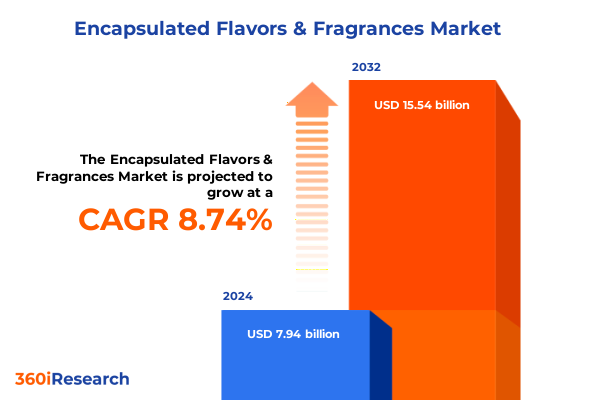

The Encapsulated Flavors & Fragrances Market size was estimated at USD 8.61 billion in 2025 and expected to reach USD 9.33 billion in 2026, at a CAGR of 8.80% to reach USD 15.54 billion by 2032.

Exploring the Core Dynamics and Market Forces Shaping Encapsulated Flavors and Fragrances Amid Technological Innovation and Shifting Consumer Demands

The realm of encapsulated flavors and fragrances has undergone a dynamic evolution, shaped by technological breakthroughs, shifting consumer tastes, and a complex global supply chain. Encapsulation techniques have advanced beyond traditional methods, enabling the precise delivery of volatile compounds in a variety of matrices. These innovations have paved the way for enhanced stability and controlled release of aromatic and taste molecules, addressing long-standing industry challenges such as thermal sensitivity and rapid volatilization. As a result, product developers across food and beverage, personal care, household, and pharmaceutical sectors are increasingly leveraging encapsulated solutions to differentiate their offerings and meet escalating demands for quality and longevity.

Simultaneously, consumer preferences are undergoing a transformation driven by heightened awareness of clean-label ingredients, natural sourcing, and sustainable production practices. This trend has elevated the importance of encapsulation processes that can accommodate natural extracts without compromising performance. Moreover, regulatory bodies worldwide are imposing stricter guidelines on additive purity, environmental impact, and safety assessments. As companies navigate these evolving requirements, the ability to adapt encapsulation processes and validate compliance through robust testing protocols has become a critical competitive advantage. Against this backdrop, stakeholders are compelled to adopt a holistic approach that integrates material science, supply chain resilience, and regulatory foresight, setting the stage for sustained innovation and growth in the encapsulated flavors and fragrances landscape.

Uncovering the Pivotal Technological, Regulatory, and Consumer-Driven Transformations Redefining the Encapsulated Flavors and Fragrances Industry Today

Over the past few years, the encapsulated flavors and fragrances industry has experienced transformative shifts fueled by advancements in microencapsulation technologies, emerging consumer wellness trends, and sustainability imperatives. Nanotechnology and precision engineering have enabled the development of novel encapsulation matrices that offer targeted release profiles and enhanced bioavailability. These technological strides have expanded application possibilities, from time-release aroma delivery in household products to taste enhancement in functional foods, fostering a more nuanced approach to product design.

In parallel, consumer demand for health-oriented and environmentally responsible products has driven manufacturers to explore biopolymer-based encapsulation carriers and solvent-free processes. This shift toward greener technologies not only addresses environmental concerns but also aligns with regulatory momentum favoring natural ingredients. Additionally, digital transformation across R&D and supply chain operations has improved process monitoring and quality control, reducing batch variability and accelerating time to market. As companies continue to invest in automation, data analytics, and predictive modeling, they are better positioned to respond swiftly to changing market dynamics, ensuring agility in a highly competitive environment.

Analyzing the Far-Reaching Consequences of United States Tariffs Implemented in 2025 on Encapsulated Flavors and Fragrances Supply Chains and Pricing Structures

The implementation of new United States tariffs in early 2025 has introduced significant complexities for companies sourcing encapsulated ingredients from key exporting regions. Supply chain stakeholders have faced escalated costs on imported raw materials, pressuring profit margins and prompting a reconsideration of supplier diversification strategies. In response, many organizations have intensified efforts to localize production or negotiate long-term procurement contracts to stabilize input costs and maintain consistent supply.

