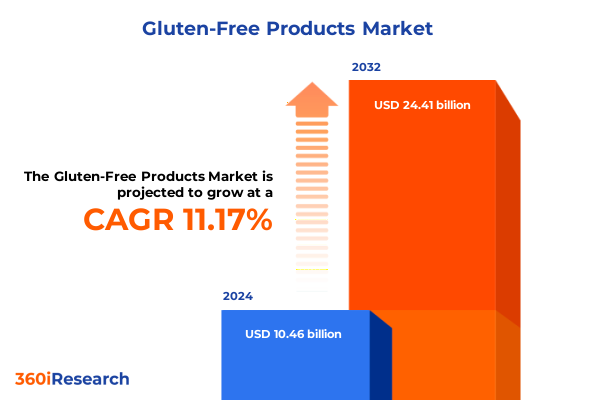

The Gluten-Free Products Market size was estimated at USD 11.56 billion in 2025 and expected to reach USD 12.80 billion in 2026, at a CAGR of 11.26% to reach USD 24.41 billion by 2032.

Understanding the Emerging Drivers and Consumer Behaviors Shaping the Gluten-Free Products Market Landscape in North America and Beyond

The gluten-free products market has transcended its origins as a niche dietary segment to become a dynamic and mainstream element of the global food industry. Initially driven by medical necessity for those with celiac disease, the category now appeals broadly to individuals pursuing perceived health benefits, lifestyle preferences, and clean‐label assurances. As awareness of gluten intolerance has grown, both certified and self‐declared gluten-free options have proliferated across product lines, signaling a shift in how consumers and manufacturers view this once specialized space.

In recent years, heightened consumer interest in wellness and digestive health has bolstered the appeal of gluten-free offerings beyond medical requirements. Social media influencers, healthcare professionals, and wellness publications have collectively amplified the narrative that gluten-free choices can align with broader health and nutrition goals. Consequently, the market has witnessed an influx of newcomers alongside established brands vying to capture attention through distinctive formulations, functional ingredients, and compelling storytelling.

Regulatory frameworks have similarly evolved to support market maturation. Labeling standards codified by authorities around the world, complemented by third-party certifications, have enhanced transparency and bolstered consumer confidence. Meanwhile, retailers and foodservice providers are integrating gluten-free categories into core offerings, reducing stigma and expanding access. As a result, the stage is set for the next phase of transformation, where innovation and strategic agility will determine market leadership

Examining the Transformative Health, Technology, and Sustainability Trends Revolutionizing the Gluten-Free Products Industry and Redefining Consumer Expectations

The gluten-free products industry is undergoing a profound transformation fueled by intersecting health, sustainability, and technological breakthroughs. Consumers increasingly demand offerings that not only cater to dietary needs but also align with environmental and ethical values. This confluence has led brands to explore alternative grains, sustainable sourcing models, and packaging innovations that reduce waste and carbon footprints.

Digital technology has emerged as a pivotal catalyst, redefining how companies engage with both consumers and suppliers. E-commerce platforms enable personalized recommendations based on individual dietary profiles, while direct-to-consumer channels facilitate rapid product rollouts and real-time feedback loops. Simultaneously, data analytics and AI-driven insights empower manufacturers to optimize formulations, predict consumer preferences, and enhance supply chain visibility, ensuring consistency and quality across diverse product lines.

Furthermore, the rising importance of clean-label commitments and transparent ingredient sourcing has prompted firms to invest in supply chain traceability and certification partnerships. As the industry embraces regenerative agriculture practices and alternative proteins, gluten-free producers are uniquely positioned to lead on sustainability narratives. Together, these shifts are redefining competitive dynamics and setting new benchmarks for innovation, quality, and consumer trust

Evaluating the Cumulative Impact of Recent United States Tariff Measures on Gluten-Free Product Supply Chains and Cost Structures in 2025

Recent trade policy developments have introduced multilayered implications for the gluten-free products sector, as import duties on key ingredients have shifted cost structures and sourcing strategies. In early March 2025, the United States government imposed a sweeping baseline 10 percent tariff on all imports, with escalated rates for major trading partners including a 34 percent levy on goods from China, 20 percent on those from the European Union, and varied surcharges for other economies, effective April 5, 2025. These comprehensive measures immediately affected the price of gluten-free grains and raw materials imported from multiple regions.

