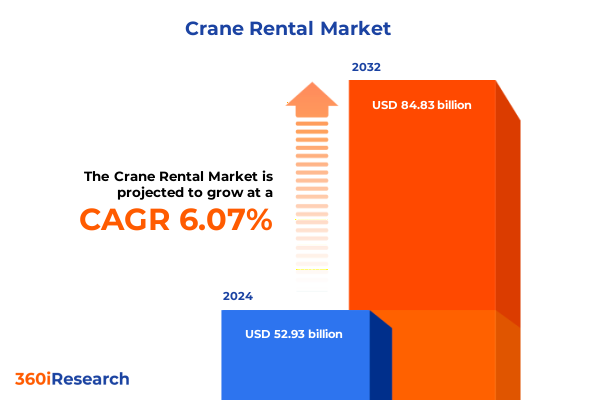

The Crane Rental Market size was estimated at USD 56.01 billion in 2025 and expected to reach USD 59.31 billion in 2026, at a CAGR of 6.10% to reach USD 84.83 billion by 2032.

Unveiling the Critical Role of Crane Rental in Modern Infrastructure and Industrial Project Success Across Dynamic Construction and Energy Sectors

The crane rental industry underpins countless infrastructure and industrial ventures by providing critical lifting capacity without the heavy burden of equipment ownership. Across major metropolitan construction sites and sprawling energy projects alike, access to diverse crane fleets empowers project teams to meet tight schedules, optimize resource allocation, and respond to evolving site requirements. In turn, stakeholders can allocate capital more judiciously, focusing investments on core competencies rather than depreciating assets.

Moreover, the flexibility inherent in rental arrangements enables companies to adapt quickly to project scale fluctuations. Seasonal peaks in construction demand, emergency maintenance shut-downs at manufacturing plants, or sudden spikes in offshore wind installations all require rapid fleet adjustments that rentals uniquely provide. By leveraging this adaptability, decision-makers can avoid project delays, manage cash flow more effectively, and maintain operational continuity even amid uncertainty or shifting regulatory landscapes.

As the global construction and heavy industry sectors navigate digital transformation, environmental pressures, and workforce challenges, crane rental emerges as a strategic lever. When integrated with advanced telematics and safety technologies, rental services can deliver not only lifting capacity but also data-driven efficiencies and risk mitigation. Thus, understanding the dynamics of crane rental becomes essential for executives seeking to enhance project performance, reduce costs, and uphold safety and sustainability objectives in an increasingly complex industrial ecosystem.

Exploring the Transformative Shifts in Crane Rental Landscape Driven by Technological Innovation and Evolving Sustainability and Safety Demands

The crane rental sector stands at the confluence of technological breakthroughs, evolving safety standards, and shifting sustainability mandates. In recent years, the widespread adoption of telematics and Internet of Things sensors has revolutionized asset management, enabling real-time monitoring of equipment health and utilization. These connected systems facilitate predictive maintenance, dramatically reducing unplanned downtime and extending asset lifecycles, while also providing actionable data on fleet performance and site productivity.

Concurrently, artificial intelligence-driven solutions are enhancing operational safety by processing environmental variables, load dynamics, and operator behaviors to anticipate risks before they materialize. Collision avoidance systems and AI-powered risk assessment tools are already making elevated work environments safer, supporting not only compliance with increasingly stringent safety regulations but also fostering a culture of proactive risk management. As a result, rental fleets equipped with advanced safety technologies deliver tangible value through reduced liability and uninterrupted operations.

In parallel, pressure to decarbonize construction activities has spurred investment in hybrid and electric cranes. By integrating regenerative braking and alternative powertrains, rental providers can offer quieter, emission-reducing solutions that align with corporate sustainability targets and municipal clean air initiatives. This shift toward low-carbon equipment reflects broader environmental trends, as projects in urban centers and sensitive ecological zones prioritize greener construction methods to meet stakeholder expectations and regulatory requirements.

Together, these transformative developments are reshaping the crane rental landscape, challenging traditional models and demanding that service providers innovate across technology, safety, and sustainability to remain competitive.

