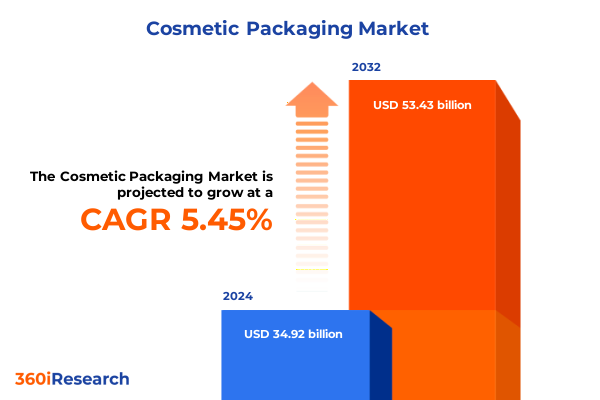

The Cosmetic Packaging Market size was estimated at USD 36.79 billion in 2025 and expected to reach USD 38.77 billion in 2026, at a CAGR of 5.47% to reach USD 53.43 billion by 2032.

Unlocking the Role of Packaging Innovation in Elevating Cosmetic Brands Through Sustainable Design, Functional Excellence, and Consumer Engagement

Innovation in cosmetic packaging is no longer a mere afterthought-it has become an essential strategic lever for brands aiming to differentiate themselves in a saturated market. As consumers demand more from their beauty experiences, packaging must evolve beyond containment and labeling to embody brand values, meet sustainability goals, and create memorable unboxing moments that drive loyalty. By integrating cutting-edge materials, design thinking, and user-centric functionality, packaging becomes an extension of brand storytelling, elevating perceived value and driving purchase intent.

In recent years, heightened awareness around environmental impact, amplified by stricter regulations and vocal consumer advocacy, has further accelerated the shift toward eco-friendly packaging solutions. This transformation compels brand leaders to reexamine their supply chains, adopt circular design principles, and leverage new material innovations-ranging from bio-based polymers to advanced refill systems. While these shifts may appear challenging, they offer a unique opportunity to pioneer sustainable luxury, fostering deeper connections with environmentally conscious consumers and generating tangible competitive advantages.

Navigating the Converging Currents of Sustainability, Digitalization, and Personalization Shaping the Cosmetic Packaging Landscape in 2025 and Beyond

The cosmetic packaging landscape is being reshaped by three converging currents: sustainability, digitalization, and personalization. Sustainability mandates are pushing brands to rethink end-of-life pathways, embracing refillable assemblies and mono-material constructs that streamline recycling. Concurrently, digital printing and smart manufacturing are enabling bespoke designs and rapid turnarounds, dramatically reducing lead times and allowing brands to respond swiftly to emerging trends.

Moreover, personalization at scale is emerging as a powerful driver of consumer engagement. Interactive packaging-equipped with QR codes, NFC chips, or augmented reality triggers-fuses physical design with digital experiences, unlocking new avenues for storytelling and data capture. As the industry navigates these transformative forces, those who can harmonize eco-credentials with intelligent functionality and tailored consumer journeys will define the next frontier of cosmetic packaging innovation.

Assessing the Far-Reaching Consequences of Recent United States Tariff Adjustments on Cosmetic Packaging Supply Chains, Costs, and Competitive Dynamics

In 2025, adjustments to United States tariffs have significantly altered cost structures across cosmetic packaging supply chains. Increased duties on imported materials such as specialized plastics, aluminum, and glass have driven procurement teams to explore alternative sourcing strategies. Many suppliers are now evaluating nearshoring opportunities to Mexico and Canada, seeking to mitigate tariff burdens and reduce total landed cost. At the same time, strategic partnerships with domestic resin and metal producers are gaining traction, enabling brands to secure predictable pricing and reliable capacity.

However, these shifts have also intensified pressure on margins. To offset the impact of elevated import duties, brands are accelerating innovation around lightweighting and material substitution. Compounders of bio-based polymers and recycled content are collaborating closely with converters to develop high-performance alternatives that comply with regulatory and consumer expectations. As trade policies remain fluid, proactive scenario planning and diversified supplier networks have become essential levers for maintaining agility and safeguarding profitability.

Decoding Consumer Preferences and Market Dynamics Through Advanced Segmentation Analysis of Cosmetic Packaging Across Product Types, Materials, and Channels

A granular view of the cosmetic packaging market reveals nuanced opportunities across five key segmentation dimensions. Based on product type, color cosmetics emerge as a major driver, with subcategories including foundation, lipsticks, and mascara each demanding bespoke closures, applicators, and aesthetic finishes. Fragrances, divided into cologne and perfume, rely heavily on precision glass molding and decorative metal collars to reinforce brand prestige. In haircare, formulators of conditioners, hair oils, and shampoos require dosing accuracy and tamper-evident seals to ensure performance and consumer safety. Meanwhile, skincare selections-spanning body lotions, eye creams, and face creams-call for airless pump mechanisms and UV-protective packaging to preserve formula integrity.

