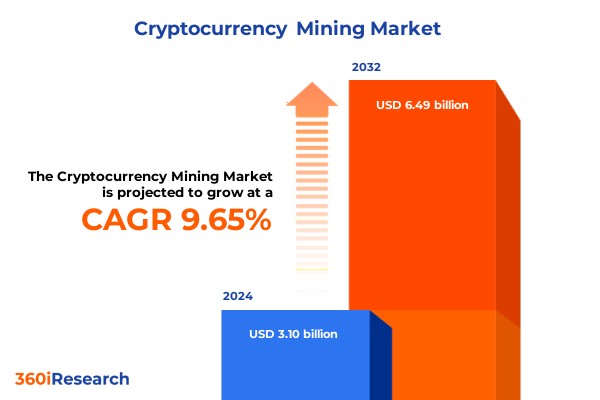

The Cryptocurrency Mining Market size was estimated at USD 3.39 billion in 2025 and expected to reach USD 3.70 billion in 2026, at a CAGR of 9.72% to reach USD 6.49 billion by 2032.

Exploring the convergence of technological innovation and market dynamics driving the evolution of cryptocurrency mining in an increasingly regulated global environment

Cryptocurrency mining has transformed from a nascent activity conducted by hobbyists to a sophisticated industrial endeavor underpinned by advanced hardware design, complex software orchestration, and intricate regulatory frameworks. The journey began with individuals using general-purpose CPUs and GPUs within their homes, but as digital asset values surged and network difficulty intensified, the pursuit of mining profitability propelled a wave of technological breakthroughs and operational scaling. Amid this evolution, the interplay between energy consumption debates, hardware supply chain considerations, and emerging regional hubs has crystallized into a multifaceted landscape that demands rigorous analysis and strategic foresight.

As mining operations have expanded in scale, the sector has attracted interest from institutional investors, utilities companies, and energy producers keen to capitalize on load-balancing opportunities and renewable power integration. Simultaneously, policymakers across major jurisdictions are grappling with environmental concerns, regulatory oversight, and fiscal revenue opportunities associated with taxing or incentivizing mining activities. The resulting convergence of technological innovation and regulatory pressure has set the stage for a new era in which mining efficiency, sustainability credentials, and supply chain resilience will determine market leaders. This introduction lays the foundation for a detailed executive summary that delves into transformative shifts, tariff impacts, market segmentation, regional dynamics, and strategic recommendations tailored to stakeholders seeking to navigate this rapidly changing domain.

Examining the pivotal shifts in hardware architectures, consensus mechanisms, and sustainability practices reshaping the competitive landscape of cryptocurrency mining

Over the past few years, the cryptocurrency mining landscape has undergone pivotal shifts as manufacturers and operators pursue marginal gains in efficiency and throughput. The development of application-specific integrated circuits (ASICs) with custom microarchitectures has significantly outpaced earlier reliance on graphics processing units, narrowing the performance delta and driving down cost-per-hash. At the same time, field-programmable gate arrays have gained traction for niche algorithms due to their reconfigurable logic and rapid deployment cycles, offering operators the flexibility to pivot toward emerging digital assets without full hardware redesign.

On the software side, mining operating systems now incorporate advanced workload orchestration, remote monitoring, and predictive maintenance features that maximize cluster uptime and reduce energy overhead. Optimization suites leverage machine learning to dynamically adjust voltage and frequency settings based on thermal conditions and network difficulty, further improving overall return on investment. These developments have coincided with heightened emphasis on sustainable energy integration. Large-scale operations increasingly locate adjacent to wind, solar, and hydroelectric facilities, leveraging real-time power pricing models and grid interconnection agreements to lower electricity costs and demonstrate environmental stewardship. Consequently, the competitive frontier in cryptocurrency mining has shifted from raw processing power to holistic solutions that balance hardware innovation, operational agility, and energy-conscious design.

Analyzing the compounding effects of 2025 United States import tariffs on mining hardware supply chains, operational costs, and global competitive positioning

In early 2025, the United States implemented additional import tariffs on mining hardware originating from certain foreign manufacturers, raising duties by up to 25 percent. This policy move aimed to strengthen domestic manufacturing incentives, address perceived supply chain vulnerabilities, and mitigate national security concerns related to critical computing infrastructure. The immediate consequence for mining firms was a sharp increase in capital expenditures for acquiring new rigs, prompting many to reassess expansion plans and seek alternative sourcing arrangements.

As tariffs accumulated over successive policy updates, operators with legacy equipment faced a widening differential between depreciated asset values and replacement costs. Some mining enterprises pivoted to emerging manufacturing hubs in Southeast Asia, leveraging more favorable trade agreements and local assembly capabilities to circumvent elevated duties. Meanwhile, domestic equipment producers ramped up investment in fabrication capacity, exploring advanced packaging techniques and vertically integrated supply chains to mitigate the tariff impact. Although these efforts have begun to yield localized production, lead times and initial pricing premiums remain challenging for large-scale deployments. Overall, the cumulative effect of 2025 US tariffs has been a realignment of procurement strategies, a wave of regional diversification among hardware suppliers, and renewed debate over the optimal balance between national security imperatives and global innovation collaboration.

