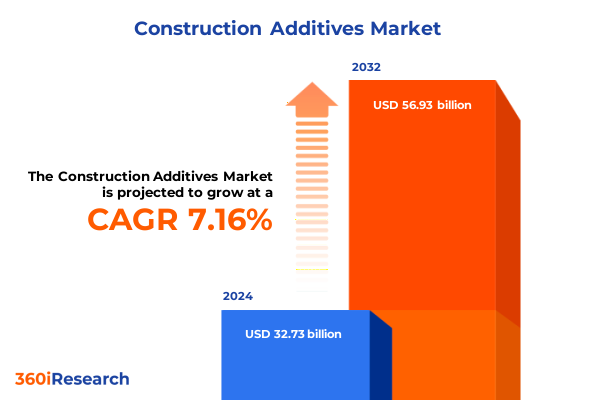

The Construction Additives Market size was estimated at USD 34.95 billion in 2025 and expected to reach USD 37.35 billion in 2026, at a CAGR of 7.21% to reach USD 56.93 billion by 2032.

Overview of the Construction Additives Market Landscape and its Critical Role in Enhancing Material Performance Across Diverse Infrastructure Projects

The construction additives landscape has evolved from a niche chemical specialty to an integral pillar supporting modern infrastructure projects, asset longevity, and performance optimization. Additives now play a fundamental role in mitigating construction challenges such as extreme environmental exposure, accelerated curing requirements, and sustainability mandates. As urbanization intensifies and infrastructure demands grow in complexity, the ability to tailor concrete, asphalt, and mortar through precise additive chemistries has become indispensable. Over the past decade, multifunctional formulations have emerged as vital enablers of high-strength materials, rapid set times, and enhanced durability, positioning additives at the forefront of material innovation.

Amid shifting regulatory frameworks and increasing pressure to reduce embodied carbon, the construction industry is turning to advanced additive technologies to balance performance with environmental stewardship. Industry stakeholders-from global manufacturers to specialty chemical producers-are investing in next-generation surfactants, bio-based polymers, and nano-engineered dispersants to deliver on cost efficiency and ecological compliance. Moreover, digitalization and data analytics are being integrated into production processes, enabling real-time quality control and predictive maintenance insights. As such, the opening chapter of this executive summary sets the stage for exploring how these forces converge to redefine the construction additives market, shaping strategic imperatives for both established players and emerging innovators.

Exploration of Emerging Technological Innovations and Sustainability Imperatives Reshaping the Future Trajectory of Construction Additives Formulations Globally

Technological breakthroughs and sustainability imperatives have coalesced to produce a paradigm shift in construction additive design and application. Bio-based polymers derived from agricultural byproducts are gaining traction through their capacity to reduce reliance on petrochemical inputs, while advanced nanomaterials enhance rheology control and microscopic crack resistance. Such innovations are redefining the parameters of material performance, enabling contractors to achieve higher compressive strengths with reduced cement volumes and lower energy footprints.

Simultaneously, the integration of digital tools-ranging from AI-powered formulation platforms to blockchain-driven supply-chain traceability-has fundamentally altered how additives are developed, tested, and distributed. By harnessing predictive modeling, manufacturers can accelerate formulation cycles, anticipate market shifts, and ensure consistent quality across global production sites. At the regulatory front, stringent emissions targets and green building certifications are prompting additive providers to align product roadmaps with circular economy principles, focusing on recyclability and carbon capture enhancement. These collective shifts are not only transforming product portfolios but are fostering collaborative ecosystems where cross-sector partnerships drive innovation in sustainable construction materials.

Comprehensive Assessment of Recent United States Tariff Policy Changes in 2025 and Their Ripple Effects on Raw Material Sourcing and Cost Structures Within Additives Supply Chains

In 2025, the United States introduced a series of revised tariff measures targeting key chemical precursors and specialty admixtures, creating pronounced reverberations across North American supply chains. Raw materials sourced from established overseas suppliers faced elevated duties, translating into cost pressures that rippled through formulating operations. This shift prompted many additive producers to reevaluate long-standing procurement strategies and negotiate new terms with domestic and alternative international partners to maintain margin stability.

The cumulative effect of these tariffs has been a renewed emphasis on supply-chain resilience. Manufacturers have expedited qualification of secondary feedstock sources, including regional chemical processors in Mexico and Canada, to circumvent elevated duty rates and minimize inventory holding costs. Furthermore, contractual clauses have been refined to include price-adjustment mechanisms, enabling downstream contractors to share volatility risks. Despite these adaptive measures, the short-term impact has manifested in transient lead-time fluctuations and sporadic raw material shortages. However, in the medium term, the industry appears poised to capitalize on nearshoring synergies and strategic stockpiling protocols, laying the groundwork for a more agile and cost-efficient competitive landscape.