In parallel, targeted Levies on agricultural commodities further disrupted conventional supply chains. Imports of sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products into China have been subject to an additional 10 percent tariff, while chicken, wheat, corn, and cotton now carry a 15 percent duty under China’s retaliatory actions announced March 4, 2025. Given that many gluten-free formulations rely on ingredients such as rice, sorghum, millet, and corn, these additional duties have reverberated through ingredient procurement, driving manufacturers to reassess supplier portfolios and explore domestic alternatives.

Moreover, the United States briefly imposed 25 percent tariffs on imports from Canada and Mexico and raised its blanket tariff on Chinese goods to 20 percent, moves that were rapidly followed by exemptions and delays for certain categories. The resulting volatility has placed additional pressure on procurement teams tasked with balancing cost, quality, and compliance. As a result, companies are increasingly turning to nearshoring strategies, diversified supply networks, and tariff-exemption petitions to mitigate risk and secure stable access to essential gluten-free ingredients

Unlocking Key Segmentation Insights to Illuminate Product Innovation and Consumer Preferences Across Type Form Source Packaging and Distribution Channels

An in-depth segmentation lens reveals nuanced patterns across product types, forms, sources, packaging, and channels that are reshaping market dynamics. In terms of product categories, everything from breads, rolls, buns, and cakes to cookies, crackers, wafers, and biscuits competes alongside condiments, dressings, dairy alternatives, meats, meat alternatives, and ready-to-eat snacks. These distinctions guide research and development priorities, with bakery innovators focusing on texture and shelf-life stability while snack manufacturers emphasize flavor variety and convenient formats.

Form-based segmentation further influences manufacturing processes and consumer messaging. Liquid options such as dressings, sauces, and beverages require specialized stabilization and emulsification techniques, whereas semi-solid applications hinge on formulations that replicate traditional mouthfeel. Solid formats, ranging from discrete baked goods to extruded snacks, demand ingredient blends that optimize structure, moisture retention, and sensory appeal. Each form factor carries its own cost and regulatory considerations, driving differentiated investment in production capabilities.

The choice of gluten-free source grains has also become a point of strategic differentiation. Amaranth, millet, and sorghum command premium positioning for perceived nutritional benefits, while corn-based and rice-based ingredients offer cost advantages and broad consumer familiarity. Packaging types such as boxes, cans, and pouches reflect divergent priorities in shelf presentation, storage conditions, and retail display. Meanwhile, distribution channels vary from extensive convenience, departmental, and supermarket footprints to the rapid-growth online retail segment. Together, these overlapping dimensions create a complex roadmap for market entrants and incumbents alike, highlighting where targeted innovation and channel investment can yield maximum impact

This comprehensive research report categorizes the Gluten-Free Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Packaging Type

- Distribution Channel

Key Regional Insights Highlighting the Unique Drivers Shaping Gluten-Free Product Demand and Distribution Dynamics Across Major World Markets

Regional dynamics underscore how geographic nuances converge to influence demand, distribution strategies, and competitive positioning. In the Americas, particularly within the United States and Canada, heightened consumer awareness and mainstream retail integration have bolstered the availability of gluten-free offerings. Retailers across convenience stores, departmental chains, and supermarkets now feature dedicated gluten-free aisles, and digital platforms facilitate direct-to-consumer access, reinforcing consistent brand visibility and availability.

In Europe, the Middle East, and Africa, regulatory harmonization around labeling standards and growing investment in product quality are enhancing consumer trust. Mature markets in Western Europe continue to innovate around premium bakery and dairy alternative categories, while emerging economies invest in supply chain infrastructure to improve local sourcing. Across the Middle East and Africa, bridging urban and rural distribution gaps remains a critical focus, prompting partnerships with regional distributors to extend gluten-free options to underserved areas.

