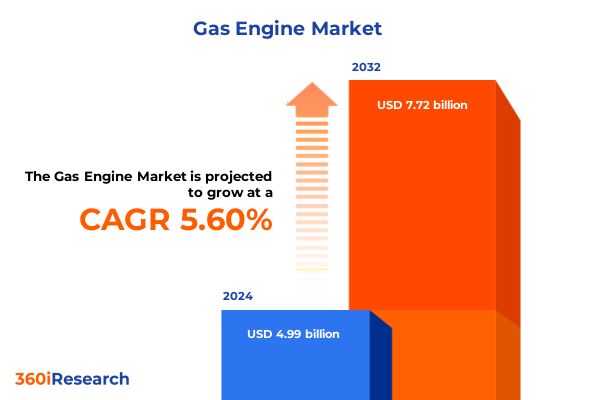

The Gas Engine Market size was estimated at USD 5.26 billion in 2025 and expected to reach USD 5.54 billion in 2026, at a CAGR of 5.64% to reach USD 7.72 billion by 2032.

Navigating the Evolving Dynamics of the Gas Engine Market Amid Energy Transition, Regulatory Pressures, and Technological Innovation Driving Sustainable Growth

In recent years, the gas engine market has become a cornerstone of the global energy transition, driven by the need for cleaner, more flexible power generation solutions. Markets such as China have witnessed a marked shift towards liquefied natural gas for heavy transport, with LNG-powered trucks accounting for over forty percent of heavy-duty vehicle sales in 2024, a trend underpinned by robust infrastructure investments and regulatory incentives aimed at reducing diesel dependence and improving energy security. This momentum has been echoed worldwide as end-use sectors increasingly prioritize fuel sources that offer lower carbon emissions and enhanced reliability compared to traditional oil-based solutions.

Moreover, the integration of advanced digital technologies and analytics into gas engine systems is revolutionizing operational maintenance and lifecycle management. Leading firms are deploying AI-driven predictive maintenance platforms that synthesize real-time engine data to flag potential anomalies well before they escalate into critical failures, thereby maximizing uptime and optimizing maintenance costs. These innovations come amid forecasts that nearly nine hundred gigawatts of new gas-fired generation capacity may be required globally through 2040 to meet rising electricity demand, underscoring both the growth potential and the operational challenges faced by gas engine manufacturers and operators.

Charting a New Era of Sustainable Energy and Supply Chain Resilience Reshaping Gas Engine Deployment and Competitive Advantage

Global policy imperatives and decarbonization targets are fundamentally reshaping the gas engine landscape, compelling manufacturers and end users to adapt swiftly to evolving environmental regulations. Governments in Europe and North America have introduced stricter emissions standards for stationary and mobile engines, prompting accelerated development of low-emission lean burn and dry low emission combustion technologies. At the same time, mandates supporting renewable gas use are catalyzing investments in biogas and landfill gas applications, creating new market niches and fostering innovation in fuel treatment and injection systems designed to handle variable gas compositions.

Fuel diversification remains a key transformative trend, as operators seek resilience against supply disruptions and price volatility. The maturing of biogas production from agricultural and municipal wastewater treatment facilities, along with the expansion of landfill gas utilization in both industrial and municipal contexts, is enabling gas engines to deliver cost-effective power while contributing to circular economy goals. Simultaneously, natural gas engines optimized for compressed and pipeline gas continue to serve as a bridge technology in regions where renewable gas infrastructure is still under development, ensuring reliable generation with lower greenhouse gas profiles compared to diesel.

Supply chain resilience has emerged as another critical shift, driven by recent tariff measures and broader geopolitical uncertainties. Disruptions in raw material flows, particularly for steel and aluminum components, have increased lead times and elevated input costs for engine manufacturers. Nearshoring and diversification of supplier networks are now imperative strategies, with many original equipment manufacturers exploring collaborative agreements to localize critical component production and mitigate exposure to future trade policy changes.

On the technology front, dual-fuel and spark ignition engines are achieving new levels of efficiency and emissions control through advanced turbocharging and electronic fuel injection systems. These developments are enhancing load-following capabilities, enabling engines to seamlessly integrate with intermittent renewable sources such as solar and wind. As a result, gas engines are increasingly deployed in hybrid configurations with battery storage and carbon capture technologies, further cementing their role in a more heterogeneous and decarbonized power generation ecosystem.

