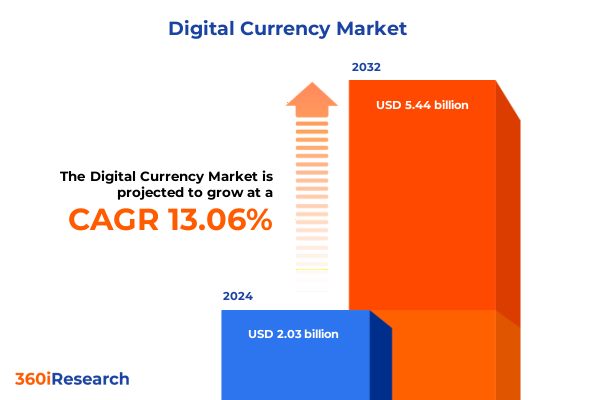

The Digital Currency Market size was estimated at USD 2.27 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 13.27% to reach USD 5.44 billion by 2032.

Charting the Expanding Digital Currency Frontier Amid Rapid Technological Disruption Regulatory Evolution and Shifting Institutional Adoption Dynamics

The digital currency ecosystem has undergone a remarkable evolution over the past decade, transitioning from a niche experiment in cryptography to a mainstream financial asset class. Originally conceived as a peer-to-peer payment system, digital currencies now span a broad spectrum of innovations including stablecoins, security tokens, and privacy-focused coins. This diversification has been driven by advancements in blockchain scalability, cryptographic standards, and decentralized finance (DeFi) protocols, which collectively have expanded the use cases beyond simple transactions. As crypto markets recently surged past a collective valuation of four trillion dollars, institutional investors have intensified their allocations, signaling a shift toward long-term adoption and integration into corporate treasury strategies.

Against this backdrop of explosive growth, regulatory bodies around the world have accelerated efforts to establish comprehensive frameworks for digital assets. In July 2025, landmark legislation such as the GENIUS Act for stablecoin oversight and the CLARITY Act to delineate jurisdiction between financial regulators marked a pivotal moment in the U.S. legislative landscape. These developments underscored the balance policymakers are seeking between fostering innovation and safeguarding market integrity. Institutional-grade custody solutions, audit-ready smart contracts, and enhanced compliance tools have emerged in parallel, helping to bridge the gap between traditional financial markets and the decentralized ecosystem.

Unveiling the Transformative Shifts Propelling Digital Currency Advancement from Decentralized Finance to Regulatory and Technological Breakthroughs

The digital currency landscape is being reshaped by a confluence of technological breakthroughs, regulatory milestones, and evolving market sentiment. Decentralized Finance (DeFi) protocols, once confined to early adopters, have matured into sophisticated platforms offering services analogous to traditional banking, including lending, borrowing, and derivatives trading. DeFi 2.0 initiatives now integrate advanced risk-management frameworks and institutional-grade oracles, enabling more secure and scalable financial instruments to attract professional investors.

Simultaneously, Central Bank Digital Currencies (CBDCs) have gained significant traction worldwide as governments seek to modernize payment infrastructures and reinforce monetary policy tools. Pilot programs in multiple jurisdictions, including digital yuan trials in China and exploratory frameworks in the European Union, demonstrate a growing consensus that CBDCs may coexist alongside privately issued cryptocurrencies to enhance transaction efficiency and financial inclusion. In the U.S., legislative actions during “crypto week” such as the Anti-CBDC Surveillance State Act underscore the contentious debate around privacy implications and sovereign control.

Beyond these regulatory shifts, tokenization of real-world assets and the integration of AI-powered smart contracts are unlocking novel use cases. NFTs have graduated from digital art to utility tokens for gaming, real estate, and digital identity management, while AI algorithms embedded within smart contract frameworks facilitate real-time adjustments based on market or supply-chain data. Together, these transformative forces are propelling the industry toward an interconnected, programmable financial ecosystem that transcends traditional boundaries.

