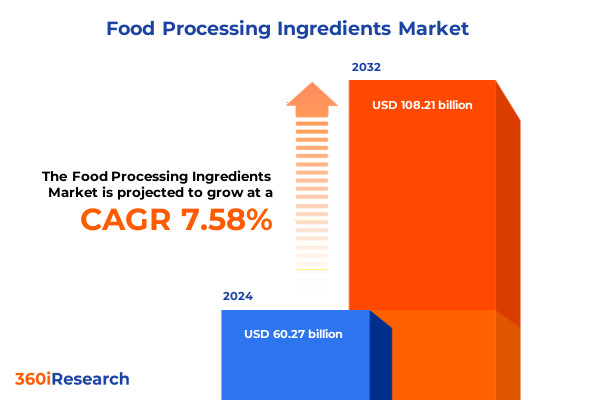

The Food Processing Ingredients Market size was estimated at USD 64.94 billion in 2025 and expected to reach USD 69.42 billion in 2026, at a CAGR of 7.56% to reach USD 108.21 billion by 2032.

How Consumer Demand for Clean Label, Sustainability, and Technological Innovation is Redefining the Food Processing Ingredients Sector

The global food processing ingredients sector is undergoing a profound transformation as it contends with evolving consumer preferences and regulatory pressures. Fueled by an increasing appetite for clean-label products and sustainable sourcing, manufacturers are reconfiguring traditional formulations and production processes to meet heightened demands for natural, minimally processed ingredients. This dynamic shift extends beyond simple ingredient swaps; it encompasses collaborative innovation among suppliers, brand owners, and technology providers who are coalescing around shared goals of transparency and environmental stewardship. Ensuring product integrity while satisfying consumer expectations has become a cornerstone of competitive advantage in this space.

Unprecedented Technological Advancements and Digital Traceability Are Catalyzing a New Era in Food Ingredient R&D and Supply Chain Transparency

Industry pioneers are embracing digitalization and advanced analytics to revolutionize R&D and supply chain management, harnessing data-driven insights to expedite new product development and trace ingredient provenance from farm to fork. Blockchain-based platforms are gaining traction, enabling instantaneous traceability and robust quality assurance, which accelerates recall responses and fortifies consumer trust. Concurrently, breakthroughs in biotechnology-such as precision fermentation and enzyme engineering-are unlocking novel ingredient functionalities and performance improvements, driving a wave of highly tailored solutions that address nutritional, sensory, and shelf-life challenges. These converging technological, regulatory, and sustainability trends are reshaping traditional food ingredient value chains into agile, purpose-driven ecosystems.

Navigating the Complex Web of Elevated Tariffs and Trade Policy Shifts Altering Ingredient Sourcing and Cost Structures in 2025

Since the introduction of sweeping tariff measures in early 2025, the food processing ingredients industry has navigated significant cost pressures and supply chain disruptions. Across categories-from packaging substrates like aluminum and plastic films to core commodities such as cocoa, spices, and specialty oils-elevated duty rates have prompted companies to revisit sourcing strategies and accelerate domestic production investments. While some ingredient segments experienced double-digit cost increases at the port of entry, forward-looking manufacturers adopted strategic supplier diversification and recalibrated inventory protocols to mitigate operational volatility. Moreover, the unanticipated termination of long-standing trade agreements with key partners led to restructured bilateral negotiations and renewed focus on nearshoring initiatives to preserve supply reliability and cost competitiveness.

Deep Dive into Ingredient, Application, Functional, Source, Form, Technology and Distribution Channel Segmentation Reveals Diverse Market Opportunities

The market landscape is delineated by multiple intersecting segmentation axes, beginning with ingredient classifications that span anti-foaming agents, colors, emulsifiers, enzymes, flavors, preservatives, proteins, stabilizers, and sweeteners. Enzymatic solutions offer specialized subsegments such as carbohydrases-including amylase and glucoamylase-lipases, phytases, and proteases like bromelain, ficin, and papain, while flavor systems encompass both artificial profiles, including alcohol-based and ester-based compounds, and natural extracts derived from essential oils, plant matrices, and spices. Protein portfolios are bifurcated into animal-based derivatives-casein, egg protein, gelatin, whey protein-and plant‐based isolates such as pea, rice, soy, and wheat. Additionally, sweetener technologies range from caloric forms, including high-fructose corn syrup, maltodextrin, and sugar, to high-intensity alternatives like acesulfame potassium, aspartame, saccharin, stevia, and sucralose.

