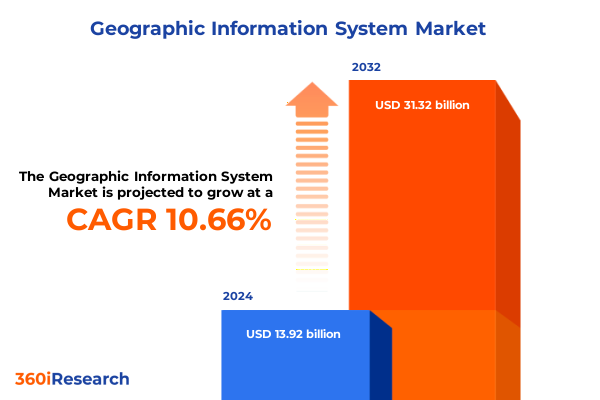

The Geographic Information System Market size was estimated at USD 15.35 billion in 2025 and expected to reach USD 16.95 billion in 2026, at a CAGR of 10.71% to reach USD 31.32 billion by 2032.

Charting the Course of Modern Geospatial Intelligence with a Comprehensive Overview of the Global Geographic Information System Landscape

Geographic Information Systems have evolved from static mapping tools to dynamic platforms driving strategic decision-making across sectors. At their core, these systems integrate spatial data capture with analytical engines, enabling organizations to visualize complex patterns and derive actionable insights. In recent years, the convergence of cloud computing, artificial intelligence, and real-time IoT data streams has accelerated the adoption of GIS solutions. These advances support applications ranging from urban planning and environmental monitoring to precision agriculture and logistics optimization, highlighting the breadth of GIS utility.

Yet, the market for GIS remains highly competitive and rapidly shifting. Established software vendors continue to enhance their platforms with embedded AI and machine learning capabilities, while agile startups introduce specialized tools for niche use cases. Across hardware, cloud services, and data analytics modules, stakeholders navigate a landscape defined by interoperability, scalability, and data governance requirements. As organizations increasingly rely on location-enabled intelligence, understanding these dynamics is critical. This executive summary distills the key market transformations, tariff effects, segmentation drivers, regional nuances, and strategic imperatives that will shape GIS deployments through 2025 and beyond.

Exploring the pivotal technological and market shifts redefining Geographic Information Systems and reshaping global spatial intelligence applications

The GIS landscape in 2025 is characterized by transformative shifts that extend far beyond traditional mapping. Cloud-native platforms now offer on-demand scalability for processing petabytes of spatial data, enabling real-time analytics and collaboration across dispersed teams. This trend is fueled by widespread public and private investment in cloud infrastructure, eliminating the need for extensive on-premise hardware while facilitating seamless integration with enterprise data lakes and AI services. Moreover, software vendors have introduced advanced machine-learning models that can detect anomalies in satellite imagery, predict infrastructure stress points, and automate feature extraction with unprecedented accuracy.

Concurrently, the fusion of GIS with Internet of Things networks is generating continuous, high-velocity data streams from sensors, drones, and autonomous vehicles. These inputs feed into geospatial data lakes, where AI-driven analytics transform raw measurements into predictive insights for applications such as asset monitoring and environmental risk assessment. The democratization of 3D visualization tools and digital twin technologies is empowering planners to simulate complex urban scenarios, assess the impact of climate events, and optimize resource allocation with a level of granularity that was once the purview of specialized research labs. As these shifts converge, GIS platforms are becoming the operating systems for spatial decision-making across industries, driving a new era of geospatial intelligence.

Assessing the Comprehensive Consequences of United States Trade Tariffs on Geospatial Technologies and Industry Operations in 2025

United States trade tariffs implemented in the wake of Section 301 investigations have introduced significant cost pressures across the GIS value chain. Specialized hardware components such as high-resolution satellite sensors, ground-based GPS receivers, and LiDAR systems often rely on imported semiconductors and precision materials now subject to 25% import duties. As a result, procurement costs for surveying equipment and remote sensing devices have risen sharply, forcing project budgets to stretch and introducing delays in hardware delivery and deployment schedules.

