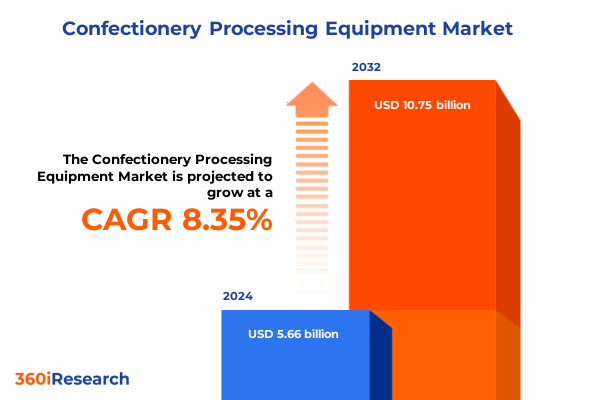

The Confectionery Processing Equipment Market size was estimated at USD 6.11 billion in 2025 and expected to reach USD 6.60 billion in 2026, at a CAGR of 8.40% to reach USD 10.75 billion by 2032.

Discover How Advancements in Confectionery Processing Equipment Are Shaping Production Efficiency, Quality Control, and Competitive Positioning in 2025

In today’s rapidly evolving food manufacturing environment, the role of confectionery processing equipment has become more critical than ever. As consumer preferences shift toward premium, artisanal, and health-oriented confections, producers are under pressure to adopt machinery capable of delivering both high throughput and exceptional product integrity. At the heart of this transformation lies a convergence of technological innovation, regulatory evolution, and shifting supply-chain paradigms that demand a nuanced understanding of equipment capabilities. This executive summary serves to articulate the most salient drivers affecting the industry, and it sets the stage for a structured examination of the major trends, policy impacts, segmentation dynamics, and regional distinctions shaping market trajectories.

Positioned to offer decision-makers a clear and concise overview, this summary begins by framing the current state of the market, then transitions into an analysis of the catalysts for change. Subsequent sections explore the repercussions of tariff adjustments, segmentation insights that inform strategic priorities, and the comparative merits of key geographic markets. Finally, the summary outlines actionable recommendations and provides context on the research methodology underpinning the findings. In providing this roadmap, the intent is to equip industry leaders with the clarity needed to navigate complex market conditions and to identify precise opportunities where investment in confectionery processing equipment can yield sustainable competitive advantage.

Unveiling the Major Transformational Trends Reshaping Confectionery Processing Equipment From Automation to Sustainable Innovation Across the Industry

Over the past few years, the confectionery equipment landscape has been redefined by an array of transformational trends that extend well beyond incremental technological improvements. Foremost among these is the acceleration of automation, where closed-loop control systems and advanced robotics have collectively driven precision to sub-millimeter levels. In parallel, the integration of data analytics and machine learning has created the potential for self-optimizing production lines that reduce waste, enhance yield, and adapt dynamically to ingredient variability. These developments have not only elevated productivity metrics but also introduced new paradigms for quality assurance, ensuring consistent texture, color, and flavor profiles across production runs.

In tandem with digitalization, sustainability has emerged as another core shift. Manufacturers are increasingly prioritizing equipment that minimizes energy consumption, incorporates recyclable materials, and supports the use of eco-friendly ingredients. This emphasis on green engineering is reinforced by evolving consumer expectations and ESG-driven investor criteria, thereby influencing capital-expenditure decisions on the factory floor. Furthermore, the demand for customization-fueled by direct-to-consumer channels and small-batch artisan producers-has prompted the development of modular and flexible machinery that can be reconfigured rapidly. Such adaptability allows confectioners to respond to seasonal trends, limited-edition offerings, and niche dietary requirements without sacrificing throughput.

Finally, the proliferation of IoT connectivity and remote‐monitoring capabilities has reshaped service and maintenance models. Predictive diagnostics reduce unplanned downtime, while cloud-based dashboards enable real-time performance benchmarking across multiple sites. As a result, equipment uptime has become a fulcrum of operational resilience, driving both cost containment and strategic agility in the face of supply-chain disruptions.

Assessing the Collective Impact of 2025 United States Tariff Measures on Confectionery Processing Equipment Sourcing, Costs, and Manufacturing Strategies

Amidst the backdrop of technological progression, the United States government’s tariff adjustments introduced in early 2025 have cast a significant influence on the confectionery processing equipment market. These measures, which increased duty rates on key components such as specialized conveyors, extruder screws, and precision gear assemblies, have elevated import costs for many original equipment manufacturers (OEMs). As a result, suppliers have encountered pressure on profit margins, prompting several to explore alternative sourcing strategies or renegotiate contracts with domestic fabricators.

