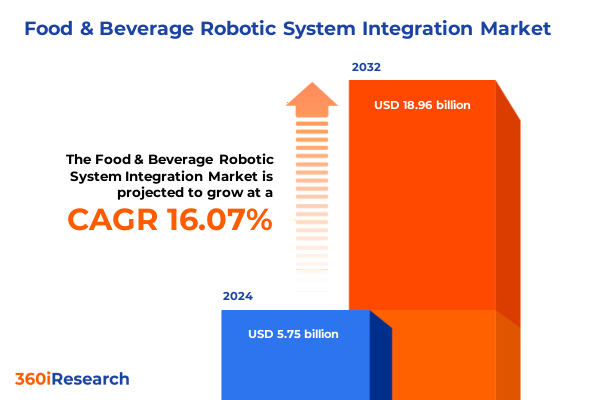

The Food & Beverage Robotic System Integration Market size was estimated at USD 6.61 billion in 2025 and expected to reach USD 7.60 billion in 2026, at a CAGR of 16.24% to reach USD 18.96 billion by 2032.

Explore the Critical Role of Robotic System Integration in Transforming Food and Beverage Operations Amidst Global Labor Shortages and Safety Demands

Over the past two years, the food and beverage industry has grappled with persistent labor shortages that have intensified operating costs and eroded productivity. In response, forward-looking manufacturers and end users have increasingly turned to robotic system integration to automate repetitive tasks such as sorting, portioning, and quality inspection, thereby alleviating staffing constraints and enhancing throughput and consistency. Notably, in September 2024, a leading quick-service restaurant chain piloted the Autocado robot, reducing avocado preparation time from 60 seconds to as little as 26 seconds per fruit, a dramatic efficiency gain that underscores the operational benefits of targeted automation initiatives.

This shift toward robotics extends beyond processing to encompass last-mile delivery, where autonomous sidewalk robots and drones are reshaping logistics. In December 2024, five AI-driven delivery robots launched in downtown Dallas via a major rideshare platform, leveraging lidar-equipped navigation to complete orders with minimal human supervision. These deployments reflect a broader investment trend: since 2019, startups focused on food delivery robotics have collectively raised over $3.5 billion, signaling strong investor confidence in automation’s potential to solve long-standing service challenges.

Industry reports further highlight that over 90,000 robotic units were actively operating in food manufacturing facilities worldwide by late 2024, marking a substantial escalation in automation adoption for critical tasks like quality inspection and packaging. Moreover, stringent food safety regulations and evolving consumer expectations for product consistency are reinforcing the urgency for integrated robotic systems capable of maintaining hygiene standards and traceable quality controls. Consequently, executives are prioritizing strategic partnerships with system integrators and robotics OEMs to deploy scalable, hygiene-ready solutions that address both immediate labor challenges and long-term growth objectives.

Uncover How Breakthrough Innovations in AI, Vision Systems, and Collaborative Robots Are Driving a New Era of Food and Beverage Manufacturing Excellence

The food and beverage sector is witnessing an unprecedented convergence of advanced automation technologies, marking a transformative shift from traditional assembly lines to fully networked, data-driven production environments. Industry 4.0 principles have become foundational, as robotics platforms increasingly integrate with IoT-enabled sensors and Manufacturing Execution Systems (MES) to deliver real-time visibility into production flows. By collating granular performance data, manufacturers can optimize energy usage, predict maintenance needs, and rapidly reconfigure lines to handle changing product variants, all while minimizing downtime and waste.

Artificial intelligence and computer vision are also emerging as catalysts for next-generation quality control. High-resolution vision software now empowers robots to detect minute product defects, verify packaging integrity, and sort items by color, shape, and size with near-perfect accuracy. These advances are particularly crucial in high-speed bottling and confectionery lines, where even a slight misalignment can lead to costly recalls. As a result, robotics vendors are embedding machine learning models within control systems, enabling continuous self-optimization of pick-and-place and inspection routines.

Beyond the factory floor, robotic servers and autonomous delivery platforms are redefining customer engagement. AI-powered autonomous robots are now navigating urban sidewalks to complete food deliveries with minimal human interaction, while indoor robotic servers are busily delivering meals, clearing tables, and freeing staff to focus on personalized guest experiences. Despite regulatory hurdles around drone corridors and pedestrian safety, pilot programs in major U.S. cities have demonstrated that these innovations can enhance order accuracy by up to 20% and reduce delivery times by nearly 30%.

