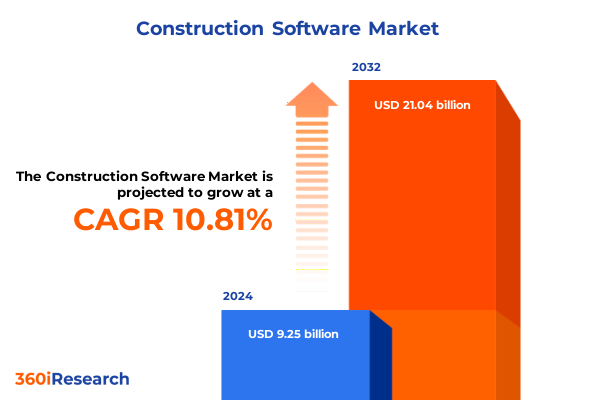

The Construction Software Market size was estimated at USD 10.19 billion in 2025 and expected to reach USD 11.25 billion in 2026, at a CAGR of 10.90% to reach USD 21.04 billion by 2032.

Exploring the Dynamic Evolution of Construction Software and the Imperative for Digital Transformation in Modern Project Delivery

The construction industry is undergoing a monumental shift as digital transformation accelerates at an unprecedented pace, reshaping the way projects are planned, designed, and executed. Modern construction software is at the forefront of this evolution, offering integrated platforms that bring together data, stakeholders, and processes in a unified environment. As organizations seek to improve productivity, enhance collaboration, and mitigate risks, the need for robust, scalable, and intelligent solutions has never been more critical. In this context, stakeholders from site managers to C-suite executives are reevaluating legacy practices and investing in technologies that can deliver real-time insights and drive operational excellence.

Against this backdrop of rapid change, emerging trends such as cloud computing, Internet of Things (IoT) sensors, and artificial intelligence are converging to create a more connected and data-driven ecosystem. These advancements not only enable predictive analytics and machine learning–powered decision making but also facilitate seamless information flow across design, field operations, and back-office functions. As a result, the construction software landscape is expanding beyond traditional standalone applications to embrace end-to-end suites that support every phase of the project lifecycle. This report opens with an overview of these transformative forces and sets the stage for a deep dive into the key market dynamics that will shape the industry’s trajectory in the coming years.

Uncovering the Pivotal Technological and Process Shifts Reshaping the Construction Software Landscape Across All Stakeholders

The construction software domain has witnessed a series of transformative shifts that have fundamentally altered stakeholder expectations and competitive positioning. Initially, standalone offerings such as isolated budgeting tools and simple design applications dominated the market. Over time, the integration of disparate modules gave rise to comprehensive platforms capable of handling everything from 3D modeling to mobile field reporting. More recently, the introduction of cloud-native architectures has enabled on-demand scalability and remote collaboration, breaking down silos and democratizing access to mission-critical data.

Simultaneously, the infusion of advanced technologies like artificial intelligence and machine learning has redefined the potential of construction software. Predictive maintenance algorithms now analyze equipment sensor data to preemptively flag potential failures, while AI-driven scheduling engines optimize resource allocation based on historical performance and real-time site conditions. In parallel, the growing ubiquity of mobile devices has empowered field teams with instant access to project documents, safety checklists, and time-tracking tools, further bridging the gap between office and site. These pivotal shifts underscore the industry’s relentless march toward interconnected, intelligent ecosystems that prioritize efficiency, sustainability, and safety.

Assessing the Cumulative Financial and Operational Impact of New United States Tariffs on Construction Software Implementation and Supply Chains

The introduction of a new tranche of United States tariffs in early 2025 has introduced a complex layer of cost considerations and supply chain challenges for construction companies and software vendors alike. Although these tariffs were primarily aimed at steel and aluminum imports, the ripple effects have been felt across the broader ecosystem, elevating input costs for hardware-dependent software deployments and increasing overhead for bundled solution offerings. In response, software providers have been compelled to revisit pricing models, support more flexible licensing options, and explore strategic partnerships with domestic suppliers to mitigate margin compression.

Moreover, the tariff-induced cost pressures have spurred innovation in software-enabled procurement and supply chain management. Construction management modules are now embedding features that track material price volatility and suggest alternative sourcing strategies, while document management platforms are facilitating contract renegotiations with embedded compliance checklists. These adaptive functionalities demonstrate the industry’s resilience and its capacity to harness software as a strategic lever for navigating macroeconomic headwinds. As a result, stakeholders are gaining a more nuanced understanding of how trade policy can directly influence technology adoption decisions and overall project economics.

