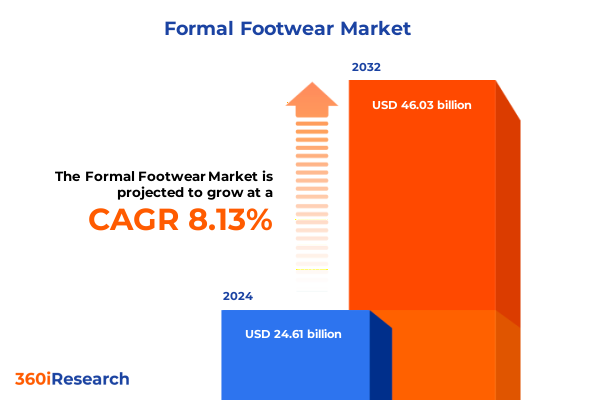

The Formal Footwear Market size was estimated at USD 26.57 billion in 2025 and expected to reach USD 28.69 billion in 2026, at a CAGR of 8.16% to reach USD 46.03 billion by 2032.

Discovering the Evolving Dynamics and Strategic Imperatives Shaping the Global Formal Footwear Industry Amid Changing Consumer Preferences and Market Forces

The formal footwear industry stands at a pivotal juncture, influenced by evolving consumer expectations, disruptive technologies, and changing global trade patterns. Demand for classic styles is now intersecting with a willingness to explore innovative materials, digitally enhanced shopping experiences, and sustainable production methods. Against this backdrop, brands and manufacturers are challenged to balance heritage craftsmanship with agility and technological advancement.

Understanding the complexity of this landscape requires a deep dive into the factors reshaping design, sourcing, and distribution strategies across diverse markets. By unpacking how digital transformation is altering the buyer’s journey, examining the implications of recent tariff measures, and highlighting key segmentation patterns, this report offers leaders a clear view of emerging opportunities and risks. Through actionable insights, stakeholders can refine their approach to product portfolios, supply chain resilience, and regional market entry, ensuring they remain at the forefront of the formal footwear sector.

Navigating Digital Innovation and Sustainability as Catalysts Redefining Formal Footwear Design, Production, and Consumer Engagement

Digital innovation and sustainability have emerged as twin pillars driving the formal footwear sector’s transformation. Advanced manufacturing technologies such as 3D printing and AI-driven prototyping are accelerating design cycles and enabling hyper-personalization at scale. Leading brands now deploy virtual fitting tools and biometric feedback systems to deliver custom-fit experiences, reducing return rates and heightening customer satisfaction. As digital engagement becomes integral to the purchasing process, companies that invest in seamless omnichannel platforms gain a competitive advantage by fostering deeper consumer connections and streamlined operations.

Meanwhile, sustainability mandates and shifting consumer values are reshaping material choices and production protocols. The leather industry, long scrutinized for its environmental footprint, is adopting biofinishing innovations that eliminate harmful chemicals and enhance supply chain transparency. Partnerships between biotech firms and traditional tanneries illustrate the potential for scalable, eco-friendly leather alternatives that maintain luxury quality. At the same time, brands are integrating circular economy principles-from modular design to take-back initiatives-to reduce waste and reinforce brand loyalty among eco-conscious shoppers. These transformative shifts underscore the need for industry participants to proactively align technology adoption with sustainable practices to thrive in today’s market.

Assessing the Compound Effects of Recent Trade Policies and Tariffs on Formal Footwear Supply Chains, Pricing Structures, and Market Viability

The formal footwear market in 2025 is navigating a complex web of tariff measures that collectively heighten production costs and reshape global sourcing strategies. Under recent executive orders, imports from Canada and Mexico face a 25% levy, while those from China are subject to a 10% charge. These surcharges compound existing duties, which for certain leather and textile footwear categories can already exceed 20%, thereby amplifying cost pressures on manufacturers and importers alike.

Furthermore, the removal of the de minimis exemption for goods entering the United States from China and Hong Kong has introduced a uniform 30% tariff or a per-item fee on all shipments, effective May 2, 2025. This change eliminates a critical advantage previously exploited by direct-to-consumer brands shipping smaller orders, forcing them to reevaluate price structures and consider alternative fulfillment hubs. As a result, supply chain diversification efforts are accelerating, with many firms exploring regional distribution centers, nearshoring options, and tariff engineering techniques to mitigate the cumulative impact of these trade policies.

Taken together, these measures are prompting a strategic realignment across the formal footwear ecosystem. Companies must now balance the pursuit of cost efficiency with the need to maintain quality and design integrity, driving renewed focus on supplier relationships, production footprint optimization, and dynamic inventory management.