Unveiling critical segmentation insights across diverse offerings, algorithm types, deployment models, and end usedemographics influencing mining market strategies

The cryptocurrency mining market can be examined through a layered lens that captures the interplay of diverse offerings, algorithmic complexity, hosting models, and end-user demographics. Hardware remains the foundation, with competition among specialized processors-ranging from application-specific integrated circuits optimized for SHA-256 to versatile central processing units-and reconfigurable solutions such as field-programmable gate arrays that bridge performance and adaptability. Graphics processing units continue to serve niche markets where parallel computing workloads benefit from their highly programmable architectures. Services have bifurcated into consulting and maintenance, which guide new entrants through site selection, energy procurement, and regulatory compliance, and hosting arrangements where operators outsource facility management and power provisioning to third-party data centers. On the software front, mining operating systems deliver essential node orchestration, while optimization suites extract incremental gains through real-time parameter tuning and predictive failure analytics.

Beyond the offering stack, algorithm type shapes hardware utilization and network economics. Ethash remains prominent for Ethereum-derived networks seeking memory-hard consensus models, while Scrypt’s legacy footprint endures among altcoin communities. SHA-256 continues to dominate Bitcoin mining, anchoring hardware roadmaps toward maximized hash rates. Deployment paradigms range from on-premises installations where enterprises maintain direct control over infrastructure to cloud mining arrangements that abstract away capital investment and operational complexity in exchange for managed service fees. The end-user base spans commercial-scale operators managing multi-megawatt facilities to individual miners who leverage compact rigs at home or in colocation centers, each segment driven by distinct scale economics, risk appetites, and performance priorities. Together, these segmentation dimensions provide a comprehensive view of competitive positioning and highlight where innovation and investment will shape the next wave of market leaders.

This comprehensive research report categorizes the Cryptocurrency Mining market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Algorithm Type

- Deployment Model

- End User

Mapping regional nuances and strategic advantages in the Americas, Europe Middle East and Africa, and Asia Pacific regions driving cryptocurrency mining expansion

Regional dynamics play a defining role in cryptocurrency mining economics as operators gravitate toward jurisdictions offering optimal combinations of energy costs, regulatory clarity, and infrastructure availability. In the Americas, expansive grid capacities and competitive electricity pricing in regions such as the U.S. Pacific Northwest and parts of Canada have attracted a surge of large-scale facilities. Latin American markets, including Paraguay and Ecuador, have also emerged as attractive destinations, leveraging hydropower generation and supportive policy frameworks to host mining activities. Shifting to Europe, Middle East and Africa, countries with access to renewable hydroelectric resources-like Iceland and Norway-continue to entice miners with zero-carbon assurances and chilly ambient temperatures, while select North African nations explore incentive schemes to diversify economic opportunities. Concurrently, corporate actors in the Middle East leverage state-backed energy initiatives to incubate pilot mining campuses.

In the Asia-Pacific region, a complex tapestry of regulatory approaches dictates mining viability. China’s phased restrictions on domestic operations have driven significant outbound investment into Kazakhstan, Russia, and Central Asian microscopy hubs. Southeast Asian economies, including Malaysia and Vietnam, have begun courting mining firms with tailored power tariffs and infrastructure upgrades to capture associated economic benefits. Australia and New Zealand, though smaller-scale, promote transparent licensing processes and grid stability as competitive advantages. Transitioning between these regional landscapes requires nuanced understanding of policy trajectories, grid integration costs, and geopolitical considerations that will ultimately determine which locales ascend in the global mining hierarchy.

This comprehensive research report examines key regions that drive the evolution of the Cryptocurrency Mining market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying leading industry players and their strategic initiatives in hardware innovation, service diversification, and software optimization within cryptocurrency mining

Within the machinery of the cryptocurrency mining sector, several leading entities have distinguished themselves through aggressive innovation, strategic partnerships, and diversified portfolios. Manufacturers of specialized hardware continue to vie for performance leadership, channeling R&D investment into next-generation chip architectures and thermal management solutions. At the same time, vertically integrated mining firms have expanded their service offerings, combining equipment leasing, data center hosting, and energy procurement under unified business models. Software developers have capitalized on this ecosystem by delivering advanced operating platforms that elevate uptime guarantees and streamline firmware updates across heterogeneous device fleets.

Meanwhile, newer entrants with deep expertise in renewable energy are forming alliances with traditional hardware suppliers to co-develop green mining campuses. This convergence of competencies has generated competition not only on raw hash power but also on holistic value propositions that address environmental, social, and governance considerations. As a result, the competitive landscape has broadened beyond pure-play mining operators to include technology conglomerates, energy companies, and niche software providers, each leveraging core competencies to capture emerging opportunities. The interactions between these diverse players continue to accelerate innovation cycles and reshape expectations around performance benchmarks and operational sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryptocurrency Mining market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argo Blockchain PLC

- Bitbox Ltd.

- BitDeer Group

- Bitfury Group Limited

- Bitmain Technologies Limited

- Canaan Creative Co., Ltd.

