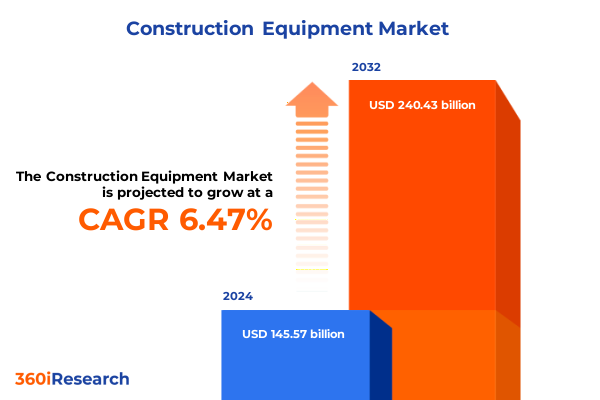

The Construction Equipment Market size was estimated at USD 154.36 billion in 2025 and expected to reach USD 163.89 billion in 2026, at a CAGR of 6.53% to reach USD 240.43 billion by 2032.

Foundational Perspectives on Evolving Construction Equipment Dynamics Shaping Strategic Decisions in Modern Infrastructure Development Landscapes

Over the past several years, the construction equipment domain has witnessed unprecedented transformation driven by evolving infrastructure priorities, technological breakthroughs, and shifting economic realities. As governments worldwide invest heavily in public works programs and private-sector players accelerate urban development projects, demand for machinery that delivers both performance and efficiency has reached new heights. Against this backdrop of dynamic opportunity, industry decision makers require a structured, in-depth perspective that deciphers complex market forces, identifies core challenges, and highlights avenues for sustainable growth.

This executive summary serves as a strategic compass, distilling extensive research into concise insights that inform critical decisions. It outlines key phenomena reshaping the sector, examines the compounding effects of tariff policies in the United States through mid-2025, and unpacks segmentation, regional nuances, and competitive landscapes. Moreover, it culminates in actionable recommendations tailored for leadership teams seeking to secure operational resilience and market differentiation. By establishing a clear roadmap from analysis to application, this introduction sets the stage for an evidence-based exploration of how construction equipment players can thrive in an environment defined by rapid change and heightened customer expectations.

Catalytic Forces Redefining the Construction Equipment Sector Through Digital Transformation and Sustainable Operational Practices Elevating Industry Resilience

The construction equipment ecosystem is undergoing a profound metamorphosis as digital adoption converges with sustainability imperatives. Telematics and internet-enabled sensors have evolved from niche experiments to foundational tools that optimize equipment utilization, monitor real-time performance, and predict maintenance needs. Consequently, fleets that embed advanced analytics into daily operations report significant reductions in downtime and cost overruns. In parallel, the ascent of electric and hybrid powertrains is redefining expectations for emissions control and energy efficiency, challenging traditional diesel-powered paradigms.

Furthermore, autonomous and semi-autonomous machinery is no longer confined to pilot deployments; it is increasingly integrated into standard workflows to enhance productivity and mitigate labor shortages. Rental business models have also matured, offering flexible access to high-value assets and reducing capex burdens. Taken together, these catalytic forces are elevating industry resilience, fostering closer collaboration between equipment manufacturers, software developers, and end users. As a result, today’s construction equipment landscape is both more interconnected and more responsive to project-level demands than ever before, marking a decisive shift toward smart, sustainable, and scalable solutions.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Construction Equipment Supply Chains and Cost Management

Since the introduction of Section 232 tariffs on steel and aluminum imports in 2018, and subsequent Section 301 levies on select imported goods, construction equipment manufacturers have navigated an increasingly complex cost environment. These measures, which cumulatively extend into 2025, have elevated input costs for steel frames, hydraulic components, and specialized alloys. In response, many original equipment manufacturers renegotiated supplier agreements and localized key production processes to mitigate import duties, reshaping global supply networks.

Moreover, the compounded duties have prompted shifts in inventory strategies and pricing models. Equipment distributors encountering higher landed costs have exercised greater discretion in fleet composition, often favoring modular machinery that can be tailored on-site to diverse applications. Simultaneously, the enduring impact of tariffs has accelerated investment in alternative materials research and strategic partnerships with domestic suppliers. As a result, organizations that proactively adjusted their procurement and design frameworks have managed to stabilize margins, while others continue to grapple with margin compression and extended lead times.

