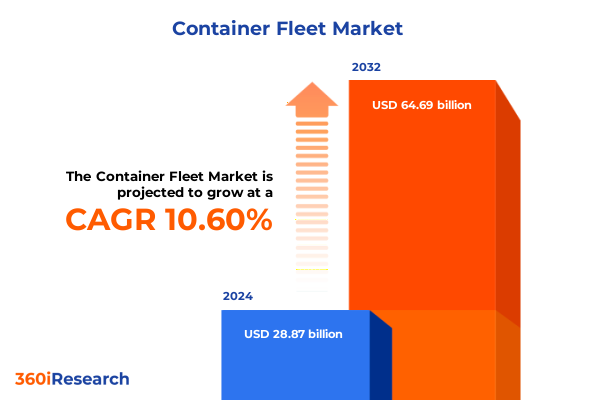

The Container Fleet Market size was estimated at USD 31.60 billion in 2025 and expected to reach USD 34.59 billion in 2026, at a CAGR of 10.77% to reach USD 64.69 billion by 2032.

Establishing the critical context of container fleet dynamics in shaping resilient global trade routes

The global container fleet landscape occupies a pivotal role in facilitating international trade and supply chain efficiency, serving as the fundamental backbone for the movement of goods across continents. Over recent years, heightened consumer demand, evolving supply chain resilience strategies, and shifts toward nearshoring have elevated the strategic importance of container fleets to new heights. Given the industry’s complexity and interdependencies across manufacturing, logistics, and regulatory frameworks, stakeholders require a clear vantage point into prevailing market dynamics to navigate challenges and seize emerging opportunities.

Drawing from in-depth qualitative interviews with leading shipping lines, leasing firms, and terminal operators, as well as extensive secondary data from port authorities, customs agencies, and trade associations, this report offers an impartial and rigorous perspective on the contemporary container fleet arena. In doing so, it empowers decision-makers with actionable insights, enabling them to optimize fleet utilization, enhance operational resilience, and future-proof investments. Consequently, leaders across shipping, logistics, manufacturing, and finance can leverage this foundational context as they craft adaptive strategies to address ongoing disruptions and long-term market transformations.

Exploring the convergence of digital innovation, environmental stewardship, and evolving trade routes reshaping container fleet strategies

The container fleet sector is undergoing a transformative phase characterized by accelerated digital adoption, sustainability commitments, and shifting trade corridors. Digital twin technology, blockchain-based tracking, and advanced telematics systems are converging to create an interconnected ecosystem that enhances end-to-end visibility and predictive maintenance. These innovations not only reduce unplanned downtime but also streamline asset management processes, offering operators unprecedented clarity into fleet health and deployment patterns.

Simultaneously, environmental regulations and corporate ESG targets have prompted significant investments in low-emission container designs and alternative fuel compatibility. Hybrid-electric chassis, solar-integrated refrigeration units, and lifecyle carbon footprint monitoring tools illustrate how manufacturers and lessees are driving decarbonization across the supply chain. Furthermore, a realignment of trade flows toward intra-regional corridors is reshaping fleet deployment strategies, with rising emphasis on capacity redistribution between the Asia-Pacific, Europe, and the Americas to mitigate congestion risks and geopolitical uncertainties.

Consequently, market participants must adopt a forward-looking mindset, balancing digital transformation with sustainability objectives while recalibrating their networks to capture emerging trade corridors. This confluence of tech-driven efficiency and environmental stewardship marks the most profound shift the container fleet industry has witnessed in decades.

Assessing the far-reaching operational and strategic effects of US tariff policies on container fleets through 2025

Since the initial imposition of duties under key trade statutes, cumulative United States tariffs have materially influenced container fleet economics and strategic planning. Import duties applied to a broad range of manufactured goods have triggered cyclical fluctuations in container demand, exacerbating equipment imbalances as certain commodity segments saw demand compression while others surged. For instance, higher duties on electronics and consumer goods resulted in a temporary deceleration in inbound container volumes, prompting some lessors to reassign assets toward high-growth routes in Southeast Asia and Latin America.

At the same time, ongoing tariff reviews and potential escalations have driven a level of uncertainty that incentivizes fleet operators to maintain higher inventory across strategic hubs to hedge against supply interruptions. The ripple effects extend beyond utilization rates; equipment dwell times have increased at import terminals, exerting pressure on chassis pools and storage yards. Container manufacturers have also adjusted production schedules to align with anticipated shifts in order pipelines, particularly as firms seek containers constructed outside tariff-exposed jurisdictions.

In essence, the cumulative impact of US tariff policy through 2025 underscores the critical imperative for flexible fleet management practices. Operators that proactively monitor tariff developments and adapt their asset deployment, production sourcing, and contract structures will be best positioned to sustain profitability amid ongoing trade policy volatility.