Unveiling the Most Critical Market Segmentation Drivers That Illuminate Consumer Demand Patterns Across Styles, Materials, Demographics, and Distribution

The formal footwear market can be most effectively understood by examining the distinct demands associated with each shoe category. Brogues and Derbies continue to appeal to traditionalists seeking detailed craftsmanship and polished appeal, while Loafers attract those prioritizing ease of wear and versatile styling. Meanwhile, the resurgence of Monk Strap shoes underscores a growing appetite for distinctive silhouettes that bridge formal and contemporary aesthetics. Oxfords remain the cornerstone of conservative footwear wardrobes, favored for their timeless refinement across professional and ceremonial settings.

Material selection represents another defining axis of consumer preference. Authentic leather sustains its premium appeal, particularly within luxury segments, while advances in bio-based and synthetic leathers are gaining traction among environmentally conscious buyers. Textile uppers are increasingly used for hybrid styles that merge formal contours with casual comfort, reflecting a broader blending of dress codes. Simultaneously, the gender divide in End User requirements reveals nuanced differences: Men often prioritize structure and durability in formal styles, whereas Women may seek lighter constructions and bolder design elements, leading brands to calibrate product innovations accordingly.

Finally, the evolving interplay between Offline and Online Distribution Channels shapes market accessibility and brand engagement. Brick-and-mortar showrooms leverage experiential retail concepts-such as in-store customization and digital fitting lounges-to reinforce brand narratives and foster loyalty. Conversely, e-commerce platforms harness virtual try-on technologies and AI-driven personalization to streamline the purchase journey, expand reach, and enable direct brand-to-consumer dialogues without geographical constraints.

This comprehensive research report categorizes the Formal Footwear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Highlighting Distinct Regional Dynamics Influencing Formal Footwear Preferences, Distribution, and Growth Opportunities Across Major Global Markets

Distinct regional characteristics are steering the formal footwear market’s evolution and revealing targeted opportunities for growth. In the Americas, the United States leads with a mature retail infrastructure and strong demand for premium formal styles that blend heritage and contemporary design. Canada’s market exhibits sensitivity to tariff changes, prompting brands to optimize North American supply chains. Across Latin America, rising middle-class segments demonstrate growing appetite for accessible luxury, yet logistical challenges and import duties necessitate tailored distribution strategies.

Europe, Middle East & Africa demonstrates wide-ranging dynamics driven by diverse consumer tastes and economic conditions. Western European markets favor legacy brands and sustainably manufactured products, while Eastern European regions show increased openness to innovative material blends as disposable incomes rise. In the Middle East, luxury and bespoke formal footwear enjoy robust demand, underpinned by high per capita spending. Sub-Saharan Africa, though still nascent, is witnessing emergent urban centers where domestic manufacturers and regional distributors are capitalizing on lower-cost production capabilities.

In the Asia-Pacific, established markets such as Japan and South Korea prioritize precision craftsmanship and refined aesthetics, whereas China’s accelerated digital adoption has spurred rapid growth in online formal footwear retail. Southeast Asia presents a mosaic of developing economies where e-commerce penetration is expanding faster than traditional retail, offering cost-sensitive consumers novel access to international brands. Across the region, infrastructural investments and strategic partnerships are enabling brands to tap into these diversifying markets with localized offerings.

This comprehensive research report examines key regions that drive the evolution of the Formal Footwear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Brands Driving Innovation, Market Expansion, and Competitive Advantage in the Formal Footwear Sector Globally

Leading global players continue to shape the formal footwear sector through strategic innovation and expansive distribution networks. Nike and Adidas, although traditionally associated with athletic footwear, have leveraged their advanced manufacturing capabilities and sustainability initiatives to introduce premium formal lines that emphasize comfort and performance-enhancing technologies. Allbirds and Rothy’s have disrupted the mid-range formal market by showcasing eco-friendly materials and direct-to-consumer models that resonate with younger, environmentally aware cohorts.

Meanwhile, established luxury houses such as Gucci and Salvatore Ferragamo maintain their commanding presence through heritage craftsmanship and limited-edition collaborations that reinforce exclusivity. Brands like Cole Haan and Clarks bridge mass-market accessibility with elevated design, deploying omnichannel strategies that integrate experiential retail concepts with advanced virtual fittings. At the same time, emerging regional manufacturers in Southeast Asia and Eastern Europe are gaining traction by offering competitive pricing, localized styles, and agile production aligned with shifting consumer and tariff landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Formal Footwear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aldo International Inc.

- Allen Edmonds Corporation

- Bata Shoe Organization

- Brooks Brothers Group, Inc.

- Burberry Group plc

- C & J Clark International Ltd.

- Calvin Klein Inc.

