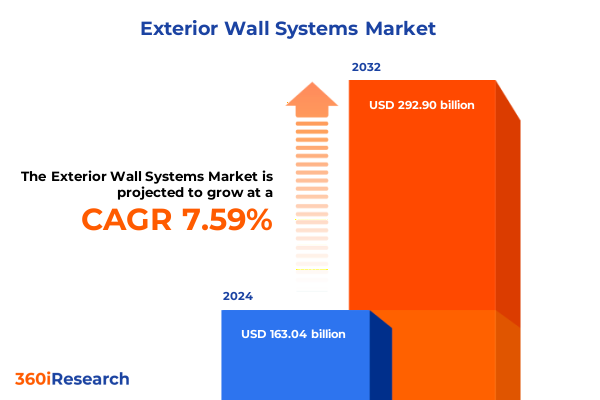

The Exterior Wall Systems Market size was estimated at USD 174.59 billion in 2025 and expected to reach USD 186.95 billion in 2026, at a CAGR of 7.67% to reach USD 292.90 billion by 2032.

Setting the Stage for Evolving Exterior Wall System Dynamics Amid Rising Demand for Resilient Construction Practices Innovative Architectural Expression

The exterior wall system sector stands at the intersection of architectural ambition and performance-driven engineering, responding to an array of environmental, aesthetic, and regulatory imperatives. Over the past decade, rising expectations for sustainability, energy efficiency, and resilience against extreme weather events have redefined the criteria for façade solutions. As a result, designers and building owners are demanding systems that not only meet stringent thermal and structural standards but also provide design flexibility and long-term durability. Consequently, manufacturers and suppliers are accelerating innovation in material science, digital integration, and modular construction approaches to address these evolving requirements.

Amidst this transformation, the regulatory environment has become an equally pivotal force. Increased stringency in building codes, particularly regarding thermal performance and hurricane and seismic resilience, has driven the adoption of ventilated wall systems and advanced composite materials. Furthermore, decarbonization targets at both national and municipal levels are incentivizing low-carbon manufacturing processes and material sourcing, prompting stakeholders to evaluate life-cycle impacts more rigorously. As we embark on this executive summary, it is essential to recognize how these intertwined drivers are reshaping the competitive landscape and setting new benchmarks for product performance and sustainability.

Looking ahead, this analysis elucidates the critical inflection points and strategic considerations that executives must navigate to capitalize on growth opportunities. From technological breakthroughs and supply chain realignments to nuanced segmentation insights, the following sections distill the vital intelligence needed to guide investment, product development, and market entry strategies in the dynamic exterior wall systems domain.

Unveiling Pivotal Transformations Shaping the Exterior Wall System Landscape from Digital Design Integration to a Sustainable Material Revolution

The exterior wall system landscape is being redefined by a convergence of digital innovation, material evolution, and performance-driven design philosophies. Digital design tools and building information modeling have enabled seamless collaboration between architects, engineers, and fabricators, accelerating the prototyping and customization of complex façade geometries. This digital transformation has also underpinned the growth of prefabrication strategies, where entire wall modules are assembled off-site under controlled conditions, enhancing quality assurance while reducing on-site labor and waste.

Concurrently, sustainability imperatives have spurred the development of bio-based materials, recycled composites, and low-carbon concrete alternatives for curtain walls and cladding panels. As more jurisdictions mandate embodied carbon reporting, manufacturers are exploring novel formulations that balance structural integrity, thermal insulation, and environmental stewardship. Rather than viewing these requirements as constraints, leading suppliers are leveraging them to differentiate through transparent supply chains and third-party certifications, thereby aligning with corporate ESG commitments.

Moreover, climate resilience has emerged as a core design criterion, driving the adoption of ventilated wall systems and impact-resistant glazing in hurricane-prone and seismic regions. Innovations in advanced connectors, pressure equalization techniques, and continuous insulation layers have significantly improved building envelope performance under extreme conditions. Consequently, what began as niche applications in high-risk zones is now informing mainstream product roadmaps across diverse markets, setting new performance benchmarks and redefining customer expectations.

