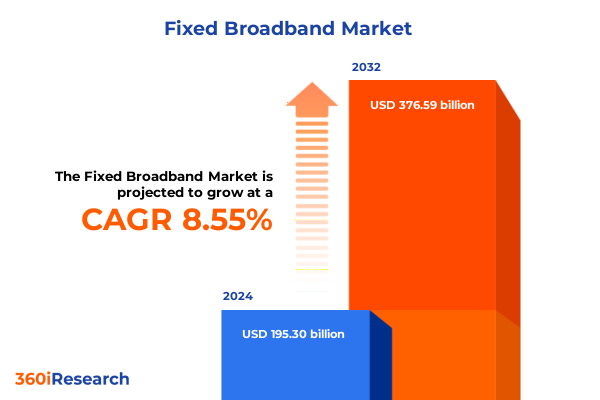

The Fixed Broadband Market size was estimated at USD 211.65 billion in 2025 and expected to reach USD 229.51 billion in 2026, at a CAGR of 8.57% to reach USD 376.59 billion by 2032.

Exploring the Critical Role of Fixed Broadband Connectivity in Powering Digital Economies, Enhancing User Experiences, and Enabling Innovation

In today’s hyperconnected world, fixed broadband has emerged as the backbone of digital transformation, enabling enterprises, public institutions, and residential users to harness the power of cloud services, streaming media, and real-time collaboration tools. As demand for high-capacity, low-latency connections accelerates, service providers are under growing pressure to expand network coverage, enhance reliability, and deliver differentiated service offerings. Consequently, fixed broadband has shifted from a mere utility to a strategic lever for economic growth, social inclusion, and technological innovation.

Moreover, the convergence of emerging technologies such as fiber optics, advanced compression algorithms, and next-generation network management platforms is redefining performance benchmarks, driving continuous investment in network upgrades. This evolution is underpinned by ambitious national broadband plans and regulatory frameworks aimed at bridging the digital divide, particularly in underserved urban and rural communities. As such, stakeholders across the telecommunications ecosystem-from infrastructure vendors to last-mile operators-are collaboratively working to ensure that fixed broadband infrastructure can meet and exceed the escalating requirements of businesses, educational institutions, and consumers.

Furthermore, consumer expectations have evolved beyond mere connectivity, with quality of experience becoming a critical differentiator. Service providers are now focusing on end-to-end service level agreements, transparent pricing models, and user-friendly support interfaces to foster loyalty and reduce churn. Looking ahead, the integration of fixed broadband with complementary solutions such as fixed wireless access and edge computing promises to unlock new revenue streams and enhance resilience against network disruptions. As these trends gather momentum, it becomes imperative for decision-makers to understand the multifaceted role that fixed broadband plays in powering digital economies and facilitating next-generation applications.

Unveiling the Paradigm Shifts Reshaping the Fixed Broadband Landscape Through Technological Advancements, Consumer Behavior Changes, and Regulatory Evolution

The fixed broadband landscape is undergoing transformative shifts driven by rapid technological advancements, evolving consumer behaviors, and dynamic regulatory frameworks. One of the most significant shifts is the accelerated deployment of fiber-to-the-home (FTTH) and fiber-to-the-node (FTTN) infrastructures, which offer gigabit-level speeds and unparalleled reliability compared to legacy copper-based networks. This fiber revolution is being bolstered by advancements in passive optical network (PON) technologies, which improve bandwidth efficiency and reduce operational costs for service providers.

In parallel, fixed wireless access (FWA) solutions powered by 5G New Radio (NR) standards are emerging as viable complements or alternatives to wired networks, particularly in areas where fiber rollout is economically challenging. The rise of FWA has been catalyzed by spectrum allocations in mid-band and millimeter-wave frequencies, enabling operators to deliver multi-hundred-megabit services without incurring the extensive civil works associated with fiber installation. These developments are reshaping network deployment strategies and prompting service providers to adopt hybrid architectures that blend wired and wireless technologies to optimize coverage and capacity.

Regulatory evolution is another key driver of change, as governments and communication authorities introduce policies to accelerate broadband access, manage spectrum resources, and ensure competitive market dynamics. Incentive programs, public–private partnerships, and digital inclusion mandates are encouraging providers to extend services to rural and low-income segments. Meanwhile, consumer preferences are increasingly gravitating towards bundled solutions that integrate high-speed broadband with IPTV, home automation, and cybersecurity services. Taken together, these forces are converging to create a more resilient, customer-centric, and future-ready fixed broadband ecosystem.