Assessing the Cumulative Impact of 2025 United States Tariffs on Cryptocurrency Infrastructure Market Volatility and Mining Economics

In early 2025, the U.S. administration enacted reciprocal tariffs on imported cryptocurrency mining equipment, with rates ranging from 25% to as high as 125% on hardware designed by Chinese firms, dramatically increasing capital expenditures for American miners. An Application-Specific Integrated Circuit (ASIC) rig that once cost $4,000 now carries premiums between 30% and 45%, elevating the break-even cost of mining a single Bitcoin to over $40,000 in certain regions. This surge in hardware costs has squeezed profit margins for domestic operators, forcing many to defer expansion plans or consider relocation to jurisdictions with more favorable trade terms.

The impact of these tariffs extends beyond cost pressures. Logistical challenges have arisen as customs delays hold shipments for weeks, triggering storage fees and complicating supply chains. To mitigate these issues, major Chinese mining hardware manufacturers such as Bitmain, Canaan, and MicroBT have begun establishing production facilities within the U.S., aiming to circumvent tariff barriers and ensure continuity of equipment supply. However, the short-term effect has been a reduction in U.S. share of global hash rate, as domestic operators struggle with capital constraints while overseas competitors maintain cost advantages.

Market reactions have also underscored the broader volatility introduced by trade tensions. Following tariff announcements, Bitcoin prices dipped by over 6%, slipping to the mid-$70,000 range, and several crypto-related equities suffered double-digit declines in pre-market trading. Although subsequent pauses in tariff enforcement have prompted partial rebounds, the uncertainty continues to fuel caution among investors and miners alike. Over the long term, sustained trade disputes may accelerate innovation in domestic manufacturing of mining rigs and incentivize diversification of supply chains to bolster resilience.

Deriving Key Segmentation Insights from Currency Type Platform Architecture Application Use Cases and End User Profiles Driving Market Differentiation

Segmented by currency type, the digital asset market exhibits distinct growth trajectories and risk-reward profiles. Cryptocurrencies like Bitcoin and Ethereum maintain dominance in market capitalization and liquidity, while privacy coins such as Monero and Zcash cater to users prioritizing anonymized transactions. Security tokens are emerging as vehicles for regulated asset ownership, offering prospects for dividends and governance rights. Stablecoins, pegged to fiat counterparts, serve as the bridge between legacy finance and blockchain rails, while utility tokens enable access to decentralized platforms and governance functions.

When viewed through the lens of underlying platform architecture, consortium blockchains are favored by enterprises for secure, permissioned transactions, whereas private blockchains facilitate internal data sharing within organizations. Public blockchains are bifurcated between Bitcoin’s robust, decentralized network optimized for value transfer and Ethereum’s versatile ecosystem capable of hosting complex smart contracts and decentralized applications.

In terms of application, digital currencies are leveraged for a spectrum of purposes. Investment vehicles range from hodling Bitcoin as a store of value to participating in yield farming within DeFi ecosystems. The NFT space has expanded into digital art, gaming, and tokenized real estate. Payments and remittance channels now include merchant acceptance networks and peer-to-peer transfers that bypass traditional correspondent banking. Smart contracts automate legal and financial agreements, and trading activities cover spot exchanges, derivatives, and algorithmic strategies.

Distinct end-user segments further refine the market outlook. Institutional actors-comprising corporates, financial institutions, and hedge funds-demand robust custody, regulatory compliance, and audit capabilities. Meanwhile, retail participants such as individual investors and merchants are drawn by user-friendly wallets, low-friction payment solutions, and loyalty-program integrations in commerce.

This comprehensive research report categorizes the Digital Currency market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Currency Type

- Platform

- Application

- End User

Distilling Key Regional Insights Spanning the Americas Europe Middle East Africa and Asia Pacific Digital Currency Adoption and Regulatory Trends

Across the Americas, the United States and Canada lead in infrastructure development, institutional adoption, and regulatory frameworks, underpinned by the proliferation of regulated exchanges, custodial services, and the launch of multiple Bitcoin and Ethereum ETFs. Latin American markets demonstrate rapid growth in stablecoin usage for cross-border remittances, as residents navigate currency devaluations and seek alternatives to local fiat volatility. Merchant acceptance of digital currencies is increasingly common, driven by partnerships between payment processors and crypto service providers.