These tariff-induced cost increases extend into maintenance and support services, where replacement parts and calibration equipment face similar duties. In many cases, organizations report elongated downtime for essential geospatial assets, impacting critical applications in infrastructure monitoring and defense sectors. To mitigate these operational challenges, service providers are reevaluating supplier networks and exploring domestic manufacturing partnerships. Meanwhile, end-users are accelerating the adoption of software-centric alternatives-such as cloud-based analytics and AI-powered positioning algorithms-that reduce hardware dependency. This strategic pivot underscores the growing importance of flexible, software-driven solutions to maintain resilience in a tariff-constrained environment.

Unveiling Strategic Market Segmentation Insights to Guide Decision-Making across Components Technology Types Devices Functionalities Deployment Models and Applications

Critical market segmentation reveals nuanced drivers that inform targeted GIS strategies. When considering components, demand is diversifying across hardware, services, and software domains. While GPS devices and remote sensors continue to command attention for field-based data capture, an increasing share of investment flows toward data analytics and visualization tools, with organizations leveraging both 2D and 3D capabilities to extract deeper insights. In the services space, installation expertise remains essential, yet maintenance and support are evolving to include remote diagnostics and automated updates, reflecting a more integrated lifecycle approach.

Technology type segmentation highlights the growing prominence of Geographic Information System software platforms relative to remote sensing modalities. Within remote sensing, multispectral imaging retains broad application due to its cost efficiency, while hyperspectral imaging gains traction for precision use cases in environmental monitoring and mineral exploration. Device type segmentation underscores the shift from traditional desktop deployments to mobile GIS solutions, with smartphones and tablets now serving as primary data collection interfaces in the field. Functional segmentation shows mapping and surveying as foundational GIS capabilities, even as urban planning and territorial analysis leverage advanced analytics for scenario modeling.

Deployment models also influence adoption patterns, with cloud-based GIS solutions outpacing on-premise installations thanks to their scalability and ease of access. End-user industry segmentation reflects agriculture’s sustained leadership in precision applications, complemented by surges in healthcare, finance, and retail for location-based services. Finally, application segmentation reveals robust uptake in environmental monitoring and resource management-particularly in water and mineral resource domains-alongside utilities management and disaster response, demonstrating the versatility of GIS across both public and private sectors.

This comprehensive research report categorizes the Geographic Information System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Technology Type

- Device Type

- Functionalities

- Deployment Model

- End-User Industry

- Application

Analyzing Distinct Regional Market Dynamics Highlighting Opportunities and Challenges in the Americas Europe Middle East Africa and Asia-Pacific Geographic Information System Adoption

Regional market dynamics are shaping the trajectory of GIS adoption in unique ways. In the Americas, robust technology infrastructures and mature cloud ecosystems have positioned North America as a leading adopter of advanced GIS tools. Favorable government initiatives and significant public sector mapping programs continue to drive demand, while private-sector investments in logistics, utilities, and infrastructure monitoring sustain growth. Latin America also shows emerging interest, particularly in applications for natural resource management and urban planning, as public bodies and NGOs leverage geospatial insights to tackle environmental and social challenges.

Europe, Middle East, and Africa present a complex mosaic of needs and opportunities. The European Union’s emphasis on sustainable development and cross-border data collaboration fuels demand for GIS solutions in renewable energy planning, transportation infrastructure, and environmental conservation. Data sovereignty regulations and interoperability standards, however, introduce compliance considerations that shape deployment strategies. In the Middle East and Africa, rapid urbanization and infrastructure initiatives in key markets are driving GIS uptake, with governments prioritizing spatial data infrastructures for smart city and disaster resilience projects.

Asia-Pacific stands out for its high growth potential, underpinned by aggressive smart city investments, expansive 5G rollouts, and burgeoning economic development. Public spending on digital twins and microsatellite imaging, combined with private-sector demand in mining, logistics, and agriculture, is expanding the GIS addressable market. India and Southeast Asian economies are leveraging cloud-native GIS platforms to democratize access for SMEs, while China’s state-led mapping initiatives demand decimeter-level accuracy that is setting new technical standards for hardware and analytics providers.