Assessing the Cumulative Consequences of United States Tariff Policies on Fixed Broadband Supply Chains, Cost Structures, and Deployment Strategies in 2025

A pivotal factor influencing the fixed broadband sector’s cost structure and strategic planning in 2025 is the continuation of United States tariff policies on imported telecommunications equipment. Since the introduction of Section 301 measures, a broad range of network hardware, optical transceivers, and active electronic components have been subject to additional duties, elevating the total landed cost of network deployments. These tariffs have compelled service providers and infrastructure vendors to reassess sourcing strategies, diversify supplier portfolios, and, in some cases, accelerate investments in domestic manufacturing capabilities.

Additionally, the uncertainty surrounding potential tariff adjustments has introduced planning challenges for capital expenditures. Procurement cycles, which traditionally extended over multiple quarters, now require more agile decision-making to hedge against sudden cost escalations. Service providers are increasingly engaging in forward contracts and strategic inventory holds to mitigate risks, while vendors are exploring localized assembly partnerships to reduce tariff exposure. This strategic recalibration has significant implications for project timelines and network rollout schedules, particularly for large-scale fiber expansion initiatives.

Moreover, the cumulative impact of these policies extends to end users, as incremental cost pressures can translate into revised pricing models or reduced incentives for service upgrades. In response, providers are focusing on value-added service bundles, loyalty programs, and tier-based pricing schemes to maintain competitive positioning without compromising profitability. Looking ahead, the anticipated policy reviews in late 2025 could usher in revised duty structures or exemptions for critical network equipment, potentially easing cost burdens and reinvigorating capital investment cycles across the fixed broadband sector.

Revealing In-Depth Segmentation Insights Across Connection Types, Speed Categories, Technology Variants, and Diverse End User Profiles to Inform Strategic Planning

The fixed broadband market can be understood more comprehensively by examining its segmentation across connection types, speed ranges, technology variants, and end user profiles. In terms of connection type, the landscape is dominated by cable internet, which leverages hybrid fiber–coaxial networks to deliver reliable broadband to urban and suburban areas, while digital subscriber line (DSL) remains a vital solution in regions where infrastructure upgrades are still in progress. Fiber optics continues to gain traction, offering unparalleled speed and capacity that caters to both consumer and enterprise applications.

Speed range is another critical dimension, encompassing tiers from less than 25 Mbps to more than 300 Mbps. Lower-speed tiers typically serve residential users with basic browsing needs, whereas mid-range performance between 25 Mbps and 100 Mbps supports video streaming and remote work applications. The 101 Mbps to 300 Mbps segment has emerged as the sweet spot for households demanding high-definition content and small-scale business operations. More than 300 Mbps speeds are increasingly sought by power users, large enterprises, and institutions requiring robust data throughput for cloud computing and telepresence environments.

When considering technology variants, fiber-to-the-building (FTTB) and fiber-to-the-node solutions offer gradual enhancements over legacy copper systems, addressing last-mile constraints without the full scope of fiber-to-the-home implementation. Fiber-to-the-home (FTTH) is the most future-proof architecture, delivering symmetrical gigabit speeds and minimal latency. Fiber-to-the-node deployments, in contrast, provide a cost-effective means to upgrade existing networks by reducing the copper distance.

End user profiles further refine market insights by delineating residential usage from commercial, educational, and government sectors. Commercial users are bifurcated into large enterprises, which demand enterprise-grade service level agreements, and small and medium enterprises that balance cost efficiency with dependable connectivity. Educational institutions require secure, scalable networks to facilitate distance learning and campus-wide digital services. Government and public sector entities prioritize network resilience, cybersecurity, and compliance with regulatory standards. Residential users seek competitive pricing, service bundles, and intuitive customer support experiences.

This comprehensive research report categorizes the Fixed Broadband market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connection Type

- Speed Range

- Technology

- Fiber Access Technology

- Application

- End Users

Highlighting Key Regional Perspectives on Broadband Adoption, Infrastructure Investment Trends, and Policy Frameworks Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping fixed broadband strategies, as varying economic conditions, regulatory landscapes, and infrastructure maturity define the investment priorities and service offerings within each geography. In the Americas, broadband adoption has been propelled by expansive fiber rollout initiatives in metropolitan areas and targeted government programs to bridge the rural digital divide. Service providers in North America are leading with multi-gigabit residential packages, while Latin American markets are focusing on affordability and scalable DSL enhancements to broaden internet penetration.

