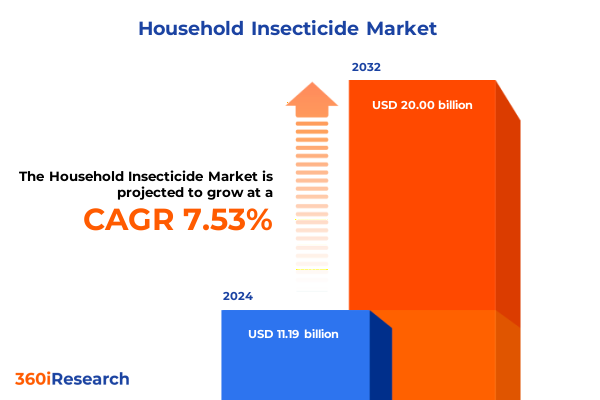

The Household Insecticide Market size was estimated at USD 11.94 billion in 2025 and expected to reach USD 12.75 billion in 2026, at a CAGR of 7.64% to reach USD 20.00 billion by 2032.

Understanding the Vital Role of Household Insecticides Amid Evolving Pest Challenges and Rising Consumer Health Consciousness in Modern Living Environments

Household insecticides are indispensable for safeguarding health and property against a broad spectrum of pests, from disease-carrying mosquitoes to structural threats like termites. In many regions, vector-borne illnesses such as dengue and malaria affect millions annually, underscoring the critical role of effective household pest control solutions in public health strategies. Concurrently, the rise of urban living has intensified the need for convenient, reliable products that address both traditional pests like cockroaches and emerging vectors thriving in densely populated environments.

The landscape is further shaped by rapid technological and consumer shifts. Innovations such as automated dispensers and smart traps integrate sensors and connectivity to optimize application timing and dosage, enhancing efficacy while minimizing chemical exposure. Simultaneously, growing environmental and health awareness has propelled demand for eco-friendly formulations, with essential oils and plant extracts becoming prominent active ingredients that resonate with sustainability-focused consumers.

Exploring Transformative Shifts Driving the Household Insecticide Industry Through Sustainability, Smart Technologies, and Regulatory Dynamics

The household insecticide industry is undergoing a profound transformation driven by sustainability mandates, evolving regulations, and digital disruption. Global regulatory bodies are tightening restrictions on certain chemical classes, prompting manufacturers to reformulate products with bio-based compounds and biodegradable carriers to maintain compliance and consumer trust. At the same time, essential oils like citronella and neem are gaining traction as they offer dual benefits of pest repellency and minimal environmental impact, signaling a clear shift toward natural pest control strategies.

Parallel to formulation trends, smart and connected devices are redefining pest management at the household level. Companies are launching app-enabled dispensers that adjust release schedules based on sensor-detected insect activity, delivering targeted control that reduces waste and user intervention. Additionally, e-commerce platforms and online marketplaces have broadened reach and accelerated product adoption, with digital channels accounting for nearly a third of global insecticide sales in 2024, effectively shortening go-to-market cycles and enabling real-time consumer feedback loops.

Analyzing the Cumulative Impact of 2025 U.S. Reciprocal Tariffs on Household Insecticide Supply Chains, Costs, and Strategic Sourcing

In April 2025, the United States implemented a universal 10% tariff on virtually all imported goods, complemented by country-specific levies that stack on existing duties. Imports from China face an additional 34% surcharge, while goods from the European Union incur a 20% duty-measures designed to address trade imbalances and bolster domestic manufacturing. For pest control businesses reliant on key active ingredients like pyrethroids and organophosphates sourced globally, these reciprocal tariffs translate directly into elevated raw material costs and potential pricing pressures along the supply chain.

Beyond headline rates, exemptions under USMCA for Canadian and Mexican goods, along with de minimis rules for low-value shipments, offer partial relief for certain categories of pest control products. However, many specialty chemicals do not qualify, leaving distributors to navigate a complex matrix of duties when restocking inventory. Chemical sector stakeholders report that underlying feedstock prices could increase by up to 37% as freight and tariff burdens intensify, amplifying unit costs and driving manufacturers to explore alternative sourcing or domestic production to mitigate financial strain.