Moreover, these trade measures have catalyzed innovation in formulation and processing, as manufacturers seek to offset higher material expenses through improved encapsulation efficiency and enhanced payload delivery. Research and development teams are exploring alternative carriers and process optimizations to reduce the quantity of encapsulant required per unit of functional ingredient. At the same time, a growing number of suppliers are investing in domestic manufacturing infrastructure to circumvent tariff-induced price volatility and strengthen resilience. As a result, the encapsulated flavors and fragrances ecosystem is evolving toward a more geographically balanced model, where onshore capabilities and agile sourcing networks mitigate the disruptive impact of international trade policies.

Deriving Actionable Insights from a Multifaceted Segmentation Framework Encompassing Type Technology Functionality Application and End Use Industries

A comprehensive segmentation analysis reveals differentiated dynamics across multiple layers of the encapsulated flavors and fragrances market. When viewed through the lens of type, natural encapsulants are gaining traction among brands seeking clean-label credentials, whereas synthetic matrices continue to dominate high-performance applications where cost optimization is paramount. Technological segmentation underscores the ascendancy of spray drying for large-scale, cost-sensitive production, while coacervation and freeze-drying maintain crucial roles in specialty formulations requiring precise release control.

Functionality serves as another pivotal axis, with aroma delivery solutions increasing in sophistication to accommodate multi-stage release patterns, and shelf life extension technologies becoming integral to perishable product categories. Taste enhancement has grown in importance within nutraceuticals, where masking bitter or off-notes is essential for consumer acceptance. Application-based segmentation highlights robust demand in food & beverage subsegments such as bakery & confectionery, beverage concentrates, and dairy alternatives, alongside burgeoning opportunities in household air fresheners and high-end personal care products. Inhalation and topical delivery systems in pharmaceuticals also benefit from encapsulation’s ability to protect sensitive active compounds and control dosing profiles.

Evaluating the market by end use industry further illuminates priority areas for investment, as trends in confectionery and functional beverages spur tailored encapsulation strategies aimed at improving sensory appeal while ensuring ingredient stability. Cross-segmentation insights enable decision-makers to pinpoint high-potential intersections-such as natural carrier solutions for nutraceutical taste masking-thereby guiding resource allocation and innovation roadmaps across the encapsulated flavors and fragrances value chain.

This comprehensive research report categorizes the Encapsulated Flavors & Fragrances market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Functionality

- Application

- End Use Industry

Exploring Regional Dynamics Growth Drivers and Strategic Considerations Spanning the Americas Europe Middle East Africa and Asia Pacific Markets

Regional market dynamics reflect diverse growth drivers and competitive landscapes across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, established food and beverage producers are increasingly collaborating with encapsulation specialists to differentiate products through novel flavor release mechanisms and extended shelf life properties. This synergy is further supported by advanced logistics networks and a regulatory environment conducive to clean-label innovations.

Europe, the Middle East, and Africa present a complex mosaic of regulatory requirements and consumer preferences, with natural and organic certifications holding significant currency. Encapsulated fragrance solutions in home care and personal care segments are capitalizing on artisanal and wellness trends, while strategic partnerships with local ingredient suppliers facilitate compliance and cultural resonance. Within Asia Pacific, rapid urbanization and rising disposable incomes have fueled demand for premium convenience foods and personal care experiences, driving investments in high-throughput spray drying facilities and digital quality control systems. Regional R&D hubs are emerging to adapt global encapsulation technologies to local ingredient portfolios, further strengthening the competitive edge of domestic manufacturers.

Across all regions, collaboration between multinational corporations and regional innovators is instrumental in navigating tariff fluctuations and evolving regulations. By leveraging local manufacturing footprints and technological expertise, companies can achieve operational efficiencies and accelerate time to market, positioning themselves for sustained success in the global encapsulated flavors and fragrances arena.