InDepth Examination of Market Segmentation Dynamics Illuminating How Type Form and Application Categories Influence Strategic Prioritization in Additives Development

Understanding the breadth of chemical functionalities is pivotal in appreciating how additives are categorized by type. From accelerators that expedite cement hydration to air-entraining agents that improve freeze-thaw resilience, each class delivers specialized performance enhancements. Retarders have become invaluable in extended-pour applications where controlled set times are essential, while superplasticizers and water-reducers offer pathways to achieve high workability with reduced water-cement ratios, enhancing both strength and durability. This spectrum of additive types enables stakeholders to select targeted solutions that address project-specific challenges and regulatory benchmarks.

Equally important is the physical form of additives, which influences logistics, handling safety, and on-site integration. Liquid concentrates facilitate rapid mixing and homogeneous dispersion, supporting continuous pour operations. Powdered blends offer ease of storage and extended shelf life, making them suitable for remote or seasonal deployment. Granular formulations bridge these characteristics, allowing measured dosing and simplified blending without compromising stability. These distinctions in form factor ensure that producers can optimize delivery models to align with contractor workflows and storage capabilities.

Application environments further nuance segmentation insights by underscoring how additives perform under varying substrate conditions. In asphalt formulations, adhesion promoters and viscosity modifiers are critical to achieve durability under fluctuating temperatures. Concrete projects leverage a combination of workability enhancers and modulus-boosting agents to fulfill structural and aesthetic demands. Grout, mortar, and plaster applications each pose distinct rheological requirements, driving the adoption of specialized thickeners, anti-shrinkage compounds, and flow regulators. Recognizing these segmentation dynamics allows industry leaders to anticipate demand patterns and refine product pipelines accordingly.

This comprehensive research report categorizes the Construction Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Form

- Hazard Classification

- Application

- End Use

- Distribution Channel

Nuanced Regional Analysis Highlighting Differentiated Growth Drivers and Regulatory Landscapes Influencing Construction Additive Adoption Across Major Global Markets

In the Americas, infrastructure renewal programs and green building mandates have elevated demand for high-performance additives that balance cost considerations with sustainability requirements. Federal and state incentives for carbon-neutral construction have pushed market participants to incorporate low-carbon admixtures and circular-economy principles into regional portfolios. Meanwhile, legacy manufacturing hubs across the Midwest and Gulf Coast continue to serve as pivotal distribution and blending centers, reinforcing North America’s logistical advantages.

Across Europe, the Middle East, and Africa, regulatory heterogeneity defines the competitive environment. European nations are enforcing aggressive carbon reduction targets under the EU Green Deal, incentivizing bio-based additive adoption and end-of-life recyclability. Megaprojects in the Middle East demand bespoke high-temperature resistant formulations, while urbanization in African markets is catalyzing cost-sensitive yet quality-driven solutions. These divergent drivers have fostered a mosaic of regional strategies, with suppliers tailoring product lines to specific regulatory and environmental conditions.

Asia-Pacific remains the most dynamic theater, fueled by large-scale infrastructure investments and rapid urbanization. In China, stringent air quality regulations are steering market participants toward low-VOC and geopolymer additives that support cleaner production methods. India’s National Infrastructure Pipeline underscores the need for robust, weather-resilient admixtures in monsoon-prone regions. Southeast Asian economies, balancing growth with environmental preservation, are emerging as testbeds for hybrid additive systems that merge conventional chemistries with renewable biomass derivatives.

This comprehensive research report examines key regions that drive the evolution of the Construction Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profile of Leading Industry Participants Showcasing Competitive Positioning Collaboration Patterns and Innovation Focuses Driving Market Differentiation

Leading chemical companies have intensified their focus on strategic alliances, in-house innovation, and targeted acquisitions to secure competitive edges in the construction additives arena. Large-scale manufacturers are leveraging global R&D networks to accelerate the development of multifunctional admixtures that meet evolving environmental standards, while regional specialists are carving out niches with localized formulations optimized for specific climatic or regulatory contexts. Collaborative partnerships between academic institutions, technology start-ups, and industry incumbents are proliferating, fostering co-innovation platforms that blend proprietary chemistries with cutting-edge digital analytics.

Concurrently, companies are refining their value-chain strategies by integrating vertical capabilities such as toll manufacturing, on-site blending services, and digital quality management systems. This holistic approach not only streamlines operational efficiencies but also enhances customer intimacy by offering turnkey solutions that extend beyond product supply. Investment in pilot plants and testing laboratories has been a clear priority, ensuring rapid prototyping and iterative refinement of emerging additive technologies. Taken together, these initiatives underscore how organizational agility and cross-sector collaboration continue to reshape the competitive contours of the construction additives ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADO Additives Mfg Pvt. Ltd.

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Birla Corporation Limited

- Cemex S.A.B. de C.V.

- Chembond Chemicals Limited

- Chryso S.A.S. by Saint-Gobain

- CICO Group

- Clariant AG

- Concrete Additives & Chemicals Pvt. Ltd.

- Denka Company Limited

- Ecoratio

- Emsland Group

- Evonik Industries AG

- Fairmate Chemicals (BD) Ltd.

- Fosroc International Ltd.

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Hycrete, Inc.

- Innovation Concrete Laboratory Kft.

- JSW Cement Limited

- LATICRETE International, Inc.

- LEVACO Chemicals GmbH

- Mapei S.p.A.