Taken together, these breakthroughs signal a new era in which food and beverage manufacturers and service providers can achieve unprecedented levels of operational agility, quality assurance, and customer satisfaction by embracing integrated robotics solutions.

Understand the Complex Effects of Emerging 2025 U.S. Trade Tariffs on Food and Beverage Robotics Supply Chains, Costs, and Strategic Sourcing

The landscape of global trade tariffs in 2025 has introduced significant complexity for food and beverage robotic system integrators, creating both hurdles and strategic inflection points. In April 2025, the U.S. administration announced a sweeping policy imposing a baseline tariff of 10% on all imports, coupled with escalated duties targeting specific trading partners, which immediately triggered concern over cost spikes and supply chain disruptions in high-tech industries. While intended to bolster domestic manufacturing, these measures quickly reverberated through robotics supply chains, where critical components-sensors, semiconductors, actuators, and precision controllers-often originate from East Asia.

At a major robotics expo in Boston, developers of humanoid and collaborative robots underscored how reciprocal tariffs have driven component costs up by as much as 30–40%, forcing many companies to reassess global sourcing strategies. For example, prices for Chinese-made actuators rose by nearly 22% following the implementation of a 34% import duty, while U.S. innovators saw project timelines slip as suppliers navigated new customs processes. In parallel, the U.S. imposed a 145% tariff on selected Chinese imports, prompting a retaliatory 125% levy that further complicated cross-border supply dynamics.

These tariff pressures have accelerated a diversification trend, with many integrators shifting sourcing to Southeast Asia, India, and domestic suppliers to mitigate risks. However, building new relationships and qualifying alternative vendors has extended lead times and introduced variability in component quality. The resulting uncertainty has led several robotics firms to invest in reshoring initiatives, partnering with local electronics assemblers and leveraging government programs aimed at onshore semiconductors. Although these efforts may yield long-term resilience, they currently contribute to elevated short-term capital requirements and necessitate recalibrated pricing models that end users must absorb.

Gain Strategic Insights from Detailed Component, Robot Type, Automation Level, Application, and End User Segmentations Shaping Market Dynamics

The food and beverage robotic systems market is characterized by a multi–dimensional segmentation framework that drives tailored solutions and strategic investment. Component segmentation, for instance, spans hardware, software, and services, where hardware encompasses actuators, controllers, end effectors, and sensors, and further dissects into electric, hydraulic, and pneumatic actuators; while software branches into analytics, control, and vision modules, with analytics differentiating between performance and predictive capabilities and vision splitting into two-dimensional and three-dimensional recognition platforms. This granularity ensures that decision-makers can align specific performance requirements-such as precision slicing or dynamic quality checks-with the optimal configuration of robotic modules.

Equally significant is the robot type segmentation across articulated, Cartesian, collaborative, delta, and SCARA robots. Articulated robots excel in flexible, multi-axis operations such as intricate assembly or dynamic carton erecting, whereas SCARA and delta robots are prized for high-speed pick-and-place tasks. Collaborative robots, meanwhile, offer a lower-risk entry point for automation by securely sharing space with human operators, making them ideal for modular lines where manual tasks require augmentation.

Automation level segmentation distinguishes between fully automated cells and semi-automated workstations, enabling practitioners to phase in robotics at a cadence that reflects operational readiness and capital availability. Application segmentation further subdivides the market into inspection and quality control, packaging, palletizing, picking and sorting, and processing operations, illuminating areas of the line where robotics can yield the greatest throughput and consistency benefits. Finally, end-user segmentation-ranging from e-commerce fulfillment centers and manufacturers to restaurants and retail settings-provides a context for deployment scenarios, highlighting how tailored automation solutions address unique regulatory, hygiene, and throughput demands across the food and beverage ecosystem.

This comprehensive research report categorizes the Food & Beverage Robotic System Integration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Robot Type

- Automation Level

- Application

- End User

Reveal Regional Growth Patterns and Adoption Drivers in the Americas, Europe Middle East & Africa, and Asia Pacific Food and Beverage Robotics Markets

Regional dynamics in the food and beverage robotics sector reveal distinct adoption patterns and growth drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific. North America commands a leadership position, with the United States benefiting from robust government incentives and tax credits under advanced manufacturing initiatives, while Canadian players leverage stringent traceability regulations to integrate vision-guided sorting and grading systems at dairy and meat processing facilities. Meanwhile, Latin America is emerging through pilot deployments of collaborative robots in beverage bottling and snack packaging, as producers respond to rising labor costs and seek modular, scalable automation solutions.