In terms of material type, glass solutions-particularly amber and flint glass-continue to be favored for high-end and natural-positioned brands seeking purity cues, while aluminum and tinplate components offer lightweight rigidity for metals. Folding cartons and paper bags address secondary packaging needs, reinforcing sustainability narratives through recyclable paperboard variants. Plastic substrates remain dominant in PET, polyethylene, and polypropylene formats, balancing cost efficiency with design versatility. Distribution channel analysis differentiates between offline formats-such as department stores, drug stores, specialty stores, and supermarkets & hypermarkets-and digital corridors, including branded websites and e-commerce platforms, each influencing structural requirements and label compliance.

Packaging type considerations split between primary vessels-bottles, jars, pumps, and tubes-and secondary enclosures like boxes and sleeves, which create shelf impact and protective functions. Finally, end use underscores the importance of context, as salon and spa products target professional channels with robust refill solutions, whereas standard retail demands shelf-ready assemblies and tamperproof seals, and travel kits and miniatures require dilution-approved containers and optimized dimensions for regulatory compliance.

This comprehensive research report categorizes the Cosmetic Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Packaging Type

- Distribution Channel

- End Use

Exploring Regional Variations and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific in the Cosmetic Packaging Industry

Regional dynamics in cosmetic packaging are defined by varying regulatory frameworks, consumer tastes, and infrastructure maturity. In the Americas, the emphasis on sustainable materials is driving innovation in post-consumer recycled content and refillable systems, supported by federal and state-level directives aimed at reducing single-use plastics. Major players in the United States are partnering with recycling coalitions to enhance circularity, while Latin American markets are witnessing a rise in locally sourced materials to bypass import restrictions and appeal to national pride.

Meanwhile, Europe, the Middle East & Africa present a complex tapestry of regulations-from the European Union’s stringent Extended Producer Responsibility mandates to Middle Eastern initiatives promoting eco-design. Brands operating across this region are tailoring packaging strategies to meet diverse certification requirements, from Nordics’ stringent eco-labels to EMEA’s halal and dermatologically tested credentials. Recycling infrastructure disparities between Western and Eastern Europe, as well as North and Sub-Saharan Africa, compel companies to adopt adaptable packaging designs that can be repurposed or upcycled in low-capacity regions.

In the Asia-Pacific zone, rapid urbanization and digital commerce expansion are catalyzing demand for premium packaging that resonates with a digitally native consumer base. Innovative surface treatments and personalized messaging are being deployed to stand out on crowded e-commerce platforms. Simultaneously, China’s national goals for waste reduction are accelerating trials of biodegradable polymers and industrial composting compatibility, influencing packaging adoption across neighboring markets in Southeast Asia and Oceania.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Influencers Driving Technological Advancements and Strategic Partnerships in the Cosmetic Packaging Ecosystem

The cosmetic packaging ecosystem is populated by a range of specialized providers and integrated suppliers that drive both technological breakthroughs and scale efficiencies. Leading component manufacturers are investing heavily in research and development to advance sustainable resin formulations, lightweight glass compositions, and hybrid metal-plastic constructs that meet rigorous performance standards. At the same time, full-service design and contract packaging firms are differentiating themselves through end-to-end solutions that streamline time to market, leveraging digital CAD workflows and automated assembly lines.

Strategic alliances between material innovators and brand owners are fostering co-creation platforms where prototypes move rapidly from concept to pilot. Collaborative ventures with academic research centers and industry consortia are also surfacing, focused on next-generation barrier coatings, smart packaging sensors, and closed-loop recycling infrastructures. These partnerships underscore a broader shift toward ecosystem-wide innovation, as companies recognize that cross-sector synergies-combining expertise in chemistry, mechanical engineering, and data analytics-are essential to solving complex challenges around sustainability, regulatory compliance, and consumer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akey Group, LLC

- Albéa S.A.

- Amcor PLC by Bemis Company, Inc.

- AptarGroup, Inc.,

- Berry Global, Inc

- Bonex d.o.o.

- Corpack GmbH

- Cosmopak Corp.

- Frapak Packaging b.v.

- Gerresheimer Ag

- H&K Müller GmbH & Co. KG

- HCP Packaging UK Ltd

- HCT Group

- Libo Cosmetics Co., Ltd.