Assessing the Comprehensive Impact of Steel, Aluminum, and Automotive Import Tariffs on the Gas Engine Supply Chain and Cost Structures

The United States’ tariff landscape has evolved significantly in 2025, extending beyond traditional steel and aluminum duties to encompass automotive components, including gas engine parts. On March 12, a 25 percent tariff on all steel and aluminum imports was reinstated, eliminating prior exemptions and increasing to 50 percent in early June, thereby escalating costs for engine casings, crankshafts, and related components sourced from abroad. These surcharges have directly impacted manufacturing expenses and prompted many suppliers to reevaluate their global sourcing strategies.

Further compounding cost pressures, the administration introduced a 25 percent tariff on imported automotive parts, including engines and powertrain components, effective April 3 and May 3, respectively. This action has disrupted the traditional North American supply chain integration, exemplified by the imposition of duties on V8 gas engines imported into U.S.-assembled trucks. For instance, manufacturers like Ford have faced incremental costs on engines supplied from Windsor, Ontario, and diesel variants from Mexico, with tariffs ultimately passed through to vehicle prices and end users.

The combined effect of these measures has exposed vulnerabilities in production scheduling and inventory management, forcing companies to accelerate nearshoring of critical parts and to seek tariff classifications that may offer relief under existing trade agreements. Nonetheless, the volatility of policy implementation has led to cautious procurement strategies, with some industry participants suspending capital expenditures until greater certainty emerges. This hiatus risks constraining capacity expansions at a time of growing demand for distributed generation solutions.

In response to sustained tariff pressures, several engine manufacturers are increasing their domestic assembly footprints and forging joint ventures with regional fabricators to localize key elements of the supply chain. While these adaptations require upfront investment, they represent a strategic hedge against future trade actions and volunteer to ensure long-term competitiveness in a market where cost structures are under intense scrutiny.

Unveiling Critical Application, Fuel, Power Rating, and Engine Type Segmentation Insights Shaping Market Dynamics and Opportunities

Segmentation by application reveals a complex tapestry of market dynamics driven by the distinct requirements of industrial, oil and gas, power generation, residential and commercial, and transportation sectors. Within industrial uses, construction, manufacturing, and mining operations demand engines capable of sustained heavy loads and frequent cycling, whereas the oil and gas sector’s upstream, midstream, and downstream subdivisions require specialized engines for drilling rigs, pipeline compression, and processing facilities. In power generation, the differentiation across base load, combined heat and power, and peak load scenarios underscores the need for engines that balance efficiency with rapid start–stop capabilities, while data centers, hospitals, and hotels in the residential and commercial realm call for resilient backup power solutions. Marine, rail, and CNG vehicles in the transportation segment further illustrate the importance of tailored engine configurations to meet diverse regulatory and operational profiles.

Fuel type segmentation highlights the versatility of gas engine platforms, as biogas derived from agricultural residues and municipal wastewater treatment provides a renewable fuel source that supports circular economy objectives, landfill gas utilization in industrial and municipal applications offers a low-cost feedstock for distributed power, and natural gas-whether compressed or delivered via pipeline-remains the backbone of many generation and mechanical drive installations. Power rating distinctions, spanning beneath 500 kW for smaller distributed energy resources to above 2000 kW for central power facilities, with intermediary tiers of 200–500 kW, 500–1000 kW, 1000–2000 kW, and larger >2000–5000 kW and >5000 kW units, reflect the granularity of energy demand and site footprint constraints. Coupled with engine type differentiation-high-efficiency intercooled and turbocharged variants, lean burn dry low emission and rich quench lean burn systems, and spark ignition platforms featuring electronic fuel injection or traditional architectures-this comprehensive segmentation framework reveals the nuanced trade-offs that inform product positioning and R&D priorities within the industry.

