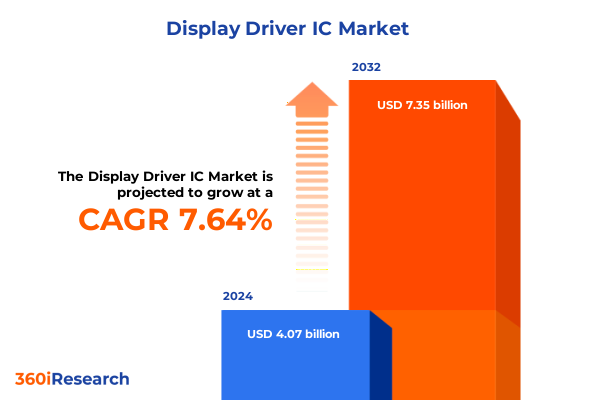

The Display Driver IC Market size was estimated at USD 4.38 billion in 2025 and expected to reach USD 4.70 billion in 2026, at a CAGR of 7.68% to reach USD 7.35 billion by 2032.

Unveiling the Critical Role of Display Driver ICs in Empowering Advanced Visual Interfaces Across Consumer Automotive and Industrial Markets

The convergence of sophisticated visual display technologies and ubiquitous connectivity has fueled an unprecedented demand for high-performance Display Driver Integrated Circuits (ICs). As the critical interface between graphic rendering engines and the physical screen, driver ICs translate digital commands into precise voltage and current signals that activate individual pixels. This vital role underpins the user experience across a broad spectrum of devices, from smartphones and televisions to automotive dashboards and medical imaging equipment. In recent years, rapid advancements in display panels-spanning Liquid Crystal Display (LCD) to Organic Light-Emitting Diode (OLED) and emerging Micro-LED architectures-have imposed stringent requirements on driver ICs for higher resolution, faster refresh rates, lower power consumption, and enhanced reliability.

Against this backdrop of technological progress, the competitive landscape has become increasingly dynamic. Startups and established semiconductor giants alike are investing heavily in next-generation process nodes, advanced packaging techniques, and proprietary driver architectures. Meanwhile, end customers demand ever-thinner bezels, flexible form factors, and seamless integration of touch and variable refresh functionality. These evolving expectations necessitate driver IC solutions that are not only standardized for mass-market consumer electronics, but also customizable for specialized applications such as industrial displays, wearable devices, and electric vehicles. As a result, industry participants are focusing on holistic system integration to deliver differentiated offerings and capture growth in adjacent markets.

In this environment, decision makers must navigate a complex matrix of technological innovation, supply chain dynamics, regulatory considerations, and competitive strategies. This executive summary provides a concise yet comprehensive overview of the forces shaping the Display Driver IC market, equipping stakeholders with the context needed to drive informed strategic planning and investment prioritization.

Mapping the Paradigm Shifts Driving Display Driver IC Evolution From Traditional LCD to Cutting-Edge MicroLED and Beyond

The Display Driver IC sector is undergoing transformative shifts catalyzed by the convergence of new display paradigms and evolving consumer expectations. Transitional leaps from conventional LCD panels to OLED and Micro-LED have redefined performance benchmarks, pushing driver IC manufacturers to optimize for higher pixel densities, dynamic range, and color accuracy. This shift is further propelled by the proliferation of high-end gaming monitors and virtual reality headsets, which require ultra-high refresh rates and minimal latency. As a result, industry leaders are accelerating R&D in advanced timing controllers and power management modules to support these demanding specifications.

Concurrently, the adoption of flexible and foldable displays has introduced a new dimension of mechanical stress tolerance and form factor variability. Driver ICs must not only maintain signal integrity under repeated flex cycles, but also adapt to non-standard panel dimensions and multi-axis bending. This trend is particularly evident in the smartphone and wearable segments, where manufacturers vie to differentiate through novel industrial designs. Transitioning seamlessly, the automotive industry’s shift toward digital cockpits has created robust demand for ruggedized driver ICs capable of operating across broad temperature ranges with high electromagnetic compatibility. These innovations underscore the requirement for cross-domain expertise as semiconductor suppliers seek to align their portfolios with both mainstream consumer electronics and niche industrial applications.