Consequently, the tariff environment has catalyzed a strategic pivot toward local manufacturing and assembly. OEMs and end users alike are assessing the trade-off between higher upfront investments in domestic lines and the long-term benefits of reduced supply-chain volatility. Alongside cost considerations, compliance with localized content requirements and the potential for expedited delivery schedules bolster the case for onshoring. At the same time, certain high-precision components remain reliant on specialized foreign vendors, creating a delicate balancing act in procurement planning.

Looking ahead, the interplay between tariff policy and capital expenditure is likely to influence broader market consolidation. Enterprises with established domestic fabrication capabilities will find themselves at a competitive advantage, while those lacking in-house manufacturing capacity may seek joint ventures or strategic partnerships to mitigate the impact of elevated duties. Ultimately, the cumulative effect of the 2025 tariff adjustments underscores the importance of supply-chain resilience, positioning agility, and forward-looking procurement models as critical determinants of success in the confectionery processing equipment space.

Deriving Strategic Insights From Multi-Dimensional Segmentation of Confectionery Processing Equipment Across Products, Automation, Materials, and End Users

A comprehensive examination of the market reveals distinct patterns when dissected across multiple segmentation dimensions. By product type, coating machines, cooling tunnels, depositors, enrobing machines, extrusion machinery, forming and shaping systems, and mixers each offer unique capabilities that align with specific production requirements-ranging from high-speed bulk production to precision artisan coating. These categories underscore how manufacturers calibrate equipment investment to match desired output volume and product complexity.

When viewed through the lens of automation, the divide between fully automatic and semi-automatic offerings reflects broader strategic choices around labor allocation, throughput targets, and capital availability. Enterprises committed to high-volume manufacturing often gravitate toward automatic systems that deliver continuous operation and minimal manual intervention, whereas smaller producers or those emphasizing frequent product shifts may find semi-automatic lines more cost-effective and versatile.

Material composition further stratifies the market, with composite, metal, and plastic equipment options each carrying distinct performance and lifecycle implications. Within metal, aluminum and stainless steel dominate, offering corrosion resistance, hygienic surfaces, and compliance with food-safety regulations. Composite constructions, by contrast, allow for lighter equipment footprints and reduced energy consumption, whereas select plastic components support rapid prototyping and lower capital outlays.

End-user segmentation highlights the diverse profiles of artisan producers, contract manufacturers, large-scale industrial processors, and restaurants or cafes. While industrial food processors invest heavily in continuous, high-speed lines, artisan producers and specialty outlets prioritize machines that facilitate intricate design work and small-batch flexibility. Similarly, applications ranging from bakery confectionery and chewing gum to chocolate and sugar confections demonstrate how ingredient rheology and process thermal dynamics dictate equipment selection.

Finally, sales channel preferences-direct sales, distributor networks, and online platforms-shape the customer journey and after-sales support models. Direct sales enable bespoke system configurations and close collaboration, distributor channels offer geographic reach and rapid delivery, and online sales platforms increasingly serve as gateways for emerging enterprises seeking standardized, off-the-shelf solutions.

This comprehensive research report categorizes the Confectionery Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Automation

- Material

- End User

- Application

Comparing Regional Dynamics in Confectionery Processing Equipment Adoption and Innovation Across the Americas, EMEA, and Asia-Pacific Markets in 2025

Regional analysis underscores how demand drivers and competitive landscapes vary across the Americas, Europe-Middle East-Africa, and Asia-Pacific markets. In the Americas, established confectionery hubs in the United States and Canada lead investments in both large-scale automated lines and artisanal equipment tailored to evolving consumer preferences. Proximity to sugar, cocoa, and dairy suppliers, coupled with robust food-safety frameworks, reinforces North America’s leadership in complex confectionery manufacturing, while Latin American producers increasingly adopt mid-tier machinery to capture growing domestic consumption.

In the Europe-Middle East-Africa region, the interplay of stringent regulatory regimes and a mature industrial base fosters demand for high-precision, hygienic equipment compliant with EU food-safety standards. Germany, the United Kingdom, and Italy stand out for their legacy in confectionery engineering and continued adoption of cutting-edge systems. Meanwhile, emerging Middle Eastern markets emphasize bespoke solutions that cater to premium hotel, restaurant, and catering segments, driving a niche for specialized enrobing and molding machinery.

