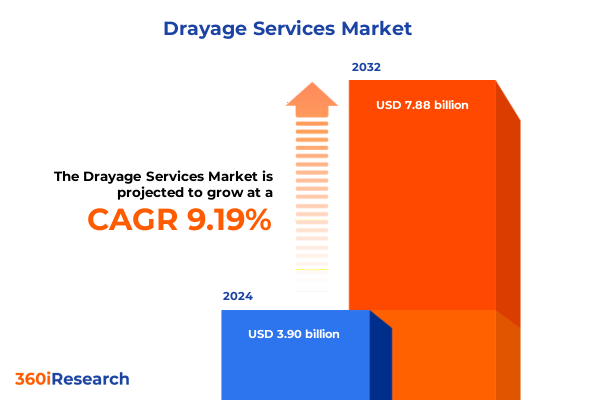

The Drayage Services Market size was estimated at USD 4.26 billion in 2025 and expected to reach USD 4.65 billion in 2026, at a CAGR of 9.18% to reach USD 7.88 billion by 2032.

Understanding the Strategic Role of Drayage Services in Modern Supply Chains to Enhance Port Efficiency and Seamless Cargo Mobility

Drayage services play a critical role as the vital link between maritime terminals and inland transportation networks, ensuring that cargo moves seamlessly from port to destination. In today’s global supply chains, efficiency at this juncture has become more important than ever, influencing lead times, operational costs, and customer satisfaction. Rapid shifts in shipping patterns, coupled with growing vessel sizes and port congestion, have increased demand for agile drayage solutions that can adapt in real time.

As industry stakeholders seek competitive advantage, understanding the foundational principles and evolving dynamics of drayage operations becomes essential. Strategic partnerships between carriers, terminal operators, and technology providers are reshaping traditional workflows, enabling more transparent and data-driven planning. This introduction lays the groundwork for exploring how drayage services will continue to underpin supply chain resilience and drive innovation across ports and hinterlands.

Exploring the Paradigm Shift in Drayage Services Driven by Technological Advancements, Environmental Policy Changes, and Operational Innovation

Over the last few years, drayage operations have undergone transformative shifts propelled by digitalization, sustainability mandates, and shifts in global trade flows. Advanced yard management systems, real-time telematics, and AI-driven route optimization have reduced dwell times and improved asset utilization across port terminals. Meanwhile, emerging environmental regulations have compelled carriers and port operators to pilot zero-emission drayage trucks, invest in electrification infrastructure, and adopt alternative fuels to meet stringent emissions targets.

Concurrently, geopolitical events and shifting trade agreements have altered cargo volumes and routing preferences, prompting drayage providers to diversify service portfolios. Greater collaboration among intermodal terminals, freight forwarders, and logistics technology firms has fostered integrated solutions that bridge ocean and land transport. These developments underscore how drayage is no longer a standalone segment but a dynamic component of a fully connected, resilient supply chain ecosystem.

Evaluating the Ripple Effects of 2025 United States Tariffs on Drayage Operations, Cost Structures, and International Trade Flows

The cumulative impact of United States tariffs enacted during 2025 has materially influenced the cost structure and flow patterns of drayage operations along major ports. Elevated duties on steel, aluminum, and a broad range of imported manufactured goods have increased landed costs, compelling importers to reevaluate sourcing strategies and prioritize domestic facilities. As a result, certain ports have experienced shifts in container volumes, creating uneven congestion and driving variable drayage pricing in high-demand corridors.

In response, drayage providers have invested in flexible capacity models, leveraging both owned assets and third party networks to absorb volatility. The adjustments required across equipment leasing, gate operations, and intermodal connectivity have underscored the sector’s sensitivity to tariff policy changes. Looking ahead, ongoing tariff reviews and potential trade negotiations will continue to ripple through drayage economics, challenging operators to maintain service reliability amid an evolving regulatory landscape.

Unveiling Critical Segmentation Dimensions Shaping the Drayage Services Market Across Freight Type, Container Configurations, and Service Modalities

A nuanced view of drayage services emerges when examining core segmentation dimensions, each offering unique insights for operational and strategic decision making. Freight type distinctions between full container load and less than container load highlight how shippers allocate resources based on consolidation needs and shipment frequency. Container type segmentation further refines market understanding, contrasting usage patterns across dry containers, flat rack units, open top units, and refrigerated units, which serve temperature-sensitive goods.

Service type distinctions reveal critical trade-offs in delivery models. Door to door and door to port options cater to end-to-end visibility and port consolidation, while intermodal solutions-whether road-rail or road-sea-optimize cost and carbon efficiency. Port to door services complete the logistics chain with final-mile agility, reflecting customer preferences. Port type segmentation underscores differences between rail port drayage and sea port drayage operations, each with distinct infrastructure and scheduling demands.

Fleet ownership models introduce another strategic layer. Asset based operations maintain equipment control and operational consistency, whereas non-asset based providers, comprising freight brokers and third party logistics providers, deliver network flexibility and expanded carrier partnerships. Finally, customer type segmentation illuminates demand drivers and service expectations across manufacturers, retailers, and third party logistics entities, informing tailored solution design.

This comprehensive research report categorizes the Drayage Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Freight Type

- Container Type

- Service Type

- Fleet Ownership

- Port Type

Analyzing Regional Dynamics Transforming Drayage Services Performance across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional market characteristics dramatically influence drayage performance, reflecting local infrastructure, regulatory environments, and trade dynamics. In the Americas, busy gateways on the west and east coasts wrestle with persistent congestion challenges, prompting drayage providers to adopt digital slot booking and dynamic routing to maintain throughput. Inland rail corridors have emerged as vital extensions of port activity, creating inland hubs that streamline container flow and reduce coastal bottlenecks.

