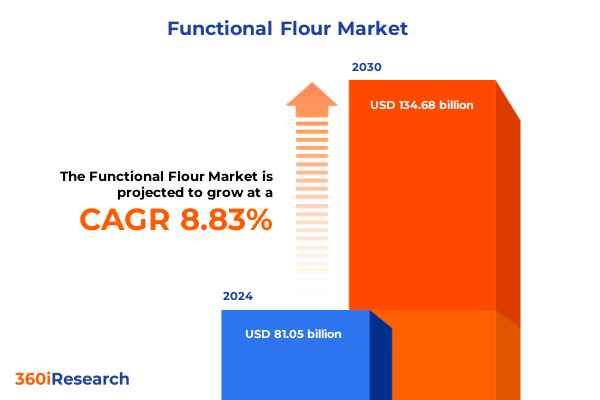

The Functional Flour Market size was estimated at USD 81.05 billion in 2024 and expected to reach USD 88.27 billion in 2025, at a CAGR 8.83% to reach USD 134.68 billion by 2030.

Introduction: Exploring the Evolving Functional Flour Market Landscape

The functional flour market has emerged as a dynamic and forward-thinking segment within the broader grain processing industry. In recent years, the shift in consumer preferences for nutritious and innovative food ingredients has propelled this market into the spotlight. This report provides a comprehensive analysis that captures the current state of the functional flour market while exploring future trends, opportunities, and challenges.

Drawing on extensive qualitative and quantitative research, the findings shed light on how advances in production technologies, along with evolving consumer lifestyles, are transforming traditional flour applications into more diverse and health-centric products. The study not only examines current market performance but also outlines the strategic drivers that are reshaping industry paradigms. Statistical evidence and industry benchmarks ensure that the insights presented are robust and actionable.

By presenting a deep dive into the competitive dynamics, consumer behavior, and product innovations, this introduction sets the stage for stakeholders to consider how new technological breakthroughs and shifting consumer priorities are breaking down conventional barriers. The ensuing sections unravel these layers of transformation, offering expert analysis and strategic perspectives that will help decision-makers steer their organizations toward sustained growth in an ever-changing market.

Transformative Shifts in the Functional Flour Market Landscape

In the last few years, the functional flour landscape has experienced a series of transformative shifts driven by technological breakthroughs, evolving consumer behavior, and regulatory reforms. Advances in milling processes and innovations in product formulations have redefined what consumers expect from traditional flours. Modern techniques ensuring enhanced nutritional profiles and sustainable production methods have led to the development of flours that cater to specialized dietary needs without compromising on taste or texture.

Simultaneously, rising health consciousness among consumers has accelerated the shift towards nutritional ingredients, emphasizing clean labels and transparency in sourcing. Market players are investing heavily in research and development to introduce products that resonate with these values. The convergence of digital transformation and supply chain innovations has further enabled companies to quickly adapt to market demands, optimize product availability, and fine-tune pricing strategies.

Moreover, evolving environmental regulations and heightened consumer awareness have prompted industry leaders to rethink sourcing and production practices. This transformative ecosystem encourages collaboration across the supply chain, operational scalability, and strategic partnerships, prompting a paradigm shift across every facet of the market from product development to distribution and end-consumer delivery.

Key Segmentation Insights Shaping the Functional Flour Market

An in-depth segmentation analysis reveals the market’s complex and multifaceted nature. When reviewing segmentation based on product type, the study delineates the market across high fiber flour, sprouted flour, and whole grain flour. High fiber flour gains further focus with the inclusion of oat fiber flour, while sprouted flour is examined through the lenses of sprouted finger millet flour and sprouted wheat flour. The whole grain flour category comprises detailed insights on brown rice flour, quinoa flour, and wheat flour, each contributing unique nutritional benefits and application potentials.