Assessing the Cumulative Impact of 2025 United States Trade Tariffs on Crane Rental Cost Structures Supply Chains and Procurement Strategies

Since April 2025, comprehensive tariff measures have systematically increased the cost and complexity of importing cranes and related equipment into the United States. A universal baseline tariff of 10 percent on all imported goods took effect on April 5, 2025, introducing a broad-based levy that directly impacts procurement costs for rental fleets and project owners alike. This tariff has elevated the landed cost of both fixed and mobile cranes, compelling market participants to reexamine sourcing strategies and consider total lifecycle economics more rigorously.

Layered atop the baseline rate are reciprocal tariffs that vary by country, with China facing additional duties that can reach up to 34 percent on certain goods. In the specialized case of ship-to-shore cranes and critical port equipment, the Office of the United States Trade Representative has proposed a supplemental 100 percent Section 301 tariff on Chinese-linked entities and components, pending public comment and further regulatory action. This significant levy has triggered intense pushback from port authorities, which rely on Chinese manufacturers for as much as 80 percent of new STS crane orders; those opposing bodies emphasize that no domestic industry currently exists to fill that gap.

Consequently, market participants face longer procurement timelines as they navigate tariff exemptions, delayed implementations, and compliance requirements. Rental companies are increasingly evaluating non-tariff alternatives, including acceleration of domestic manufacturing partnerships, strategic stockpiling under existing exemption windows, and broader fleet diversification to mitigate exposure. These evolving trade dynamics demand sophisticated supply-chain orchestration and highlight the necessity for forward-looking procurement policies that account for tariff volatility and geopolitical uncertainty.

Deriving Actionable Insights from Multifaceted Crane Rental Market Segmentation by Duration Type Crane Configuration Load Capacity Application and End User Industry

Insight into the crane rental market emerges most clearly when examined through multiple segmentation lenses that reflect customer needs and equipment characteristics. Rental duration, for instance, spans long-term contracts-structured on annual or monthly rates-and short-term agreements, covering daily or weekly use. Long-term commitments often appeal to large infrastructure and industrial maintenance projects with predictable schedules, enabling cost efficiencies and fleet stability. Conversely, the agility afforded by daily or weekly rentals suits contractors managing fluctuating workloads, emergency repairs, or specialized one-off tasks.

Equipment configurations themselves comprise fixed cranes, such as bridge and overhead systems deployed in manufacturing and assembly facilities, and mobile cranes designed for on-site versatility. Fixed cranes break down into subcategories including gantry and jib variants, each optimized for repetitive lifting patterns in constrained spaces. Mobile fleets further diversify into carry deck, crawler, floating, and rough terrain types, addressing everything from shipyard installations to remote pipeline construction. When aligned with specific job requirements, this diversity ensures precise matching of lift capacity, reach, and mobility.

Load capacity segmentation defines three core classes: below 50 tons, a workhorse range for standard building and maintenance tasks; 50 to 100 tons, popular in mid-range construction and utility applications; and above 100 tons, reserved for heavy-lift scenarios like petrochemical plant modules and power generation components. Application-based insights reveal distinct usage patterns: demolition assignments rely on mobile units for reach and flexibility, while facade installation and roofing deployments favor telescopic and tower cranes for vertical precision. Bulk, cargo, and container handling operations demand specialized heavy-duty cranes with enhanced stability and load management systems.

End user industries further illuminate demand drivers, ranging from construction and manufacturing to mining, oil and gas, power and energy, and utilities. Each sector brings unique requirements-from the frequency and scale of lifts to environmental and safety protocols-guiding rental providers in tailoring fleet composition, service offerings, and support capabilities to optimize client outcomes.

This comprehensive research report categorizes the Crane Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Rental Duration

- Crane Type

- Load Capacity

- Application

- End User Industry

Illuminating Key Regional Variations in Crane Rental Demand Service Preferences and Growth Drivers across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the crane rental market reflect variations in infrastructure investment, regulatory frameworks, and macroeconomic trends. In the Americas, robust government spending on highways, bridges, and renewable energy installations underpins sustained demand for mobile cranes and specialized lifts. Municipal emission regulations in major North American cities have also accelerated adoption of hybrid and electric models, prompting rental fleets to upgrade their offerings and invest in cleaner technologies.

Europe, the Middle East, and Africa present a mosaic of demand patterns shaped by divergent economic cycles and regulatory regimes. Western Europe’s emphasis on modular construction and urban redevelopment projects favors compact electric cranes and sophisticated safety solutions, while the Gulf region’s ongoing oil and gas megaprojects lean heavily on high-capacity crawler and floating cranes. In Sub-Saharan Africa, infrastructure gaps continue to drive demand for versatile mobile cranes that can traverse challenging terrain and serve remote development initiatives.