Across Asia-Pacific, rapid urbanization, rising disposable incomes, and shifting dietary habits fuel a voracious appetite for both traditional and contemporary confections. Nations such as China, India, and Japan lead capital-investment activity, with an emphasis on modular, scalable lines that can transition between products swiftly. In addition, local OEMs are building out domestic assembly capabilities to serve regional clients more effectively, supported by government incentives that promote manufacturing self-reliance. As supply chains evolve, the Asia-Pacific landscape is poised to become a critical node in global equipment sourcing and innovation.

This comprehensive research report examines key regions that drive the evolution of the Confectionery Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Practices and Competitive Positioning Among Leading Suppliers in the Global Confectionery Processing Equipment Landscape

Within the global supplier ecosystem, a handful of companies distinguish themselves through continuous innovation, strategic partnerships, and expansive service networks. Leading multinational engineers leverage decades of experience in precision fabrication and advanced automation to deliver turnkey solutions spanning from standalone modules to fully integrated production lines. These organizations maintain broad geographic footprints, ensuring rapid installation, commissioning, and aftermarket support across major confectionery regions.

Strategic acquisitions have enabled certain players to diversify their portfolios and accelerate entry into adjacent segments such as packaging or quality-inspection systems. In parallel, collaborations with software providers have yielded next-generation digital platforms that facilitate remote monitoring, predictive maintenance, and data-driven process optimization. As clients emphasize total cost of ownership metrics, suppliers with strong service and spare-parts infrastructures gain preference, particularly in markets where uptime directly correlates with brand reputation.

Moreover, nimble regional vendors have carved out niches by catering to small and mid-sized producers, offering cost-efficient semi-automatic machinery and plug-and-play modular units. These manufacturers often differentiate on ease of use, quick changeover capabilities, and localized customer training programs. As the pace of market evolution accelerates, the competitive advantage increasingly resides with organizations that can combine robust engineering with agile customer engagement and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Confectionery Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aasted ApS

- Alfa Laval AB

- Baker Pekins Limited

- BCH Ltd.

- Bühler AG

- Bühler Group

- Candy Machinery Pty Ltd

- Cargill, Incorporated

- Chocotech GmbH

- Confect Machine Inc.

- d.d.&d. Machinery Inc.

- GEA Group

- Heat and Control, Inc.

- Hosokawa Confectionery & Bakery Group

- IMA Group

- JBT Corporation

- Latini-Hohberger Dhimantec Inc.

- Loesch GmbH

- Loynds International Ltd

- Rieckermann GmbH

- Robert Bosch GmbH

- Savage Bros. Co.

- SOLLICH KG

- SPX Flow

- Tanis Confectionery

Implementing Actionable Strategic Recommendations for Industry Stakeholders to Navigate Market Disruptions and Capitalize on Emerging Confectionery Processing Trends

To thrive in an environment defined by technological flux and policy uncertainty, industry leaders should embrace a suite of strategic imperatives. First, prioritizing investment in modular processing lines will allow companies to pivot seamlessly between product formats and batch sizes, unlocking greater responsiveness to consumer trends. Likewise, developing in-house digital capabilities-such as predictive analytics and real-time performance monitoring-can drive incremental gains in yield, energy efficiency, and quality consistency. By embedding these tools within equipment platforms, manufacturers can convert raw operational data into prescriptive insights.

Furthermore, diversifying component supply chains through a blend of domestic fabrication and qualified international vendors can mitigate the risk associated with geopolitical disruptions and tariff fluctuations. Establishing partnerships or joint ventures for local assembly not only reduces duty exposure but also supports accelerated delivery schedules and enhanced after-sales service. Concurrently, aligning equipment specifications with sustainability objectives-ranging from low-energy motors to recyclable material components-will resonate with corporate ESG mandates and environmentally conscious consumers.

Additionally, fostering cross-functional collaboration between R&D, operations, and commercial teams ensures that machinery investments align with both technical feasibility and market desirability. This integrated approach can expedite time to market for new product launches while optimizing total cost of ownership. Finally, industry participants should cultivate talent pipelines skilled in automation, data science, and maintenance engineering, thus reinforcing the human capital foundation necessary to leverage increasingly sophisticated equipment assets.

