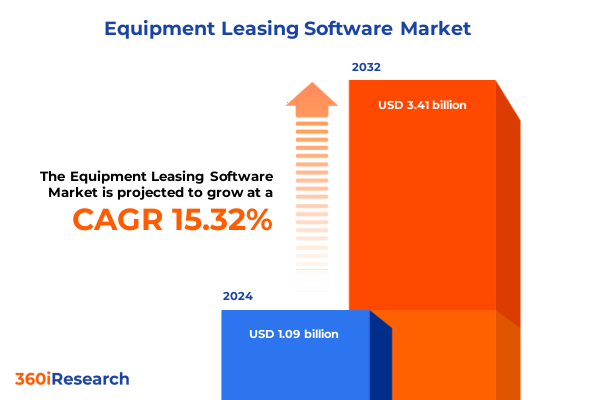

The Equipment Leasing Software Market size was estimated at USD 1.24 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 15.44% to reach USD 3.41 billion by 2032.

Setting the Stage for an Era of Streamlined and Transformative Asset Management Fueled by Intelligent Equipment Leasing Software Solutions

The adoption of specialized equipment leasing software has become a cornerstone of modern asset management strategies, transcending traditional manual processes to deliver heightened efficiency and precision. In an environment characterized by volatile capital costs, complex regulatory requirements, and increasingly sophisticated financing structures, organizations are compelled to deploy integrated platforms capable of orchestrating end-to-end lease lifecycles. This executive summary distills critical insights that illuminate how these digital solutions are reshaping operational paradigms across diverse industries, setting the foundation for informed decision-making at the executive level.

As businesses navigate the convergence of digital transformation initiatives and evolving financial landscapes, the role of equipment leasing software has expanded well beyond basic record-keeping. Advanced functionalities-ranging from automated invoice workflows to dynamic document generation and originations management-have become essential to maintain compliance, enhance transparency, and optimize capital deployment. This introduction lays out the strategic imperative for adopting these intelligent platforms and underscores the transformative potential they hold in driving sustained competitive advantage.

Navigating the Pivotal Shifts Redefining Equipment Leasing Software to Deliver Greater Agility, Enhanced Connectivity, and Data-Driven Decision Making

The equipment leasing software landscape is undergoing a profound metamorphosis, driven by a confluence of technological advancements and shifting market expectations. Cloud-enabled architectures now underpin seamless deployment models, enabling organizations to leverage scalable resources without heavy on-premises investments. Concurrently, the integration of artificial intelligence and machine learning is facilitating proactive risk assessment, predictive maintenance triggers, and real-time analytics, thereby elevating the strategic value of these platforms.

Interoperability has emerged as a non-negotiable standard, with open APIs and standardized data schemas ensuring frictionless connections to ERP systems, IoT telemetry feeds, and third-party financing partners. This integrated approach not only accelerates time-to-insight but also unlocks cross-functional collaboration between finance, operations, and asset management teams. As a result, businesses can orchestrate lease origination, document processing, and invoice reconciliation within a cohesive ecosystem, significantly reducing cycle times and minimizing manual errors.

Moreover, the shift toward user-centric design and mobile-first interfaces reflects a growing emphasis on accessibility and user adoption. Field technicians can now initiate lease applications, upload contract documents, and reconcile invoices directly from handheld devices, which in turn streamlines administrative workflows and enhances data accuracy. These transformative shifts collectively underscore how next-generation equipment leasing software is redefining operational excellence, delivering agility, scalability, and heightened decision support.

Examining the Multi-Layered Consequences of 2025 U.S. Tariff Adjustments on Equipment Leasing Software Supply Chains and Operational Dynamics

In 2025, the United States implemented a series of tariff modifications aimed at balancing domestic manufacturing interests with international trade commitments. While these adjustments were designed to bolster onshore production, they have produced ripple effects throughout the equipment leasing software ecosystem. Suppliers of hardware components essential for advanced telemetry and connectivity modules have faced increased import duties, leading to higher capital expenditure profiles for lessors evaluating equipment outfitting options.

Beyond hardware considerations, software vendors that rely on offshore development centers have encountered elevated operational costs, as cross-border service agreements are renegotiated to accommodate new tariff thresholds. These increased labor and service fees have, in turn, intensified the imperative for software platforms to deliver rapid automation of document workflows and invoice management, ensuring that finance teams can offset rising overhead through efficiency gains.

