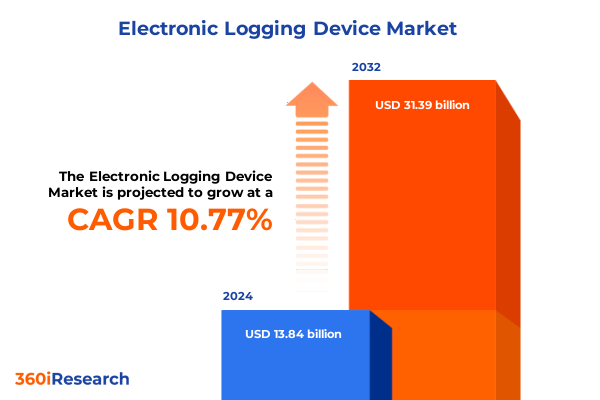

The Electronic Logging Device Market size was estimated at USD 13.58 billion in 2024 and expected to reach USD 14.30 billion in 2025, at a CAGR of 5.37% to reach USD 20.65 billion by 2032.

Unlocking the Potential of Electronic Logging Devices in Modern Fleet Management Through an Integrated Compliance and Efficiency Framework

Electronic logging devices have emerged as indispensable tools for modern fleet operators striving to achieve operational efficiency and regulatory compliance. Rooted in the Federal Motor Carrier Safety Administration’s mandate to replace paper logs, these devices have evolved from standalone hardware units into integrated platforms that leverage digital connectivity, data analytics, and telematics. In these pages, we explore how the convergence of hardware, software, and services is accelerating the adoption of electronic logging solutions across transportation verticals.

Today’s introduction lays the groundwork for understanding the multidimensional benefits of electronic logging devices beyond mere Hours of Service monitoring. By automating data capture, reducing human error, and providing real-time visibility into driver behavior and vehicle performance, these platforms create new avenues for optimizing route planning, fuel consumption, and maintenance schedules. Moreover, the reduction of administrative burdens frees operational staff to focus on strategic initiatives that drive business growth.

As you proceed through this executive summary, maintain a focus on the intersection of compliance, efficiency, and innovation at the heart of the electronic logging device ecosystem. The subsequent sections will delve into the shifts redefining the market, the impact of recent tariff changes, and how segment-specific insights are empowering fleet managers to tailor solutions to their unique operational needs.

Navigating the Convergence of Safety, Telematics and Regulatory Evolution Reshaping Electronic Logging Device Adoption and Innovation Trends

The electronic logging device landscape is undergoing transformative shifts driven by rapid advancements in telematics, data analytics, and regulatory expectations. No longer confined to logging driver hours, these systems now integrate with vehicle sensors, predictive maintenance platforms, and advanced navigation services, ushering in an era of proactive fleet management.

Cloud-based deployment models have further catalyzed this evolution by enabling seamless software updates, centralized data storage, and scalable integrations with third-party applications. Artificial intelligence and machine learning algorithms analyze vast data streams to identify patterns in driver behavior, enabling fleet managers to implement targeted coaching programs that reduce accidents and lower insurance premiums. Additionally, rising cybersecurity concerns are prompting solution providers to embed robust encryption and authentication measures, ensuring the integrity and confidentiality of critical operational data.

These technological and regulatory catalysts are reshaping competitive dynamics, as established hardware manufacturers expand into software and services, while nimble startups leverage API-driven architectures to rapidly innovate. The interplay between evolving safety standards and digital transformation initiatives underscores a new paradigm in which electronic logging devices serve as the connective tissue between compliance mandates and performance-driven decision-making.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Electronic Logging Device Supply Chains and Operational Expenditures

The imposition of revised tariffs by the United States in 2025 has introduced both challenges and strategic opportunities within the electronic logging device supply chain. With a significant proportion of hardware components, such as wireless modules and sensor assemblies, sourced from overseas manufacturing hubs, the increased duty rates have elevated landed costs and compressed vendor margins, particularly for wired and wireless device producers.

In response, many solution providers are diversifying their sourcing strategies, exploring nearshoring options and forging partnerships with domestic electronics assemblers to mitigate the impact of customs levies. Concurrently, procurement teams are renegotiating supplier agreements to secure volume-based discounts and longer-term contracts, providing price stability for the end user and preserving the affordability of smartphone and tablet-based logging solutions.

Moreover, the ripple effects of the tariff adjustments have catalyzed innovation in device design, prompting manufacturers to optimize bill-of-materials structures, reduce reliance on high-cost imported components, and invest in modular architectures. As a result, the ecosystem is witnessing a gradual shift toward hybrid manufacturing models that balance cost efficiency with responsiveness to evolving compliance requirements.