Deriving Key Insights from Segmentation by Product Type, Active Ingredient, Sales Channel, Application, and End User to Inform Strategic Decisions

The product-type landscape of household insecticides encompasses a spectrum of delivery formats tailored to diverse use cases. Aerosol sprays continue to dominate, offering rapid knockdown and broad coverage, which makes them a preferred choice in North America and Europe where convenience and efficacy are paramount-accounting for about 37% of total sales formats in 2024. Meanwhile, baits-available as gel or pellet formulations-offer targeted control for rodents and crawling insects, gaining traction in both residential settings and commercial facilities seeking discreet applications without drift or residue.

Foggers, segmented into thermal and ultrasonic variants, provide whole-room treatment options for hard-to-reach areas, while coils remain a mainstay in high-humidity markets across Asia-Pacific, where continuous slow release of active ingredients is vital. Liquid concentrates and ready-to-use solutions address users seeking customizable dosage, and mats and powders offer long-lasting residual action for sustained protection against mosquitoes and other persistent pests.

Active-ingredient segmentation reveals a transition toward pyrethroid compounds such as cypermethrin, deltamethrin, and permethrin, prized for their broad-spectrum efficacy and favorable mammalian safety profiles. Organophosphates and carbamates retain niche presence in some regions subject to regulatory allowances, whereas the natural segment-comprising essential oils and plant extracts-is the fastest-growing category, resonating with health-conscious consumers demanding green alternatives.

Sales channels range from convenience stores and specialty outlets to supermarkets and hypermarkets, yet online retail has emerged as a critical vector for both company websites and third-party platforms, leveraging targeted digital marketing and subscription models. Specialty and natural product retailers excel in promoting eco-friendly formulations, while mass-market supermarket chains drive trial among mainstream consumers.

Applications bifurcate into indoor and outdoor use cases. Indoor solutions-covering kitchens, bathrooms, and living areas-prioritize low-odor, child-safe formats, whereas outdoor treatments for garages, sheds, gardens, and patios emphasize weather-resistant sprays and coils. End-user segmentation further delineates residential households, which represent the bulk of consumption, from commercial users including hotels, offices, institutions, and restaurants, where regulatory compliance and sustained efficacy are paramount.

This comprehensive research report categorizes the Household Insecticide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Active Ingredient

- Application

- Sales Channel

- End User

Uncovering Regional Dynamics Shaping Household Insecticide Demand in the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, North America leads consumption driven by high urbanization rates and heightened awareness of health risks associated with insect vectors. Approximately two-thirds of U.S. households reported regular use of insecticide products in 2023, reflecting both preventive attitudes and promotional activity by retailers during peak seasons. Latin America, meanwhile, sees substantial demand for low-cost coil and mat solutions, particularly in regions battling dengue and Zika outbreaks, where affordability and ease of use are critical.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and consumer preferences. In Western Europe, stringent EU regulations have accelerated innovation in bio-based formulations, while specialty retailers cater to demand for sustainable products. In the Middle East and Africa, sales of electronic repellents and herbal sprays surged by over 21% in markets like Saudi Arabia and the UAE in 2023, illustrating growing investment in advanced and natural vector control solutions.

Asia-Pacific commands the largest regional share-exceeding 42% in 2024-fueled by dense populations, tropical climates, and expanding middle classes investing in home protection. India’s market is characterized by robust coil and aerosol formats, while China and Southeast Asia embrace electric vaporizers and gel baits. Government-led vector control programs also drive institutional procurement, further augmenting commercial segment growth.

This comprehensive research report examines key regions that drive the evolution of the Household Insecticide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning and Innovation Trajectories of Leading Global Household Insecticide Companies

Market leadership is concentrated among a handful of global players distinguished by brand equity, R&D investment, and extensive distribution networks. SC Johnson & Son commands a leading position in aerosol segments with brands like Raid and OFF!, leveraging partnerships with entomologists and innovations in child-resistant packaging and eco-friendly propellants to secure roughly a third of global aerosol sales. Reckitt Benckiser follows closely, driven by its Mortein and Harpic brands, which capitalize on aggressive pricing and deep penetration in emerging markets across Asia and Africa, securing around 16% of the overall household insecticide market.