This comprehensive research report examines key regions that drive the evolution of the Geographic Information System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning Innovations and Collaborative Ecosystem of Leading Geographic Information System Providers Driving Market Progress

Leading GIS providers are solidifying their market positions through strategic innovations, partnerships, and ecosystem expansions. Esri, the longstanding market leader, continues to enhance ArcGIS Online and ArcGIS Pro with integrated AI and real-time data connectors. Recent collaborations with Microsoft have embedded Azure AI Foundry services directly into the ArcGIS platform, streamlining geospatial workflows and enabling new vertical use cases in public safety and infrastructure planning.

Hexagon has deepened its focus on public safety applications by formalizing a strategic partnership with SDI Presence. This collaboration strengthens the delivery of computer-aided dispatch systems and geospatial analysis tools for emergency services, enhancing situational awareness and response capabilities in North America. Hexagon’s investment in technical support and GIS development services underscores its commitment to mission-critical deployments that rely on high-precision spatial data.

Trimble has renewed its collaboration with Esri, integrating advanced field systems and asset lifecycle management suites into the ArcGIS ecosystem. The launch of Trimble Unity demonstrates a concerted effort to bridge construction, utilities, and government sectors with high-accuracy mapping and AI-enabled fabrication drawing services. These joint offerings simplify workflows from data collection to enterprise asset management, aligning with broader digital transformation initiatives.

HERE Technologies has entered the GIS space with the introduction of its GIS Data Suite, providing pre-symbolized, foundational datasets optimized for ArcGIS Pro. By removing data preparation barriers, HERE is enabling GIS professionals to accelerate time to insight and focus on analysis. This launch, timed with the 2025 Esri User Conference, signals HERE’s ambition to become a staple in the map data supply chain and to support advanced analytics across industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geographic Information System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaco SpA

- AmigoCloud, Inc.

- Attentive Inc.

- Autodesk, Inc.

- BatchGeo LLC

- Bentley Systems, Incorporated

- Blackshark.ai GmbH

- Blue Marble Geographics

- Cadcorp Limited

- Caliper Corporation

- Carlson Software Inc.

- CartoDB Inc.

- ComNav Technology Ltd.

- Environmental Systems Research Institute, Inc.

- Galigeo SAS

- General Electric Company

- Geospin GmbH

- Golden Software, LLC

- Google LLC by Alphabet Inc.

- Hexagon AB

- Hexasoft Development Sdn. Bhd.

- Hitachi, Ltd.

- L3Harris Technologies, Inc.

- Mapbox, Inc.

- Maxar Technologies Holdings Inc.

- Microsoft Corporation

- NV5 Global, Inc.

- Orbital Insight, Inc.

- Pasco Corporation

- Pitney Bowes Inc.

- Precisely Software Incorporated

- Shanghai Huace Navigation Technology Ltd.

- Surveying And Mapping, LLC

- TomTom International BV

- Topcon Corporation

- Trimble Inc.

Implementable Strategic Imperatives and Best Practice Recommendations for Industry Leaders to Navigate the Evolving Geographic Information System Landscape

Industry leaders must diversify technology portfolios to maintain resilience amid evolving market conditions. Prioritizing a hybrid approach that balances cloud scalability with on-premise control can optimize performance and data governance. By investing in modular deployment architectures, organizations ensure that GIS capabilities can adapt to regulatory changes and fluctuating workload demands.

Strengthening supply chains is critical in light of tariff uncertainties and component shortages. Executives should cultivate relationships with multiple hardware vendors and explore regional manufacturing partnerships to reduce dependency on any single source. Concurrently, embedding IoT and AI capabilities within GIS platforms can offset hardware constraints by enhancing software-driven analytics, enabling faster decision cycles and lower operational costs.