Deriving Actionable Intelligence from Multidimensional Segmentation Data to Tailor Electronic Logging Device Solutions Across Diverse Market Niches

Interpreting market dynamics through the lens of solution type segmentation reveals nuanced preferences and investment patterns across hardware, software, and service domains. Hardware continues to anchor adoption, with demand bifurcating between wired and wireless ELD devices and spanning dedicated in-cab terminals as well as mobile smartphone and tablet platforms. On the software front, integrated systems that fuse navigation or telematics functionality command attention from large commercial operators seeking end-to-end visibility, whereas standalone offerings focused on compliance management appeal to smaller fleets prioritizing simplicity and cost-effectiveness. Services complement these technology layers by offering structured implementation roadmaps-from maintenance schedules to training curricula-and tiered customer and technical support packages designed to accelerate time-to-value and ensure ongoing system reliability.

Examining vehicle type segmentation underscores the differential adoption trajectories across heavy-duty tractor-trailer fleets, medium-duty delivery trucks, and light-duty passenger or service vehicles. Tractor trailers hauling dry vans or refrigerated trailers frequently leverage advanced telematics-integrated logging units to manage intricate route schedules and temperature-sensitive loads, whereas light trucks and passenger vehicles predominantly adopt mobile-first solutions for ad hoc or last-mile applications. Delivery trucks and school buses in the medium-duty category strike a balance between operational simplicity and regulatory rigor, often bundling ELD hardware with basic fleet management software to satisfy compliance mandates while enhancing route efficiency.

Deployment mode further amplifies market heterogeneity, as cloud-hosted platforms-both private and multi-tenant public environments-offer rapid scalability and minimal on-premise infrastructure overhead. In contrast, on-site hosted solutions appeal to end users with stringent data sovereignty or offline connectivity requirements. Finally, end-user segmentation demarcates large commercial and governmental fleets from medium and small fleet operators, each cohort exhibiting distinct preferences for bundled or à la carte service models. Connectivity choices, spanning cellular technologies from 3G to 5G and satellite options across GEO and LEO constellations, round out the segmentation framework by ensuring that fleet operators maintain uninterrupted data transmission in even the most remote geographies.

This comprehensive research report categorizes the Electronic Logging Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Connectivity Type

- Deployment Mode

- Vehicle Type

- Application

- End User

Deciphering Regional Dynamics Revealing Distinct Drivers and Barriers Influencing Electronic Logging Device Integration Across Global Territories

Regional analysis brings into focus three primary territories each defined by unique regulatory, economic, and technological drivers. In the Americas, rigorous enforcement of federal and state electronic logging mandates, combined with high mobile network penetration, accelerates adoption among commercial carriers seeking to avoid penalties and leverage data for operational optimization. Latin American markets, while at an earlier stage of regulatory maturity, demonstrate growing interest in cost-effective mobile solutions as local carriers modernize their compliance infrastructure.

Across Europe, the Middle East, and Africa, a mosaic of regulatory frameworks governs electronic logging device usage, with the European Union’s digital tachograph standards intersecting national Hours of Service regulations. Advanced telematics ecosystems in Western Europe contrast with nascent deployments in parts of Africa and the Gulf, where satellite connectivity and modular service bundles address connectivity gaps. These diverse environments drive solution providers to develop region-specific feature sets and support models that align with local mandates and infrastructure capabilities.

In the Asia-Pacific region, rapid industrialization and extensive cross-border trade corridors fuel demand for integrated compliance and fleet management platforms. Markets such as Australia and Japan, which have adopted progressive electronic logging regulations, provide fertile ground for next-generation telematics innovations, while emerging economies in Southeast Asia and the Indian subcontinent prioritize flexible cloud deployments and hybrid connectivity options to bridge gaps in terrestrial network coverage.

This comprehensive research report examines key regions that drive the evolution of the Electronic Logging Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Electronic Logging Device Market Landscape Through Technology and Collaboration

The competitive ecosystem for electronic logging devices is characterized by a mix of established technology conglomerates and agile specialist vendors innovating at the intersection of hardware design and software services. Leading providers differentiate their offerings through end-to-end platforms that integrate navigation, telematics, and compliance functionality or through modular architectures that enable rapid customization for specific verticals such as refrigerated transport or local distribution.

Strategic partnerships between hardware manufacturers, network operators, and software integrators further amplify the pace of innovation, as cross-industry alliances unlock new data sources and service bundles. Meanwhile, a wave of venture-funded entrants is challenging incumbents by deploying API-first architectures and leveraging artificial intelligence to deliver predictive analytics and automated anomaly detection. This influx of competition is compelling legacy players to expand their service portfolios, invest in customer success frameworks, and enhance their global delivery networks.

Together, these market forces are creating a landscape in which differentiation hinges on the ability to deliver reliable, scalable, and user-friendly solutions that minimize administrative friction and drive tangible return on investment for fleet operators of all sizes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Logging Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Assured Telematics Inc.

- AT&T Inc.

- Aurora Software, Inc.

- Ayvens by ALD International

- Azuga by Bridgestone Corporation

- Blue Ink Technology, Inc.

- EROAD Ltd

- Garmin Ltd

- Geotab Inc.

- Gorilla Safety Fleet Management

- Honeywell International Inc.

- Linxup, LLC

- Masternaut Limited by Michelin Group

- Motive Technologies, Inc.

- Omnitracs LLC by Solera Holdings, LLC

- One Step GPS, LLC

- Powerfleet, Inc

- Rand McNally

- Samsara Inc.