Across Europe, the Middle East and Africa, drayage services are adapting to a fragmented port network and cross-border regulatory complexities. Leading European ports are piloting eco-port initiatives, incentivizing low-emission drayage fleets and investing in shore-power connectivity. In the Middle East, transshipment hubs leverage high-velocity turnarounds, while African ports increasingly integrate inland container depots to overcome hinterland accessibility limitations.

The Asia-Pacific region drives scale with mega-port facilities and vast intermodal rail links. Electrification programs in major Southeast Asian and Australian ports signal a broader shift toward lower carbon footprints. Regional free trade agreements continue to spur container throughput, demanding flexible drayage capacity to accommodate fluctuating volumes across short-sea and rail-on-land corridors.

This comprehensive research report examines key regions that drive the evolution of the Drayage Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Pioneering Drayage Service Excellence through Technology, Sustainability, and Network Optimization

A diverse ecosystem of carriers, technology firms, and logistics integrators shapes the competitive landscape of drayage services. Leading providers have differentiated through investments in digital platforms that unify yard operations, real-time shipment tracking, and performance analytics. Collaborative alliances between shipping lines and rail operators have also emerged, enabling seamless intermodal transitions and expanded service footprints.

Innovative players are leveraging green vehicle fleets and charging infrastructure partnerships to meet rising sustainability expectations, positioning themselves as preferred partners for environmentally conscious shippers. In tandem, strategic acquisitions and network expansions are cementing the market position of major drayage specialists, driving industry consolidation and raising the bar for service reliability and technological sophistication.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drayage Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- APL Logistics Ltd.

- Bison Transport

- Boa Logistics LLC

- C.R. England

- Canada Drayage Inc.

- Clopton Truck Lines, Inc.

- ContainerPort Group

- Cowan Systems

- Evans Network of Companies

- Forward Air

- G&D Integrated

- Hub Group, Inc.

- IMC Companies

- Interlog USA

- ITS ConGlobal

- J.B. Hunt Transport Services, Inc.

- Landstar System

- Marten Transport

- NFI

- Pace Global Logistics

- Pacific 9 Transportation, Inc.

- Paper Transport

- Pasha Distribution Services, Inc.

- Port Logistics Group, Inc.

- RoadOne Intermoda Logistics, Inc.

- Schneider Electric SE

- Seafront Transportation Group, LLC

- SEKO Logistics, Inc.

- Swift Intermodal

- Universal Intermodal Services

- XPO Logistics, Inc.

Practical Strategies and Actionable Steps for Industry Leaders to Optimize Drayage Operations, Reduce Emissions, and Enhance Competitive Positioning

To thrive in an increasingly complex environment, drayage operators and shippers must adopt practical strategies that align operational efficiency with strategic resilience. Prioritizing deployment of advanced terminal yard management and telematics systems can reduce idle time and enhance equipment utilization, while integrated freight planning tools provide visibility across ocean and land segments. Moreover, fostering close collaboration with port authorities and carriers supports proactive slot allocation and capacity forecasting.

Equally important is the transition to low-emission assets, which can deliver regulatory compliance and brand differentiation. Building partnerships to share charging and maintenance infrastructure enables smoother adoption of electric and alternative-fuel trucks. Finally, empowering the workforce through targeted training in digital tools and safety protocols ensures that human capital remains a competitive advantage as operations evolve.

Outlining the Rigorous Research Methodology Employed to Deliver Comprehensive and Insightful Drayage Services Market Analysis

This research report combines rigorous primary and secondary research methodologies to ensure comprehensive coverage of the drayage services market. Primary insights derive from in-depth interviews with executives across carrier organizations, port authorities, and logistics technology providers. These expert consultations inform the qualitative understanding of operational challenges, technological adoption, and strategic priorities.

Secondary data sources include government transportation statistics, industry association reports, peer-reviewed publications, and publicly available financial statements. Data triangulation techniques and validation workshops with subject-matter experts enhance the accuracy and findings. Throughout the process, consistent data cleaning and standardization protocols were applied to deliver reliable, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drayage Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drayage Services Market, by Freight Type

- Drayage Services Market, by Container Type

- Drayage Services Market, by Service Type

- Drayage Services Market, by Fleet Ownership

- Drayage Services Market, by Port Type

- Drayage Services Market, by Region

- Drayage Services Market, by Group

- Drayage Services Market, by Country

- United States Drayage Services Market

- China Drayage Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Implications of Drayage Service Trends to Empower Decision Makers in a Complex Supply Chain Landscape

As supply chains continue to evolve under the pressures of digitalization, regulatory change, and sustainability imperatives, drayage services remain a pivotal link in the movement of containerized goods. The intersection of advanced yard management, intermodal integration, and environmental innovation will define the next wave of industry leadership. Companies that embrace agility, invest in collaborative partnerships, and leverage data-driven insights will unlock significant value.

By synthesizing segmentation perspectives, regional dynamics, tariff impacts, and competitive landscapes, decision makers can make informed investments that enhance operational resilience. Ultimately, drayage service excellence will hinge on the ability to anticipate disruptions, innovate continuously, and maintain the highest standards of service reliability in an ever-changing global trade environment.

Take the Next Step to Acquire the Complete Drayage Services Market Research Report with Expert Support from Ketan Rohom Associate Director Sales & Marketing

To unlock the full depth of insights within the comprehensive drayage services market research report, reach out to Ketan Rohom Associate Director, Sales & Marketing for personalized guidance and purchasing assistance. He stands ready to help you navigate the detailed analysis, ensure the report aligns with your strategic priorities, and answer any questions regarding data access and bespoke deliverables. Connect with him to explore tailored solutions that can drive actionable outcomes in your drayage operations and supply chain initiatives.

- How big is the Drayage Services Market?

- What is the Drayage Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?