Across Asia-Pacific, rapid urbanization and large-scale infrastructure programs in countries such as India, Indonesia, and Australia fuel a dynamic rental market. Offshore wind and port expansion projects in Southeast Asia create demand for both fixed and floating crane solutions, while urban transit and high-rise construction in East Asia rely on agile tower crane deployments. Regulatory shifts toward carbon neutrality in key markets are further influencing fleet modernization priorities, with rental providers collaborating closely with clients to pilot electric and hydrogen-powered cranes.

These regional distinctions underscore the importance of tailoring service strategies to local conditions, whether navigating complex approval processes, addressing climate-driven equipment specifications, or leveraging cross-border partnerships to optimize fleet positioning and logistics.

This comprehensive research report examines key regions that drive the evolution of the Crane Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Fleet Innovations among Leading Crane Rental Providers Shaping Competitive Dynamics and Service Excellence

Leading crane rental providers continue to differentiate through strategic acquisitions, fleet modernization, and service innovation. United Rentals’ landmark acquisition of H&E Equipment Services in early 2025 expanded its fleet by nearly 64,000 units, enhancing capacity in critical markets and generating projected cost synergies through integrated operations. This bold move underscores the competitive imperative to scale rapidly and deliver comprehensive, one-stop rental solutions.

Bigge Crane and Rigging has likewise reinforced its market position by deepening partnerships with top OEMs. In March 2025, the company announced the addition of multiple Liebherr crawler and telecrawler cranes to its Perfect Fleet® program, signaling its commitment to high-performance equipment and customer uptime optimization. By curating specialized assets and offering premium maintenance services, Bigge elevates value propositions for infrastructure and heavy-lift clients.

Maxim Crane Works distinguished itself as an industry leader in fleet capacity metrics, securing the number one spot in the 2025 ACT100 ranking and third in the IC100, based on total maximum lifting capability and moment ratings respectively. The company’s strategic focus on fleet scalability, safety protocols, and operational excellence has earned recognition as an industry disruptor, challenging incumbents and reshaping competitive benchmarks.

Specialized transactions also illustrate emerging market dynamics: Maxim Crane Works’ acquisition of Sims Crane & Equipment’s tower crane fleet in April 2025 expanded its vertical lift capacity, enabling deeper penetration into high-rise construction markets in the southeastern United States. Collectively, these moves reflect a market where scale, technological integration, and customer-centric services define the leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crane Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Action Construction Equipment Ltd

- ALL Erection & Crane Rental Corp.

- BARNHART CRANE AND RIGGING CO.

- Bigge Crane and Rigging Co.

- Boels Rental Ltd.

- Buckner HeavyLift Cranes, LLC

- Custom Truck One Source, Inc.

- Deep South Crane & Rigging, LLC

- Doggett Equipment Services Group

- Gemini Equipment And Rentals Pvt. Ltd.

- Herc Holdings Inc.

- Industrial Supplies Development Co. Ltd.

- Kanamoto Co., Ltd.

- Kiloutou, SAS

- Lampson International

- Mammoet Holding B.V. & regional affiliates

- Maxim Crane Works, L.P.

- Nishio Rent All Co., Ltd.

- Sanghvi Movers Limited

- Sarens N.V.

- Tat Hong Holdings Limited

- United Rentals, Inc.

- Zahid Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Optimize Crane Rental Operations Navigate Trade Challenges and Capitalize on Emerging Opportunities

Industry leaders must prioritize diversification of supply chains to buffer against tariff volatility and geopolitical risk. By cultivating relationships with domestic manufacturers, OEM service partners, and secondary market brokers, rental firms can secure critical equipment under multiple sourcing scenarios and reduce lead times amid fluctuating duty structures. Strengthening these alliances supports fleet resilience and facilitates rapid redeployment in response to changing project requirements.

Investment in advanced telematics and AI-driven analytics will continue to yield dividends in both safety and utilization. Firms should accelerate the deployment of sensors and remote monitoring platforms, integrating predictive maintenance workflows that preempt mechanical failures and optimize asset availability. Training programs that leverage virtual and augmented reality simulations can further enhance operator proficiency, reducing incident rates and reinforcing safety cultures across diverse operating environments.