Asia-Pacific markets are characterized by rapid growth and experimentation, with consumer segments ranging from health-conscious millennials in metropolitan hubs to traditional diets being reimagined through gluten-free adaptations. Localization efforts have spurred unique product variations, from rice-based noodles in Southeast Asia to millet-infused snacks in India. As distribution channels evolve, e-commerce giants and modern trade retailers are playing an instrumental role in introducing both global brands and local innovators to a digitally engaged audience

This comprehensive research report examines key regions that drive the evolution of the Gluten-Free Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Competitive Highlights Revealing Innovations Partnerships and Market Positioning of Leading Gluten-Free Industry Players

Industry leaders and emerging challengers alike are making bold moves to capture share within the gluten-free arena. Established multinational food corporations are leveraging extensive research capabilities and manufacturing scale to introduce next-generation gluten-free lines. Concurrently, specialist brands are capitalizing on agility and authenticity to differentiate through novel formulations, premium ingredients, and direct consumer engagement.

A case in point is Feel Good Foods, which has rebranded with a streamlined design and expanded its frozen snack portfolio to include pancake bites, soup dumplings, and burritos set to launch nationwide in May 2025. Such product innovation underscores the intersection of convenience and taste, positioned to resonate with both gluten-free purists and mainstream consumers seeking quality frozen meals.

At the same time, product testing and validation continue to be critical competitive levers. Independent platforms systematically analyze gluten content and manufacturing integrity, publishing findings on items ranging from gluten-free cereals to crackers, further raising the bar on transparency and safety. Driven by consumer demand for rigorous standards, companies are accelerating third-party certifications and investing in closed-loop quality controls

These strategic maneuvers, spanning from product pipeline diversification to rigorous quality benchmarking, highlight an industry in relentless pursuit of excellence, sustainability, and consumer trust

This comprehensive research report delivers an in-depth overview of the principal market players in the Gluten-Free Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amy’s Kitchen, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Bob’s Red Mill Natural Foods, Inc.

- Canyon Bakehouse LLC

- Conagra Brands, Inc.

- Dr. Schär AG / SPA

- Enjoy Life Foods, Inc.

- General Mills, Inc.

- Glutino Food Group, Inc.

- Hero Group AG

- Kellanova

- Nature’s Path Foods, Inc.

- Pamela’s Products, Inc.

- PureFoods India Private Limited

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Udi’s Gluten Free

- Vezlay Foods Private Limited

- Wheafree Foods Private Limited

- Wheaty Foods Private Limited

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Market Opportunities and Navigate Regulatory and Supply Chain Challenges

To navigate the evolving terrain of gluten-free products, industry leaders must adopt a multifaceted strategy that addresses cost pressures, consumer preferences, and regulatory landscapes. First, strengthening relationships with diverse ingredient suppliers is essential to mitigate tariff exposure and ensure consistency of supply. By cultivating regional partnerships for rice, sorghum, and millet sourcing, companies can build agility and reduce dependency on any single market.

Parallel investments in R&D should focus on functional innovation, balancing clean-label expectations with sensory excellence. Prioritizing trials for underutilized grains, plant-based protein integrations, and novel texturizing agents can position brands at the forefront of taste and nutrition. Equally important is leveraging digital marketing and e-commerce channels to capture insights through interactive platforms, enabling rapid iteration of product formulations and messaging.