Bayer AG’s household insecticide portfolio, marketed under Bayer Advanced, benefits from the company’s agrochemical expertise, focusing on high-efficacy synthetic formulations and hybrid biological technologies. Godrej Consumer Products fortifies its regional stronghold in Asia-Pacific with brands like Goodknight and HIT, emphasizing affordability and localized product design. Spectrum Brands and Henkel AG push the envelope on formulation innovation, rolling out aerosol, electric vaporizer, and mat upgrades that combine enhanced safety profiles with extended residual action. Emerging players such as Amplecta and Natural Insecto leverage niche positioning in organic and botanical segments, underscoring the market’s evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Household Insecticide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bayer AG

- FMC Corporation

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Insecticides (India) Ltd.

- ITC Limited

- Kao Corporation

- Procter & Gamble

- Reckitt Benckiser Group plc

- Rentokil Initial plc

- SC Johnson & Son, Inc.

- Spectrum Brands Holdings, Inc.

- Sumitomo Chemical Company, Limited

- Syngenta AG

- Unicharm Corporation

- Vebi Istituto Biochimico Italiano S.r.l.

- Voluntary Purchasing Groups

Formulating Actionable Recommendations to Strengthen Market Positioning, Supply Resilience, and Innovation in the Home Insecticide Industry

Industry leaders should prioritize diversification of raw-material sourcing to reduce reliance on high-tariff regions, exploring partnerships with North American and Latin American specialty chemical producers to offset rising import duties. Concurrent investment in domestic production capacity, particularly for essential oils and plant extracts, will enhance supply resilience and align with consumer demand for green formulations.

Simultaneously, companies must accelerate digital transformation initiatives by integrating IoT-enabled devices and data-driven pest management platforms, capturing consumer usage patterns and optimizing product refills through subscription services. Strengthening e-commerce channels and omnichannel distribution, while collaborating with specialty retailers on educational campaigns, will expand market reach and deepen brand loyalty. Finally, proactively engaging with regulatory bodies to shape emerging policies and gain early access to compliance frameworks will streamline product approvals and reinforce market credibility.

Detailing the Rigorous Research Methodology Employed to Ensure Credibility, Depth, and Accuracy in Market Analysis and Insights

This research integrates extensive secondary data from public domain sources, trade publications, regulatory filings, and proprietary databases to map competitive landscapes and identify emerging trends. In parallel, primary interviews were conducted with key stakeholders including R&D heads, supply chain executives, and distribution partners to validate findings and enrich contextual understanding. A triangulation methodology was applied to reconcile quantitative shipment and sales figures with qualitative insights, ensuring robust, defensible conclusions. The analytical framework encompasses SWOT, PESTLE, and Porter’s Five Forces to deliver comprehensive, actionable intelligence suited for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Household Insecticide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Household Insecticide Market, by Product Type

- Household Insecticide Market, by Active Ingredient

- Household Insecticide Market, by Application

- Household Insecticide Market, by Sales Channel

- Household Insecticide Market, by End User

- Household Insecticide Market, by Region

- Household Insecticide Market, by Group

- Household Insecticide Market, by Country

- United States Household Insecticide Market

- China Household Insecticide Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Future Landscape of Household Insecticides and Strategic Imperatives for Market Participants

As the household insecticide market advances, balancing efficacy, safety, and sustainability will define competitive differentiation. Manufacturers that adeptly navigate tariff pressures, embrace eco-friendly formulations, and harness digital ecosystems will be poised to capture growing segments across regions. The strategic interplay of localized product design, global supply chain agility, and consumer-centric innovation represents the cornerstone for sustained growth. Ultimately, stakeholders who integrate these imperatives into cohesive, forward-looking strategies will drive resilience and profitability in a market fundamental to public health and everyday living.

Engage with Ketan Rohom to Access Comprehensive Household Insecticide Market Intelligence and Drive Strategic Growth

For deeper insights and a tailored consultation on how to leverage these market dynamics for your business growth, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in household insecticide market analysis and can guide you through the nuances of product positioning, regulatory navigation, and supply chain optimization. Reach out to schedule a personalized briefing, receive exclusive data excerpts, and explore strategic partnership opportunities that will equip you to stay ahead of evolving consumer demands and competitive pressures.

- How big is the Household Insecticide Market?

- What is the Household Insecticide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?