Europe, the Middle East, and Africa present a heterogeneous picture. Western Europe benefits from high household penetration rates and aggressive fiber-to-the-home deployments driven by competitive markets and supportive regulatory frameworks. In contrast, Eastern European nations are in the midst of network modernization programs that emphasize last-mile upgrades and public–private partnerships. The Middle East shows robust growth fueled by smart city projects and diversified telecommunications portfolios, whereas Africa is experiencing rapid expansion through wireless broadband solutions that compensate for the high costs of wired infrastructure deployment.

Asia-Pacific stands out as a dynamic region with both mature and emerging markets. Developed economies such as Japan, South Korea, and Australia excel in delivering ultra-high-speed optical networks, with ongoing trials of terabit-capable PON technologies. Meanwhile, emerging markets like India and Southeast Asia are witnessing exponential subscriber growth, driven by aggressive fiber expansion, competitive pricing, and strategic alliances between global vendors and local operators. These regional disparities underscore the importance of tailored deployment strategies and regulatory engagement to capitalize on market-specific opportunities.

This comprehensive research report examines key regions that drive the evolution of the Fixed Broadband market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players, Strategic Partnerships, and Innovation Initiatives That Are Driving Growth and Differentiation in the Fixed Broadband Sector

In the competitive theater of fixed broadband, leading service providers and equipment vendors are differentiating themselves through strategic alliances, innovation pipelines, and customer-centric offerings. Major network operators are forging partnerships with over-the-top content providers to bundle streaming services with broadband subscriptions, thereby enhancing customer retention and average revenue per user metrics. At the same time, equipment manufacturers are investing in research and development to introduce modular, scalable network elements that streamline upgrades and reduce total cost of ownership.

Emerging players are disrupting traditional models by focusing on niche markets, such as specialized enterprise connectivity solutions for industries like healthcare, manufacturing, and finance, which demand stringent security and uptime guarantees. These companies are leveraging software-defined networking and network function virtualization to offer dynamic bandwidth allocation and rapid service provisioning. Meanwhile, established vendors are expanding their global footprint through joint ventures and localized manufacturing partnerships to mitigate supply chain risks and comply with region-specific regulatory requirements.

Innovation initiatives are also gaining momentum, particularly in the realms of network automation, predictive maintenance, and customer experience optimization. Artificial intelligence and machine learning algorithms are being embedded into operations support systems to analyze real-time network performance data, anticipate faults, and trigger preemptive actions. This proactive approach to network management not only reduces service interruptions but also optimizes resource utilization. Taken together, these strategic maneuvers are accelerating market growth and redefining competitive benchmarks in the fixed broadband sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fixed Broadband market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- América Móvil, S.A.B. de C.V.

- AT&T Inc.

- BCE Inc.

- Bharti Airtel Limited

- British Telecommunications plc

- Charter Communications, Inc.

- China Telecom Corporation Limited

- China Unicom (Hong Kong) Limited

- Cisco Systems, Inc.

- Comcast Corporation

- Deutsche Telekom AG

- Huawei Technologies Co., Ltd.

- Illiad S.A.

- Koninklijke KPN N.V.

- Liberty Global plc

- Lynham Networks Pty Ltd

- Nippon Telegraph and Telephone Corporation

- Nokia Corporation

- Orange S.A.

- PLDT Inc.

- Reliance Jio Infocomm. Ltd.

- Rogers Communications Inc.

- Saudi Telecom Company

- SK Telecom Co., Ltd.

- Swisscom AG

- Telefonica, S.A.

- Telenor ASA

- Telstra Group Limited

- TELUS Corporation

- TPG Telecom Limited

- Verizon Communications Inc.

- Vodafone Goup PLC

Delivering Actionable Recommendations for Industry Leaders to Navigate Competitive Challenges, Harness Emerging Technologies, and Optimize Network Investments

Industry leaders seeking to maintain a competitive edge should prioritize multi-pronged investment strategies that address both network performance and customer value propositions. First, accelerating fiber-to-the-home deployments in high-demand corridors can establish a foundation for premium service tiers and future-proof network architectures. Service providers are advised to collaborate with local municipalities to streamline permitting processes and leverage cost-sharing models for civil works, thereby reducing deployment timelines and capital expenditures.

Second, diversifying equipment sourcing and adopting modular network components can mitigate the financial impact of trade policies and supply chain disruptions. Providers should evaluate alternative suppliers and explore strategic inventory management practices, such as vendor-managed stock and framework agreements, to ensure continuous access to critical hardware. In addition, integrating fixed wireless access solutions into last-mile strategies can offer flexible capacity expansions in underserved or geographically challenging areas without the need for extensive trenching.