- CleanSpark, Inc.

- Core Scientific, Inc.

- DCX POLSKA SP. Z O.O.

- EZ Blockchain

- Greenidge Generation Holdings Inc.

- Hive Blockchain Technologies Ltd.

- Hut 8 Mining Corp

- Iris Energy Ltd.

- Kontena cv

- Layer1 Technologies, LLC

- Marathon Digital Holdings, Inc.

- Minerbase

- Power Mining LLC

- Riot Platforms, Inc.

- SBI Crypto Co., Ltd.

- Virginia Transformer Corporation

Strategic imperatives for industry leaders to navigate regulatory headwinds, optimize operational efficiency and capitalize on emerging mining opportunities

To thrive amid evolving market dynamics and regulatory uncertainties, industry leaders must adopt a portfolio of strategic imperatives designed to bolster resilience and capture growth. Embracing modular hardware architectures and standardized interfaces enables rapid redeployment across algorithmic shifts and consensus transitions, minimizing stranded asset risk. Concurrently, integrating real-time monitoring and automated control loops allows operators to optimize power usage, reduce downtime, and swiftly react to network difficulty adjustments.

Engaging proactively with policymakers and energy regulators can secure long-term contracts and favorable tariff structures while demonstrating commitment to sustainability through transparent reporting of carbon metrics. Cultivating partnerships across the energy value chain, from renewable generators to grid operators, provides leverage in negotiating dynamic pricing models and accessing demand response programs. Finally, exploring hybrid hosting models that blend on-premises expertise with cloud-based orchestration services can unlock new revenue streams and lower barriers for commercial and individual miners alike. By aligning technology roadmaps with energy strategies and stakeholder engagement plans, industry leaders can position themselves for durable competitive advantage and sustainable expansion.

Detailing a robust research methodology combining primary insights, secondary data analysis, and applied analytical frameworks to ensure comprehensive market understanding

This research leverages a multi-step methodology designed to deliver comprehensive and actionable insights into the cryptocurrency mining market. Primary research involved in-depth interviews with senior executives from mining operations, hardware vendors, and energy service providers, complemented by structured surveys targeting both commercial operators and individual miners. These engagements yielded firsthand perspectives on technology adoption patterns, tariff impact experiences, and regional expansion plans.

Secondary research included systematic analysis of trade publications, industry white papers, regulatory filings, and academic studies to triangulate findings and validate emerging trends. Analytical frameworks such as Porter’s Five Forces and SWOT analyses were employed to dissect competitive forces and identify strategic inflection points. Segmentation analysis was applied across offering types, algorithm categories, deployment models, and end-user demographics to illuminate market pockets and highlight innovation hotspots. Throughout the study, data integrity protocols and cross-validation techniques ensured accuracy and consistency, while scenario modeling provided foresight into possible regulatory and technological developments over the near term.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryptocurrency Mining market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryptocurrency Mining Market, by Offering

- Cryptocurrency Mining Market, by Algorithm Type

- Cryptocurrency Mining Market, by Deployment Model

- Cryptocurrency Mining Market, by End User

- Cryptocurrency Mining Market, by Region

- Cryptocurrency Mining Market, by Group

- Cryptocurrency Mining Market, by Country

- United States Cryptocurrency Mining Market

- China Cryptocurrency Mining Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing key findings on technological trends, tariff impacts, segmentation dynamics, and regional growth prospects shaping the future of cryptocurrency mining

The cryptocurrency mining sector stands at an inflection point defined by rapid technological advancement, shifting regulatory landscapes, and heightened sustainability imperatives. Hardware innovation has transitioned from general-purpose processors to finely tuned ASICs and reconfigurable architectures, while software platforms now deliver unprecedented levels of automation and optimization. Concurrently, the introduction of import tariffs in early 2025 has reshaped supply chain strategies and prompted both domestic and international realignment of production capabilities.

Layered on this technological and policy canvas is a complex network of market segments-spanning hardware, services, and software offerings, diverse algorithm types, multiple deployment models, and varied end-user profiles-that demand nuanced understanding and strategic differentiation. Regional variations further complicate the picture, as operators chase the lowest energy costs and clearest regulatory frameworks across the Americas, Europe Middle East & Africa, and Asia Pacific. Amid these dynamics, leading companies are forging new partnerships and expanding service portfolios to maintain growth trajectories. For industry stakeholders, the imperative is clear: only by integrating advanced technology adoption, agile operational models, and proactive stakeholder engagement will organizations secure lasting competitive advantage in this evolving market.

Connect with Ketan Rohom to secure tailored insights and unlock the full cryptocurrency mining research report for strategic growth

To gain a comprehensive understanding of the cryptocurrency mining market’s evolving dynamics and leverage actionable insights for strategic advantage, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you can explore customized briefing options, secure early-access deliverables, and receive tailored guidance on implementing best practices and competitive strategies drawn from the full market research report. Connect today to unlock the full value of this in-depth study and position your organization for sustained growth in the rapidly advancing world of cryptocurrency mining.

- How big is the Cryptocurrency Mining Market?

- What is the Cryptocurrency Mining Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?