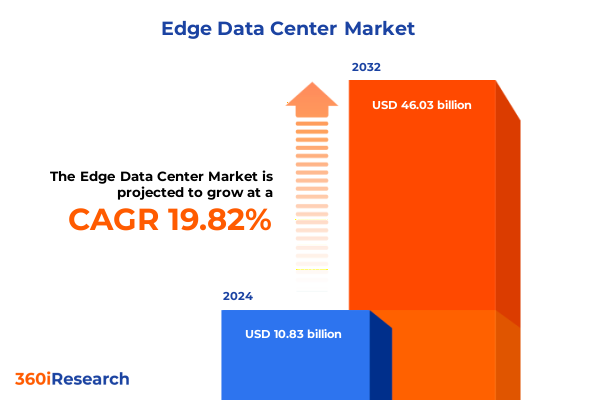

The Edge Data Center Market size was estimated at USD 12.82 billion in 2025 and expected to reach USD 15.19 billion in 2026, at a CAGR of 20.02% to reach USD 46.03 billion by 2032.

Unveiling the Critical Role and Expanding Influence of Edge Data Centers in Enhancing Performance and Resilience of Modern Digital Infrastructure Landscapes

The proliferation of data-intensive applications and the surge in real-time analytics requirements have propelled edge data centers from niche installations to foundational pillars of modern network architectures. As organizations seek to reduce latency and enhance data sovereignty, edge deployments are emerging as critical enablers of digital transformation. Edge data centers are now being integrated into hybrid infrastructures, bridging centralized cloud environments with distributed micro data hubs located closer to end users.

Moreover, the growing demand for immersive technologies such as augmented reality, autonomous vehicles, and Internet of Things ecosystems has intensified the need for localized processing capabilities. This shift is driving enterprises across industries to deploy compact, resilient facilities that can handle workloads at the network edge. In parallel, sustainability considerations are prompting a focus on energy-efficient designs, leveraging innovations in modular power systems and liquid cooling solutions to minimize environmental impact and operating costs.

Ultimately, decision-makers must grasp the evolving dynamics of edge data centers to capitalize on their potential. By evaluating technological enablers, regulatory frameworks, and application trajectories, stakeholders can chart a clear path for deploying edge infrastructure that aligns with strategic objectives and delivers tangible business value.

Exploring the Rapid Technological Convergence and Strategic Realignment Driving the Evolution and Adoption of Edge Data Center Architectures Worldwide

In recent years, edge data center architectures have undergone a profound transformation driven by technological convergence and shifting enterprise priorities. Advances in compact server designs, high-density networking switches, and software-defined infrastructure platforms have converged to enable highly customizable micro data center modules. This convergence has empowered organizations to deploy edge facilities that seamlessly integrate compute, storage, and network functions in a fraction of the space traditionally required.

Simultaneously, the rise of 5G connectivity has catalyzed new use cases, particularly in smart manufacturing and autonomous systems, necessitating ultra-low-latency processing capabilities at the network periphery. Edge data centers are no longer isolated testbeds but are now being strategically aligned with core data center operations and cloud services. This strategic realignment underscores a broader architectural shift toward distributed, multi-access edge computing (MEC) frameworks that prioritize both scalability and proximity.

Looking ahead, the coalescence of artificial intelligence inference engines with containerized workloads at the edge will further accelerate this trend. As enterprises increasingly demand real-time insights, the ability to deploy AI workloads in localized environments will become a key differentiator. Consequently, the edge data center landscape will continue to evolve in tandem with innovations in chip architectures, networking protocols, and software orchestration tools.

Assessing the Extensive and Ongoing Effects of 2025 United States Tariffs on Edge Data Center Supply Chain Dynamics and Operational Cost Structures

The implementation of new tariffs by the United States in early 2025 has introduced tangible shifts in the supply chain economics of edge data center deployments. By levying additional duties on certain imported components-such as semiconductor wafers and high-performance networking modules-project planners are encountering increased procurement costs and extended lead times. These cumulative effects have incentivized a reevaluation of sourcing strategies and prompted a greater emphasis on regional manufacturing partnerships.

In response, many operators have accelerated their adoption of domestic fabrication for critical hardware assemblies, forging alliances with locally based electronics manufacturers. This pivot not only mitigates exposure to cross-border trade fluctuations but also aligns with broader national security directives aimed at reinforcing domestic production capabilities. Meanwhile, the operational budgets for new edge sites are being recalibrated to accommodate contingency buffers for tariff-related escalations, ensuring that unexpected cost variances do not undermine deployment timelines.

Despite these challenges, the tariff environment has galvanized investment in supply chain transparency initiatives. Companies are increasingly deploying blockchain-led traceability platforms and real-time procurement analytics to monitor origin, certification, and tariff categorization for every component. Such measures are proving indispensable for maintaining budgetary discipline and ensuring compliance in a landscape marked by evolving trade regulations.