This comprehensive research report categorizes the Gas Engine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Power Rating

- Engine Type

- Application

Illuminating Strategic Regional Trends and Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, the United States continues to spearhead demand for gas engine solutions, driven by policy incentives for combined heat and power installations in industrial parks and the expansion of natural gas pipelines into emerging regions. Concurrently, Latin American markets are leveraging abundant biogas resources from agricultural operations to fuel decentralized power systems, underpinned by supportive regulatory frameworks aimed at rural electrification and greenhouse gas reduction. Cross-border trade agreements within North America are facilitating the flow of engine components, although recent tariff measures have necessitated a strategic recalibration toward domestic assembly and regional supply hubs to minimize cost exposure.

The Europe, Middle East, and Africa region is marked by a dualistic shift toward decarbonization and energy security, with Western Europe advancing stringent emissions targets that favor lean burn and high-efficiency engines, while the Middle East is investing heavily in gas-to-power infrastructure to diversify energy sources beyond oil. Africa’s nascent gas engine market is emerging around resource-rich corridors in North Africa and East Africa, where off-grid and mini-grid projects capitalize on local gas reserves to support industrial growth and rural electrification.

Across Asia-Pacific, developing economies exhibit robust growth trajectories, notably in China and India, where increasing ambient air quality concerns and grid reliability challenges have propelled the adoption of gas engine systems in both urban and industrial settings. Regional LNG import capacity expansions, coupled with government programs incentivizing renewable gas blends, are accelerating demand for versatile dual-fuel engines. Moreover, Southeast Asian island nations are embracing gas-fired microgrids to mitigate the high costs of diesel imports, positioning the APAC region as the fastest-growing market segment globally.

This comprehensive research report examines key regions that drive the evolution of the Gas Engine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading OEM Strategies Leveraging Digitalization, Fuel Flexibility, and Sustainability to Drive Competitive Edge in the Gas Engine Market

Original equipment manufacturers are leveraging digital innovation and subscription-based service models to differentiate their offerings in a competitive market. For instance, leading providers have integrated AI-driven monitoring tools into their lifecycle solutions, enabling real-time diagnostics and dynamic maintenance planning that reduce unplanned downtime and extend overhaul intervals. Condition-based support agreements now utilize neural networks to detect subtle performance deviations and proactively dispatch expert assistance, reflecting a transformational shift from reactive to predictive service paradigms.

Cummins has aggressively advanced its HELM engine platform, encompassing its B, X10, and X15 series, providing a unified base architecture capable of operating on natural gas, advanced diesel, and hydrogen. The recent acquisition of First Mode assets augments Cummins’ retrofit capabilities in the mining and rail sectors, enabling hybrid conversions that reduce total cost of ownership and accelerate decarbonization in heavy-duty applications. Joint ventures with energy services companies further expand Cummins’ footprint in hydraulic fracturing power systems, underscoring its commitment to fuel flexibility and operational excellence.

Caterpillar continues to refine its gas engine portfolio through modular control systems and retrofittable emissions solutions such as closed crank ventilation kits that can reduce methane venting by up to twenty percent on existing G3600 platforms. Concurrently, the company is targeting dual-fuel capabilities-ranging from methanol to hydrogen admixtures-to future-proof engine designs and meet evolving regulatory requirements, showcasing a dual-track strategy that balances sustainable innovation with legacy fleet optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gas Engine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Caterpillar Inc.

- Clarke Energy

- Cummins Inc.

- Deutz AG

- Doosan Corporation

- Fairbanks Morse, LLC

- General Electric Company

- Guascor Power

- INNIO Jenbacher GmbH & Co OG

- JFE Engineering Corporation

- Jinan Lvneng Power Machinery Equipment Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kohler Co.

- Liebherr‑International AG

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Moteurs Baudouin

- MTU Friedrichshafen GmbH

- Perkins Engines Company Limited

- Rolls‑Royce Holdings plc

- Siemens AG

- Wärtsilä Corporation

- Yanmar Co., Ltd.

Strategic Imperatives for Industry Leaders to Optimize Supply Chains, Embrace Innovation, and Navigate Policy to Sustain Growth and Competitiveness

Industry leaders must diversify and fortify their supply chains by establishing multi-sourcing arrangements for critical components and exploring nearshoring opportunities. Such strategies can mitigate the operational disruptions arising from shifting tariff regimes and geopolitical tensions, ensuring consistent access to raw materials such as steel and specialized alloys essential for engine fabrication. Collaborative partnerships with regional fabricators and tooling suppliers will not only reduce lead times but also foster local economic engagement and regulatory compliance.