Segmentation by end use further refines the landscape into baked goods, breakfast cereals, and pasta and noodles. Within baked goods, specific attention is given to bread, cakes, and cookies, whereas breakfast cereals are broken down into cereal bars and granola; pasta and noodles are analyzed through the differentiation of instant noodles and regular pasta. A deeper look into sales channels reveals distribution through the food service industry, offline retail spaces, and online retail platforms. The food service segment is elaborated with insights into catering services and restaurants, while offline retail is exemplified by health food stores and supermarkets. In the rapidly evolving online retail sector, channels include direct-to-consumer approaches and third-party e-commerce platforms.

Further segmentation insights are derived from consumer demographics, which encompass age groups and dietary preferences. In this instance, age-based segmentation differentiates between adults and children, and dietary preferences are explored through demand for gluten-free, keto, and vegan options. Finally, packaging type is another critical aspect, with the market being studied across bagged packaging and bulk packaging—where bagged options extend into paper and plastic bags, and bulk packaging is typified by large sacks. These nuanced segmentation insights provide a layered understanding of consumer needs and market trends.

- Product Type

- End Use

- Sales Channel

- Consumer Demographics

- Packaging Type

Regional Insights Revealing Market Dynamics Across Key Geographies

A regional analysis unveils distinctive market dynamics and growth potentials across pivotal zones. In the Americas, robust consumer demand is met by an increasing preference for health-driven, nutrient-rich formulations, reflecting a trend that resonates deeply with regional dietary habits and lifestyle changes. Meanwhile, the Europe, Middle East & Africa region is characterized by a confluence of traditional culinary techniques and modern nutritional innovations, leading to significant adoption of functional flour products within both established and emerging markets.

The Asia-Pacific region, witnessing rapid urbanization and a surge in health awareness, has emerged as a critical area of focus for industry stakeholders. This area combines a rich agricultural heritage with modern technological advancements, paving the way for localized production adjustments that meet stringent quality standards while embracing new health trends. In each region, local consumer preferences, regulatory frameworks, and distribution network sophistication play vital roles in shaping the product offerings and market strategies.

These regional insights encapsulate how geographic diversity and cultural influences steer market growth and consumer acceptance, ultimately driving competitive advantages for companies that adeptly tailor their strategies to regional demands and trends.

- Americas

- Asia-Pacific

- Europe, Middle East & Africa

Company Insights: Leading Players and Market Innovators

A review of key market players underscores the competitive intensity and strategic innovation embedded in the functional flour market. Prominent companies, including Agrana Beteiligungs-AG, Archer Daniels Midland Company, Bay State Milling Company, and Bunge Limited, have long established their reputations by delivering consistent quality and driving industry best practices. These companies are joined by industry stalwarts such as Cargill, Incorporated, Conagra Brands, Inc., and Foodchem International Corporation, each contributing robust technological and distribution expertise.

Other notable entities, such as Gemef Industries SA, General Mills, Inc., and Grain Millers, Inc. by Richardson International, have significantly influenced product innovation and market scalability. The operations of Great River Organic Milling by Columbia Grain International, Gruma, S.A.B. de C.V., and Harinas Polo highlight a dedicated focus on both organic and traditional product offerings. Additionally, industry influencers like Hodgson Mill, Ingredion Incorporated, ITC Limited, and King Arthur Baking Company have leveraged core competencies to introduce novel product lines.

Companies such as LifeLine Foods, LLC, Mennel Milling Company, PHM Brands, LLC, and Siemer Milling Company are continuously optimizing their supply chains and quality systems. The strategic directions set by Stern-Wywiol Gruppe GmbH & Co. KG, SunOpta Inc., The Hain Celestial Group, Inc., The Scoular Company, and Wilmar Group illustrate the market’s commitment to innovation, sustainability, and consumer-centric solutions, further fueling the competitive spirit that defines the industry.

- Agrana Beteiligungs-AG

- Archer Daniels Midland Company

- Bay State Milling Company

- Bunge Limited

- Cargill, Incorporated

- Conagra Brands, Inc.

