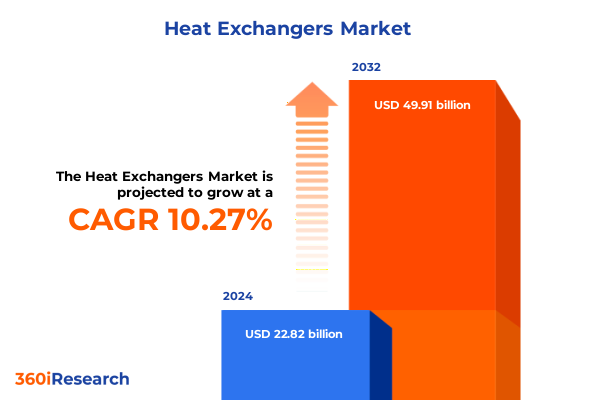

The Heat Exchangers Market size was estimated at USD 25.09 billion in 2025 and expected to reach USD 27.60 billion in 2026, at a CAGR of 10.32% to reach USD 49.91 billion by 2032.

Unveiling the Critical Role of Heat Exchangers in Driving Industrial Efficiency and Environmental Sustainability Across Sectors

Heat exchangers are the unsung heroes of industrial operations, quietly enabling the recovery and transfer of thermal energy across countless applications. In many manufacturing processes, 20 to 50 percent of the energy input is lost as waste heat through exhaust gases, cooling water, and heated surfaces-a substantial inefficiency that underscores the critical importance of heat exchanger technology in modern industry. By capturing this otherwise wasted energy and repurposing it for productive use, heat exchangers not only improve energy efficiency but also generate significant cost savings and reduce environmental impact.

Revolutionary Technological and Market Forces Reshaping the Heat Exchanger Landscape With Smart Connectivity and Sustainable Designs

The heat exchanger market is undergoing a profound transformation driven by technological innovation and shifting operational priorities. Manufacturers are embedding smart sensors and Internet of Things (IoT) capabilities to enable real-time monitoring of temperature, pressure, and flow rates, paving the way for predictive maintenance and reducing unplanned downtime by identifying issues before they escalate. Concurrently, advanced materials research has introduced new alloys and composites that deliver superior thermal conductivity and corrosion resistance, extending equipment lifespans and supporting operations under increasingly demanding conditions.

Assessing the Compounding Effects of U.S. Section 232 and Section 301 Tariffs on Heat Exchanger Trade and Supply Chains in 2025

Since 2018, the United States has imposed a 25 percent tariff on steel and a 10 percent tariff on aluminum under Section 232 of the Trade Expansion Act, profoundly affecting the supply chains for heat exchanger components. In parallel, Section 301 tariffs on imports from China, originally set at an additional 25 percent on specific industrial machinery, have been periodically supplemented by extensions and exclusions. These measures, aimed at addressing perceived unfair trade practices, have generated persistent uncertainty in procurement strategies and cost structures.

Insightful Market Segmentation Reveals Diverse Opportunities Across Types Designs and End-Use Industries in Heat Exchanger Markets

Market segmentation by heat exchanger type reveals distinct performance and application profiles across three primary categories. Air-cooled designs, including compact, direct, and indirect variants, excel in installations where water resources are constrained and maintenance simplicity is paramount. Fluid-cooled exchangers, encompassing alkali-cooled, oil-cooled, and water-cooled configurations, deliver high thermal efficiency in heavy-duty industrial applications. Hybrid heat exchangers, featuring adiabatic and evaporative principles, strike a balance by harnessing water or air when needed to optimize energy use and adaptability.

Design segmentation underscores how configuration choices shape operational outcomes. Air-cooled heat exchangers are offered in horizontal and vertical orientations to suit installation footprint and airflow requirements, while plate designs-brazed, gasketed, or welded-cater to varying pressure tolerances and service conditions. Traditional shell and tube exchangers, with fixed tube sheet, floating head, and U-tube options, remain indispensable in high-pressure processes that demand robust construction and straightforward maintenance.

End-use industry segmentation highlights the tailored applications driving growth in distinct sectors. Within the chemical industry, fertilizer production and petroleum refining rely on specialized exchangers for precise temperature control. Energy and power applications span non-renewable plants and burgeoning renewable installations, each demanding unique materials and configurations. Manufacturing segments such as automotive assembly and textiles production leverage optimized exchanger designs to enhance throughput, while oil and gas operations prioritize corrosion resistance and high thermal duty performance.

This comprehensive research report categorizes the Heat Exchangers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Design

- End-Use Industry

Regional Dynamics Uncovered: How the Americas EMEA and Asia-Pacific Are Shaping Heat Exchanger Demand and Innovation Trends

In the Americas, stringent regulations and incentive programs have spurred the adoption of energy recovery solutions across industrial sectors. The United States saw energy demand rise by 1.7 percent in 2024, with heat exchanger deployment playing a central role in meeting efficiency targets and mitigating carbon emissions through waste heat recovery initiatives. Canada’s focus on decarbonizing its oil sands operations has also driven innovative exchanger applications that capture residual heat for power generation and process integration.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the EU’s Energy Efficiency Directive and emissions trading systems are catalyzing investments in next-generation exchangers. The European Union returned to growth in energy demand for the first time since 2017, underscoring a renewed industrial activity that will necessitate advanced thermal management infrastructure. Meanwhile, the Middle East continues to expand its refining capacity, integrating compact and modular heat exchangers to optimize flare gas recovery and minimize environmental impact.