Across Europe, Middle East & Africa, mature economies such as Germany, France, and the United Kingdom emphasize Industry 4.0 implementations that feature digital twins and predictive maintenance platforms. Southern and Eastern European nations are rapidly upgrading legacy bakeries and meat processing lines through innovation grants, while Middle Eastern food parks leverage fully automated sorting and packaging systems to meet export-grade quality standards. African markets, though nascent, are adopting entry-level robotics to mitigate labor shortages and reduce post-harvest spoilage, supported by growing investments in food security imperatives.

Asia-Pacific stands out as the fastest-expanding region, driven by China’s large-scale adoption of washdown-ready robotic systems, Japan’s precision automation in confectionery and beverage bottling, India’s burgeoning quick-service restaurant deployments of cooking and cutting robots, and Southeast Asia’s integration of conveyor-based vision systems for quality inspection. Government programs in China and Japan continue to subsidize robotics uptake, further accelerating market momentum across the entire value chain.

This comprehensive research report examines key regions that drive the evolution of the Food & Beverage Robotic System Integration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Leading Robotics Manufacturers and System Integrators Driving Innovation, Hygiene, and Scalability across Food and Beverage Automation Solutions

A competitive landscape of robotics OEMs and system integrators underpins the rapid evolution of food and beverage automation. ABB, a Swiss-Swedish powerhouse, remains at the forefront with its washdown-rated collaborative robots and OmniCore™ controller platform, which deliver high precision in wet environments while ensuring operational safety alongside human workers. FANUC Corporation, leveraging its legacy in numerical control, offers an extensive suite of articulated and SCARA robots designed for heavy-payload palletizing and high-speed pick-and-place applications, distinguished by zero-downtime architecture and robust field reliability.

Yaskawa Electric Corporation contributes advanced robotics solutions known for energy efficiency and precise motion control, particularly in packaging lines where seamless integration with servo drives and motion controllers enhances throughput. KUKA AG, with its heritage in collaborative automation, provides adaptive cobot platforms that excel in flexible, small-batch production environments. Universal Robots, recognized for its plug-and-play approach, empowers smaller food processors and restaurants to deploy accessible automation with intuitive teach-pendant interfaces and lightweight arm designs.

System integrators like JBT Corporation complement these OEM capabilities by delivering turnkey solutions that encompass cooking, freezing, and packaging processes, bridging the gap between robotics hardware and complex plant environments. Software providers such as Rockwell Automation and Siemens further enrich the ecosystem with advanced control software and analytics suites, enabling predictive maintenance and real-time performance dashboards that drive continuous improvement across the production line.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food & Beverage Robotic System Integration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bastian Solutions, Inc.

- Blueprint Automation LLC

- Comau S.p.A.

- Denso Corporation

- Fallas Automation, Inc.

- FANUC Corporation

- JLS Automation LLC

- Kassow Robots A/S

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Motion Controls Robotics LLC

- Omron Corporation

- Polytron Corporation

- POMO Robotics Ltd.

- Prime Robotics Inc.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Seiko Epson Corporation

- Siemens AG

- Simplimatic Automation Ltd.

- Stäubli International AG

- Universal Robots A/S

- Yaskawa Electric Corporation

Adopt Pragmatic Strategies to Leverage Flexible Automation, Mitigate Supply Risks, and Enhance Operational Resilience in Food and Beverage Industries

Industry leaders are advised to adopt a modular automation strategy that begins with collaborative robots for low-risk introduction, then scales to fully automated cells once processes and ROI become established. Integrators should prioritize sourcing components from diversified suppliers, including emerging markets in Southeast Asia and domestic manufacturers under government subsidy programs, to mitigate tariff-related cost fluctuations and supply chain disruptions.

Next, companies must embed AI-driven analytics within robotic control architectures to enable predictive maintenance and dynamic process optimization. By leveraging performance data streams, operations teams can reduce unplanned downtime, maximize throughput, and ensure compliance with stringent safety standards. Investing in washdown-ready and hygienic robot designs can facilitate frequent sanitation cycles, addressing rising consumer and regulatory demands for contamination-free production.