Unpacking the nuanced influences of container type, ownership models, and diverse cargo applications on fleet composition and strategy

When viewed through the prism of container type, the market displays a fundamental dichotomy between general-purpose units and temperature-controlled solutions. Dry van containers continue to underpin the transportation of diverse cargo categories, from apparel to consumer electronics, owing to their versatility and cost efficiency. In contrast, refrigerated containers serve as vital enablers of cold chain logistics, preserving perishable goods and pharmaceuticals over long distances. This divergence in application drives distinct procurement, maintenance, and utilization paradigms for each fleet segment.

Ownership models further shape strategic considerations, as leasing firms offer flexible access to equipment without capital-intensive commitments, while owned fleets deliver greater control over customization and long-term cost amortization. Companies evaluating fleet expansion must weigh the balance between operational agility provided by leased fleets and the asset control benefits intrinsic to owned container pools.

Across application verticals, the spectrum of cargo-from automotive parts and consumer appliances to chemical shipments and temperature-sensitive produce-commands specialized equipment specifications. Bulk liquids, whether destined for food grade or industrial processes, demand liquid-tight containers with corrosion-resistant linings. Similarly, hazardous and nonhazardous chemicals require compliance with stringent safety standards and appropriate material handling features. Refrigerated transport subdivides into fresh produce and frozen food segments, each imposing unique thermal performance and door-sealing requirements. Understanding these nuanced segmentation dynamics is essential for aligning fleet composition with specific cargo demands, regulatory compliance, and service level commitments.

This comprehensive research report categorizes the Container Fleet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Ownership Model

- Application

Revealing how distinct economic drivers and infrastructure priorities across the Americas, EMEA, and Asia-Pacific are shaping fleet deployment strategies

The Americas region continues to serve as a cornerstone of global container trade, driven by the United States’ vast consumer market and Canada’s cross-border manufacturing integration. Major gateway ports along the Atlantic and Pacific coasts have expanded terminal capacity to absorb surges in import volumes, while inland rail corridors facilitate container redistribution to heartland logistics hubs. Regional emphasis on nearshoring and onshoring has prompted companies to adjust fleet configurations to support shorter, more frequent voyages, enhancing responsiveness and reducing supply chain complexity.

Across Europe, the Middle East, and Africa, fleet strategies are influenced by a mix of mature Western European markets and rapidly developing North African ports. There is a pronounced focus on decarbonization and port digitalization initiatives, particularly within the European Union’s regulatory framework that incentivizes green terminal upgrades and shore power deployment. Meanwhile, the Middle East’s pivot toward reexport hubs and the ongoing development of free zones in the Gulf Cooperation Council have created new demand pockets for both general-purpose and specialized containers.

In the Asia-Pacific, sustained manufacturing growth, combined with expanding intra-Asian trade lanes, continues to drive robust demand for both dry and refrigerated units. Key hubs in Southeast Asia are investing in automated container terminals and enhanced hinterland connectivity, while Pacific rim economies maintain strategic partnerships to share capacity and mitigate container shortages. The interplay of government infrastructure investment, regional trade agreements, and rising e-commerce penetration ensures that Asia-Pacific remains the fastest-evolving theatre for container fleet expansion and operational innovation.

This comprehensive research report examines key regions that drive the evolution of the Container Fleet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading fleet operators and specialized innovators deploy scale and technology to secure competitive advantages

Global leasing giants and integrated shipping lines are at the forefront of driving innovation and scale in the container fleet domain. Major independent lessors have leveraged diversified portfolios to offer value-added services such as digital tracking platforms, proactive maintenance programs, and fleet reconfiguration expertise, catering to a wide spectrum of shipper requirements. Shipping lines with vertically integrated asset ownership employ proprietary data analytics to optimize vessel stowage patterns and container allocations, thereby reducing idle time and boosting operational efficiency.

Moreover, specialized niche players have emerged to address unique market pockets, such as temperature-sensitive pharmaceuticals or high-value automotive components, by providing tailored containers with advanced monitoring, remote temperature control, and compliance certification. Collaborative ventures between leasing firms and technology providers are accelerating the adoption of real-time condition monitoring sensors, predictive maintenance algorithms, and blockchain-enabled documentation workflows, enhancing transparency and reducing administrative friction.

As the competitive landscape intensifies, companies that combine scale with innovation will secure lasting leadership positions. Those that invest in integrated service offerings, deepen digital capabilities, and tailor solutions for high-growth verticals will capture outsized value across the evolving container fleet ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Container Fleet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Moller - Maersk A/S

- Beacon Intermodal Leasing Ltd.

- CAI International, Inc.

- CARU Containers B.V.

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- Evergreen Marine Corporation (Taiwan) Ltd.