Proactive engagement with policymakers and trade associations can unlock opportunities for targeted tariff exemptions and regulatory support. Establishing a formal process for reviewing trade policy developments will allow companies to anticipate shifts and present data-driven cases for relief. Finally, integrating sustainability metrics into strategic planning-not merely as a compliance exercise but as a core brand differentiator-will resonate with an increasingly values-oriented consumer base

Comprehensive Research Methodology Detailing Data Sources Analytical Approaches and Validation Processes Underpinning the Gluten-Free Products Market Study

This study employs a robust research methodology designed to deliver comprehensive, actionable insights. Primary data sources include in-depth interviews with senior executives, R&D leaders, and supply chain managers from multinational corporations, regional brands, and ingredient suppliers. These conversations provided qualitative context on innovation priorities, operational challenges, and strategic initiatives.

Secondary research encompassed a wide spectrum of industry publications, regulatory filings, and trade association reports to map evolving tariff regimes, labeling regulations, and consumer trends. Academic journals and patent filings were analyzed to track emerging technologies in grain processing, texturizing techniques, and packaging innovations. All data points were cross-validated through triangulation with market intelligence platforms and third-party testing organizations.

Segmentation analyses were structured around five dimensions: product type, form, source, packaging, and distribution channel. Each dimension was examined through criteria such as manufacturing complexity, cost drivers, and consumer adoption metrics. Regional assessments integrated macroeconomic indicators, demographic profiles, and distribution infrastructure evaluations. The outcome is a holistic framework that underpins strategic decision-making and highlights high-impact opportunities

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gluten-Free Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gluten-Free Products Market, by Type

- Gluten-Free Products Market, by Form

- Gluten-Free Products Market, by Source

- Gluten-Free Products Market, by Packaging Type

- Gluten-Free Products Market, by Distribution Channel

- Gluten-Free Products Market, by Region

- Gluten-Free Products Market, by Group

- Gluten-Free Products Market, by Country

- United States Gluten-Free Products Market

- China Gluten-Free Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Evolving Gluten-Free Products Market Landscape Emphasizing Competitive Dynamics and Growth Imperatives

The gluten-free products market stands at a pivotal juncture, shaped by shifting consumer expectations, technological advancements, and evolving trade policies. The convergence of health and wellness priorities with sustainability objectives has elevated both strategic imperatives and competitive intensity. Brands that embrace innovation across grains, processing techniques, and packaging formats will be best positioned to capture the expanding mainstream audience.

Tariff volatility and supply chain disruptions underscore the importance of resilient sourcing strategies and proactive policy engagement. Companies that diversify ingredient portfolios and secure regional partnerships can insulate their operations from cost shocks and regulatory shifts. Equally, investments in quality assurance and third-party validations will sustain consumer trust in a category where safety is paramount.

Looking forward, success will hinge on the ability to translate rich data insights into consumer-centric product experiences. As the industry continues to mature, collaboration between established leaders and agile innovators will accelerate breakthroughs in nutrition, taste, and convenience. In this dynamic landscape, adopting a strategic, research-backed approach will be the distinguishing factor between fleeting trends and sustainable growth

Take the Next Step in Your Strategic Decision-Making for Gluten-Free Products Market Growth by Engaging Directly with Ketan Rohom for Customized Insights

Engaging with an experienced industry professional can transform how you interpret and act upon complex market intelligence. Ketan Rohom, Associate Director of Sales & Marketing with extensive expertise in the gluten-free products sector, offers tailored consultations designed to align strategic priorities with the latest market findings. By partnering directly with Ketan, companies gain access to personalized insights that integrate competitive analysis, consumer trend identification, and regulatory guidance into actionable steps. This collaborative dialogue not only clarifies your organization’s unique challenges but also pinpoints opportunities for product differentiation and growth.

Whether you seek to refine your product innovation roadmap, optimize supply chain resilience, or navigate evolving trade policies, connecting with Ketan ensures your decision-making is grounded in rigorous research and deep sector knowledge. Prospective clients can leverage this direct line of communication to request bespoke data packages, scenario planning workshops, or interactive briefings that drive results. Accelerate your strategic planning process and secure a competitive edge by taking the next step - reach out to Ketan Rohom today to explore how these insights can be customized for your organization’s success.

- How big is the Gluten-Free Products Market?

- What is the Gluten-Free Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?