- Mathiesen Group

- Nouryon Chemicals Holding B.V.

- Pidilite Industries Ltd.

- RPM International Inc.

- Sika AG

- Solvay S.A.

- Synthomer PLC

- The Dow Chemical Company

- Thermax Limited

- Tolsa S.A.

- USG Corporation by Knauf Group

- W. R. Grace & Company by Standard Industries

- Yuanwang Group

Targeted Actionable Recommendations to Empower Industry Leaders in Leveraging Technological Advances and Policy Insights for Sustainable Competitive Advantage

To thrive amidst tightening regulatory landscapes and intensifying sustainability imperatives, industry leaders should prioritize investment in bio-derived additive platforms that capitalize on agricultural and industrial byproducts. Establishing consortiums with feedstock suppliers and research institutions can accelerate technical validation and market entry while sharing R&D risks. In parallel, companies must strengthen supply-chain resilience by diversifying procurement channels, incorporating nearshore sourcing strategies, and instituting dynamic inventory management protocols with adaptive reorder thresholds.

Digital transformation initiatives should center on implementing integrated formulation management systems and blockchain-enabled traceability to ensure ingredient provenance and regulatory compliance. Embedding advanced analytics into production processes will yield predictive maintenance capabilities, reducing downtime and facilitating continuous quality assurance. Moreover, engaging proactively with policy bodies to shape balanced tariff and trade frameworks can mitigate future cost disruptions and support long-term strategic planning. By aligning product portfolios with circular economy principles and achieving sustainability certifications, organizations can differentiate their offerings in a market where ecological credentials are increasingly influencing procurement decisions.

Rigorous Research Methodology Outline Detailing Data Collection Validation and Analytical Frameworks Ensuring Accuracy and Reliability of Insights

This analysis is underpinned by a robust blend of primary and secondary research methodologies designed to ensure the reliability and precision of insights. Primary research encompassed in-depth interviews with senior R&D executives, procurement directors, and regulatory specialists across key geographic regions. These conversations provided first-hand perspectives on raw material availability, formulation challenges, and evolving policy landscapes.

Secondary research involved comprehensive reviews of regulatory filings, patent databases, and industry association publications to map current best practices and emerging technologies. Company annual reports, technical white papers, and peer-reviewed journals were triangulated to validate product performance claims and contextualize competitive strategies. Quantitative data from trade associations and customs records informed an analysis of import and export flows.

Analytical frameworks employed include SWOT, Porter’s Five Forces, and value-chain mapping, each adapted to the nuances of construction additive chemistry and market dynamics. All collected data underwent rigorous quality checks and cross-verification to minimize bias, with findings peer-reviewed by subject-matter experts. This structured approach ensures that conclusions and recommendations accurately reflect industry realities and equip stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Additives Market, by Product Type

- Construction Additives Market, by Material Type

- Construction Additives Market, by Form

- Construction Additives Market, by Hazard Classification

- Construction Additives Market, by Application

- Construction Additives Market, by End Use

- Construction Additives Market, by Distribution Channel

- Construction Additives Market, by Region

- Construction Additives Market, by Group

- Construction Additives Market, by Country

- United States Construction Additives Market

- China Construction Additives Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesis of Key Insights Underscoring Critical Takeaways and Strategic Imperatives for Stakeholders Engaged in the Construction Additives Ecosystem

The evolving matrix of technological breakthroughs, sustainability mandates, and trade policy shifts has underscored the strategic importance of construction additives as both performance enhancers and enablers of low-carbon infrastructure. Stakeholders that adeptly navigate type, form, and application segmentation can anticipate shifting demand patterns and unlock new avenues for product innovation. Regional complexities-from North American green building incentives to Asia-Pacific urbanization imperatives-require tailored strategies that reconcile global best practices with local regulatory and environmental nuances.

Competitive positioning will increasingly hinge on collaborative R&D ecosystems, digital supply-chain transparency, and supply-chain resilience measures that preempt external shocks. Organizations that embrace circular-economy models, prioritize bio-based chemistries, and engage proactively with policymaking forums will be best placed to secure long-term sustainable growth. Ultimately, the construction additives sector stands at a pivotal juncture where scientific ingenuity and strategic foresight converge, offering unparalleled opportunities for those prepared to lead rather than follow.

Interactive Call To Action Encouraging Personalized Engagement With Associate Director of Sales And Marketing to Secure Comprehensive Market Intelligence Solutions

To gain unparalleled insights tailored to your strategic needs in the construction additives domain, we invite you to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. Engaging in a personalized discussion will allow you to explore how this comprehensive research can inform your product development roadmap, optimize procurement strategies, and strengthen your competitive positioning. By partnering with Ketan, you will receive an in-depth briefing that aligns with your organization’s priorities, ensuring that you capitalize on emerging trends, navigate regulatory complexities, and leverage actionable intelligence to secure sustainable growth. Reach out today to schedule a confidential consultation, explore bespoke data solutions, and secure early access to exclusive executive briefings designed for high-impact decision-makers seeking real-time market intelligence in the rapidly evolving construction additives sector.

- How big is the Construction Additives Market?

- What is the Construction Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?