Exploring How United States Tariff Measures in 2025 Are Reshaping Supply Chains Material Costs and Strategic Sourcing in Exterior Wall Systems

The cumulative effect of United States tariff measures implemented in early 2025 has sent reverberations through the global supply chain for exterior wall systems. Tariffs on imported aluminum and steel - foundational materials for curtain wall framing and composite panels - have introduced an average cost increase in raw material procurement. Consequently, manufacturers reliant on foreign extrusions and sheet stock have experienced margin compression, prompting a reassessment of supplier portfolios and inventory strategies to mitigate volatility.

In response to these elevated duties, many supply chain stakeholders have shifted toward domestic mills and authorized recyclers whose value propositions now resonate more strongly on the basis of reliability and lead-time certainty. While this pivot has alleviated some tariff-related pressures, capacity constraints in domestic processing have occasionally produced bottlenecks, underscoring the need for expanded local fabrication capabilities. At the same time, some suppliers have reengineered product formulations to reduce the quantity of tariff-exposed metals or to substitute higher-duty materials with alternative composites and engineered polymers.

Furthermore, these tariff dynamics have accelerated collaborative efforts between suppliers and multinational contractors to pursue duty mitigation strategies through bonded warehousing and tariff classification reviews. Although these workarounds offer temporary relief, industry participants must monitor ongoing negotiations and potential policy extensions closely. As such, strategic sourcing and supply chain resilience have become paramount considerations for firms seeking to maintain competitiveness in an environment characterized by evolving trade policies and cost headwinds.

Diving into Critical Segmentation Layers That Define Exterior Wall System Adoption across Type Material Application and Construction Stage Dynamics

The exterior wall system market is dissected into core system types encompassing curtain wall assemblies as well as both non-ventilated and ventilated cladding solutions, each presenting distinct performance and design profiles. By overlaying these system types with an extensive range of material categories - from traditional brick and stone veneers and ceramic tile wraps to advanced exterior insulation and finish systems, high-pressure laminate panels, and glass-reinforced concrete formulations - stakeholders gain nuanced insight into product positioning and competitive differentiation. Furthermore, a diverse spectrum of glass panel, metal panel, fiber cement, fiberglass panel, gypsum or plasterboard, vinyl, and wood options underscores the market’s material complexity and the imperative for specialized installation expertise.

Equally critical is the application context, spanning commercial edifices - including office buildings and retail spaces - through industrial facilities like factories and warehouses, to institutional campuses and residential developments differentiated by high-rise and low-rise typologies. Each end-use segment imposes varied requirements for structural load, fire resistance, acoustic attenuation, and thermal performance. In addition to performance metrics, the choice between new construction and renovation or retrofitting scenarios further refines the competitive landscape. New projects often prioritize integration with emerging digital construction workflows, while renovation efforts emphasize compatibility with existing structural substrates and minimal on-site disruption.

This integrative segmentation framework illuminates the intersections of system type, material composition, application environment, and project phase, offering executives a comprehensive lens through which to evaluate product development priorities, go-to-market strategies, and investment prospects across the exterior wall system ecosystem.

This comprehensive research report categorizes the Exterior Wall Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Application

- Construction Stage

Examining Regional Market Drivers across the Americas Europe Middle East Africa and Asia-Pacific Influencing Exterior Wall System Preferences and Regulations

Regional dynamics in the exterior wall system industry are profoundly influenced by localized regulatory standards, climatic imperatives, and construction market maturity. In the Americas, stringent energy codes in North America have catalyzed widespread adoption of high-performance insulated cladding systems and ventilated façades, whereas Latin American markets continue to prioritize cost-effective solutions that balance thermal comfort with durability in tropical climates. Advanced manufacturing hubs in the United States and Canada also facilitate innovation partnerships focused on sustainable material development and digital fabrication.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts such as the European Union’s Energy Performance of Buildings Directive are driving consistent upwards trajectories in insulation performance and embodied carbon reduction. At the same time, Gulf-region projects emphasize resilience against extreme temperatures and sand impact, leading to growth in impact-resistant glazing and specialized metal panel coatings. In sub-Saharan and North African markets, infrastructure expansions are creating nascent opportunities for prefabricated wall modules designed to expedite project delivery.