- Spireon, Inc.

- Teletrac Navman by Vontier Corporation

- Trimble Inc.

- Verizon Communications Inc.

- Wheels, Inc.

- Zonar Systems, Inc.

Strategic Imperatives and Tactical Roadmaps Empowering Industry Leaders to Capitalize on Emerging Electronic Logging Device Opportunities and Compliance Mandates

Industry leaders must adopt a multifaceted strategy to capitalize on emerging opportunities and navigate compliance complexities. Prioritizing the integration of advanced analytics and machine learning capabilities into electronic logging platforms will enable deeper insights into driver performance, vehicle health, and fuel consumption trends. Simultaneously, investing in comprehensive training and certification programs ensures that drivers and administrators maximize system utilization and adhere to best practices, reinforcing safety outcomes and reducing liability exposure.

To offset supply chain volatility triggered by tariff adjustments and global logistics challenges, executives should diversify sourcing strategies by engaging regional manufacturing partners and exploring contract assembly models. Cultivating long-term alliances with telecommunications providers and cloud service vendors can secure favorable connectivity rates and accelerate time-to-market for software updates and new feature rollouts. Additionally, establishing cross-functional compliance task forces that monitor evolving regulatory environments and liaise with industry associations will help organizations anticipate policy shifts and adapt their solutions proactively.

Embracing open API architectures and fostering an ecosystem of third-party application developers will further expand the value proposition of electronic logging devices. By enabling seamless plug-and-play integrations with navigation, maintenance, and driver wellness tools, solution providers can deliver holistic fleet management experiences that drive customer loyalty and generate incremental service revenue.

Outlining a Robust Multi-Phase Research Blueprint Ensuring Methodological Rigor in Analyzing Electronic Logging Device Market Variables and Stakeholder Perspectives

Our research methodology blends primary and secondary approaches to ensure comprehensive, unbiased insights. Primary research consisted of in-depth interviews with fleet operators, technology executives, and regulatory experts to capture real-world perspectives on deployment challenges, feature requirements, and service expectations. These conversations informed the development of structured questionnaires administered to a cross-section of small, medium, and large fleet organizations across key geographies.

Secondary research involved the systematic review of public filings, regulatory publications, and industry whitepapers to map legislative changes, tariff schedules, and technology benchmarks. We triangulated this information with competitive intelligence gathered from vendor press releases and product roadmaps, validating feature sets and service capabilities through hands-on platform demonstrations and proof-of-concept pilots.

Quantitative data analysis techniques, including cross-segmentation comparisons and connectivity performance modeling, were employed to identify adoption patterns and reveal areas of untapped growth potential. Throughout the process, our team adhered to rigorous data validation protocols, ensuring that findings are both replicable and relevant to strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Logging Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Logging Device Market, by Solution Type

- Electronic Logging Device Market, by Connectivity Type

- Electronic Logging Device Market, by Deployment Mode

- Electronic Logging Device Market, by Vehicle Type

- Electronic Logging Device Market, by Application

- Electronic Logging Device Market, by End User

- Electronic Logging Device Market, by Region

- Electronic Logging Device Market, by Group

- Electronic Logging Device Market, by Country

- United States Electronic Logging Device Market

- China Electronic Logging Device Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Future Outlooks to Reinforce Strategic Decision-Making in the Evolving Electronic Logging Device Ecosystem

The evolution of electronic logging devices from basic compliance tools to comprehensive fleet management hubs underscores their pivotal role in driving operational excellence. Key insights from our analysis highlight the critical importance of integrated software functionalities, scalable deployment architectures, and resilient supply chains in sustaining market momentum. As hardware and connectivity costs stabilize, the emphasis shifts toward elevating user experience through intuitive interfaces and value-added service bundles.

Regulatory dynamics, particularly the 2025 tariff landscape and region-specific compliance mandates, will continue to shape vendor strategies and procurement decisions. Organizations that proactively adapt to these external pressures-by refining sourcing structures, aligning feature roadmaps with emerging policy requirements, and deepening customer support offerings-will secure competitive advantages in an increasingly crowded marketplace.

Ultimately, the ability to translate segmentation and regional insights into tailored solution offerings will distinguish market leaders from followers. Decision-makers equipped with a nuanced understanding of their end-user profiles, vehicle types, and connectivity needs are best positioned to deliver differentiated value propositions and cultivate long-term customer partnerships in the dynamic electronic logging device ecosystem.

Engage with Associate Director of Sales and Marketing to Unlock Comprehensive Electronic Logging Device Market Research Insights and Drive Informed Decisions

For organizations seeking to navigate the intricate electronic logging device landscape with confidence, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides unparalleled access to the comprehensive market research report. His expertise in synthesizing in-depth analysis, actionable recommendations, and bespoke insights will empower your team to make informed strategic decisions, optimize compliance strategies, and stay ahead of emerging industry shifts. Reach out today to secure your copy of the report and unlock the full suite of intelligence needed to drive operational excellence and sustained competitive advantage.

- How big is the Electronic Logging Device Market?

- What is the Electronic Logging Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?