Investments in digital transformation are paramount, as predictive maintenance systems and remote performance monitoring yield quantifiable reductions in unplanned outages and maintenance expenditures. By adopting AI-enabled analytics platforms, companies can transition to outcome-based service contracts that align incentives between manufacturers and asset operators, unlocking new revenue streams and reinforcing customer loyalty. Scaling these platforms across global installations requires standardized data architectures and cybersecurity frameworks to safeguard operational integrity.

To remain at the forefront of the energy transition, engine providers should accelerate the development of fuel-agnostic platforms capable of accommodating renewable gases and liquid fuel alternatives. Joint ventures with biogas producers and hydrogen suppliers can secure early access to emerging fuel streams, while pilot projects in collaboration with end users can validate performance under real-world conditions. Such initiatives will help companies adapt to tightening emissions standards and support circular economy objectives through decentralized energy models.

Finally, proactive engagement with policymakers and industry associations is critical to shaping regulatory frameworks that balance environmental goals with practical implementation timelines. Coordinated advocacy efforts aimed at harmonizing emissions standards and securing incentives for clean-fuel infrastructure can create a stable policy environment that underpins long-term investment decisions. By maintaining open dialogue with government agencies, industry stakeholders can ensure that future regulations support sustainable growth without undermining competitiveness.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data, and Rigorous Triangulation to Ensure Analysis Credibility

This research integrates extensive secondary data collection from authoritative sources, including U.S. government trade and energy agencies, international energy organizations, and leading industry publications. Publicly available filings, regulatory documents, and baseline economic indicators were analyzed to establish a comprehensive understanding of market drivers, tariff impacts, and technology trends.

Primary insights were obtained through in-depth interviews with senior executives, technical specialists, and procurement officers across the gas engine value chain. These expert discussions illuminated real-world challenges in supply chain management, technology adoption, and regulatory compliance, enabling the validation and enrichment of secondary findings.

Data triangulation was employed to reconcile information from diverse sources, ensuring the credibility and consistency of the analysis. Quantitative data points were cross-referenced with qualitative insights, while discrepancies were reviewed through additional expert consultations to maintain analytical rigor.

Segment-specific and regional analyses were conducted using a combination of market segmentation frameworks and geospatial mapping tools. This approach facilitated a granular evaluation of industry applications, fuel types, power ratings, and engine configurations, as well as the identification of high-growth geographies and emerging policy landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gas Engine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gas Engine Market, by Fuel Type

- Gas Engine Market, by Power Rating

- Gas Engine Market, by Engine Type

- Gas Engine Market, by Application

- Gas Engine Market, by Region

- Gas Engine Market, by Group

- Gas Engine Market, by Country

- United States Gas Engine Market

- China Gas Engine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Market Insights to Illuminate Future Pathways for Sustainable, Efficient, and Resilient Gas Engine Market Growth

The evolving gas engine market represents a unique intersection of sustainable energy imperatives, technological innovation, and complex trade dynamics. Companies that master the nuances of application-specific requirements, align their offerings with regulatory trajectories, and harness digital transformation stand poised to capitalize on robust growth opportunities globally.

As the industry transitions toward higher shares of renewable gas and explores novel fuel blends, the strategic integration of modular engine platforms will be critical. Stakeholders that invest in agile manufacturing capabilities and dynamic service models will achieve competitive differentiation, ensuring resilience in the face of policy shifts and market fluctuations. By adopting a holistic perspective-one that encompasses supply chain agility, digital excellence, and collaborative partnerships-leaders can navigate the challenges ahead and drive the gas engine sector toward a sustainable, efficient, and resilient future.

Unlock Comprehensive Gas Engine Market Intelligence and Drive Strategic Decisions with Our In-Depth Research Report Available for Purchase Today

To access the comprehensive analysis, strategic insights, and detailed outlook presented in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy and empower your organization’s decision-making with unparalleled market intelligence

- How big is the Gas Engine Market?

- What is the Gas Engine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?