Meanwhile, Asia-Pacific markets present a dynamic spectrum from highly regulated metropolitan centers to rapidly urbanizing areas. In Japan and Australia, seismic performance requirements and sustainability certifications shape system specifications, while Southeast Asian megacities demand cost-competitive, weather-resilient envelope solutions. China’s shifting environmental policies are fueling local innovations in low-carbon façade materials, and India’s infrastructure growth agenda is accelerating the adaptation of modern cladding technologies. This regional mosaic underscores the strategic need for diversified product portfolios and tailored market-entry approaches to capture distinct growth drivers and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Exterior Wall Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Exterior Wall System Suppliers Highlighting Strategic Innovations Partnerships and Competitive Differentiators Driving Market Leadership

Leading providers of exterior wall systems are distinguished by their integrated capabilities in materials science, design customization, and end-to-end project support. Some market frontrunners have leveraged proprietary framing technologies and advanced thermal break solutions to set new benchmarks in energy performance, while others have emphasized modular prefabrication, offering plug-and-play façade panels that streamline installation timelines and reduce labor costs. A growing cohort of manufacturers has also deepened their service offerings by investing in digital platforms that facilitate real-time project tracking, quality assurance, and lifecycle maintenance planning.

Strategic partnerships between material innovators and architectural firms are yielding co-developed systems that align with avant-garde design narratives and sustainability mandates. Concurrently, several companies have expanded their geographic footprints through acquisitions of regional fabricators, thereby enhancing local responsiveness and regulatory compliance in target markets. Amid intensifying competitive pressures, R&D investment has increasingly focused on the intersection of smart façade technologies, such as integrated photovoltaics and responsive shading elements, and traditional cladding substrates.

As competition intensifies, the ability to translate technical differentiation into compelling total cost of ownership propositions is proving essential. Consequently, these leading firms are augmenting their product portfolios with performance warranties, energy modeling services, and embodied carbon transparency tools to address evolving customer expectations and regulatory scrutiny. Their collective trajectory underscores the industry’s pivot from transactional product sales toward consultative, lifecycle-oriented engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exterior Wall Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites GmbH by Schweiter Technologies AG

- AGC Inc.

- Alcoa Corporation LLC

- AluK S.A.

- Alumak Glazing Facade System

- Aparna Craft Exteriors Pvt Ltd

- China Leiyuan Architectural Terracotta Facade Company

- Compagnie de Saint-Gobain S.A.

- Cornerstone Building Brands, Inc.

- CRH PLC

- Delby PVC Panels

- Etex NV

- Fletcher Building Limited

- Foshan Keenhai Metal Products Co., Ltd.

- Glass Wall Systems (I) Pvt Ltd.

- HVG Facades Pty Ltd.

- James Hardie Building Products Inc.

- KIKUKAWA KOGYO CO., LTD.

- Kingspan Group

- Knauf Group

- Konoshima Chemical Co.,Ltd.

- Linyi Chuangsheng Wood Co., Ltd.

- Luoyang North Glass Technology Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- NOZAWA Corporation

- Olam Clad

- Palram Industries Ltd.

- Qingdao REXI Industries Co.,Ltd

- ROCKWOOL A/S

- RPM International Inc.

- Shanghai Metal Corporation

- Shanghai Unifloor New Material Co., Ltd.

- Shenyang Yuanda Aluminium Industry Engineering Co., Ltd.

- Shenyang Yuanda Enterprise Group

- Sika AG

- Sto SE & Co. KGaA

- Toray Industries, Inc.

Actionable Strategies for Industry Stakeholders to Enhance Supply Resilience Minimize Risks and Capitalize on Emerging Exterior Wall System Opportunities

Industry leaders should prioritize the diversification of raw material sources and strengthen domestic fabrication networks to mitigate the risks posed by tariff fluctuations and supply-chain disruptions. By proactively forging alliances with local extrusion and composite producers, companies can secure more stable lead times and enhance responsiveness to project schedules. Equally, investing in advanced manufacturing techniques - including robotic assembly and additive layering for complex panel geometries - will yield both quality gains and cost efficiencies.

Furthermore, integrating sustainability criteria into the core product development process will unlock differentiation in an increasingly ESG-conscious market. Leaders should advance the use of recycled content, low-carbon binders, and third-party certifications to substantiate environmental claims and meet the demands of progressive building codes. Simultaneously, embedding digital twins and Internet of Things sensors within façade systems offers the promise of proactive maintenance, energy optimization, and valuable performance analytics that can be monetized as premium services.