- Foodchem International Corporation

- Gemef Industries SA

- General Mills, Inc.

- Grain Millers, Inc. by Richardson International

- Great River Organic Milling by Columbia Grain International

- Gruma, S.A.B. de C.V.

- Harinas Polo

- Hodgson Mill

- Ingredion Incorporated

- ITC Limited

- King Arthur Baking Company.

- LifeLine Foods, LLC

- Mennel Milling Company

- PHM Brands, LLC

- Siemer Milling Company

- Stern-Wywiol Gruppe GmbH & Co. KG

- SunOpta Inc.

- The Hain Celestial Group, Inc.

- The Scoular Company

- Wilmar Group

Actionable Recommendations for Industry Leaders to Leverage Market Opportunities

Industry leaders are encouraged to adopt a multi-faceted strategy to navigate the evolving challenges and opportunities in the functional flour market. A primary recommendation is to invest in research and development to unlock new product formulations that address emerging consumer trends. By focusing on technological innovations and sustainable practices, companies can differentiate their product offerings and align closely with the growing demand for nutritious and responsibly produced ingredients.

Another key recommendation involves bolstering supply chain efficiencies. Enhancing collaboration with agricultural suppliers and investing in digital technologies to forecast demand more accurately can streamline production cycles and reduce costs. Embracing diversified sales channel strategies, particularly in e-commerce, will also open avenues for tapping into new customer segments.

Industry leaders should further consider regional market nuances when formulating marketing and distribution strategies. Tailoring product mixes and brand messaging to suit local consumer preferences and regulatory environments is essential. Additionally, forging strategic partnerships with research institutions and technology providers can catalyze innovation and performance improvements. By adopting these actionable recommendations, companies will be well-positioned to capitalize on growth opportunities while mitigating risks associated with market volatility.

Ask ResearchAI anything

World's First Innovative Al for Market Research

Conclusion: Synthesizing Insights for a Robust Market Future

In summary, the functional flour market is undergoing a profound transformation fueled by innovative production techniques, shifting consumer demands, and strategic market segmentation. The detailed analysis of product typologies, regional variances, and key company contributions elucidates a vibrant and competitive landscape. This evolving market not only signals promising growth prospects but also presents a multitude of challenges that require precision, agility, and a clear strategic vision from industry players.

The insights derived from an integrative approach to segmentation across product types, end use, demographics, and other key factors offer a solid foundation for developing targeted strategies. Industry stakeholders are well-advised to harness the collective intelligence stemming from technological advancements, market trends, and consumer preferences. As market dynamics continue to shift, the insights provided herein form a crucial toolset for decision-makers aiming to drive innovation, operational excellence, and sustainable growth in a competitive arena. Ultimately, a holistic understanding of these manifold factors will enable companies to secure a robust and forward-looking market position.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Functional Flour Market, by Product Type

- Functional Flour Market, by End Use

- Functional Flour Market, by Sales Channel

- Functional Flour Market, by Consumer Demographics

- Functional Flour Market, by Packaging Type

- Americas Functional Flour Market

- Asia-Pacific Functional Flour Market

- Europe, Middle East & Africa Functional Flour Market

- Competitive Landscape

- List of Figures [Total: 27]

- List of Tables [Total: 808 ]

Call-To-Action: Secure In-Depth Market Insights Today

For decision-makers and industry experts seeking a deeper dive into the intricacies of the functional flour market, this comprehensive research report offers a rich source of data, trend analysis, and strategic foresight. The report is a valuable resource designed to guide your organization through complex market dynamics and emerging opportunities.

Connect with Ketan Rohom, Associate Director, Sales & Marketing, to learn how this report can equip you with actionable insights and a competitive edge. Taking the step to leverage this detailed research can help in formulating strategies that are both innovative and responsive to real-time market changes. Engage now to enhance your strategic roadmap and gain exclusive access to data-driven insights that are critical for steering your business toward sustained success.

- How big is the Functional Flour Market?

- What is the Functional Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?