The Asia-Pacific region remains the powerhouse of global energy growth, accounting for three-fifths of total demand increases in 2024 and driving heat exchanger demand to new heights. Rapid industrialization in China and Southeast Asia, coupled with ambitious renewable energy targets in markets such as India and Australia, is fueling the adoption of specialized exchangers in power plants, petrochemical complexes, and emerging hydrogen production facilities.

This comprehensive research report examines key regions that drive the evolution of the Heat Exchangers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Heat Exchanger Manufacturers and Innovators Driving Competitive Strategies Through Collaboration and Technological Excellence

Leading heat exchanger manufacturers are pursuing strategies that combine product innovation, digital integration, and strategic partnerships to strengthen market positions. Alfa Laval has solidified its leadership in the plate and frame segment by leveraging its extensive production network and a diversified portfolio of separators, pumps, and valves to offer turnkey energy recovery systems. Kelvion, born from GEA Group’s heat exchanger division, capitalizes on its German engineering heritage to deliver customized shell and tube and air-cooled solutions, while maintaining a broad aftermarket service network across more than 49 countries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heat Exchangers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aero Engineers Pvt. Ltd.

- Alfa Laval Corporate AB

- API Heat Transfer Inc.

- Boyd Corporation

- Chart Industries, Inc.

- Danfoss A/S

- Enerquip, LLC

- General Electric Company

- Godrej Group

- Güntner GmbH & Co. KG

- Hindustan Dorr-Oliver Ltd.

- Hisaka Works, Ltd.

- HRS Heat Exchangers Ltd.

- IHI Corporation

- Johnson Controls International PLC

- Kaltra GmbH

- Kelvion Holding GmbH

- KGC Engineering Projects Private Ltd.

- Koch, Inc.

- Mason Manufacturing LLC

- Modine Manufacturing Company

- Nuberg Engineering Limited

- Royal Hydraulics, Inc.

- Sierra S.p.A

- Teksons Pvt. Ltd.

- Xylem Inc.

Strategic Action Plan for Industry Leaders to Capitalize on Emerging Heat Exchanger Trends and Strengthen Competitive Positioning

To capitalize on emerging opportunities, industry leaders should accelerate the integration of IoT-enabled monitoring and digital twin technologies to unlock real-time performance insights and predictive maintenance capabilities. Diversifying supply chains by qualifying alternative raw material suppliers and pursuing near-shoring can mitigate tariff-driven cost pressures and strengthen operational resilience. Engaging proactively with policymakers to shape favorable energy efficiency standards and secure incentives for sustainable installations will create long-term market advantages. Finally, investing in workforce development programs focused on advanced thermal design, data analytics, and regulatory compliance will empower organizations to execute innovative projects successfully.

Robust Research Methodology Ensuring Comprehensive Insights Through Rigorous Data Collection Analysis and Expert Validation Processes

This study combines comprehensive secondary research with targeted primary interviews to ensure depth and accuracy. Industry reports, trade publications, regulatory databases, and company disclosures were analyzed to establish baseline insights. In-depth interviews with plant operators, OEM engineers, and energy managers provided practical perspectives on technology adoption, performance metrics, and procurement challenges. Quantitative data were triangulated through top-down and bottom-up approaches, validating findings against historical trends and real-world case studies. A rigorous peer review process, including feedback from subject-matter experts, further refined the analysis and ensured that conclusions reflect the latest market dynamics and technological advancements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heat Exchangers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heat Exchangers Market, by Type

- Heat Exchangers Market, by Design

- Heat Exchangers Market, by End-Use Industry

- Heat Exchangers Market, by Region

- Heat Exchangers Market, by Group

- Heat Exchangers Market, by Country

- United States Heat Exchangers Market

- China Heat Exchangers Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2067 ]

Synthesis of Key Findings Demonstrates the Pivotal Role of Heat Exchangers in Accelerating Industrial Efficiency and Sustainability Goals

Heat exchangers stand at the intersection of operational efficiency and sustainability imperatives, offering a proven pathway to capture lost energy and reduce environmental impact. Technological advancements in smart sensing, materials science, and modular design are enabling more precise control and extended service life, while evolving tariff landscapes and regulatory drivers underscore the need for adaptive supply chain strategies. Segmentation by type, design, end-use, and region reveals a landscape rich with tailored solutions, from compact air-cooled units to high-duty shell and tube systems. As industries navigate decarbonization commitments and efficiency targets, heat exchangers will remain pivotal enablers of productivity and resource stewardship, driving competitive advantage for organizations that embrace innovation and strategic foresight.

Secure Strategic Advantage Today by Partnering With Ketan Rohom to Access In-Depth Heat Exchanger Market Research and Insights

For personalized guidance on leveraging these heat exchanger insights to drive your business objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise and strategic perspective can help you navigate the evolving market dynamics and identify the research solutions tailored to your organization’s needs. Engage with Ketan to explore custom report options, discuss emerging opportunities, and secure the comprehensive data essential for informed decision-making. Take the next step toward strengthening your competitive position by partnering with an industry expert committed to delivering actionable intelligence and supporting your success in the complex heat exchanger landscape.

- How big is the Heat Exchangers Market?

- What is the Heat Exchangers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?