- LUMSON S.p.A.

- Masterchem Logoplaste Sp. z o.o.

- MJS Packaging

- Mondi plc

- Quadpack Industries, S.A.

- Silgan Holdings Inc.

- Stoelzle Glass Group

- vetroplas packaging limited

- Vimal Plastics.

- VIROSPACK, S.L.U.

- Zenvista Packagings

Formulating Strategic, Data-Driven Recommendations to Equip Industry Leaders for Competitive Advantage and Sustainable Growth in Cosmetic Packaging

Industry leaders should prioritize the integration of circular-economy principles into every stage of packaging design, from material selection to end-of-life collection. By establishing refill schemes and incentivizing returns through loyalty programs, brands can drastically reduce waste and deepen consumer connection. Simultaneously, investments in digital printing technologies will enable agile localization of packaging runs, catering to region-specific aesthetics without incurring substantial tooling costs.

To mitigate the effects of fluctuating tariff regimes and supply chain disruptions, companies must diversify their supplier base across multiple geographies, including North American, European, and Asia-Pacific hubs. Robust risk management frameworks-incorporating scenario analysis and dual-sourcing strategies-will ensure continuity even amid geopolitical uncertainty. Additionally, embedding IoT-enabled tracking devices in high-value shipments can provide real-time visibility, reducing shrinkage and expediting customs clearance.

Finally, fostering collaborative innovation ecosystems-through partnerships with startups, material scientists, and logistics providers-will accelerate the development of smart packaging solutions, such as NFC-enabled authenticity tags and environmental sensors. These technologies not only enhance consumer trust but also generate valuable data streams, informing continuous product refinement and personalized marketing efforts.

Detailing Robust Research Methodologies Employed to Gather Comprehensive Insights Into Consumer Behavior, Supply Chains, and Industry Innovations

The foundation of this analysis is a rigorous blend of primary and secondary research methodologies. Extensive interviews were conducted with key stakeholders across the value chain, including brand executives, packaging engineers, material scientists, and regulatory specialists. These discussions provided firsthand insights into pressing challenges, innovation roadmaps, and investment priorities, illuminating the nuanced trade-offs between cost, performance, and sustainability.

Complementing primary inputs, a thorough review of trade publications, patent databases, and regulatory filings ensured a robust understanding of emerging materials, technology patents, and compliance frameworks. Field observations at major packaging expos and site visits to manufacturing facilities added an experiential dimension, validating technical capabilities and process efficiencies. Data triangulation techniques were employed to cross-reference supplier claims with independent lab validations and consumer feedback surveys, yielding a comprehensive and balanced perspective on market readiness and adoption pathways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Packaging Market, by Product Type

- Cosmetic Packaging Market, by Material Type

- Cosmetic Packaging Market, by Packaging Type

- Cosmetic Packaging Market, by Distribution Channel

- Cosmetic Packaging Market, by End Use

- Cosmetic Packaging Market, by Region

- Cosmetic Packaging Market, by Group

- Cosmetic Packaging Market, by Country

- United States Cosmetic Packaging Market

- China Cosmetic Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Summarizing Key Findings and Strategic Implications to Empower Stakeholders in Navigating Evolving Trends and Regulatory Landscapes in Cosmetic Packaging

The evolving landscape of cosmetic packaging underscores an imperative for brands to embrace holistic strategies that balance environmental stewardship with functional innovation. Key findings highlight that sustainable materials and refillable architectures are no longer optional but foundational to future-proofing brand equity. Concurrently, digital and smart packaging functionalities stand as powerful differentiators in a crowded marketplace.

As regulatory pressures and consumer expectations converge, the capacity to swiftly adapt through diversified sourcing and modular packaging platforms will be crucial. Strategic partnerships between material developers, design firms, and technology providers are already unlocking new performance thresholds, proving that collaborative innovation is a catalyst for accelerated progress. Ultimately, stakeholders who internalize these insights and act decisively will secure leadership positions, setting benchmarks for responsible growth and consumer delight in the cosmetic packaging domain.

Encouraging Immediate Engagement With Associate Director of Sales and Marketing to Secure Invaluable Market Research Insights for Competitive Decision-Making

To secure a comprehensive understanding of the cosmetic packaging landscape and gain exclusive access to in-depth analysis, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding leading brands through the complexities of material innovation, sustainability mandates, and evolving consumer expectations ensures that your organization will be equipped with actionable insights tailored to your strategic priorities. Engage early to customize a research package that addresses your unique challenges and positions your business for resilient growth in an ever-competitive marketplace.

- How big is the Cosmetic Packaging Market?

- What is the Cosmetic Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?