Delineating Comprehensive Component and End-User Segmentation to Illuminate Strategic Opportunities and Growth Drivers in Edge Data Center Markets

In the component dimension, the market is dissected into hardware, services, and software realms. Hardware components encompass a broad array of networking equipment including routers and switches, an evolving portfolio of server infrastructure spanning blade servers to micro data center nodes, and versatile storage devices ranging from high-density arrays to object-based systems. Services offerings extend beyond traditional maintenance and support to include pre-deployment consulting services that guide customization, specialized installation and deployment services that ensure seamless integration of modular units, and comprehensive maintenance support that optimizes uptime through predictive analytics.

Complementing these layers, software solutions deliver orchestration platforms, virtualization frameworks, and security suites that unify distributed edge nodes under a singular management umbrella. When considering end-user dynamics, the banking, financial services, and insurance sector is leveraging edge facilities for ultra-secure transaction processing and real-time fraud detection. Energy and utilities entities are deploying localized processing for grid monitoring and predictive maintenance, while government and defense agencies prioritize edge nodes for secure communications and mission-critical applications. In healthcare environments, proximity computing supports diagnostics and telehealth services, and IT and telecommunications service providers are embedding edge nodes to facilitate carrier-grade connectivity. Manufacturing operations harness localized analytics for quality control and automation, while retail organizations deploy edge systems to enhance in-store experiences and enable rapid inventory management.

These segmentation insights illuminate the multifaceted nature of edge data center demand and highlight where specialized solutions can yield maximum operational impact.

This comprehensive research report categorizes the Edge Data Center market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End-User

- Facility Size

Highlighting Distinct Growth Trajectories and Infrastructure Priorities Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

In the Americas, expansive greenfield initiatives are being underpinned by robust investment in fiber and 5G rollouts, with edge facilities emerging along major transit corridors and urban centers. The region’s emphasis on sustainability is driving the integration of renewable energy sources and advanced cooling techniques, positioning edge deployments as testbeds for low-carbon data infrastructure.

Across Europe, the Middle East, and Africa, infrastructure priorities vary widely, with Western Europe focusing on regulatory compliance and data sovereignty, while the Middle East is channeling investment from sovereign wealth funds into smart city and oil and gas digitalization projects. In Africa, edge deployments are spearheading efforts to bridge connectivity gaps in remote regions, leveraging modular designs that can be rapidly deployed and powered by off-grid microgrids.

The Asia-Pacific region is characterized by a dual trajectory: advanced markets such as Japan and South Korea are integrating edge data centers with next-generation AI and robotics applications, whereas emerging economies in Southeast Asia are deploying cost-effective micro data centers to support expanding e-commerce and digital government services. Across all regions, the interplay between regulatory frameworks, energy availability, and technological maturity is giving rise to distinct deployment archetypes that reflect localized priorities and ecosystem capabilities.

This comprehensive research report examines key regions that drive the evolution of the Edge Data Center market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping Competitive Dynamics and Technological Advancements in the Edge Data Center Sector Globally

Leading global technology providers are rapidly augmenting their portfolios through strategic partnerships and targeted acquisitions. Network equipment manufacturers are embedding advanced telemetry capabilities into switches and routers to enable real-time monitoring at edge sites, while prominent server vendors are optimizing blade and microserver configurations for power efficiency and compact form factors. Major power and cooling system suppliers have introduced integrated modular solutions combining UPS units, precision cooling, and rack-based distribution to streamline edge deployments.

Collaborative ecosystems are also emerging, with hyperscale cloud providers investing in edge partnerships to extend platform services into distributed locations. At the same time, specialized colocation operators are differentiating through localized service bundles, offering concierge-level support and rapid on-site maintenance. Furthermore, software vendors are developing unified orchestration platforms that transcend on-premises and cloud boundaries, enabling centralized control over geographically dispersed edge nodes.

Enterprise end users, from financial institutions to healthcare systems, are selectively engaging these vendors based on demonstrated expertise in sector-specific deployments, proven track records in reliability, and the ability to deliver scalable solutions aligned with evolving security mandates. Such dynamics underscore a competitive landscape where technological innovation, service excellence, and strategic alliances dictate market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Edge Data Center market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 365 Data Centers

- Amazon Web Services, Inc.

- American Tower Corporation

- AtlasEdge Data Centres

- Broadcom, Inc.

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Compass Datacenters

- DartPoints

- Dell Inc.

- Digital Realty Trust Inc.

- Eaton Corporation PLC

- Edge Centres Pty Ltd.

- EdgeConneX, Inc.

- EdgePresence by Ubiquity

- Equinix, Inc.

- Flexential Corporation

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- H5 Data Centers

- Hewlett Packard Enterprise Company

- HostDime Global Corp.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Lumen Technologies, Inc.