Unveiling Critical Segmentation Insights Spanning Product Types Power Outputs Fuel Varieties Design Models Autonomy Tiers and Sales Channels

A nuanced understanding of market segmentation reveals distinct patterns across equipment categories, power ratings, fuel systems, chassis designs, levels of autonomy, sales pathways, and end-use applications. When examining product classifications-from concrete and road construction machinery through compactors, mixers, and pavers to earth moving assets like backhoes, dozers, excavators, and loaders-each subsegment exhibits unique demand cycles driven by project scope, terrain considerations, and volume requirements. Likewise, heavy construction vehicles such as dump trucks and tank trucks, lifting solutions including elevators and hoists, and material handling platforms spanning cranes, forklifts, and telehandlers demonstrate differentiated adoption curves based on deployment environments.

Power output constitutes another critical axis of differentiation. Machines delivering below one hundred horsepower often serve emerging markets and specialized niche tasks, whereas mid-range systems between one hundred and five hundred horsepower remain the backbone of mainstream earth moving and lifting operations. Above five hundred horsepower, the largest motorized equipment supports heavy industrial and large-scale infrastructure applications. Fuel preferences further segment user needs, with diesel power still predominant but electric drivetrains gaining traction in urban settings and gasoline units retaining relevance for light-duty tasks. Design choices-crawler versus wheeled configurations-dictate mobility and ground pressure considerations, while autonomy features range from fully manual control to advanced autonomous navigation. In addition, go-to-market strategies differ between OEM direct channels and aftermarket support networks, and end users span construction companies, government infrastructure bodies, mining operations, oil and gas producers, and equipment rental providers. Each layer of segmentation underscores the imperative for suppliers to adopt agile product portfolios and bespoke service packages.

This comprehensive research report categorizes the Construction Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Output

- Fuel Type

- Design Type

- Autonomy

- Sales Channel

- End User

Illuminating Pivotal Regional Market Nuances Across the Americas Europe Middle East Africa and the Dynamic Asia Pacific Landscape

Geographic markets within the construction equipment arena exhibit varied growth trajectories and operational nuances. In the Americas, robust infrastructure stimulus in the United States, coupled with evolving regulatory frameworks and renewable energy projects in Canada, underpins stable demand. Latin American economies, while subject to cyclical volatility, are showing renewed activity in road rehabilitation and urban transit expansions. Transitioning to Europe, Middle East and Africa, densely populated urban centers in Western Europe prioritize low-emission machinery and digital fleet management protocols, whereas Gulf Cooperation Council states continue to invest heavily in large-scale energy, transport, and real estate projects. North African and sub-Saharan regions are gradually adopting mid-tier machinery to support mining, agriculture, and civil works initiatives.

Across Asia-Pacific, rapid urbanization in India and Southeast Asia fuels strong uptake of versatile loader and excavator models. In China, the industry balances the decline of property-driven construction with growth in public utilities and high-speed rail corridors. Australia and Japan, influenced by aging infrastructure bases, emphasize refurbishment and machinery modernization. While regulatory landscapes and financing structures differ significantly across these geographies, common themes such as emissions reduction, digital integration, and lifecycle cost optimization create shared opportunities for global players seeking to harmonize regional offerings.

This comprehensive research report examines key regions that drive the evolution of the Construction Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Strategic Focus Areas Innovative Practices and Collaborative Growth Trajectories Driving Market Leadership

Major equipment manufacturers have solidified their leadership through targeted investments, strategic collaborations, and continuous product innovation. Established global players capitalize on comprehensive product lines and established service networks, while emerging manufacturers differentiate through niche technologies and cost-competitive offerings. For instance, industry leaders have expanded telematics capabilities in partnership with software firms, enabling predictive maintenance and remote diagnostics that enhance fleet uptime. Concurrently, several original equipment makers have forged alliances with battery producers and energy storage specialists to accelerate the deployment of electric models tailored for urban and indoor applications.

In parallel, second-tier and regional manufacturers focus on compact equipment segments and specialized applications, leveraging localized production to optimize cost structures and aftersales support. Furthermore, joint ventures between international and domestic companies have emerged as an effective strategy to penetrate high-growth markets constrained by import restrictions or demanding local content regulations. This mosaic of competition and collaboration underscores how forward-thinking enterprises are harnessing cross-industry partnerships, research and development investments, and digital services to fortify market positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Atlas Copco AB

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Group

- Fayat Group

- Guangxi LiuGong Machinery Co., Ltd.

- Hangcha Group Co., Ltd.

- Haulotte Group by Solem SA

- HD Hyundai Construction Equipment Co.,Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Hysoon Australia Pty Ltd

- J.C. Bamford Excavators Limited

- Kobe Steel, Ltd.