Moreover, the emphasis on energy efficiency and sustainable manufacturing practices has driven the integration of smarter power delivery architectures and eco-friendly materials. By leveraging advanced lithography and wafer-level packaging processes, companies are reducing die size and improving thermal dissipation, thereby extending battery life in handheld devices and enabling fanless designs in compact displays. As these transformative shifts converge, the market landscape becomes more competitive, with success hinging on the ability to anticipate emerging requirements and build synergistic hardware-software ecosystems that address the full spectrum of performance, durability, and sustainability.

Analyzing the Comprehensive Effects of the 2025 United States Tariff Measures on Supply Chains Pricing and Innovation in the Display Driver IC Sector

In 2025, the United States implemented a series of tariff measures targeting imported semiconductor components, including Display Driver ICs, with the dual objectives of bolstering domestic manufacturing and addressing national security concerns. These levies have reverberated throughout the global supply chain, prompting both price adjustments and strategic recalibrations. Suppliers based in export-focused regions have had to absorb increased costs or transfer them to customers, leading to upward pressure on device pricing. At the same time, domestically oriented foundries and assembly-test service providers have seen an uptick in orders as OEMs and ODMs explore onshore alternatives to mitigate tariff exposure.

Consequently, companies with vertically integrated manufacturing capabilities gained a competitive edge, since they could internalize more of the production value chain and limit the impact of external duties. This trend accelerated capacity expansions at U.S.-based fabs and stimulated capital investment in advanced packaging facilities. Conversely, smaller market entrants and specialized driver IC designers faced margin constraints, which in some cases curtailed R&D budgets or compelled strategic partnerships with non-U.S. contract manufacturers. In parallel, regional trade agreements in Asia and Europe catalyzed collaborative supply networks, offering tariff-optimized pathways for high-value IC components destined for end markets in North America.

Looking ahead, stakeholders must maintain vigilant scenario planning to navigate potential adjustments in tariff rates, which remain subject to geopolitical negotiation. Diversification of procurement sources, integration of local content clauses, and real-time tariff modeling have emerged as indispensable practices for risk management. By adopting these measures, companies can safeguard against volatile duty structures while sustaining innovation roadmaps and cost competitiveness in the ever-evolving Display Driver IC domain.

Distilling Core Insights From Multifaceted Segmentation Covering Display Technologies Packaging Formats and End-User Applications for Strategic Clarity

Deep analysis of the Display Driver IC market reveals nuanced insights when segmenting by display type, IC packaging, driver technology, application, and end-user vertical. In terms of display technologies, Light-Emitting Diode configurations continue to thrive in high-brightness signage and infotainment systems, while Liquid Crystal Display panels maintain a cost-efficient presence in monitors and budget smartphones. Organic Light-Emitting Diode solutions, on the other hand, dominate premium wearables and high-end televisions due to superior contrast ratios and power profiles.

Packaging formats serve as another critical vector of differentiation. Ball Grid Array packages balance performance with manufacturability, making them prevalent in mainstream consumer devices. Fine Pitch Land Grid Array and Land Grid Array implementations are preferred for applications demanding high signal integrity, such as professional-grade monitors and medical imaging equipment. Low-Profile Quad Flat Packages cater to ultra-thin form factors in mobile devices, whereas Wafer Level Chip Scale Packages enable ultra-compact integration, powering minimalist wearable displays and space-constrained IoT modules.

The underlying driver technology further delineates market opportunities. Common Drivers, which orchestrate row and column signaling, are essential for basic display operations. Gate Drivers deliver precise voltage control across gate lines in high-resolution panels, while Segment Drivers optimize current delivery for column lines. Source Drivers, which handle data reception and pixel-level information, are critical in applications requiring rapid refresh and deep color processing.

