiles, and regional demand patterns, highlighting the importance of tailored design and procurement strategies. Topological variations-bipolar configurations offering redundancy, homopolar structures for simplicity, and economical monopolar links-provide another lens through which to assess resilience, cost, and operational complexity. Finally, application-driven segmentation across interconnection bridges, renewable integration schemes, and transmission-focused backbones illustrates how functional priorities shape converter station specifications and service models.

This comprehensive research report categorizes the HVDC Converter Station market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Converter Type

- Power Capacity

- Station Topology

- Application

Regional Dynamics Shaping Adoption Trends and Investment Priorities of High-Voltage Direct Current Converter Stations Across Key Global Markets

Regional market dynamics exhibit distinct strategic patterns across the Americas, Europe-Middle East & Africa, and Asia-Pacific. In the Americas, major projects such as the Grain Belt Express initiative underscore the region’s emphasis on connecting renewable energy hubs with load centers, driving a preference for utility-scale voltage source converters that facilitate flexible power routing across multi-state grids. Meanwhile, North American grid interconnectors also benefit from supportive regulatory frameworks and active tariff mitigation programs that accelerate project timelines.

In Europe, the Middle East, and Africa, government-led decarbonization targets and cross-border energy sharing agreements fuel demand for high-capacity bipolar converter stations. Integration of offshore wind resources in the North Sea and Mediterranean regions often necessitates multi-terminal UHVDC links that can dynamically balance power flows among multiple jurisdictions. Simultaneously, energy security imperatives in MENA nations stimulate investments in transmission backbones that traverse challenging terrains, underscoring the importance of robust station designs that withstand extreme operational conditions.

Asia-Pacific markets present a dual growth narrative. China and India continue to expand ultra-high voltage corridors to connect remote renewable generation sites with urban consumption centers, while Southeast Asian nations embark on foundational interconnection projects to stabilize grid resilience. The region’s appetite for turnkey solutions and technology licensing agreements highlights an opportunity for strategic partnerships that deliver localized manufacturing, technical training, and long-term service commitments.

This comprehensive research report examines key regions that drive the evolution of the HVDC Converter Station market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Participants Driving Innovation, Strategic Alliances, and Technology Advancements in High-Voltage Direct Current Converter Station Solutions

Leading industry participants continue to drive innovation, strategic collaborations, and technological advancement across the HVDC converter station sector. ABB, a pioneer in HVDC system upgrades, recently completed a state-of-the-art refurbishment on the Québec–New England link, delivering advanced MACH control and protection systems that enhance operational reliability while enabling sophisticated smart-grid integration. ABB’s heritage in pioneering voltage source converter solutions and its record of commissioning multimode UHVDC transformer and valve assemblies underscore its leadership in capacity expansion and digitalization.

Similarly, Siemens Energy has fortified its market position through high-profile project successes and framework agreements, including turnkey delivery of the Bipole III converter stations for Manitoba Hydro. Collaborating with Mortenson, Siemens supplied core HVDC technology, balancing system design with construction expertise to navigate extreme site conditions and stringent scheduling demands. The company’s extensive portfolio of over 50 global HVDC systems reflects a commitment to technology deployment, partnership-driven project delivery, and continuous research into next-generation converter architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the HVDC Converter Station market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bharat Heavy Electricals Ltd

- C-Epri Power Engineering Company

- CG Power and Industrial Solutions Limited)

- China XD Group

- Detector Electronics, LLC

- General Electric Company

- Greenlink Interconnector Limited

- Hitachi Energy Ltd.

- Hyosung Heavy Industries

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- Prysmian Group

- Schneider Electric SE

- Siemens Energy AG

- Toshiba Energy Systems & Solutions Corporation

- Xi’an XD Power System Co., Ltd.

Actionable Recommendations for Industry Leaders to Navigate Regulatory Complexities and Enhance Operational Efficiency in HVDC Converter Station Deployment

Industry leaders should pursue an integrated procurement and localization strategy to mitigate tariff exposures and strengthen supply chain resilience. By partnering with domestic fabricators for steel and aluminum supports and pursuing joint ventures for semiconductor assembly, organizations can reduce landed costs and maintain project margins. Concurrently, engaging with converter technology providers on collaborative R&D programs can accelerate the adoption of next-generation silicon carbide and gallium nitride devices, delivering enhanced efficiency and thermal performance.