Environmental compliance and corporate sustainability mandates demand proactive fleet modernization. Industry participants should develop clear decarbonization roadmaps that identify high-impact opportunities for adopting electric, hybrid, and alternative-fuel cranes. Collaboration with clients on green project certifications and demonstration initiatives can position rental companies as trusted partners in achieving net-zero objectives, unlocking access to ESG-driven project pipelines.

Finally, differentiation through value-added services-such as integrated rigging solutions, mobile maintenance units, and digital project management platforms-will become increasingly vital. By combining equipment rental with comprehensive lifecycle support, rental providers can elevate customer satisfaction, foster long-term partnerships, and capture greater share of project budgets beyond basic lift capacity.

Detailing Rigorous Research Methodology Integrating Primary Stakeholder Engagement Secondary Data Analysis and Qualitative Expert Validation Techniques

This research synthesizes quantitative and qualitative data through a comprehensive mixed-methods approach. Primary data collection involved structured interviews and surveys with key stakeholders, including rental executives, project managers, and safety officers across North America, Europe, and Asia-Pacific. These engagements yielded nuanced perspectives on fleet utilization patterns, procurement strategies, and emerging technology adoption.

Secondary research incorporated a systematic review of regulatory documents, trade policy announcements, OEM technical publications, and industry news sources. Government tariff notifications and USTR rulings provided the foundation for assessing trade-related impacts, while market commentary and press releases offered insights into competitive maneuvers and fleet investments. Throughout the analysis, rigorous source triangulation ensured data reliability.

To validate findings, expert panels comprising industry consultants, trade association representatives, and logistics specialists convened in virtual workshops. These sessions facilitated iterative refinement of insights, ensuring alignment with on-the-ground realities and strategic imperatives. In addition, cross-referencing telematics data and financial disclosures where available allowed for a robust interpretation of utilization trends and cost structures.

The final report integrates these layers of evidence into a cohesive narrative, balancing empirical rigor with practical relevance. This methodological framework ensures that conclusions and recommendations are grounded in both comprehensive data analysis and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crane Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crane Rental Market, by Rental Duration

- Crane Rental Market, by Crane Type

- Crane Rental Market, by Load Capacity

- Crane Rental Market, by Application

- Crane Rental Market, by End User Industry

- Crane Rental Market, by Region

- Crane Rental Market, by Group

- Crane Rental Market, by Country

- United States Crane Rental Market

- China Crane Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Critical Takeaways on Crane Rental Market Evolution and Strategic Imperatives for Sustained Competitive Advantage and Operational Resilience

The crane rental market stands at a pivotal juncture as technological innovation, environmental mandates, and trade policy shifts converge. Providers that adopt connected equipment, embrace sustainability solutions, and navigate tariff complexities will lead the industry’s next wave of growth. Those who invest in predictive maintenance and operator training will not only enhance safety but also unlock operational efficiencies that distinguish them in competitive bid processes.

Regional nuances underscore the necessity of tailored strategies: North America’s infrastructure programs, EMEA’s diverse project mix, and Asia-Pacific’s rapid urbanization each demand bespoke fleet compositions and service offerings. Companies that skillfully adapt to these local conditions by aligning equipment, compliance expertise, and logistical support will secure deeper market penetration.

Strategic acquisitions and fleet expansions by market leaders exemplify the significance of scale and specialization. Yet, the most resilient firms will be those that pair scale with agility-able to reallocate assets swiftly, pivot sourcing models, and co-innovate with clients on green and digital projects. As the sector evolves, the interplay of technology, policy, and client expectations will continue to recalibrate competitive dynamics.

Ultimately, the future of crane rental hinges on integrated solutions that transcend mere equipment provision. By coupling advanced safety systems, decarbonization initiatives, and data-driven insights with robust supply-chain strategies, industry participants can unlock sustainable value and spearhead the next era of heavy-lift excellence.

Don’t Miss Out on the In-Depth Crane Rental Market Report—Connect with Ketan Rohom to Secure Comprehensive Insights and Drive Your Strategic Decisions Today

Ready to elevate your strategic planning with unparalleled market intelligence? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive crane rental market research report. Gain exclusive access to in-depth analyses, segmented insights, and actionable recommendations tailored to your business needs. Don’t wait to transform your decision-making process; contact Ketan today to purchase the full report and stay ahead in this dynamic industry

- How big is the Crane Rental Market?

- What is the Crane Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?