In Europe, the Middle East, and Africa region, regulatory approaches range from comprehensive frameworks in the European Union’s Markets in Crypto-Assets (MiCA) regulation to the cautious issuance of pilot central bank digital currencies in several Gulf Cooperation Council (GCC) countries. African nations, notably Nigeria and South Africa, exhibit high peer-to-peer crypto trading volumes as users utilize digital assets to circumvent banking restrictions and manage foreign-exchange shortages. Privacy and consumer-protection concerns are central to policy debates, prompting unique licensing structures and compliance requirements.

The Asia-Pacific region encompasses diverse market dynamics. China continues to expand its digital yuan pilot and digital infrastructure investments while maintaining restrictions on private cryptocurrencies. Japan and Australia have advanced licensing regimes for exchanges, fostering strong retail participation and institutional pilot programs for tokenized assets. Southeast Asian economies such as Singapore and Malaysia are positioning themselves as crypto innovation hubs through sandbox environments and international collaboration, emphasizing interoperability and digital asset custody standards.

This comprehensive research report examines key regions that drive the evolution of the Digital Currency market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Key Companies Shaping the Digital Currency Ecosystem with Innovations in Infrastructure Services and Strategic Partnerships

Major corporations and startup innovators are forging new frontiers in digital currency infrastructure, services, and applications. Leading exchange operators have expanded offerings to include institutional custody, over-the-counter trading desks, and token-listing services tailored to compliance mandates. Prominent technology firms have integrated blockchain platforms into supply-chain solutions, leveraging smart contracts to automate audit trails and verify product provenance.

Hardware manufacturers are intensifying efforts to localize production and mitigate tariff impacts. Industry leaders with dominant ASIC design capabilities have initiated domestic assembly lines in the U.S., collaborating with chip-fabrication partners to sustain equipment availability. Simultaneously, emerging mining hardware suppliers are exploring novel architectures optimized for energy efficiency, aiming to attract miners facing elevated electricity costs.

Financial services organizations, from global banks to fintech challengers, are embedding programmable money into their product suites. This includes tokenized securities, cross-border rail solutions, and API-driven payment portals that enable seamless on-ramps between traditional banking networks and blockchain ecosystems. Strategic partnerships between crypto-native firms and traditional financial institutions have accelerated the development of compliance tools, KYC/AML platforms, and audit reporters, reinforcing trust and regulatory adherence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Currency market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apirone OÜ

- Bank of Canada

- Binance Holdings Limited

- Bitfury Group Limited

- BITMAIN Group

- BitPay Inc.

- Bitstamp Ltd

- Blockonomics

- Boxcoin

- BTC Korea.com Co., Ltd

- Circle Internet Financial Limited

- Coinbase Global, Inc.

- CoinGate

- Coinify ApS

- Coinremitter Pte Ltd.

- CoinZoom, Inc.

- Crypto.com (Monaco) Limited

- Cryptomus

- Cryptopay Ltd.

- European Central Bank

- Huobi Technology Holdings Limited

- iFinex Inc.

- Kraken Digital Asset Exchange, LLC

- KuCoin Global Limited

- NOWPayments

- Nvidia Corporation

- OKX Holdings Inc

- Paymium SAS

Formulating Actionable Recommendations for Industry Leaders to Navigate Evolving Regulatory Landscapes Drive Innovation and Sustain Competitive Advantage

Industry leaders should prioritize diversification of hardware supply chains and consider near-shoring or domestic partnerships to mitigate tariff-induced cost pressures. By investing in research and development of next-generation mining equipment that emphasizes energy efficiency and modular design, operators can reduce dependency on imported rigs and enhance resilience against future trade disruptions.