The cumulative impact extends to supply chain visibility and risk management practices. Heightened freight costs and customs clearance delays have underscored the need for advanced tracking and predictive analytics within leasing software to anticipate potential disruptions. By leveraging real-time alerts and scenario modeling, businesses can proactively adjust lease terms, negotiate revised delivery schedules, and maintain continuity in high-demand sectors.

Ultimately, the 2025 tariff landscape has catalyzed a renewed focus on strategic vendor diversification and nearshore development partnerships. Equipment leasing software providers are accelerating investments in regional data centers and cross-border compliance modules, enabling clients to mitigate the cost implications of tariff fluctuations while preserving global expansion strategies and ensuring robust service delivery.

Unveiling Strategic Segmentation Insights Across Deployment, Lease Types, Durations, Organizational Scales, Industries, and Core Functional Capabilities

When examining the equipment leasing software market through a functional lens, systems that specialize in streamlining invoice management have become indispensable for orchestrating complex billing schedules, automating reconciliation, and enforcing compliance workflows with minimal manual intervention. In parallel, lease application management modules are empowering teams to accelerate credit checks, underwrite contracts, and manage approval hierarchies through intuitive dashboards. Complementing these core capabilities, lease document management functionalities facilitate secure generation, storage, and retrieval of digitally signed agreements, while origination management frameworks seamlessly guide new equipment lease deals from initial inquiry to execution.

Deployment modalities play a pivotal role in tailoring solutions to organizational imperatives, with cloud-based platforms delivering continuous feature enhancements, elastic scalability, and reduced infrastructure overhead, while on-premises installations cater to enterprises with rigorous data residency requirements or legacy system integrations. This dichotomy enables businesses to align their technology strategy with internal governance policies and digital transformation roadmaps without sacrificing critical functionality or security standards.

Lease structures themselves introduce distinct operational nuances: capital leases demand precise accounting treatment and asset depreciation schedules, financial leases necessitate detailed interest calculations and cash flow forecasting, and operating leases require flexible term adjustments and maintenance scheduling. The duration of leasing arrangements further differentiates requirements, as long term lease agreements emphasize total cost of ownership analytics and periodic compliance audits, whereas short term lease contracts prioritize rapid onboarding, accelerated billing cycles, and dynamic fleet utilization insights.

Organizational scale and industry context also shape software priorities, with large enterprises often seeking enterprise-grade security, advanced reporting suites, and multi-entity consolidation capabilities, while small and medium enterprises favor modular, pay-as-you-use models that align with lean operating budgets. Across verticals such as agriculture, construction, energy & utilities, healthcare, IT & telecommunications, manufacturing, and transportation & logistics, specialized sub-modules-like construction machinery and heavy equipment workflows-ensure context-specific compliance checks, maintenance protocols, and utilization tracking that resonate with domain-specific operational challenges.

This comprehensive research report categorizes the Equipment Leasing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Deployment Type

- Lease Type

- Lease Duration

- Organization Size

- Industry Vertical

Distilling Critical Regional Patterns Shaping the Uptake of Equipment Leasing Software in the Americas, EMEA, and Asia-Pacific Landscape

The Americas region continues to dominate the early adoption curve for equipment leasing software, driven by robust investment in digital infrastructure, a mature financing landscape, and an established ecosystem of leasing specialists. In North America, the convergence of stringent revenue recognition standards and heightened demand for automated lease accounting has prompted swift migration to cloud-native platforms optimized for IFRS 16 and ASC 842 compliance. Meanwhile, Latin American markets are embracing simplified invoicing modules and multilingual document management to streamline cross-border equipment financing arrangements, overcoming historical barriers to transparency and scalability.

In Europe, Middle East, and Africa, regulatory harmonization and cross-jurisdictional trade agreements have catalyzed a surge in demand for configurable lease origination engines capable of adapting to disparate legal frameworks. European enterprises, in particular, are prioritizing data privacy and security certifications, driving preference for on-premises or private cloud deployments. Across the Middle East, infrastructure-led asset financing initiatives in energy and construction have spurred the integration of IoT-based maintenance and telemetry modules, fostering predictive service models. Sub-Saharan African markets, though at an earlier stage of digital maturity, are rapidly adopting mobile-first applications to facilitate lease approvals in remote regions.