Applications themselves reveal distinctive growth trajectories. Televisions and digital signage benefit from continual screen size and resolution upgrades, whereas smartphones and tablets push innovation in power efficiency and bendable panels. Laptops and notebooks leverage thin-bezel designs driven by advanced driver IC integration, and the emergence of wearables demands ultra-low-power solutions. In medical devices, precise imaging and reliability are paramount, while monitors and screens for industrial and gaming markets exploit high refresh rates and HDR support.

Finally, end-user segmentation underscores where strategic focus can yield the highest returns. The automotive industry’s investment in interactive dashboards and head-up displays has created a burgeoning market for ruggedized, temperature-tolerant driver ICs. Consumer electronics remain the largest volume driver, yet the healthcare sector’s stringent regulatory requirements for medical-grade displays opens opportunities for specialized certification and reliability testing. Retail environments, with their increasing reliance on digital signage for immersive experiences, drive demand for flexible installation and remote management capabilities. Telecommunications infrastructure utilizes driver ICs in network monitoring and control displays, rounding out a diverse end-market landscape that demands tailored solutions.

This comprehensive research report categorizes the Display Driver IC market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display

- IC Package

- Driver Technology

- Application

- End-User

Navigating Regional Dynamics Revealing Unique Growth Catalysts and Competitive Landscapes Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the Display Driver IC market are shaped by distinct growth catalysts and competitive landscapes. In the Americas, strong demand in consumer electronics and the automotive sector has fostered significant local capacity for IC design and testing. Proximity to major OEMs enables streamlined collaboration, while supportive government incentives bolster domestic manufacturing. However, reliance on a limited number of high-volume fabs necessitates supply chain resilience planning, particularly in light of potential natural disruptions and geopolitical tensions.

Across Europe Middle East and Africa, regulatory frameworks and sustainability mandates have driven adoption of energy-efficient display technologies. Initiatives such as EcoDesign requirements in the European Union encourage the integration of low-power driver ICs, especially in public information systems and smart city projects. The region’s diversified manufacturing base-spanning automotive centers in Germany to consumer electronics hubs in Turkey-supports a balanced ecosystem of global chip designers and local assemblers. Meanwhile, economic development programs in parts of the Middle East and Africa are positioning these markets as emerging sites for display integration and localized content deployment.

In the Asia Pacific region, rapid consumer adoption of cutting-edge smartphones, televisions, and wearables has propelled a competitive semiconductor landscape. Taiwan, South Korea, and Japan maintain leadership in advanced process nodes and packaging technologies, while China’s vertical integration initiatives aim to reduce import dependence for critical IC components. Collaborative research clusters in Singapore and India emphasize next-generation packaging and testing methodologies, reflecting a broader strategy to capture adjacent markets such as AR/VR displays and IoT devices. These regional variations underscore the importance of tailored market entry strategies, ecosystem partnerships, and compliance navigation to capitalize on each geography’s unique drivers.

This comprehensive research report examines key regions that drive the evolution of the Display Driver IC market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Intelligence Spotlighting Key Industry Players Strategic Partnerships and Technological Leadership Shaping the Display Driver IC Marketplace

The competitive milieu of the Display Driver IC sector is defined by a mix of global semiconductor titans and specialized, regionally focused innovators. Industry leaders have leveraged economies of scale to invest in advanced node development and extensive IP portfolios, delivering comprehensive driver solutions that integrate timing control, power management, and signal processing. At the same time, nimble startups and mid-size companies have carved out niches by addressing specific applications such as low-power wearables or high-refresh gaming monitors.