Deriving Actionable Insights Through Deep Analysis of Construction Software Demand Across Types Deployment Applications and End Users

A granular examination of the construction software market reveals a complex tapestry of solution types, deployment approaches, end-user applications, and stakeholder profiles. Within the domain of software types, offerings range from accounting systems that streamline budget tracking, expense reporting, and invoicing, to bidding platforms that accelerate competitive tendering. Building Information Modeling applications deliver 3D visualization and data-rich model management, while construction management suites integrate cost estimation, document control, project scheduling, and resource planning. Meanwhile, design software spans both 2D drafting applications and advanced 3D modeling environments, and field service management platforms unify equipment management with precise time tracking. Complementing these are safety and reporting tools that capture compliance metrics and incident analysis to uphold rigorous site standards.

Turning to deployment models, organizations are increasingly favoring cloud-based architectures for their flexibility, low upfront capital requirements, and ability to support distributed teams working across multiple projects. Nevertheless, concerns around data sovereignty, regulatory compliance, and on-premises legacy infrastructures ensure that a significant portion of the market continues to rely on traditional installations. In application terms, commercial construction entities prioritize project management and bidding efficiency, industrial projects demand robust safety and asset management capabilities, infrastructure initiatives emphasize BIM and resource coordination, and residential builders focus on simplified design-to-build workflows. Finally, end users span a spectrum from builders and contractors, who require operational tools for site execution, to consultants seeking analytical platforms for program oversight, and engineers and architects who depend on precision design and documentation solutions.

This comprehensive research report categorizes the Construction Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End-User

- Deployment

Revealing Regional Dynamics and Growth Drivers Impacting Construction Software Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Geographical dynamics play a pivotal role in shaping construction software adoption, with each region exhibiting distinct drivers and challenges. In the Americas, North America leads the charge with early cloud adoption, stringent regulatory frameworks, and a mature vendor ecosystem. Latin America, by contrast, is characterized by a surge in public infrastructure investment and an appetite for cost-effective SaaS solutions that can be implemented with minimal local IT overhead. Transitioning to Europe, Middle East, and Africa, the contours of the market are defined by divergent maturity levels: Western Europe emphasizes sustainability and BIM mandates, the Middle East’s mega-projects demand high-touch customization and regional data centers, and Africa’s emerging economies are exhibiting growing interest in mobile-centric field solutions.

Meanwhile, the Asia-Pacific region is witnessing some of the fastest rates of digital adoption globally, fueled by ambitious infrastructure plans in China and India and a growing emphasis on smart city initiatives. The convergence of government-backed digitization programs and thriving software development hubs has fostered a dynamic landscape where local providers compete head-to-head with international brands. Across all regions, common themes emerge-mobility, integration, and data analytics-yet the pace and depth of adoption vary, underscoring the importance of region-specific go-to-market strategies and partnership models.

This comprehensive research report examines key regions that drive the evolution of the Construction Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Competitive Positions and Innovation Trajectories of Leading Construction Software Providers in a Rapidly Evolving Market

Leading technology providers are jockeying for position through strategic product enhancements, ecosystem alliances, and targeted acquisitions. Global incumbents have leveraged vertically integrated offerings to lock in large enterprise accounts, while nimble challengers capitalize on specialized modules and rapid release cadences to capture greenfield opportunities. Strategic partnerships with hardware vendors, telecommunications providers, and systems integrators have become increasingly common, reflecting a recognition that end-to-end value requires seamless interoperability between on-site sensors, mobile devices, and cloud platforms.

Innovation trajectories also differ by vendor archetype. Some market leaders focus on embedding artificial intelligence capabilities such as predictive analytics, risk modeling, and autonomous schedule optimization directly within their core platforms. Others prioritize user-centric interfaces and low-code customization, enabling non-technical stakeholders to configure workflows and generate real-time dashboards. Meanwhile, a new breed of specialist providers is emerging with niche solutions tailored to disciplines such as concrete placement monitoring, utility coordination, or laser scanning data management. This diverse vendor landscape fosters healthy competition and continuous evolution, challenging every player to balance depth of functionality with ease of adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acumatica, Inc.

- Arcoro, Inc.

- Autodesk, Inc.

- Buildertrend Solutions, Inc.

- CMiC Global Inc.