Asia-Pacific exhibits a dynamic blend of nascent and advanced adoption patterns, with markets like Japan and Australia leading in comprehensive platform deployments, including advanced analytics and AI-driven credit scoring. China and India continue to scale rapidly, placing emphasis on cost-effective cloud subscriptions and modular buildouts tailored to high-volume, short-term leasing transactions. Southeast Asian economies are capitalizing on regional trade frameworks to integrate shared service centers, leveraging equipment leasing software to synchronize asset fleets across geographic hubs and reinforce competitive positioning in global supply chains.

This comprehensive research report examines key regions that drive the evolution of the Equipment Leasing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Software Providers Driving Innovation, Collaboration, and Competitive Differentiation in the Global Equipment Leasing Domain

Leading software vendors have distinguished themselves by offering end-to-end suites that encompass origination, document handling, invoice workflows, and analytics in a unified framework. These market frontrunners have leveraged strategic partnerships with cloud hyperscalers to deliver high-availability infrastructures complemented by pre-built connectors to enterprise resource planning and customer relationship management platforms. Their portfolios are characterized by robust security postures, real-time reporting dashboards, and modular architectures that accommodate rapid expansion into adjacent services such as contract lifecycle management and asset performance monitoring.

At the same time, specialized innovators have carved out niches by embedding artificial intelligence engines that automate credit risk assessments, detect anomalies in lease payment patterns, and recommend optimized equipment utilization strategies. These providers often deliver agile development cycles and configurable machine learning models, enabling clients to tailor predictive insights to distinct asset categories, from construction machinery to high-value medical devices. Investments in natural language processing have enhanced the extraction of contractual terms from legacy documents, significantly reducing time-to-value in document migration projects.

Additionally, collaborative ecosystems have emerged where software platforms integrate third-party marketplaces, enabling lessors and lessees to transact directly for equipment refurbishment, maintenance services, and secondary market sales. By fostering transparent, digitally mediated interactions, these platforms are redefining competitive differentiation and creating new revenue streams for both software providers and equipment owners. Together, these leading companies and specialized players are shaping an environment in which innovation, interoperability, and comprehensive support services are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Equipment Leasing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accruent, LLC

- Aptitude Software Limited

- Asset Panda, LLC

- Banyan Software, Inc.

- ChargeAfter, Inc.

- Codix SA

- Constellation Financial Software

- CSC Leasing Company

- CSI Leasing, Inc.

- Enrich Software Corp.

- FIT Global B.V.

- FMIS Ltd.

- iLease Management LLC

- KloudGin, Inc.

- LeaseAccelerator, Inc.

- Leasecake, Inc.

- LeaseCalcs, Inc.

- LeaseQuery, LLC

- LTi Technology Solutions

- Matellio Inc.

- MRI Software LLC

- Nakisa, Inc.

- NEC Corporation

- Netsol Technologies, Inc.

- Occupier, Inc.

- Odessa Technologies, Inc.

- Origa Lease Finance Pvt. Ltd.

- Q2 Software, Inc.

- Ryzn Enterprise Systems Inc.

- Siemens AG

- Soft4Leasing

- Solifi Group

- Sopra Steria Group SA

- Tata Capital Financial Services Limited

- Turnford Systems Inc.

- TurnKey Lender Inc.

- View the Space, Inc.

- Visual Lease, LLC

- Wolters Kluwer N.V.

- ZenTreasury Ltd.

Formulating Practical, Action-Oriented Recommendations to Empower Industry Stakeholders in Maximizing Equipment Leasing Software Advantages

Industry leaders should embark on a cloud-first modernization journey that prioritizes the migration of legacy systems to secure, scalable environments while preserving critical data integrity and operational continuity. By establishing a phased cloud adoption roadmap, organizations can mitigate risk, optimize total cost of ownership, and accelerate access to continuous feature enhancements. Concurrently, embedding AI-driven analytics from day one will enable proactive maintenance scheduling, dynamic credit evaluation, and real-time compliance monitoring, delivering tangible ROI and driving stakeholder buy-in.

To harness the full potential of these platforms, stakeholders must invest in cross-functional training programs that bridge the gap between finance, operations, and IT teams. Equipping personnel with the skills to leverage intuitive dashboards and configure process automation workflows fosters organizational alignment and accelerates time-to-insight. Moreover, developing strategic partnerships with software vendors and consulting firms ensures access to best practices, implementation accelerators, and ongoing advisory support, further reducing deployment risks and enhancing solution longevity.