Collaboration with public and private stakeholders yields significant dividends. Engaging in industry consortia and government-backed spatial data initiatives can unlock access to shared datasets and reduce implementation timelines. Establishing centers of excellence for GIS within enterprises fosters knowledge sharing, supports workforce upskilling, and accelerates the adoption of best practices. By aligning geospatial strategies with overarching digital transformation roadmaps, organizations can elevate GIS from a niche function to a cornerstone of strategic planning and competitive advantage.

Outlining the Comprehensive Research Framework Data Collection Validation and Analytical Approaches Underpinning the Geographic Information System Study

This research followed a rigorous methodology combining both primary and secondary data sources. Primary research consisted of in-depth interviews with key industry stakeholders, including GIS vendors, technology integrators, end-users in government and private sectors, and hardware manufacturers. These interviews provided qualitative insights into market drivers, technology adoption patterns, and operational challenges.

Secondary research involved comprehensive reviews of company filings, investor presentations, patent filings, and regulatory documentation. Publicly available market studies, industry whitepapers, and academic publications were analyzed to contextualize market trajectories and validate primary findings. Data triangulation techniques were applied to reconcile discrepancies across sources and ensure accuracy.

Quantitative analysis leveraged a hybrid approach. A top-down assessment of overall GIS market revenues was cross-checked with a bottom-up evaluation of segment-level demand across components, deployment models, and end-user industries. Geospatial datasets and tariff schedules were mapped to hardware and software cost structures to quantify the impact of trade policies. Continuous data validation and peer reviews by domain experts ensured the robustness of the final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geographic Information System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geographic Information System Market, by Components

- Geographic Information System Market, by Technology Type

- Geographic Information System Market, by Device Type

- Geographic Information System Market, by Functionalities

- Geographic Information System Market, by Deployment Model

- Geographic Information System Market, by End-User Industry

- Geographic Information System Market, by Application

- Geographic Information System Market, by Region

- Geographic Information System Market, by Group

- Geographic Information System Market, by Country

- United States Geographic Information System Market

- China Geographic Information System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Integrating Key Insights and Future Outlooks to Conclude the Comprehensive Assessment of Global Geographic Information System Trends and Opportunities

The evolution of Geographic Information Systems reflects a convergence of technological innovation, policy landscapes, and shifting user requirements. Cloud-native deployments and AI-driven analytics have redefined the operational boundaries of GIS, enabling real-time insights and predictive modeling that inform strategic decisions across sectors. Concurrently, tariff pressures underscore the importance of supply chain diversification and software-centric resilience strategies.

Segmentation analysis reveals that a holistic approach-encompassing hardware, software, services, and deployment models-is essential for capturing the full spectrum of GIS opportunities. Regional nuances further illustrate that success hinges on aligning platform capabilities with local regulatory frameworks, infrastructure maturity, and vertical-specific needs. Leading providers are differentiating through partnerships, open data initiatives, and value-added services that accelerate time to impact.

Looking ahead, organizations that embrace hybrid architectures, foster collaborative ecosystems, and invest in data governance will be best positioned to leverage the transformative power of geospatial intelligence. This comprehensive assessment arms decision-makers with the insights and strategic imperatives needed to navigate a rapidly changing GIS landscape and capture emerging avenues for growth.

Engage with Ketan Rohom to Gain Tailored Insights and Secure Access to the Geographic Information System Market Research Report for Strategic Advancement

For decision-makers aiming to harness the full potential of geographic intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will work with your team to understand specific strategic objectives and deliver a customized package of insights that align with your operational priorities. Engaging directly ensures that the market research report provides actionable data, contextual analysis, and tailored recommendations to support expansion, innovation, or competitive differentiation in the GIS arena. Whether you require a deep dive into emerging technologies, regional dynamics, or supply chain resilience strategies, Ketan can facilitate introductions to subject-matter experts and schedule executive briefings. By connecting with Ketan, you secure priority access to the comprehensive report, gain exclusive addenda on the latest market developments, and unlock volume-based licensing options for enterprise teams. This direct collaboration expedites your research cycle and empowers you with the confidence to make informed, timely decisions in a rapidly evolving landscape.

- How big is the Geographic Information System Market?

- What is the Geographic Information System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?