Third, embracing network automation and AI-driven operations support tools will be essential for sustaining high service quality amid growing traffic loads and complexity. By implementing predictive analytics to monitor network health, providers can shift from reactive maintenance to proactive optimization, reducing downtime and operational costs. Concurrently, packaging differentiated service bundles with security, cloud backup, and managed Wi-Fi offerings will help cultivate long-term customer loyalty and enhance revenue diversification.

Finally, industry leaders should cultivate an innovation culture that encourages cross-industry partnerships, pilot programs for emerging technologies like terabit PON, and continual skill development within their workforce. These actionable measures will empower organizations to navigate competitive pressures, harness new growth avenues, and optimize network investments in an ever-evolving fixed broadband landscape.

Outlining Rigorous Research Methodology Employing Primary Expert Interviews, Secondary Data Triangulation, and Comprehensive Competitive Benchmarking Approaches

The research methodology underpinning this report integrates rigorous qualitative and quantitative approaches to ensure the highest standards of accuracy and reliability. Primary research was conducted through in-depth interviews with senior executives and technical experts from service providers, equipment manufacturers, and regulatory bodies, capturing firsthand perspectives on emerging trends, strategic priorities, and operational challenges. These discussions provided nuanced insights into investment rationales, deployment roadmaps, and competitive dynamics.

Secondary research involved systematic analysis of industry publications, regulatory filings, corporate presentations, and peer-reviewed studies to validate and enrich the primary findings. Data triangulation techniques were employed to reconcile discrepancies between sources, ensuring consistency across market segmentation, regional assessments, and technology evaluations. In addition, comprehensive competitive benchmarking was performed by mapping key players’ portfolios, partnership networks, and innovation trajectories to identify differentiators and potential gaps.

Proprietary databases and analytical frameworks supported the evaluation of tariff impacts, cost structures, and supplier ecosystems. This multistage validation process included scenario analyses to test the resilience of strategic assumptions under various policy and market conditions. Quality assurance was maintained through iterative peer reviews and editorial oversight, guaranteeing that the final insights are robust, actionable, and aligned with the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fixed Broadband market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fixed Broadband Market, by Connection Type

- Fixed Broadband Market, by Speed Range

- Fixed Broadband Market, by Technology

- Fixed Broadband Market, by Fiber Access Technology

- Fixed Broadband Market, by Application

- Fixed Broadband Market, by End Users

- Fixed Broadband Market, by Region

- Fixed Broadband Market, by Group

- Fixed Broadband Market, by Country

- United States Fixed Broadband Market

- China Fixed Broadband Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing the Strategic Imperatives of the Fixed Broadband Sector with Emphasis on Investment Priorities, Innovation Trajectories, and Market Dynamics

In summary, fixed broadband remains a cornerstone of digital infrastructure, driving economic productivity, social connectivity, and technological innovation across diverse end user segments. Strategic imperatives for stakeholders include prioritizing fiber expansion in key markets, balancing supply chain resilience amid evolving tariff landscapes, and leveraging advanced network management tools to optimize performance. Moreover, nuanced segmentation analyses highlight the distinct requirements of connection types, speed tiers, technology architectures, and user profiles, underscoring the need for tailored service offerings and pricing strategies.

Regional insights illuminate the heterogeneous nature of broadband deployment, from the mature fiber markets of Western Europe and developed Asia-Pacific to the burgeoning demand in the Americas and emerging wireless-led initiatives in Africa. Competitive intelligence underscores the importance of strategic partnerships, modular network designs, and innovation-driven differentiation to navigate market complexities. As the market evolves, actionable recommendations emphasize cross-sector collaboration, agile investment approaches, and sustained emphasis on customer experience enhancement.

Ultimately, industry players that embrace these imperatives and align their strategies with the latest technological advancements, regulatory shifts, and consumer expectations will be best positioned to capture growth opportunities and deliver superior value in the dynamic fixed broadband sector.

Empowering You to Take the Next Step by Connecting with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Copy of the Market Research Report

To unlock the full potential of your organization’s fixed broadband strategies and gain unparalleled clarity on market dynamics, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report. His expertise will guide you through tailored insights on deployment priorities, supply chain resilience, and competitive positioning to ensure your investment decisions are grounded in the latest industry intelligence. Connect with Ketan Rohom today to initiate your journey toward data-driven growth and operational excellence.

- How big is the Fixed Broadband Market?

- What is the Fixed Broadband Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?