Finally, executives should adopt a modular integration strategy that emphasizes open APIs and microservices architectures, enabling rapid connectivity to third-party applications such as ERP, CRM, and supply chain management systems. This approach not only future-proofs technology investments but also positions enterprises to capitalize on emerging innovations like blockchain-based asset registries and IoT-driven telemetry solutions. By adhering to these actionable recommendations, industry stakeholders can transform equipment leasing software into a strategic asset that drives efficiency, resilience, and sustained competitive advantage.

Detailing a Robust, Mixed-Method Research Approach Integrating Qualitative Insights and Quantitative Analysis for Equipment Leasing Software

This research integrates a dual-method approach, beginning with in-depth qualitative interviews conducted with C-level executives, asset managers, and IT leaders across multiple regions. These interviews provided nuanced perspectives on implementation challenges, strategic objectives, and the impact of regulatory developments. Complementing the qualitative insights, an extensive quantitative survey collected structured data on technology adoption levels, feature utilization rates, and satisfaction metrics from a diverse array of end users and decision-makers.

Secondary research formed the backbone of market landscape analysis, encompassing white papers, regulatory filings, and technology vendor documentation to map the competitive ecosystem and technology roadmaps. These sources enabled cross-validation of primary data and ensured a comprehensive understanding of current platform capabilities and strategic initiatives. The methodology further employed case study reviews to illustrate successful deployment scenarios, quantify efficiency gains, and highlight lessons learned in migrating from legacy systems.

Lastly, expert panel workshops were convened to validate key findings, refine segmentation models, and stress-test actionable recommendations. Participants included industry analysts, software developers, and equipment financing specialists who debated emerging trends, assessed vendor positioning, and identified best practices for accelerating digital transformation in leasing operations. This rigorous, mixed-method framework ensures that the conclusions and strategic guidance presented herein are both empirically grounded and practically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Equipment Leasing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Equipment Leasing Software Market, by Type

- Equipment Leasing Software Market, by Deployment Type

- Equipment Leasing Software Market, by Lease Type

- Equipment Leasing Software Market, by Lease Duration

- Equipment Leasing Software Market, by Organization Size

- Equipment Leasing Software Market, by Industry Vertical

- Equipment Leasing Software Market, by Region

- Equipment Leasing Software Market, by Group

- Equipment Leasing Software Market, by Country

- United States Equipment Leasing Software Market

- China Equipment Leasing Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Illuminate the Strategic Imperatives and Future Trajectory of the Equipment Leasing Software Ecosystem

The insights gleaned from this executive summary underscore a clear industry imperative: to navigate the complexities of modern asset financing, organizations must adopt integrated, data-driven equipment leasing software that delivers end-to-end visibility, operational agility, and regulatory compliance. From cloud-based deployment models to AI-infused analytics, the technological innovations profiled herein form the foundation for sustainable competitive advantage across sectors.

As businesses contend with evolving tariff landscapes, diversified supply chains, and dynamic market demands, the strategic adoption of advanced leasing platforms will be instrumental in optimizing capital allocation, enhancing risk management, and driving superior customer experiences. By leveraging the segmentation, regional, and vendor-centric insights outlined above, executive stakeholders can craft targeted strategies that align technology investments with broader organizational goals, ensuring resilience and growth in an increasingly complex global environment.

Seize the Competitive Edge by Engaging with Ketan Rohom to Secure Comprehensive Market Research Intelligence and Drive Business Growth

We invite senior executives and decision-makers to establish a dialogue with Ketan Rohom, Associate Director, Sales & Marketing, to explore how this comprehensive research can inform pivotal strategic initiatives and deliver measurable outcomes. By engaging directly, stakeholders can gain tailored insights, access exclusive data visualizations, and receive a customized consultation to align equipment leasing software investments with long-term organizational objectives.

Securing this market research report today will empower your teams to capitalize on emerging opportunities, mitigate risks associated with evolving supply chain dynamics and regulatory changes, and reinforce a competitive stance in a rapidly innovating landscape. Connect with Ketan Rohom to initiate your journey toward enhanced operational efficiency, optimized asset utilization, and sustained business growth.

- How big is the Equipment Leasing Software Market?

- What is the Equipment Leasing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?