Outlining a Rigorous Research Methodology Integrating Primary Interviews, Secondary Sources, and Data Validation to Ensure Comprehensive Market Analysis

The findings presented in this report are grounded in a robust research methodology designed to capture the multifaceted nature of the confectionery processing equipment market. Initially, secondary research was conducted to consolidate published data from industry registries, regulatory filings, company annual reports, and trade association publications. This phase established foundational context around technological advancements, policy developments, and competitive landscapes.

Subsequently, a series of primary research activities were undertaken, including in-depth interviews with senior executives at OEMs, key equipment operators across diverse end-user segments, and subject-matter experts in food-safety and process engineering. These conversations provided qualitative insights into strategic priorities, procurement challenges, and emerging investment rationales. Complementing the interviews, structured surveys captured quantitative perspectives on equipment preferences, anticipated CAPEX cycles, and service expectations.

To ensure data integrity, the research process applied triangulation techniques, cross-referencing primary inputs against multiple secondary sources. In addition, validation workshops with industry stakeholders were convened to critique preliminary findings and refine key assumptions. The scope of the analysis spans all major regional markets-Americas, EMEA, and Asia-Pacific-and covers the full spectrum of processing equipment segments. By blending rigorous desk research with frontline intelligence, this methodology delivers a comprehensive and reliable depiction of current market dynamics and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Confectionery Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Confectionery Processing Equipment Market, by Product Type

- Confectionery Processing Equipment Market, by Automation

- Confectionery Processing Equipment Market, by Material

- Confectionery Processing Equipment Market, by End User

- Confectionery Processing Equipment Market, by Application

- Confectionery Processing Equipment Market, by Region

- Confectionery Processing Equipment Market, by Group

- Confectionery Processing Equipment Market, by Country

- United States Confectionery Processing Equipment Market

- China Confectionery Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways from the Executive Summary to Reinforce Strategic Understanding of Confectionery Processing Equipment Market Dynamics

The landscape of confectionery processing equipment is marked by a delicate balance of technological innovation, regional differentiation, and policy-driven supply-chain dynamics. Rapid advancements in automation and sustainability are redefining the capabilities of both large-scale industrial lines and nimble artisanal systems, while the 2025 tariff environment has underscored the importance of geographic diversification and domestic fabrication. Multi-dimensional segmentation analysis reveals the critical interplay between product type, automation level, material composition, end-user profile, application requirements, and go-to-market channels in shaping procurement and investment decisions.

Moreover, varied regional trajectories across the Americas, EMEA, and Asia-Pacific markets demonstrate that both mature and emerging economies present unique opportunities and challenges. The competitive terrain is populated by global leaders leveraging scale, innovation, and service excellence, alongside regional specialists catering to niche use cases. Strategic recommendations emphasize modularity, digital integration, supply-chain resilience, and cross-functional alignment as cornerstones for achieving long-term success.

In conclusion, the ability to anticipate evolving consumer demands, navigate tariff uncertainties, and harness the potential of next-generation processing technologies will determine market leadership in the confectionery equipment domain. Equipped with the insights and recommendations distilled in this executive summary, stakeholders are positioned to make informed decisions and to secure a durable competitive edge in a swiftly evolving industry.

Engage With Ketan Rohom to Access Detailed Confectionery Processing Equipment Market Research and Unlock Strategic Insights for Competitive Advantage

To delve deeper into the comprehensive analysis of the confectionery processing equipment market, readers are invited to engage directly with Ketan Rohom. As the Associate Director of Sales & Marketing, Ketan Rohom brings a wealth of expertise in guiding industry professionals through detailed market intelligence and strategic insights. By connecting with Ketan, stakeholders can access the full research report, which encompasses in-depth discussions of technological transformations, tariff impacts, regional dynamics, and segmentation strategies. This collaboration offers an opportunity to tailor the findings to specific organizational needs, ensuring that procurement, product development, and investment decisions are informed by the most robust data available. Prospective clients will benefit not only from the extensive quantitative and qualitative analysis contained in the report but also from personalized consultation sessions that translate market trends into actionable roadmaps. To secure your copy and schedule a consultation, reach out to Ketan Rohom for an immediate briefing on how these insights can elevate your competitive positioning in the evolving confectionery processing equipment landscape.

- How big is the Confectionery Processing Equipment Market?

- What is the Confectionery Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?