Workforce transformation remains critical. Upskilling internal teams via targeted training programs on robot programming and maintenance fosters in-house expertise and eliminates reliance on scarce external technicians. Parallel to technical training, organizations should develop cross-functional innovation labs to pilot emerging robotic, vision, and software solutions in controlled environments, accelerating the cultivation of best practices.

Finally, collaboration with policymakers and industry associations can yield strategic exemptions or phased tariff relief for essential automation components. Open dialogues with trade bodies help inform balanced policy frameworks that support domestic manufacturing while preserving international collaboration and supply chain resilience.

Understand the Comprehensive Research Approach Combining Primary Expert Interviews, Rigorous Secondary Data, and Multi-Layered Validation Techniques

This research combined a multi-phase methodology to ensure robust and actionable insights. Initially, secondary research involved an exhaustive review of industry publications, trade journals, regulatory filings, and company press releases to map the competitive landscape and identify prevailing technological trends. Publicly available trade data and tariff schedules were analyzed to quantify cost impacts and sourcing shifts driven by recent policy changes.

Subsequently, primary research was conducted through structured interviews with over two dozen senior executives, robotic system integrators, plant managers, and policy advisors. These qualitative discussions provided nuanced perspectives on implementation challenges, ROI considerations, and strategic priorities, enriching the contextual understanding of market dynamics.

Quantitative validation was achieved through a triangulation process, cross-referencing interview findings with supplier revenue data, installation volumes, and regional adoption metrics. A detailed segmentation framework was applied to categorize insights by component, robot type, automation level, application, and end user, ensuring that conclusions could be tailored to specific operational contexts.

Finally, an expert panel comprising robotics technologists, supply chain strategists, and food safety specialists reviewed draft insights, offering critical feedback on assumptions, risk factors, and emergent opportunities. This rigorous, layered approach underpins the credibility and relevance of the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food & Beverage Robotic System Integration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food & Beverage Robotic System Integration Market, by Component

- Food & Beverage Robotic System Integration Market, by Robot Type

- Food & Beverage Robotic System Integration Market, by Automation Level

- Food & Beverage Robotic System Integration Market, by Application

- Food & Beverage Robotic System Integration Market, by End User

- Food & Beverage Robotic System Integration Market, by Region

- Food & Beverage Robotic System Integration Market, by Group

- Food & Beverage Robotic System Integration Market, by Country

- United States Food & Beverage Robotic System Integration Market

- China Food & Beverage Robotic System Integration Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesize Key Takeaways on Robotics Integration Trends, Policy Impacts, and Market Opportunities to Inform Strategic Decision-Making in F&B Automation

The analysis reveals that food and beverage manufacturers must prioritize automation as a key enabler for overcoming labor shortages and meeting stringent safety requirements. Technological advances in AI, vision systems, and collaborative robots are now mature enough to deliver measurable gains in throughput, quality, and cost efficiency. However, emerging trade tariffs in 2025 have underscored the importance of supply chain diversification and domestic manufacturing partnerships to mitigate short-term price volatility and project delays.

Segmentation insights highlight that tailored robotic solutions-whether high-speed delta robots for precise sorting or hygienic articulated arms for wet processing-are essential to maximize ROI and align with end-user needs across e-commerce, manufacturing, restaurant, and retail environments. Regional patterns show that while North America and Europe emphasize digital twin-enabled predictive maintenance, Asia-Pacific is accelerating large-scale deployments via government-backed automation incentives.

Leading OEMs and integrators are responding by embedding analytics and control software into hardware platforms, creating end-to-end systems that enable real-time performance monitoring and rapid reconfiguration. To capture these advances, organizations should blend modular implementation, workforce upskilling, and policy engagement, thus positioning themselves to capitalize on the sustained momentum of robotics integration in food and beverage operations.

Connect with Ketan Rohom to Secure Your In-Depth Market Research Report and Propel Your Food and Beverage Robotics Strategy Forward Today

Empower your organization with comprehensive insights tailored to the unique challenges and opportunities of food and beverage robotic systems. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to request a personalized consultation and secure access to a detailed market research report offering in-depth analysis, case studies, and strategic roadmaps designed to elevate your automation initiatives. Start the conversation today to transform your robotics strategy and stay ahead of industry evolution.

- How big is the Food & Beverage Robotic System Integration Market?

- What is the Food & Beverage Robotic System Integration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?