Application-wise, the industry serves diverse channels such as bakery, where inclusions cover biscuits, bread, cakes, pastries, and savory crackers, and beverages that span alcoholic, carbonated, functional, and juice formulations. Confectionery segments address candies, chocolates, and toffees, while dairy applications include butterspreads, cheeses, ice creams, dairy beverages, and cultured yogurts. Meat products leverage cured, extenders, and processed formats, and nutraceutical markets incorporate dietary supplements and functional foods. Pet food production segments dry kibbles, wet mixes, and treats, whereas sauces and dressings feature dressings, ketchups, and mayonnaises. Functional roles of ingredients are categorized under nutritional (fiber enrichment, protein fortification, vitamin and mineral enhancement), preservation (antimicrobial, antioxidant), and technological functions (emulsifying, foaming, gelling, thickening).

Source attributions classify materials as animal-derived from cow, marine, or pig origins; microbial from bacteria, fungi, or yeast; or plant-based from corn, pea, soy, or wheat. Physical forms include granules, liquids, and powders, while production technologies range from biotechnology, conventional extraction methods like pressing, solvent extraction and steam distillation, enzymatic synthesis, and fermentation-performed in solid-state or submerged reactors. Distribution environments encompass direct sales, distributors and wholesalers, foodservice outlets, and online retail platforms.

This comprehensive research report categorizes the Food Processing Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Application

- Function

- Source

- Form

- Technology

- Distribution Channel

Diverse Regional Drivers from the Americas to EMEA and Asia-Pacific Shaping Unique Growth Profiles and Supply Chain Strategies

Regional dynamics in the Americas have been shaped by increasing consumer interest in clean-label ingredients, driving substantial growth in plant-based proteins and natural preservatives, particularly in the United States and Brazil. Mexico’s proximity offers agricultural sourcing advantages, yet evolving trade policies require adaptive supply chain strategies to maintain cost efficiency and product quality. In the Europe, Middle East & Africa region, stringent regulatory environments and advanced food safety frameworks are spurring investment in traceability solutions and sustainable ingredient sourcing, with the EU’s regulatory harmonization and Middle Eastern market expansions catalyzing new application segments. The Asia-Pacific landscape is characterized by rapid urbanization, rising disposable incomes, and strong culinary heritage, which combine to accelerate demand for novel flavors, texturizers, and functional ingredients, while local innovation hubs are thriving in China, India, Japan, and Australia to serve both domestic and export markets.

This comprehensive research report examines key regions that drive the evolution of the Food Processing Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Ingredient Suppliers Forge Strategic Partnerships, Mergers, and Sustainability Initiatives to Drive Innovation and Market Leadership

Major ingredient suppliers are advancing leadership through strategic mergers, acquisitions, and collaborative innovation models. Cargill is focusing on regenerative agriculture and digital food platforms, partnering with leading consumer goods companies to ensure sustainable corn and oilseed supply chains while deploying novel functional blends for emerging markets. Kerry Group has fortified its ProActive Health portfolio by integrating branded botanical extract companies and divesting non-core sweet ingredient assets to streamline focus on high-margin, science-backed functional solutions. International Flavors & Fragrances has emerged as a global biosolutions leader following its merger with DuPont’s Nutrition & Biosciences business, expanding capabilities in enzymes, cultures, soy proteins, and probiotics to advance “better-for-you” product innovation. Givaudan continues to drive performance in natural colors, texturisers, and flavor systems, leveraging sustainability partnerships and upcycling initiatives to address food waste and offer clean-label emulsification solutions. Novonesis, formed through the integration of Novozymes and Chr. Hansen, leads enzymatic and microbial biosolutions, pioneering precision fermentation and advanced cultures for diverse food, beverage, and nutritional applications. Other key players such as ADM, DSM, Ingredion, Tate & Lyle, BASF, and DuPont are likewise intensifying investments in biotechnology, green chemistry, and digital insight platforms to maintain competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Processing Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- BASF SE

- Britannia Industries Limited

- Bunge Limited

- Cargill, Incorporated

- Corbion N.V.

