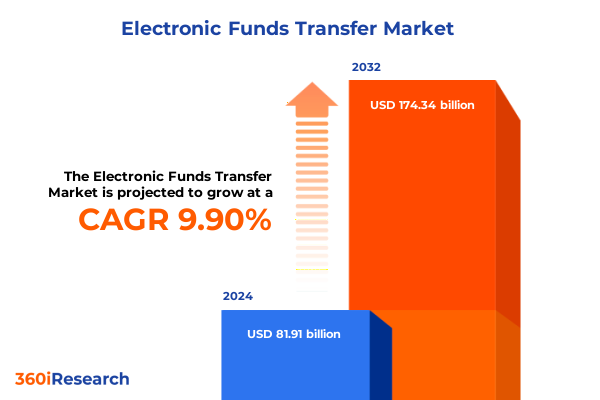

The Electronic Funds Transfer Market size was estimated at USD 90.20 billion in 2025 and expected to reach USD 98.35 billion in 2026, at a CAGR of 9.87% to reach USD 174.34 billion by 2032.

Exploring the Evolving Electronic Funds Transfer Ecosystem and Its Strategic Importance for Modern Financial Transactions

The electronic funds transfer landscape has undergone remarkable evolution in recent years, driven by rapid shifts in consumer behavior, technological breakthroughs, and an increasingly complex regulatory environment. Where paper-based checks once dominated, noncash payments now form the backbone of daily transactions, underscoring the critical role of digital infrastructure in modern economies. In the United States alone, non-prepaid debit card payments surged to nearly 90 billion transactions in 2022, with credit card volumes surpassing 58 billion-data reflecting a persistent migration away from traditional payment instruments toward more efficient electronic alternatives. Moreover, initiatives to introduce real-time settlement networks like FedNow have been underway, yet adoption remains nascent, with fewer than 350,000 transactions processed in the third quarter of 2024 compared to over five billion through ACH for the same period.

Against this backdrop, the global ecosystem of payment providers, financial institutions, and technology vendors is under pressure to innovate and streamline operations. Stakeholders must contend with cybersecurity threats, interoperability challenges, and evolving customer expectations for seamless, borderless experiences. As instant payments gain momentum in leading markets such as India, where real-time systems process over 185 billion transactions annually , the imperative for U.S. providers to modernize legacy rails and enhance service delivery has never been stronger. This introduction sets the stage for a detailed exploration of the transformative shifts, tariff impacts, segmentation nuances, regional dynamics, competitive landscape, and strategic recommendations essential for navigating the electronic funds transfer market in 2025 and beyond.

Unraveling the Pivotal Technological and Regulatory Transformations Redefining Electronic Funds Transfer Dynamics Globally in 2025

The electronic funds transfer domain is experiencing a profound metamorphosis, propelled by innovations in instant payment systems, API-driven open banking frameworks, and the early-stage adoption of tokenization technologies. In North America, the FedNow Service has gradually onboarded over 700 financial institutions since its launch, signaling a shift toward 24/7/365 settlement capabilities that can reduce float and improve liquidity management for businesses and consumers alike. Simultaneously, initiatives by The Clearing House and major commercial banks are extending real-time payment rails to corporate clients, enabling faster payroll distribution and immediate supplier settlements.

On the regulatory front, legislation such as the Instant Payments Regulation in the European Union mandates euro-zone participants to support instant credit transfers by early 2025, establishing stricter execution timelines and fostering widespread adoption of SEPA Instant Credit Transfers. This harmonization effort complements industry-led interoperability projects like BIS Innovation Hub’s Project Nexus, which explores cross-border linkage of fast payment systems to streamline remittances and reduce costs in emerging markets. Concurrently, the promise of tokenized platforms-facilitating unified ledgers for central bank reserves, commercial bank money, and government securities-signals a longer-term revolution in how payments and asset transfers are conducted.

In this environment, market participants must balance the urgency of modernizing legacy infrastructures with the strategic deployment of next-generation solutions. Whether through API-based integration of e-wallets, the roll-out of digital banking APIs under open banking mandates, or pilot programs for wholesale central bank digital currencies, the trajectory is clear: electronic funds transfer is transitioning from a batch-oriented, multiday process to a seamless, instantaneous utility underpinning global commerce.