- Komatsu Ltd.

- Kubota Corporation

- Larsen & Toubro Limited

- Liebherr-International Deutschland GmbH

- Sany Heavy Industry Co., Ltd.

- Shantui Construction Machinery Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- Tadano Ltd.

- Takeuchi Mfg. Co., Ltd.

- Terex Corporation

- Toyota Industrial Equipment Manufacturing, Inc. by Toyota Industries

- Wacker Neuson SE

- Xuzhou Construction Machinery Group Co., Ltd.

Actionable Strategies and Forward Looking Recommendations Empowering Construction Equipment Leaders to Capitalize on Emerging Trends and Operational Efficiencies

To remain at the forefront of this rapidly evolving environment, leadership teams must embrace holistic strategies that span technology, supply chain resilience, and customer engagement. Organizations should accelerate the integration of digital platforms that unify telematics, maintenance scheduling, and performance analytics under single dashboards to drive data-informed decision making. At the same time, diversifying supplier footprints and exploring near-shoring for critical components can protect operations from tariff shocks and logistical constraints. Moreover, allocating dedicated resources toward electrification roadmaps and modular design architectures will prepare fleets for accelerated deployment of low-emission machinery.

In addition, companies are advised to cultivate strategic partnerships with technology startups and energy providers to co-develop innovative solutions, from smart charging stations to autonomous navigation systems. Equally important is the establishment of comprehensive training programs that equip operators with the skills necessary to maximize the value of advanced equipment features. Finally, leadership should prioritize transparent communication with end users, offering flexible financing models, usage-based maintenance packages, and outcome-driven service agreements that foster long-term loyalty and ongoing revenue streams.

Comprehensive Research Methodology Detailing Rigorous Data Collection Analytical Frameworks and Verification Protocols Underpinning the Executive Insights

The research underpinning this executive summary combined systematic secondary analysis with primary engagement across the value chain. Initially, peer-reviewed journals, industry white papers, regulatory filings, and company disclosures were reviewed to establish a comprehensive baseline of market dynamics and historical trends. This was followed by structured interviews with senior executives from equipment manufacturers, fleet operators, rental firms, and infrastructure authorities to validate emerging hypotheses and uncover real-world challenges.

Subsequently, quantitative data from proprietary equipment registries, import-export databases, and machinery lifecycle records were triangulated with qualitative insights to ensure analytical rigor. The process incorporated multiple rounds of data cleansing, cross-validation, and scenario testing to identify meaningful patterns and isolate driver variables. Finally, findings underwent peer review by subject-matter experts and industry consultants to align interpretations with field realities and reinforce the credibility of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Equipment Market, by Product Type

- Construction Equipment Market, by Power Output

- Construction Equipment Market, by Fuel Type

- Construction Equipment Market, by Design Type

- Construction Equipment Market, by Autonomy

- Construction Equipment Market, by Sales Channel

- Construction Equipment Market, by End User

- Construction Equipment Market, by Region

- Construction Equipment Market, by Group

- Construction Equipment Market, by Country

- United States Construction Equipment Market

- China Construction Equipment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward in Construction Equipment Evolution and Competitive Positioning

This executive summary has explored the defining forces reshaping the construction equipment sector and decoded critical segmentation and regional idiosyncrasies. From digital and sustainable transformation to the persistent influence of tariff regulations, the analysis highlights the need for agile responses and technology-driven innovation. Leading companies are those that balance product diversification with strategic partnerships, while also anchoring decision making in robust data frameworks.

As the industry progresses toward integrated, electrified, and semi-autonomous operations, stakeholders must remain vigilant to geopolitical shifts, regulatory developments, and evolving customer expectations. By synthesizing the core insights presented herein, organizations can chart a path that capitalizes on emerging opportunities, manages risk effectively, and secures competitive advantage in an increasingly complex and interconnected market environment.

Engage with Ketan Rohom for Personalized Consultation and Secure Exclusive Access to In Depth Construction Equipment Market Insights and Guidance

To explore how these insights translate into tangible advantages for your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation. He can guide you through the report’s comprehensive findings and discuss how the intelligence can be tailored to address your unique objectives. Engage now to secure exclusive access to actionable analyses, proprietary data, and customized strategic guidance that will position your team at the forefront of construction equipment innovation and market competitiveness. Don’t miss the opportunity to leverage expert support as you navigate an evolving landscape of technology, regulations, and customer demands.

- How big is the Construction Equipment Market?

- What is the Construction Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?