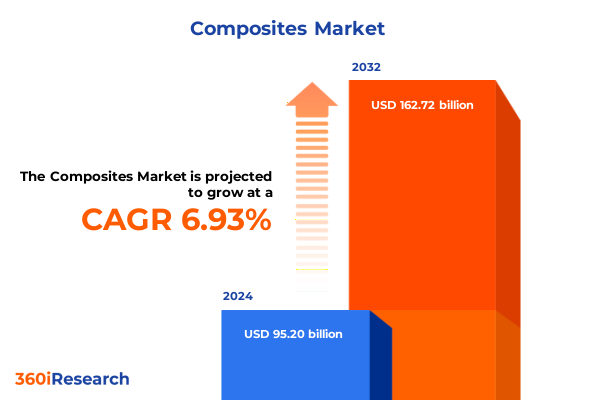

The Composites Market size was estimated at USD 101.38 billion in 2025 and expected to reach USD 108.10 billion in 2026, at a CAGR of 6.99% to reach USD 162.72 billion by 2032.

A Strategic Overview Demonstrating How Advanced Composites Propel Innovation and Sustainability Across Key Industrial Sectors

The composites industry has emerged as a critical driver of innovation and efficiency across a multitude of sectors, from aerospace to automotive to renewable energy. This introduction offers a panoramic view of how advanced composite materials are redefining engineering paradigms by combining high performance with lightweight profiles. Rapid advancements in material science have led to the development of carbon matrix composites with superior strength-to-weight ratios, ceramic matrix composites capable of withstanding extreme temperatures, and polymer matrix composites that provide cost-effective versatility for mass production.

Shifts in global manufacturing and supply chain dynamics have further accelerated the adoption of composites, enabling companies to meet stringent regulatory requirements for fuel efficiency, emissions reduction, and structural integrity. As end-use industries increasingly prioritize sustainability, composites offer an attractive avenue for reducing carbon footprints while enhancing product lifecycles. Moreover, the cross-sector collaboration between research institutions, material suppliers, and OEMs has fostered a robust pipeline of innovations, setting the stage for composites to play an even more transformative role in future applications.

Against this backdrop, stakeholders must understand the complex interplay between technological breakthroughs, regulatory landscapes, and end-user demands. This executive summary lays the groundwork for navigating that intersection, presenting key shifts in the sector, the repercussions of recent policy changes, nuanced segmentation insights, and actionable recommendations to guide strategic decision-making.

An In-Depth Exploration of Disruptive Technological Advancements and Material Innovations Redefining the Composites Landscape

The composites landscape is undergoing seismic shifts driven by breakthroughs in additive manufacturing, nanotechnology, and automated production techniques. Innovations such as 3D-printed carbon fiber-reinforced polymers are enabling geometries and performance levels previously unattainable through traditional lay-up methods. Simultaneously, advances in nano-reinforcements like graphene and carbon nanotubes are enhancing mechanical properties, thermal conductivity, and electrical performance, unlocking novel applications in electronics and energy storage.

At the same time, the integration of digital twins and Industry 4.0 practices is transforming quality control and process optimization. Real-time data analytics and in-line monitoring systems are reducing defects and accelerating time-to-market. Moreover, the growing convergence of bio-based resins with natural fiber reinforcements underscores an industry pivot toward circular economy principles, as manufacturers seek to balance high performance with environmental stewardship.

Emerging collaborative ecosystems between material scientists, software developers, and production engineers are amplifying these shifts. Cross-disciplinary partnerships are refining resin formulations for enhanced recyclability while optimizing reinforcement architectures for multi-functional performance. These transformative trends establish a new paradigm in which composites are not merely replacements for traditional materials but foundational enablers of next-generation product ecosystems.

A Critical Assessment of How Recent United States Tariff Measures Are Shaping Cost Structures and Supply Chain Dynamics in Composites

In 2025, the United States implemented a spectrum of tariff measures targeting imported composites and key raw materials, compelling stakeholders to recalibrate supply chain strategies and cost structures. These tariffs have driven a resurgence in domestic sourcing and in-house production capabilities, as manufacturers seek to mitigate margin pressures and ensure continuity of supply. The re-onshoring trend has also spurred investment in capacity expansion for carbon fiber precursors and high-temperature ceramic precursors, reducing reliance on traditional import routes.

Nevertheless, elevated duties have introduced complexities in project budgeting and vendor negotiations, particularly for industries like aerospace and automotive that operate on tight cost targets. To absorb incremental costs, many organizations have accelerated the adoption of hybrid material systems and local partnerships, blending imported reinforcements with domestically produced resins. In parallel, value-engineering initiatives have become paramount, with design teams refining part geometries to minimize waste and lower material consumption without compromising performance.