- Danone S.A.

- General Mills, Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hindustan Unilever Limited

- International Flavors & Fragrances Inc.

- ITC Limited

- Kerry Group plc

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Nestlé S.A.

- Novozymes A/S

- Parle Products Private Limited

- PepsiCo, Inc.

- Tate & Lyle plc

- Unilever PLC

Actionable Roadmap for Industry Stakeholders to Integrate Clean Label, Biotechnology, Supply Chain Resilience and Digital Traceability Strategies

To thrive in this evolving landscape, food processing ingredient leaders should adopt an integrated clean-label strategy that combines transparent ingredient sourcing, certified sustainable practices, and consumer-driven formulation. Investment in advanced bioprocessing and enzyme engineering can unlock new functional capabilities, enhancing product performance while reducing reliance on synthetic additives. Companies should diversify supply networks by incorporating nearshore and domestic production capacities, mitigating trade policy risks. Embracing digital traceability-through blockchain or IoT-enabled platforms-can streamline quality control, optimize recall response, and reinforce brand trust. Formulating in close collaboration with end-use partners will accelerate adoption of tailored solutions, while ongoing engagement with regulatory authorities will ensure agility in navigating evolving food safety and labeling standards.

Comprehensive Primary and Secondary Research Framework with Triangulation for Robust Segmentation, Regional and Competitive Intelligence

This research integrated extensive primary interviews with industry experts, ingredient manufacturers, and brand formulators to capture firsthand perspectives on innovation drivers and supply chain challenges. Secondary data sources included regulatory filings, peer-reviewed journals, technology provider whitepapers, and reputable news outlets. A triangulation methodology was employed to validate findings by cross-referencing quantitative insights with qualitative stakeholder feedback. Segmentation models were constructed using bottom-up supply chain mapping and category-specific analysis, while regional assessments leveraged trade flow data and macroeconomic indicators. Rigorous data quality checks and expert review panels ensured the reliability and accuracy of the compiled intelligence, providing a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Processing Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Processing Ingredients Market, by Ingredient Type

- Food Processing Ingredients Market, by Application

- Food Processing Ingredients Market, by Function

- Food Processing Ingredients Market, by Source

- Food Processing Ingredients Market, by Form

- Food Processing Ingredients Market, by Technology

- Food Processing Ingredients Market, by Distribution Channel

- Food Processing Ingredients Market, by Region

- Food Processing Ingredients Market, by Group

- Food Processing Ingredients Market, by Country

- United States Food Processing Ingredients Market

- China Food Processing Ingredients Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 5724 ]

Synthesizing Consumer, Regulatory, and Technological Imperatives to Guide Future-Ready Strategies Across Global Food Ingredient Markets

The food processing ingredients sector is at an inflection point shaped by converging consumer, regulatory, and technological imperatives. Clean-label credentials, sustainability commitments, and advanced biomanufacturing are no longer optional; they form the bedrock of competitive differentiation. Robust segmentation and regional analyses illuminate lucrative white spaces, while a thorough understanding of tariffs and trade dynamics underscores the necessity of supply chain agility. Likewise, collaborating with leading suppliers, embracing data-driven traceability, and investing in R&D will catalyze innovation pipelines and cement market leadership. By internalizing the insights and recommendations presented herein, industry leaders can anticipate shifting dynamics, seize emerging growth opportunities, and chart a path toward a resilient, future-ready operating model.

Secure Your Competitive Edge with a Comprehensive Food Processing Ingredients Market Research Report Tailored to Your Strategic Needs

Ready to elevate your strategic decisions and gain unparalleled insights into the complex food processing ingredient landscape? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, and discover how our comprehensive market research report can empower your organization with the actionable intelligence needed to stay ahead of market shifts, navigate emerging trends, and capitalize on future growth opportunities.

- How big is the Food Processing Ingredients Market?

- What is the Food Processing Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?