Engagement with regulatory bodies is essential to shaping balanced policies that protect consumers without stifling innovation. Collaborative forums, public-private working groups, and proactive policy submissions can foster mutual understanding and pave the way for clear, consistent frameworks. Entities should allocate resources to compliance functions, ensuring readiness for evolving standards in areas such as stablecoin oversight, tokenization protocols, and cross-border data flows.

To capture new growth opportunities, firms should expand service portfolios beyond asset trading, embracing decentralized finance and tokenization of real-world assets. Developing turnkey solutions for custodial services, smart-contract auditing, and off-chain integration will unlock value for institutional clients. Additionally, cultivating customer education programs around risk management, governance, and security best practices will strengthen market confidence and accelerate mainstream adoption.

Outlining the Rigorous Research Methodology Employed to Ensure Comprehensive Credible and Actionable Insights into the Digital Currency Market Landscape

This study employs a rigorous multi-stage research methodology that combines primary and secondary data sources to ensure the validity and reliability of insights. Primary research included in-depth interviews with executives from leading digital currency exchanges, mining operators, financial institutions, and regulatory agencies. These conversations provided qualitative nuance around strategic priorities, operational challenges, and future outlooks.

Secondary research drew on regulatory filings, legislative texts, industry white papers, and reputable news outlets to contextualize market developments and corroborate primary findings. Data triangulation techniques were applied to reconcile conflicting perspectives and to detect emerging patterns in adoption rates, price movements, and technological advancements.

Quantitative analysis encompassed statistical modeling of on-chain activity, price volatility metrics, hash rate distribution, and transaction volume trends. Advanced analytics tools facilitated scenario planning and sensitivity analyses, exploring potential outcomes under alternative regulatory environments and tariff regimes. Expert panels reviewed draft conclusions to refine assumptions and validate interpretations, ensuring comprehensive coverage and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Currency market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Currency Market, by Currency Type

- Digital Currency Market, by Platform

- Digital Currency Market, by Application

- Digital Currency Market, by End User

- Digital Currency Market, by Region

- Digital Currency Market, by Group

- Digital Currency Market, by Country

- United States Digital Currency Market

- China Digital Currency Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Consolidating Critical Findings and Charting Future Outlooks for the Digital Currency Sector in a Rapidly Evolving Global Financial Ecosystem

This report has synthesized the most significant transformative forces shaping the digital currency ecosystem-from legislative milestones and tariff impacts to segmentation dynamics and regional adoption patterns. Technological innovations in DeFi, CBDCs, and AI-enhanced smart contracts are redefining the contours of financial intermediation, while corporate and institutional engagement continues to validate the sector’s maturation.

The cumulative effects of tariff policies underscore the importance of supply-chain resilience and regulatory engagement, as hardware localization efforts seek to stabilize mining economics against geopolitical headwinds. Segmentation analysis reveals that differentiated strategies across currency types, platform architectures, application use cases, and end-user cohorts will be crucial for tailored value propositions.

Looking ahead, industry stakeholders must remain agile, leveraging data-driven insights and strategic partnerships to capitalize on emerging trends. Continued dialogue between private innovators and policy makers will catalyze balanced frameworks that protect market participants while fostering sustainable growth. With comprehensive research and actionable guidance at hand, organizations are well-positioned to navigate the evolving digital currency frontier.

Connect Directly with Ketan Rohom to Secure Your Definitive Digital Currency Market Research Report and Gain a Competitive Edge

To take your strategic planning to the next level, reach out to Ketan Rohom, an Associate Director of Sales & Marketing who specializes in digital currency research. Ketan brings a deep understanding of market dynamics and can guide you through the bespoke insights contained in this comprehensive market analysis. By connecting with him, you will gain direct access to the full suite of detailed findings, proprietary data visualizations, and expert commentary that will empower your organization to capitalize on emerging trends. Act now to ensure you have the actionable intelligence needed to stay ahead in a rapidly evolving digital currency ecosystem. Contact Ketan today to secure your copy of the definitive market research report and start shaping your competitive advantage immediately.

- How big is the Digital Currency Market?

- What is the Digital Currency Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?