- Florens Asset Management Co., Ltd.

- Hapag-Lloyd Aktiengesellschaft

- HMM Co., Ltd.

- Kawasaki Kisen Kaisha, Ltd.

- Mediterranean Shipping Company S.A.

- Ocean Network Express Pte. Ltd.

- Orient Overseas Container Line Ltd.

- Pacific International Lines (Pte) Ltd.

- Seaco Global Ltd.

- SeaCube Container Leasing Ltd.

- SITC International Holdings Company Limited

- Textainer Group Holdings Limited

- Touax Container Solutions S.A.

- Triton International Limited

- Wan Hai Lines Ltd.

- Wan Hai Lines Ltd.

- Yang Ming Marine Transport Corporation

Outlining strategic digital, sustainability, and operational initiatives that empower fleet operators to thrive amid market volatility

Industry leaders must embark on a structured digital transformation journey that aligns technology adoption with strategic objectives. By prioritizing integrated asset management platforms that unify telematics, maintenance scheduling, and route optimization, executives can drive substantial cost savings and elevate service reliability. In parallel, forging partnerships with port authorities and logistics providers to pilot green terminal solutions-such as electrified handling equipment and shore-to-ship power connections-will underscore a firm’s commitment to sustainability and regulatory compliance.

Furthermore, diversifying fleet ownership models can afford operators the agility to scale capacity in response to market volatility. Hybrid approaches that combine long-term owned assets for core lanes with leased containers for peak-season surges will optimize working capital and mitigate idle inventory risks. Senior management should also consider tiered service packages for customers, blending standard container options with premium offerings that incorporate real-time condition monitoring, warranty-backed maintenance, and expedited customs clearance.

Strategically, stakeholders ought to engage in continuous scenario planning exercises that incorporate potential tariff changes, geopolitical shifts, and evolving trade agreements. Establishing a cross-functional task force to monitor policy developments, analyze impacts on supply chain flows, and recommend fleet rebalancing actions will enhance resilience and maintain competitive leverage in an increasingly dynamic global trade environment.

Detailing the comprehensive research framework combining qualitative interviews, secondary data, and scenario modeling for robust insights

This analysis integrates a multi-pronged research framework to ensure robustness and reliability. Primary research involved in-depth interviews with executives from leading container lessors, shipping lines, port operators, and major shippers, capturing qualitative insights on fleet utilization patterns, technology adoption, and response to trade policy shifts. Concurrently, extensive secondary data collection included customs clearance statistics, port throughput reports, industry whitepapers, and regulatory filings, providing quantitative benchmarks for key market parameters.

Data triangulation techniques were employed to reconcile disparate sources and validate core findings, while scenario analysis modeled potential futures under varying assumptions related to tariff escalations, regulatory reforms, and technological breakthroughs. Complementing this approach, peer benchmarking against publicly available sustainability disclosures, financial statements, and patent filings offered an objective gauge of competitive positioning.

By merging empirical evidence with forward-looking modeling and expert validation, the methodological rigor underpinning this study delivers actionable insights with a high degree of confidence, equipping stakeholders to make data-driven decisions and navigate the complexities of the container fleet landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Container Fleet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Container Fleet Market, by Type

- Container Fleet Market, by Ownership Model

- Container Fleet Market, by Application

- Container Fleet Market, by Region

- Container Fleet Market, by Group

- Container Fleet Market, by Country

- United States Container Fleet Market

- China Container Fleet Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing how integrated digital, environmental, and trade-responsive strategies will define future success in container fleet management

In summary, the container fleet industry stands at a critical juncture where technological innovation, environmental imperatives, and shifting trade dynamics intersect. Organizations that embrace digitalization, align fleet strategies with emerging trade corridors, and proactively manage tariff-related risks will secure lasting competitive advantages. Meanwhile, specialized container solutions and flexible ownership models promise to address the increasingly granular needs of diverse cargo verticals.

As regional infrastructure development progresses and regulatory frameworks evolve, fleet operators must remain vigilant, continuously recalibrating vessel allocations, equipment sourcing, and service offerings to stay ahead of market shifts. The strategic recommendations outlined herein provide a roadmap for navigating near-term uncertainties and engineering long-term value creation across the global container fleet ecosystem.

Ultimately, the ability to synergize operational excellence with sustainability objectives and policy responsiveness will determine industry leaders’ success in the years ahead, reinforcing the container fleet’s enduring role as a linchpin of global commerce.

Connect with our Associate Director of Sales and Marketing for an exclusive opportunity to access the complete container fleet market research report for strategic gains

To explore deeper insights or secure a tailored discussion on how this comprehensive container fleet research can empower your strategic initiatives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for a personalized consultation and immediate access to the full report.

- How big is the Container Fleet Market?

- What is the Container Fleet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?