- CoConstruct, LLC

- Contractor Foreman, Inc.

- Hilti Corporation

- JobTread Software, Inc.

- monday.com Ltd.

- NYGGS Automation Suite Private Limited

- Oracle Corporation

- Procore Technologies, Inc.

- Trimble Inc.

- Wrike, Inc.

- Zoho Corporation Pvt. Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption and Drive Sustainable Growth in Construction Software

Industry leaders must chart a robust digital roadmap that aligns technology investments with organizational priorities and market dynamics. First, adopting a phased implementation strategy can minimize disruption and accelerate return on investment, beginning with high-impact use cases such as mobile field data capture and document management before scaling to advanced analytics and AI-driven modules. In tandem, cultivating cross-functional teams comprising IT specialists, project managers, and field supervisors is essential to drive user adoption and continuous process improvement.

Next, organizations should explore strategic collaborations with software vendors and integration partners to access turnkey solutions that address specific pain points-whether that involves insulating operations from tariff-driven cost fluctuations, enhancing safety oversight through real-time incident reporting, or streamlining bid-to-build workflows. Embracing open APIs and interoperable data standards will further future-proof digital ecosystems and facilitate the incorporation of emerging technologies. Finally, developing a comprehensive change management and skills development program will ensure that employees are equipped to leverage new tools effectively, fostering a culture of innovation and resilience.

Detailing a Rigorous Research Framework Combining Primary Interviews Secondary Data and Expert Validation to Ensure Comprehensive Market Understanding

This research effort combined rigorous primary and secondary methodologies to achieve a holistic understanding of the construction software landscape. On the primary side, in-depth interviews were conducted with senior executives, product heads, and digital transformation leaders from across the global construction value chain. Complementing these discussions, surveys captured quantitative data on technology adoption patterns, budget allocation priorities, and implementation challenges. Expert validation sessions were held to refine key findings and ensure accuracy in the contextualization of emerging trends.

Secondary research encompassed a comprehensive review of public company filings, regulatory frameworks, industry white papers, and reputable news outlets to trace the historical evolution of tariffs, regional policies, and vendor strategies. Furthermore, technology demonstration reviews and analyst briefings provided insights into product roadmaps, integration capabilities, and innovation pipelines. Data triangulation across these multiple sources guaranteed a balanced perspective, while continuous cross-checking with field experts prevented any single viewpoint from dominating the narrative.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Software Market, by Type

- Construction Software Market, by Application

- Construction Software Market, by End-User

- Construction Software Market, by Deployment

- Construction Software Market, by Region

- Construction Software Market, by Group

- Construction Software Market, by Country

- United States Construction Software Market

- China Construction Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Highlight the Future Imperatives and Strategic Pathways for Stakeholders in the Construction Software Ecosystem

The analysis underscores a construction software market in the midst of profound transformation, driven by cloud proliferation, advanced analytics, and shifting economic policies. Translating these insights into action requires a clear vision, adaptable technology strategies, and an unwavering focus on value delivery. As trade policies exert new pressures on costs and supply chains, software-enabled process optimization emerges as both a defensive bulwark and a source of competitive advantage.

Looking ahead, stakeholders who embrace modular, API-driven architectures and invest in workforce upskilling will be best positioned to capitalize on the convergence of IoT, AI, and mobile technologies. Ultimately, the most successful organizations will be those that treat digital tools not as standalone products but as integral components of a broader transformation journey-one that reimagines the very foundations of project delivery, asset management, and stakeholder collaboration. This report’s findings illuminate the pathways to that future, equipping leaders with the knowledge they need to drive innovation, enhance resilience, and secure sustainable growth.

Empower Your Organization with In-Depth Construction Software Market Insights by Partnering with Ketan Rohom to Access the Full Research Report Today

To gain unparalleled visibility into the multifaceted dynamics of the construction software market and leverage data-driven strategies that will position your organization for competitive advantage, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. This comprehensive research report distills expert insights, in-depth analyses, and nuanced perspectives tailored to inform critical decision making across the enterprise. By engaging with Ketan Rohom, you can access customizable packages that align with your specific objectives-whether you seek granular deep dives on tariff impacts, regional adoption trends, segmentation-driven use cases, or competitive intelligence on leading vendors. Reach out today to secure your license and empower your teams with the actionable intelligence needed to drive innovation, optimize operations, and sustain growth in one of the most dynamic sectors of the digital economy.

- How big is the Construction Software Market?

- What is the Construction Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?