Collaborative alliances between chip designers and foundry partners are pervasive, enabling seamless handoff from architecture definition to volume production. This model accelerates time-to-market for differentiated driver ICs that meet stringent performance and reliability targets. In parallel, strategic partnerships with display panel manufacturers have become a de facto requirement for early access to new materials and process innovations. These joint development agreements yield joint roadmaps and co-optimized hardware that enhance overall display system efficiency.

Mergers and acquisitions continue to reshape the competitive landscape as larger entities absorb specialized firms to bolster their product portfolios. This consolidation wave underscores the premium placed on proprietary driver IP and proprietary packaging processes, which serve as key differentiators. Additionally, a growing number of top-tier players have established dedicated business units focused on automotive and industrial displays, recognizing the higher entry barriers and margin profiles in these segments. Collectively, these competitive dynamics signal an era of intensified collaboration, targeted consolidation, and continuous investment in next-generation driver architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Display Driver IC market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams-OSRAM AG

- Analog Devices, Inc.

- Elitech Co., Ltd.

- FocalTech Systems Co., Ltd.

- Himax Technologies, Inc.

- Infineon Technologies AG

- LX Semicon Co., Ltd.

- Macroblock, Inc.

- Magnachip Semiconductor, Ltd.

- MediaTek Inc.

- Novatek Microelectronics Corporation

- NXP Semiconductors N.V.

- Power Integrations, Inc.

- Princeton Technology Corporation by Intervala, LLC

- Raydium Semiconductor Corporation

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Richtek Technology Corporation

- Rohm Co., Ltd.

- Samsung Electronics Co., Ltd.

- Semiconductor Components Industries, LLC

- Semtech Corporation

- Sitronix Technology Corp.

- Skyworks Solutions, Inc.

- Solomon Systech Limited

- Synaptics Incorporated

- Texas Instruments Incorporated

- Ultrachip, Inc.

- VIA Technologies Inc.

Actionable Strategic Roadmap Outlining Supply Chain Diversification Advanced R D Investments and Collaborative Initiatives for Sustained Competitive Advantage

To capitalize on the evolving Display Driver IC landscape, industry leaders must adopt a proactive strategic framework that balances innovation with supply chain resilience. First, diversifying manufacturing partners across multiple geographies will mitigate exposure to tariff fluctuations and regional disruptions. Building robust relationships with foundries in adjacent markets and incorporating local content strategies can further insulate cost structures. Concurrently, investing in advanced packaging techniques such as wafer-level chip scale integration and heterogeneous multi-die assemblies will unlock new form factors and performance thresholds for high-end applications.

Equally critical is the acceleration of targeted R&D initiatives that address emerging demands in automotive cockpits, wearable health monitors, and virtual reality ecosystems. By aligning internal development roadmaps with end-user requirements through co-innovation agreements, companies can preemptively integrate custom functionalities, such as high-temperature resilience or AI-driven power optimization. This approach not only differentiates products but also deepens customer engagement and fosters long-term partnerships.

Moreover, industry participants should establish cross-functional teams dedicated to continuous tariff monitoring, regulatory compliance, and sustainability best practices. Incorporating real-time duty modeling into procurement workflows and optimizing material selection for eco-friendly manufacturing will enhance both cost predictability and corporate responsibility credentials. Finally, cultivating an agile organizational culture that embraces iterative testing, rapid prototyping, and collaborative ecosystem partnerships will prove indispensable in navigating the complex intersection of technology advancement and market volatility.

Elucidating a Robust Research Framework Combining Primary Interviews Secondary Data Triangulation and Quantitative Modeling to Ensure Insight Rigor

The insights presented in this report are underpinned by a rigorous research methodology that blends qualitative expertise with quantitative validation. Primary research formed the backbone of our analysis, involving in-depth interviews with senior executives from leading semiconductor firms, display panel manufacturers, and OEMs across multiple regions. These engagements provided first-hand perspectives on technology roadmaps, procurement strategies, and end-market requirements. To ensure comprehensive coverage, subject-matter experts contributed specialized assessments of emerging driver architectures and packaging innovations.