Finally, a segmented go-to-market approach is essential to navigate the diverse requirements of commercial, industrial, institutional, and residential segments across both new-build and renovation contexts. Tailored specification guides, combined with localized training programs for contractors and architects, will foster deeper market penetration and reinforce brand authority. Through these concerted actions, industry participants can transform current challenges into competitive advantages and chart a path to sustainable growth in the evolving exterior wall system arena.

Illuminating the Rigorous Research Methodology Underpinning Insights from Expert Interviews Through Comprehensive Secondary Data Triangulation

This research employs a hybrid methodology combining rigorous secondary data analysis with targeted primary research to ensure a comprehensive and balanced perspective. Secondary sources included regulatory documents, sustainability guidelines, and technical standards from authoritative bodies such as the International Code Council, ASTM International, and leading building energy certification programs. Published industry white papers, trade publications, and academic journals were systematically reviewed to benchmark emerging materials and performance innovations.

Complementing secondary insights, primary research comprised in-depth interviews with architects, façade engineers, project developers, and procurement executives across North America, Europe, and Asia-Pacific. These qualitative discussions probed strategic priorities, pain points, and adoption drivers for advanced exterior wall systems. In parallel, quantitative surveys of manufacturer and installer networks provided statistical grounding for material preference trends and project type distributions without revealing proprietary data or market forecasts.

Data triangulation was achieved by cross-referencing interview feedback with observed project specifications and regulatory requirements, ensuring the credibility of conclusions. This structured approach underpinned the generation of segmentation frameworks, regional analyses, and competitive profiling presented herein, delivering a validated intelligence foundation for strategic decision-making in the exterior wall systems market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exterior Wall Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exterior Wall Systems Market, by Type

- Exterior Wall Systems Market, by Material Type

- Exterior Wall Systems Market, by Application

- Exterior Wall Systems Market, by Construction Stage

- Exterior Wall Systems Market, by Region

- Exterior Wall Systems Market, by Group

- Exterior Wall Systems Market, by Country

- United States Exterior Wall Systems Market

- China Exterior Wall Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights on the Converging Forces Redefining Exterior Wall Systems Emphasizing Adaptation Speed and Innovation Imperatives

In an era defined by sustainability imperatives and resilient design mandates, exterior wall systems have evolved from commoditized façade treatments into central pillars of building performance and architectural identity. The convergence of advanced digital tools, material innovations, and evolving regulatory landscapes is reshaping stakeholder expectations and redefining value propositions. As tariff-induced cost pressures continue to realign supply chains, the ability to adapt through strategic sourcing and manufacturing flexibility has become essential for maintaining competitiveness.

Segmentation nuances - from system type and material composition to application context and construction stage - offer a rich tapestry of market opportunities for those armed with granular insights. Regional disparities in code stringency and climate challenges underscore the importance of market-specific strategies and locally attuned product offerings. Concurrently, the competitive arena is characterized by firms that translate technical differentiation into comprehensive service models, emphasizing total cost of ownership, lifecycle performance, and digital-enabled maintenance solutions.

Ultimately, the organizations that will succeed are those that integrate sustainability at the core of their innovation pipelines, harness digitalization to enhance transparency and operational efficiency, and cultivate resilient supply chains to navigate policy shifts. As such, the frontiers of exterior wall system development lie not only in material and design breakthroughs but also in forging strategic partnerships and embedding value-added services that anticipate the building industry’s evolving needs.

Secure Exclusive Access to In-Depth Exterior Wall Systems Intelligence by Contacting Associate Director of Sales and Marketing Ketan Rohom Today

To explore the full breadth of detailed analysis on exterior wall systems, we invite you to connect directly with Associate Director of Sales & Marketing Ketan Rohom to secure your copy of the complete research report. With unrivaled insights into market dynamics, regulatory impacts, segmentation strategies, and company benchmarking, this study provides the strategic intelligence required to inform your decision-making and stay ahead of evolving architectural and sustainability trends. Engage with our team today to discuss tailored licensing options and gain immediate access to comprehensive data, expert interpretation, and forward-looking recommendations that will empower your organization’s competitive positioning in the global exterior wall systems arena.

- How big is the Exterior Wall Systems Market?

- What is the Exterior Wall Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?