Assessing the Comprehensive Consequences of 2025 United States Tariff Adjustments on Electronic Funds Transfer Operations and Cost Structures

The introduction of sweeping tariff changes by the United States government in early 2025 has introduced a layer of complexity for electronic funds transfer infrastructure providers and hardware manufacturers. In April 2025, a baseline 10% tariff on imported electronics-covering payment terminals, ATM components, and backend hardware-was implemented universally, with additional country-specific reciprocal tariffs layered on targeted imports from major trading partners. For instance, Chinese-manufactured payment processors and network switches now face an effective duty exceeding 54% when previous levies are aggregated with the new baseline level, dramatically increasing input costs for terminal vendors and independent service organizations.

Compounding these challenges, the elimination of the $800 de minimis exemption for postal and small-package imports in May 2025 resulted in uniform duties on cross-border shipments, disrupting e-commerce-driven acquisitions of point-of-sale hardware and spare parts. While certain electronics-such as smartphones and laptops-remain temporarily exempt pending sector-specific reviews, the broader hardware ecosystem supporting ATM fleets and merchant-acquirer installations now faces unpredictable cost escalations. These tariff measures, framed as part of an overarching “America First” trade policy, aim to incentivize reshoring of critical manufacturing, yet they risk constraining innovation and driving up prices for end users.

Financial service firms must therefore reassess supply chain strategies, reevaluate sourcing from multiple geographies, and explore collaborative models with domestic manufacturers. The heightened duty environment also underscores the need for software-driven differentiation and extended servicing models, allowing providers to recoup hardware cost pressures through premium maintenance and integration offerings rather than one-off terminal sales.

Uncovering Vital Segmentation Insights to Illuminate Market Variations Across Payment Modes, Transaction Types, Channels, Components, and End Users

A nuanced understanding of market segments is essential for tailoring product development and service delivery in the electronic funds transfer space. Payment modes can be classified into bank transfers, in which Automated Clearing House and real-time account-to-account transfers dominate; card-based payments, which encompass credit, debit, and prepaid card schemes managed by global networks; and digital wallets that integrate mobile-first interfaces for peer-to-peer and merchant transactions. Each mode exhibits distinct settlement cycles, fraud risk profiles, and fee structures, influencing vendor roadmap priorities.

In parallel, transaction types span business-to-consumer gateways for e-commerce and point-of-sale purchases; consumer-to-business channels facilitating bill payments; government-to-consumer disbursements such as benefits and stimulus payments; and person-to-person flows that underpin remittance services and informal transfers. Hybrid providers aiming for ecosystem ubiquity must support all four to maintain relevance with end users.

Channel considerations extend from physical ATM networks and point-of-sale terminals to online banking portals and mobile applications, each presenting unique integration challenges with core banking systems. On the component level, hardware deployments must be complemented by robust software platforms and professional services-spanning implementation, integration, support, and maintenance-to drive client adoption and system resilience. Finally, end users break down into retail consumers seeking convenience, corporate clients demanding scalable B2B payment solutions, and government bodies requiring secure, high-volume disbursement capabilities. This multifaceted segmentation framework allows stakeholders to align value propositions with customer pain points and investment cycles.

This comprehensive research report categorizes the Electronic Funds Transfer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Mode

- Transaction Type

- Component

- End User

Analyzing Distinct Regional Trends Shaping Electronic Funds Transfer Adoption and Innovation Across Americas, Europe Middle East Africa, and Asia Pacific

Regional market dynamics reveal divergent trajectories in the adoption and innovation of electronic funds transfer solutions. In the Americas, the United States and Canada are migrating legacy ACH and EFTPOS rails toward continuous-processing models, driven by consumer demand for instant disbursements and low-cost digital wallets. Meanwhile, Latin American markets such as Brazil have achieved near-universal instant settlement through Pix, which processed over 70 billion transactions in 2024, underscoring the region’s receptivity to QR-code-based payments and rapid onboarding of nonbank participants.