- Microsoft Corporation

- NEC Corporation

- Nvidia Corporation

- Oracle Corporation

- Penta C.V.

- Rittal GmbH & Co. KG

- SAP SE

- Schneider Electric SE

- The Siemon Company

- Vapor IO, Inc.

- Vertiv Group Corporation

Outlining Practical Strategic Imperatives for Industry Leaders to Capitalize on Emerging Edge Data Center Trends and Maintain Competitive Advantage

Industry leaders should prioritize modular infrastructure architectures that allow for rapid scalability while maintaining operational consistency across sites. By adopting standardized micro data center modules, organizations can reduce deployment timelines and simplify maintenance protocols. Additionally, forging partnerships with regional manufacturing experts will help mitigate tariff-induced cost fluctuations and bolster supply chain resilience.

To stay ahead of evolving application demands, executives must invest in software-defined orchestration tools that unify edge and core environments under a single pane of glass. This integrated approach not only streamlines resource allocation but also enhances visibility into performance metrics, enabling proactive capacity planning. Furthermore, embedding advanced telemetry and predictive analytics into critical components can preempt operational disruptions and optimize energy consumption, driving both reliability and sustainability.

Finally, stakeholders should develop clear governance frameworks that address data privacy and security at the edge. Establishing uniform policies for encryption, identity management, and compliance monitoring will ensure that distributed nodes adhere to organizational standards. Coupling these measures with ongoing training programs for field technicians and IT personnel will cultivate the expertise needed to manage complex, geographically dispersed infrastructures effectively.

Detailing a Transparent Multi-Stage Research Framework and Methodological Rigor Underlying the Comprehensive Edge Data Center Analysis

This analysis is founded on a rigorous research framework that integrates both primary and secondary data sources. Primary research involved in-depth interviews with senior executives, data center architects, and technology providers, complemented by structured surveys targeting operational managers responsible for edge deployments. These engagements provided firsthand insights into deployment challenges, technology preferences, and strategic priorities across diverse verticals.

Secondary research encompassed the systematic review of publicly available documents, including regulatory filings, technical whitepapers, industry standards publications, and press releases. Proprietary databases tracking component shipments, software licensing trends, and service contracts were leveraged to validate market dynamics. Data triangulation was achieved by cross-referencing interview feedback with vendor roadmaps and infrastructure deployment case studies, ensuring consistency and accuracy.

Throughout the process, methodological rigor was upheld by implementing quality checks such as data cleansing protocols, bias assessments, and consistency validation. This multi-stage approach ensures that the findings and insights reflect a balanced perspective, free from single-source dependencies, and tailored to inform strategic decision-making in the evolving edge data center landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Edge Data Center market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Edge Data Center Market, by Component

- Edge Data Center Market, by Deployment Mode

- Edge Data Center Market, by End-User

- Edge Data Center Market, by Facility Size

- Edge Data Center Market, by Region

- Edge Data Center Market, by Group

- Edge Data Center Market, by Country

- United States Edge Data Center Market

- China Edge Data Center Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings, Strategic Insights, and Critical Considerations to Navigate the Evolving Edge Data Center Ecosystem with Confidence

The executive summary encapsulates the transformative dynamics redefining edge data center infrastructures, from the confluence of advanced hardware and software innovations to the strategic repercussions of evolving trade policies. By delineating component and end-user segmentation, it becomes clear where investment and innovation are converging to address mission-critical low-latency and data sovereignty requirements. Regional insights further contextualize deployment imperatives, emphasizing how localized regulatory, energy, and connectivity factors shape distinctive market archetypes.

Profiles of leading technology suppliers and ecosystem partners underscore the critical role of collaboration in accelerating edge adoption. Strategic recommendations highlight the need for modular architectures, unified orchestration platforms, and rigorous governance frameworks to ensure operational excellence. The employed research methodology lends credibility to the analysis, having integrated diverse data sources and validation techniques to distill actionable intelligence.

As organizations chart their edge strategies, this synthesis serves as a compass, guiding stakeholders through a complex environment marked by rapid innovation and shifting external forces. By embracing the core findings and insights, decision-makers can position their operations for resilience, agility, and sustained competitive advantage in the decentralized data era.

Connect Directly with Associate Director Ketan Rohom to Secure Exclusive Access to the In-Depth Edge Data Center Market Research Report and Insights

To explore how the insights and analysis presented in this executive summary can drive your strategic initiatives, connect directly with Associate Director Ketan Rohom. He will provide you with an in-depth walkthrough of the comprehensive Edge Data Center market research report, offering tailored guidance on how to leverage these findings for maximum impact. Engaging with Ketan Rohom will enable you to secure exclusive access to proprietary data, detailed case studies, and benchmark comparisons that are not available in the summary. Reach out today to arrange a personalized briefing and take the first step toward transforming your data infrastructure strategy.

- How big is the Edge Data Center Market?

- What is the Edge Data Center Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?