Secondary research complemented these insights by synthesizing data from industry publications, regulatory filings, and patent databases. Trade association reports and technical whitepapers were leveraged to validate performance benchmarks and gauge adoption trends. In addition, investor presentations and quarterly earnings calls offered transparency into companies’ strategic priorities, capital expenditures, and product launch timelines. Cross-referencing these sources allowed for triangulation of findings and the identification of potential discrepancies.

Quantitative modeling incorporated granular supply chain data, including equipment utilization rates, wafer fabrication lead times, and material cost trajectories. Statistical analyses were applied to historical delivery schedules and pricing indices to project relative cost impacts under various scenario parameters. Finally, iterative peer reviews and validation workshops with industry stakeholders ensured that the conclusions and recommendations reflect current realities and anticipate near-term market developments. This robust methodology underlies the strategic clarity and actionable conclusions delivered in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Display Driver IC market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Display Driver IC Market, by Display

- Display Driver IC Market, by IC Package

- Display Driver IC Market, by Driver Technology

- Display Driver IC Market, by Application

- Display Driver IC Market, by End-User

- Display Driver IC Market, by Region

- Display Driver IC Market, by Group

- Display Driver IC Market, by Country

- United States Display Driver IC Market

- China Display Driver IC Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Executive Insights to Highlight Strategic Imperatives and Emerging Opportunities Steering the Future Trajectory of the Display Driver IC Landscape

As the Display Driver IC market navigates an era defined by rapid technological evolution, geopolitical complexity, and shifting end-user demands, industry participants must embrace a multi-faceted strategy. The fundamental role of driver ICs in translating digital commands into dynamic visual experiences positions the sector at the heart of innovation across consumer electronics, automotive interfaces, and industrial displays. By synthesizing emerging display paradigms, tariff considerations, and regional dynamics, this executive summary illuminates the key levers for competitive differentiation.

Segmentation analysis underscores the importance of tailoring solutions to specific display types, packaging formats, and vertical applications. Whether addressing the performance demands of high-refresh gaming monitors, the power constraints of wearable health devices, or the environmental tolerances of automotive cockpits, driver IC providers must align their roadmaps with nuanced end-market requirements. Furthermore, regional considerations-ranging from government incentives in the Americas to sustainability mandates in Europe and capacity expansions in Asia Pacific-shape strategic priorities and partnership opportunities.

In this landscape, collaboration emerges as a central theme. Manufacturers, foundries, and system integrators must synchronize efforts through joint development agreements and strategic alliances to accelerate time-to-market and optimize system-level efficiency. Simultaneously, supply chain diversification and proactive tariff management will safeguard cost competitiveness and ensure reliable access to critical components. Taken together, these strategic imperatives form a cohesive blueprint for stakeholders seeking to navigate the complexities of the Display Driver IC ecosystem and achieve sustainable growth.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Tailored Advisory for Maximizing ROI in the Display Driver IC Domain Starting Today

To gain unparalleled depth in understanding the evolving Display Driver IC ecosystem and access tailored insights that directly address your strategic priorities, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of industry knowledge and can guide you in selecting the precise research modules that align with your unique growth objectives. His expertise ensures that your organization leverages the most relevant market intelligence, enabling data-driven decisions that drive measurable business outcomes.

Whether you seek a deep dive into advanced packaging innovations, a comparative analysis of regional supply chain resilience, or a competitive benchmarking study focused on emerging players, Ketan will tailor the engagement to your requirements. By partnering with him, you gain direct access to our research team’s support, early briefings on emerging trends, and exclusive workshops designed to accelerate your commercialization strategies. We invite you to collaborate with Ketan Rohom to position your business for success in the dynamic Display Driver IC market. Reach out today to secure your comprehensive market research report and embark on a journey toward informed, strategic growth.

- How big is the Display Driver IC Market?

- What is the Display Driver IC Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?