Europe, the Middle East, and Africa are navigating a mosaic of regulatory regimes, with the European Union’s Instant Payments Regulation mandating real-time euro transfers by January 2025, while emerging economies in Africa are exploring pan-continental interoperability initiatives under the African Continental Free Trade Area framework. Cross-border remittance corridors in sub-Saharan Africa are benefiting from blockchain-enabled platforms that reduce fees and settlement times, reflecting a region-specific emphasis on financial inclusion.

In Asia-Pacific, India’s Unified Payments Interface (UPI) has set benchmark performance, processing 185.8 billion transactions in FY25-a 41.7% increase year-over-year-and capturing 48.5% of global real-time payment volumes. Other APAC markets, such as Japan and Australia, are enhancing mobile-led payment services, while China’s digital yuan pilot programs continue to expand, albeit amid evolving regulatory considerations. These diverse regional patterns highlight the need for adaptable go-to-market strategies that respect local infrastructure maturity and consumer behavior.

This comprehensive research report examines key regions that drive the evolution of the Electronic Funds Transfer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovations from Leading Electronic Funds Transfer Providers to Illuminate Competitive Market Dynamics

Competitive intensity in the electronic funds transfer market is defined by major network operators, fintech challengers, and infrastructure providers expanding their service portfolios. Visa, a stalwart in global card processing, reported that it processed 233.8 billion transactions on its networks in fiscal year 2024, representing a 10% increase year-over-year and total payment volume crossing $15.7 trillion. The firm continues to invest in tokenization services and cross-border settlement enhancements to strengthen its value-added ecosystem.

Mastercard likewise recorded robust momentum, with its fourth-quarter 2024 results highlighting a 12% increase in global gross dollar volume to $2.6 trillion, underpinned by a 20% surge in cross-border transactions and a 12% rise in overall transaction volume. The company has also tokenized 30% of its transaction volume as of 2024, reflecting strategic bets on blockchain and digital asset integration.

Emerging fintech players such as Stripe and Square are carving out niches in developer-centric payment APIs and small-merchant POS solutions, while service providers like FIS and Fiserv leverage their scale to bundle software, hardware, and managed services. Meanwhile, PayPal’s continued expansion into buy-now-pay-later offerings and digital wallet enhancements positions it as both a payment facilitator and a consumer finance platform, intensifying competitive dynamics. Across this spectrum, success hinges on seamless interoperability, competitive pricing models, and the agility to respond to evolving cybersecurity and compliance demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Funds Transfer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide Inc.

- Adyen N.V.

- American Express Company

- Bank of America Corporation

- Citigroup Inc.

- Diebold Nixdorf Incorporated

- Discover Financial Services

- Euronet Worldwide Inc.

- Fiserv Inc.

- Global Payments Inc.

- Jack Henry & Associates Inc.

- JPMorgan Chase & Co.

- Mastercard Incorporated

- MoneyGram International Inc.

- NCR Corporation

- PayPal Holdings Inc.

- Remitly Global Inc.

- Square Inc.

- Stripe Inc.

- TransferWise Ltd.

- Visa Inc.

- Wells Fargo & Company

- Western Union Company

- Worldpay LLC

Proposing Targeted Action Plans and Strategic Imperatives to Empower Industry Leaders in Navigating Electronic Funds Transfer Challenges and Opportunities

To thrive amid these shifts, industry leaders should prioritize the deployment of comprehensive real-time payment solutions that align with emerging regulatory requirements. By accelerating the integration of tokenization and encryption services, firms can bolster transaction security while enhancing customer trust. Investments in API-first architectures will also facilitate faster time-to-market for value-added services, enabling seamless connectivity with merchants, banks, and fintech ecosystems.

Furthermore, organizations must recalibrate their supply chains to mitigate the impact of elevated tariff environments. Establishing partnerships with domestic hardware manufacturers and diversifying component sourcing can reduce cost volatility. Concurrently, service-driven revenue models-centering on implementation, maintenance, and analytics-can offset hardware margin pressure and create recurring revenue streams.