While the long-term impact on total landed cost remains to be fully assessed, the immediate effect has been a pronounced shift toward supply chain resilience and vertical integration. Companies are exploring alternative manufacturing processes, such as additive layering and near-net-shape fabrication, to reduce dependency on tariff-affected imports. Ultimately, these dynamic responses highlight the industry’s adaptability and underline the strategic importance of maintaining diverse sourcing channels.

A Comprehensive Analysis Revealing Distinctive Market Segments and Their Impact on Product Development and Application Trends

Segmenting the composites market by matrix type reveals clear differentiation in performance attributes and end-use suitability. Carbon matrix composites dominate applications requiring extreme stiffness and strength, particularly in aerospace structures, whereas polymer matrix composites offer a cost-effective balance of toughness and processability for automotive interior and exterior components. Within the polymer segment, thermoset composites remain prevalent due to their thermal stability, while emerging thermoplastic variants enable rapid cycle times in injection molding processes.

Looking at reinforcement materials, carbon fiber continues to command premium positioning for high-performance applications, while glass fiber retains strong traction in electrical enclosures and consumer goods owing to its affordability. The rise of meta-aramid fibers in ballistic protection and para-aramid fibers in high-temperature scenarios underscores the nuanced trade-offs between thermal resistance and mechanical robustness. Meanwhile, interest in natural fibers such as bamboo and jute is gaining momentum in sustainable product lines, particularly within the construction and marine sectors.

Resin type segmentation further refines market understanding: epoxy resins lead where high adhesion and chemical resistance are essential, whereas polyester resins find favor in cost-sensitive marine and recreational vessel components. Vinyl ester resins are increasingly specified in corrosive environments, and polyamide resins are carving out niches in electrical & electronics applications for their dielectric properties. This layered segmentation approach enables stakeholders to align material selection with performance, cost, and processing requirements in a targeted manner.

This comprehensive research report categorizes the Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Reinforcement Material

- Resin Type

- Manufacturing Process

- Application

- End-Use Industry

A Nuanced Examination of Regional Market Characteristics Highlighting Growth Drivers and Challenges Across Major Global Territories

Regional dynamics within the composites landscape vary significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, strong demand from the automotive sector, driven by electrification initiatives and lightweighting mandates, has propelled investment in both carbon fiber production and advanced polymer matrix formulations. Latin American markets have also begun exploring natural fiber composites for sustainable infrastructure projects, reflecting a broader environmental emphasis.

Across Europe Middle East & Africa, the aerospace & defense industry remains a primary growth engine, supported by robust R&D frameworks and extensive government collaboration. Regulatory frameworks addressing recyclability and end-of-life disposal have accelerated the development of closed-loop recycling processes, particularly in Western Europe. Meanwhile, Gulf nations are exploring ceramic matrix composites for high-temperature power generation applications, signaling a shift toward advanced material adoption in energy sectors.

In Asia-Pacific, the convergence of established manufacturing hubs in China and emerging centers in Southeast Asia and India has created a diversified production landscape. Polymer matrix composites dominate mass-production segments like consumer electronics, while metal matrix composites are gaining traction in heavy machinery and rail transport. Strategic partnerships with global suppliers are optimizing supply chains, and government incentives for wind energy infrastructure are bolstering demand for blade composites. These regional insights underscore the importance of tailoring strategies to local industry drivers and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A Detailed Investigation Into Leading Industry Players’ Strategic Initiatives Partnerships and Competitive Differentiators in the Composites Sector

Leading players in the composites sector are differentiating through a blend of vertical integration, strategic partnerships, and focused R&D. Major carbon fiber producers have invested in precursor manufacturing facilities, securing upstream control and reducing vulnerability to raw material shortages. At the same time, polymer resin manufacturers are collaborating with end-users to co-develop tailored formulations, enhancing compatibility with emerging processing technologies like automated fiber placement.

Key alliances between aerospace OEMs and ceramics specialists have yielded next-generation ceramic matrix composites capable of operating at temperatures exceeding 1,200 degrees Celsius, opening possibilities for more efficient jet engines and hypersonic vehicles. In parallel, automotive suppliers are forging ties with additive manufacturing firms to pilot 3D-printed structural components, enabling lightweight designs that integrate fluid channels and sensor networks within single composite parts.

Furthermore, diversified conglomerates are leveraging existing industrial infrastructures to expand into metal matrix composites, targeting sectors such as defense and heavy equipment. These strategic moves, combined with ongoing investment in recycling technologies and bio-based resin platforms, illustrate how leading companies are positioning themselves to capture both performance-driven and sustainability-oriented opportunities in the evolving composites ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARRIS Composites, Inc.

- BASF SE

- Celanese Corporation

- China Jushi Co., Ltd.

- Compagnie Chomarat

- Compagnie de Saint-Gobain S.A.