To manage regulatory complexities, project teams must monitor tariff schedules and harmonized code classifications continuously, leveraging advanced analytics for real-time duty optimization and compliance reporting. Proactive engagement with trade counsel and participation in exclusion petition processes will further safeguard critical equipment imports. On the operational front, deploying modular multilevel converter topologies with integrated digital twin platforms will enhance predictive maintenance, reduce unplanned downtime, and support dynamic grid services.

Finally, decision-makers should cultivate ecosystem partnerships across utilities, equipment vendors, and technology innovators to co-develop multi-terminal UHVDC demonstrators. Such collaborative initiatives will validate emerging topologies, unlock economies of scale, and shape standards that underpin the next wave of cross-border power interconnections.

Comprehensive Research Methodology Outlining Data Sources, Analytical Frameworks, and Validation Processes Underpinning HVDC Converter Station Market Insights

This study integrates a rigorous research methodology combining comprehensive secondary research, in-depth primary interviews, and quantitative data analysis to underpin market insights. Secondary resources encompass technical papers, regulatory filings, trade commission reports, and corporate press releases to establish an authoritative baseline of technological and policy developments. Primary insights derive from structured interviews with converter station OEMs, independent system operators, and engineering consultants, ensuring balanced perspectives on project drivers and barriers.

Data validation and triangulation efforts include cross-referencing supplier shipment records with customs databases and corroborating tariff impact modeling through scenario analysis. Segmentation analysis leverages detailed converter type, power rating, topology, and application classifications to delineate market niches and technology adoption curves. Regional market sizing draws on capacity projections and infrastructure investment plans, while vendor landscaping relies on a weighted scoring methodology that assesses technical competencies, project track record, and collaborative network strength.

Throughout the research process, adherence to universally accepted market study protocols and peer review checkpoints ensures robust, repeatable outcomes. The final deliverables present actionable insights designed to inform strategic planning, technology selection, and investment prioritization across the HVDC converter station ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HVDC Converter Station market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HVDC Converter Station Market, by Component

- HVDC Converter Station Market, by Converter Type

- HVDC Converter Station Market, by Power Capacity

- HVDC Converter Station Market, by Station Topology

- HVDC Converter Station Market, by Application

- HVDC Converter Station Market, by Region

- HVDC Converter Station Market, by Group

- HVDC Converter Station Market, by Country

- United States HVDC Converter Station Market

- China HVDC Converter Station Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Strategic Imperatives, Technological Trajectories, and Future Outlook for High-Voltage Direct Current Converter Stations

The evolution of high-voltage direct current converter stations has transitioned from early line-commutated installations to versatile, modular systems equipped with advanced power electronics and digital control architectures. Strategic imperatives now center on scaling UHVDC corridors, integrating renewable energy hubs, and fostering multi-terminal networks that enhance grid stability and enable emergent market structures. Technological trajectories point towards silicon carbide device adoption, digital twin optimization, and seamless interoperability across asynchronous grids.

As regulatory landscapes fluctuate, particularly in tariff environments, stakeholders must adopt dynamic sourcing models and champion domestic manufacturing partnerships to preserve project economics. Meanwhile, the competitive landscape underscores the importance of collaborative R&D, shared pilot projects, and harmonized standards to unlock network-wide efficiencies. By aligning deployment strategies with evolving policy frameworks and technology roadmaps, industry participants can secure enduring value creation and promote resilient, decarbonized power systems.

In closing, HVDC converter stations stand at the nexus of energy transformation, offering unparalleled capabilities to bridge geographic distances, stabilize complex grid topologies, and support the global shift towards sustainable power architectures. Navigating this dynamic environment requires foresight, collaboration, and a commitment to continuous innovation.

Empowered Next Steps to Acquire Authoritative HVDC Converter Station Market Intelligence with Ketan Rohom, Associate Director of Sales & Marketing

For personalized guidance on leveraging these insights to drive strategic growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in aligning technical market intelligence with business objectives and can tailor a comprehensive package that addresses your organization’s unique challenges and opportunities. Engage with a trusted partner to secure the most authoritative and actionable HVDC converter station market report available. Contact Ketan today to initiate a conversation about custom research solutions that empower your next phase of investment and innovation.

- How big is the HVDC Converter Station Market?

- What is the HVDC Converter Station Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?