In regional markets, a tailored approach is vital: market players in the Americas should focus on scaling instant payroll and B2B disbursement services, while those in EMEA must ensure compliance with SEPA IPR mandates and explore interoperability frameworks for cross-border transactions. Meanwhile, engagement with UPI-style open-loop networks in Asia-Pacific offers lessons in rapid consumer adoption and low-cost QR-based payment roll-outs. By embracing a data-driven mindset, leveraging advanced analytics for risk management, and fostering collaborative industry partnerships, payment providers will be well-positioned to capture growth opportunities and navigate sector challenges.

Detailing Robust Research Frameworks and Analytical Techniques That Ensure Comprehensive and Reliable Insights into Electronic Funds Transfer Markets

This research leveraged a hybrid methodology combining primary interviews, secondary data analysis, and proprietary modeling techniques. In-depth discussions with senior executives across banks, fintech startups, and payment network operators provided qualitative insights into strategic priorities and adoption barriers. These conversations were supplemented by comprehensive reviews of public financial disclosures, regulatory filings, and industry whitepapers to triangulate key trends and validate emerging use cases.

Quantitative analysis drew from authoritative sources, including central bank reports, annual payments studies, and global tariff schedules. Data on transaction volumes, settlement speeds, and digital wallet penetration were obtained from national payment system authorities and international bodies such as the Bank for International Settlements. Tariff impact assessments incorporated harmonized system codes and duty rates published by the U.S. Trade Representative.

Our segmentation framework was developed through iterative clustering of market characteristics, ensuring relevance to both product development strategies and go-to-market initiatives. Regional analyses were informed by economic indicators, digital infrastructure benchmarks, and policy developments. Finally, competitive profiling involved benchmarking key performance metrics-such as processed transaction volumes, revenue growth, and strategic investments-against leading providers to identify best practices and differentiation strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Funds Transfer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Funds Transfer Market, by Payment Mode

- Electronic Funds Transfer Market, by Transaction Type

- Electronic Funds Transfer Market, by Component

- Electronic Funds Transfer Market, by End User

- Electronic Funds Transfer Market, by Region

- Electronic Funds Transfer Market, by Group

- Electronic Funds Transfer Market, by Country

- United States Electronic Funds Transfer Market

- China Electronic Funds Transfer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Strategic Implications to Conclude the Exploration of Electronic Funds Transfer Advancements and Market Dynamics

The exploration of electronic funds transfer reveals a sector in constant flux, shaped by technological breakthroughs, evolving consumer expectations, and shifting geopolitical landscapes. From the emergence of true instant payment rails in leading economies to the adoption of tokenization platforms promising unified ledgers, the imperative for modernization is clear. Regulatory interventions, such as SEPA’s Instant Payments Regulation and U.S. tariff reforms, are simultaneously catalyzing innovation and introducing new cost considerations.

Segmentation analysis underscores the diverse requirements across payment modes, transaction types, channels, and end-user categories, emphasizing the need for adaptable solutions that balance performance, security, and user experience. Regional insights highlight the success of systems like Pix in Latin America and UPI in India, while reminding stakeholders of the heterogeneity in infrastructure maturity and regulatory frameworks. Competitive benchmarking illustrates that network giants and nimble fintechs alike must continuously refine their offerings to maintain relevance.

Looking ahead, industry participants who embrace open architectures, invest in advanced analytics, and cultivate cross-sector partnerships will be best equipped to navigate this dynamic environment. By aligning strategic priorities with customer needs and regulatory mandates, organizations can capitalize on the transformative potential of electronic funds transfer to drive growth and deliver superior user experiences.

Empower Your Strategic Decisions Today by Connecting with Ketan Rohom to Access the Definitive Electronic Funds Transfer Market Research Report

Don't miss the opportunity to leverage deep market intelligence and strategic analysis specifically tailored for electronic funds transfer. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today and gain a competitive edge in navigating payment industry dynamics.

- How big is the Electronic Funds Transfer Market?

- What is the Electronic Funds Transfer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?