- Church’s Shoes

- Deichmann SE

- ECCO Sko A/S

- Florsheim Shoe Company

- Gucci S.p.A.

- Hugo Boss AG

- Hush Puppies

- John Lobb Ltd.

- Kenneth Cole Productions, Inc.

- Louis Vuitton Malletier S.A.

- Magnanni S.A.

- Meermin Majorica S.L.

- Pavers England Ltd.

- Prada S.p.A.

- Red Tape Footwear Pvt. Ltd.

- Salvatore Ferragamo S.p.A.

- Santoni S.p.A.

- Tod’s S.p.A.

Actionable Strategies and Forward-Looking Initiatives to Strengthen Supply Chains, Enhance Brand Differentiation, and Capture Emerging Formal Footwear Trends

To excel in this evolving environment, industry leaders should prioritize end-to-end supply chain visibility and agility. Investing in digital platforms that offer real-time inventory tracking and demand forecasting will facilitate rapid responses to regional tariff adjustments and shifting consumer preferences. Concurrently, forging strategic partnerships with material innovators and logistics providers can unlock cost efficiencies while advancing sustainability goals.

Enhancing consumer engagement requires a dual focus on personalized digital experiences and immersive in-store interactions. Brands that integrate augmented reality try-on capabilities and AI-driven stylistic recommendations will differentiate themselves online, while experiential retail studios can reinforce premium value propositions. In parallel, scaling circular business models-such as trade-in and refurbishment programs-will address increasing environmental scrutiny and deepen customer loyalty.

Finally, cultivating a balanced market portfolio across geographies is critical. Leveraging localized distribution hubs and nearshoring options in response to tariff regimes will mitigate import costs and delivery lead times. By aligning strategic investments with region-specific consumer insights and regulatory developments, industry participants can secure sustainable growth and maintain competitive resilience.

Outlining Rigorous Research Methodologies and Analytical Frameworks Employed to Deliver In-Depth Insights Into the Formal Footwear Market

This report synthesizes insights through a comprehensive methodology that integrates both primary and secondary research pillars. Foundational desk research examined trade publications, industry white papers, and official tariff documentation to establish baseline trends and regulatory impacts. Primary interviews with brand executives, materials developers, and distribution specialists provided qualitative depth and real-world perspectives on technology adoption and market responsiveness.

Quantitative data collection encompassed structured surveys targeting end consumers and B2B buyers, enabling segmentation analysis along product type, material preference, and distribution channel. The research team applied rigorous data triangulation techniques to validate findings, cross-referencing proprietary survey results with publicly available trade statistics and expert viewpoints. Such an approach ensures that conclusions are both robust and reflective of real-time market dynamics.

Analytical frameworks including SWOT and Porter’s Five Forces were employed to assess competitive positioning and strategic risks. Scenario planning exercises modeled the potential implications of evolving tariff measures and sustainability regulations, guiding actionable recommendations. This multi-dimensional methodology underpins the accuracy and relevance of the insights presented in this formal footwear market review.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Formal Footwear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Formal Footwear Market, by Product Type

- Formal Footwear Market, by Material

- Formal Footwear Market, by End User

- Formal Footwear Market, by Distribution Channel

- Formal Footwear Market, by Region

- Formal Footwear Market, by Group

- Formal Footwear Market, by Country

- United States Formal Footwear Market

- China Formal Footwear Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Core Insights and Strategic Implications Driving the Future Trajectory of the Global Formal Footwear Landscape

In synthesizing the findings, it is clear that the formal footwear market’s trajectory will be shaped by the interplay of digital innovation, sustainability imperatives, and trade policy evolution. Brands that harness advanced manufacturing technologies and data-driven consumer engagement will capture a greater share of evolving demand patterns. Simultaneously, embracing circular models and alternative materials will be essential to address environmental pressures and regulatory expectations.

Regional diversity necessitates adaptable strategies: optimizing supply chains for tariff volatility, tailoring product offerings to cultural preferences, and leveraging local partnerships. Leading companies are already exemplifying how to blend heritage craftsmanship with agile, tech-enabled operations, setting benchmarks for resilience and growth.

Ultimately, the ability to integrate these strategic priorities-innovation, sustainability, and regional agility-will determine the most successful players in the global formal footwear landscape. Stakeholders equipped with these insights can confidently navigate emerging challenges and capitalize on untapped opportunities.

Secure Direct Access to Expert Insights and a Comprehensive Formal Footwear Market Research Report From Our Associate Director

To gain a definitive edge in a market defined by rapid innovation and shifting trade dynamics, connect with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the unique findings of this comprehensive formal footwear market research report and tailor solutions to your strategic objectives.

- How big is the Formal Footwear Market?

- What is the Formal Footwear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?