This comprehensive research report examines key regions that drive the evolution of the Encapsulated Flavors & Fragrances market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Innovative Practices Driving Competitive Advantage in the Encapsulated Flavors and Fragrances Sector

The competitive landscape of encapsulated flavors and fragrances is characterized by a blend of established chemical and ingredient suppliers alongside emerging technology providers. Leading corporations are differentiating through vertically integrated supply chains, combining upstream raw material sourcing with in-house encapsulation capabilities. These firms have invested heavily in proprietary carrier chemistries and advanced spray drying systems to achieve superior encapsulation efficiencies and batch consistency.

At the same time, innovative start-ups and specialized R&D firms are challenging incumbents by focusing on niche applications such as microencapsulated probiotics or solvent-free coacervation processes. These agile players often collaborate with academic institutions to commercialize cutting-edge formulations, accelerating the translation of laboratory breakthroughs into scalable offerings. Collaborative alliances between legacy manufacturers and small-scale innovators are becoming increasingly common, enabling rapid validation of new technologies while sharing the risks and rewards of product development.

Moreover, strategic M&A activity has intensified as companies seek to expand their technology portfolios and geographic reach. By acquiring firms with complementary encapsulation expertise or regional production assets, market participants can enhance their service scope and respond more effectively to evolving customer requirements. This integration trend underscores the importance of both organic innovation and inorganic growth strategies in shaping competitive advantage within the encapsulated flavors and fragrances sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Encapsulated Flavors & Fragrances market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Inc.

- Aveka Inc.

- Balchem Corporation

- Blue Pacific Flavors, Inc.

- Buchi Labortechnik AG

- Cargill, Incorporated

- Clextral S.A.

- DSM-Firmenich

- Döhler GmbH

- Firmenich International SA

- Fona International, Inc.

- Givaudan SA

- Glatt GmbH

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Keva Fragrances Private Limited

- Mane SA

- MikroCaps d.o.o.

- Robertet SA

- Sensient Technologies Corporation

- Symrise AG

- Takasago International Corporation

- TasteTech Ltd.

- Tate & Lyle PLC

Formulating Strategic and Operational Recommendations to Accelerate Innovation and Enhance Resilience for Industry Leaders in Encapsulated Flavors and Fragrances

Industry leaders aiming to capitalize on encapsulation opportunities should prioritize strategic investments in advanced process technologies and digitalization initiatives. By integrating process analytical technology and real-time monitoring systems, companies can optimize encapsulation parameters, reduce waste, and ensure batch-to-batch consistency. This technological commitment not only enhances product performance but also strengthens regulatory compliance and quality assurance frameworks.

Furthermore, fostering cross-functional collaboration between R&D, procurement, and marketing teams can uncover valuable synergies. R&D insights into novel carrier materials and release mechanisms should inform procurement strategies that secure robust supply chains, while marketing feedback on consumer preferences can refine formulation targets. This end-to-end alignment accelerates product development cycles and enhances time to market. Additionally, strategic supplier partnerships and joint ventures can amplify innovation capacity and geographic reach, enabling companies to navigate tariff challenges and regulatory complexities more effectively.

Finally, leaders should adopt a segmentation-driven go-to-market approach, leveraging detailed insights across type, technology, functionality, application, and end use industries. Customized product portfolios that address specific segment needs-such as natural encapsulants for the clean-label trend or spray-dried flavor systems for high-volume beverages-will resonate more strongly with customers and drive premium positioning. By combining technological excellence, collaborative ecosystems, and targeted segmentation strategies, industry players can unlock sustainable growth and maintain a competitive edge in the encapsulated flavors and fragrances market.

Outlining the Rigorous Research Methodology Underpinning Comprehensive Analysis of Encapsulated Flavors and Fragrances Market Trends and Segmentation Layers

The research underpinning this analysis employed a rigorous, multi-tiered methodology to ensure comprehensive coverage of the encapsulated flavors and fragrances landscape. Secondary research involved a systematic review of industry publications, patent filings, regulatory frameworks, and company reports to establish historical trends and identify key technological milestones. Primary research comprised in-depth interviews with subject matter experts across R&D laboratories, manufacturing facilities, and end user segments, providing real-world perspectives on innovation drivers and operational challenges.