- Covestro AG

- Creative Composites Group

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Flex Composite Group

- General Electric Company

- Gurit Services AG

- Hexcel Corporation

- Honeywell International Inc.

- Huntsman Corporation

- Kineco Limited

- LAMILUX Heinrich Strunz Holding GmbH & Co. KG

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Nippon Electric Glass Co., Ltd.

- Owens Corning

- Performance Composites Inc.

- Safran S.A.

- Schütz GmbH & Co. KGaA

- SGL CARBON SE

- Sigmatex (UK) Limited

- Sika AG

- Solvay S.A.

- Strongwell Corporation

- Toray Industries, Inc.

- TPI Composites Inc.

A Pragmatic Roadmap Offering Actionable Strategies and Best Practices for Elevating Operational Performance and Innovation in Composites

Industry leaders must adopt a multi-pronged strategy to thrive in the rapidly evolving composites arena. First, integrating digital design and simulation tools with production processes can uncover efficiencies and accelerate product validation cycles. Companies should prioritize the deployment of advanced analytics and machine learning to predict part performance, optimize fiber orientation, and minimize material waste.

Next, forging collaborative research ventures with academic institutions and technology startups will expedite the development of next-generation materials, including nano-enhanced reinforcements and recyclable resin systems. Such alliances can also facilitate pilot projects for emerging manufacturing methods like autonomous lay-up robots and directed energy deposition in metal matrix composites. By sharing risk and pooling expertise, stakeholders can achieve breakthroughs that would be unattainable in isolation.

Finally, cultivating a resilient supply chain through diversified sourcing, on-shoring of critical precursors, and strategic inventory management will safeguard against geopolitical and tariff-related disruptions. Leaders should also implement circular economy principles by investing in recycling infrastructure and designing products for disassembly. Together, these actionable recommendations will empower organizations to navigate uncertainty, seize innovation opportunities, and establish enduring competitive advantage.

An Insight Into Rigorous Research Frameworks Methodologies and Analytical Approaches Underpinning the Composites Market Study

The research framework underpinning this composites market study combines primary and secondary data sources to ensure a rigorous and unbiased analysis. Primary insights were gathered through confidential interviews with material scientists, procurement executives, and design engineers from key end-use industries. These qualitative inputs were supplemented by structured surveys targeting both established manufacturers and emerging technology providers to capture real-time shifts in strategic priorities.

Secondary research encompassed a comprehensive review of technical white papers, patent filings, and industry consortium reports, with particular emphasis on peer-reviewed journals to validate breakthrough claims. Macro-economic indicators and trade data were analyzed to contextualize regional demand patterns and tariff impacts. Advanced bibliometric techniques were employed to map innovation trajectories across reinforcement materials and matrix formulations, identifying clusters of activity in areas such as additive manufacturing and bio-based composites.

Analytical approaches included cross-segmentation comparisons to reveal performance trade-offs, scenario analysis for assessing supply chain risks, and financial benchmarking to highlight operating models. The integration of quantitative metrics with expert-led qualitative assessments ensures that this study offers a balanced, data-driven perspective, equipping stakeholders with the insights needed to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composites Market, by Type

- Composites Market, by Reinforcement Material

- Composites Market, by Resin Type

- Composites Market, by Manufacturing Process

- Composites Market, by Application

- Composites Market, by End-Use Industry

- Composites Market, by Region

- Composites Market, by Group

- Composites Market, by Country

- United States Composites Market

- China Composites Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

A Concise Synthesis Underscoring Key Insights Implications and Strategic Imperatives for Stakeholders Navigating the Composites Domain

This executive summary has illuminated the dynamic forces shaping the composites industry, from disruptive material innovations to policy-driven supply chain realignments. By examining key shifts, tariff impacts, granular segmentation, regional nuances, and leading company strategies, we have underscored the multifaceted nature of market evolution. Stakeholders are now better positioned to align their product roadmaps and investment priorities with evolving performance requirements and sustainability goals.

The imperative for resilient operations is clear: leveraging digital design tools, fostering collaborative R&D, and embedding circularity principles will be essential for navigating emerging challenges. As global demand for lightweight, high-performance materials intensifies, organizations that integrate these strategic imperatives stand to capture significant value. This synthesis reinforces the criticality of a holistic approach-one that bridges technology, policy, and market realities-to driving long-term success in the composites sector.

A Personalized Invitation From Ketan Rohom to Secure Comprehensive Composites Market Insights and Drive Strategic Growth Through Tailored Research Solutions

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive composites market research report can empower your organization with unparalleled strategic insights. This is your opportunity to leverage tailored analysis, gain clarity on industry complexities, and identify the most impactful areas for innovation and investment. Reach out to secure the full report, deepen your understanding of evolving material trends, and accelerate your roadmap to achieving sustainable competitive advantage through informed decision-making.

- How big is the Composites Market?

- What is the Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?