Quantitative data was gathered through a combination of trade data analysis, supply chain mapping, and technology adoption surveys to characterize raw material flows, production capacities, and market penetration of various encapsulation methods. These insights were synthesized using cross-segmentation frameworks and regional analyses, enabling a nuanced understanding of competitive dynamics and growth drivers. Rigorous data validation protocols, including triangulation and consistency checks, ensured the reliability and findings.

Finally, strategic validation workshops were conducted with industry stakeholders to refine key assumptions and corroborate actionable recommendations. This collaborative approach enhanced the practical relevance of the research outputs and aligned strategic insights with evolving market realities. By integrating qualitative and quantitative research streams, the methodology provides a robust foundation for decision-making in the encapsulated flavors and fragrances sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Encapsulated Flavors & Fragrances market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Encapsulated Flavors & Fragrances Market, by Type

- Encapsulated Flavors & Fragrances Market, by Technology

- Encapsulated Flavors & Fragrances Market, by Functionality

- Encapsulated Flavors & Fragrances Market, by Application

- Encapsulated Flavors & Fragrances Market, by End Use Industry

- Encapsulated Flavors & Fragrances Market, by Region

- Encapsulated Flavors & Fragrances Market, by Group

- Encapsulated Flavors & Fragrances Market, by Country

- United States Encapsulated Flavors & Fragrances Market

- China Encapsulated Flavors & Fragrances Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications to Illuminate Future Directions in the Encapsulated Flavors and Fragrances Space

This analysis reveals that encapsulated flavors and fragrances are at the intersection of innovation, consumer demand, and regulatory evolution, creating both challenges and opportunities for market participants. Technological advancements in spray drying, coacervation, and freeze drying have expanded formulation capabilities, while emerging trends toward natural and sustainable carriers are reshaping ingredient preferences. The cumulative impact of United States tariffs in 2025 has underscored the importance of supply chain resilience and local manufacturing, prompting strategic shifts toward diversified sourcing and domestic production.

Segmentation insights highlight the need for tailored approaches across type, technology, functionality, application, and end use industry dimensions. Food and beverage subsegments such as bakery and confectionery, beverages, dairy, and nutraceuticals present distinct requirements, as do household air fresheners, personal care categories, and pharmaceutical delivery systems. Regional dynamics further complicate the landscape, with the Americas, Europe Middle East Africa, and Asia Pacific each offering unique regulatory, cultural, and logistical considerations.

Together, these findings demonstrate that success in the encapsulated flavors and fragrances market hinges on a holistic strategy that integrates advanced technologies, segmentation-driven innovation, and strategic partnerships. By leveraging targeted investments in R&D, optimizing supply chains, and adapting offerings to regional and functional needs, companies can secure a competitive edge and position themselves for long-term growth.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Cutting Edge Research on Encapsulated Flavors and Fragrances Market Dynamics

To delve deeper into the nuanced dynamics of the encapsulated flavors and fragrances domain and explore tailored strategies for your organization’s specific challenges, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly with Ketan, you gain privileged access to comprehensive intelligence on emerging encapsulation technologies and regulatory shifts, enabling you to make informed decisions and accelerate product innovation. His expertise spans global supply chain optimization, tariff impact analysis, and segmentation-driven go-to-market planning. Engaging with Ketan ensures that you receive customized insights aligned with your company’s strategic objectives, whether you are seeking to expand into new geographies, enhance product performance, or mitigate trade-related risks. Don’t miss the opportunity to secure the full research report and obtain actionable recommendations that can transform your positioning in the fiercely competitive encapsulated flavors and fragrances market. Connect with Ketan Rohom today to unlock detailed data and expert guidance that will propel your business forward.

- How big is the Encapsulated Flavors & Fragrances Market?

- What is the Encapsulated Flavors & Fragrances Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?