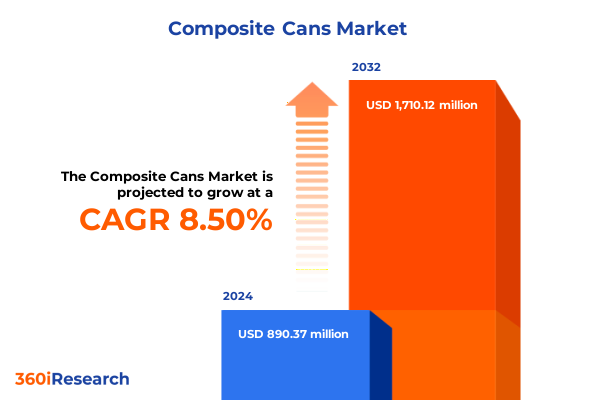

The Composite Cans Market size was estimated at USD 933.84 million in 2025 and expected to reach USD 984.51 million in 2026, at a CAGR of 9.02% to reach USD 1,710.12 million by 2032.

Pioneering the Future of Composite Cans with a Deep Dive into Key Innovations, Market Drivers, and Material Advancements That Define Industry Beginnings

Composite cans have emerged as a pivotal innovation in the packaging sector, uniting the strength of various materials into cylindrical containers that meet rigorous performance and aesthetic demands. Initially conceived to overcome the limitations of single-material cans, these multi-layered structures leverage substrates such as films, foils, and laminates to deliver superior barrier protection, structural integrity, and visual appeal. The continual evolution of printing technologies and barrier coatings has further elevated the appeal of composite cans, enabling brands to differentiate on shelf with vibrant graphics and extended shelf life for perishable goods.

The rise of composite cans is driven by an intersection of consumer expectations, regulatory imperatives, and supply chain efficiencies. Consumers increasingly seek convenient, sustainable packaging solutions that deliver on freshness and minimal environmental impact. Meanwhile, tightening food safety and recycling mandates in key markets are pressuring manufacturers to adopt advanced materials that comply with evolving standards. In response, producers of composite cans are optimizing production processes, forging partnerships across material suppliers, and investing in R&D to refine film formulations and laminating techniques. This introduction sets the stage for a deeper examination of the transformative shifts, tariff impacts, segmentation nuances, and strategic imperatives that define the composite can landscape today.

Revealing how Technological Disruptions, Sustainability Demands, and Modernized Logistics Are Transforming the Composite Can Landscape at Its Core

The composite can industry is undergoing profound transformation as sustainability considerations reshape every stage of product development and distribution. Increasing regulatory pressure and consumer demand for recyclable and renewable materials have catalyzed the adoption of bio-based coatings and metallized films designed to optimize barrier performance without compromising end-of-life recyclability. At the same time, digital printing technologies are revolutionizing brand storytelling, enabling shorter print runs with variable data and faster turnaround times. This confluence of material science and digital innovation is empowering packaging designers to conceive products that are both functionally robust and visually compelling.

Alongside technological advancements, shifts in global supply chain models are influencing how manufacturers source raw materials and position production assets. Agile manufacturing footprints have emerged as a competitive advantage, allowing producers to respond swiftly to regional demand fluctuations and mitigate tariff-induced cost pressures. Moreover, the rise of e-commerce as a primary retail channel has prompted the redesign of composite cans with enhanced durability and tamper evidence, ensuring product integrity during extended transit. These transformative shifts underscore the industry’s pivot toward resilience, customization, and sustainability.

Evaluating the Far-Reaching Consequences of United States Tariffs on Composite Can Supply Chains and Pricing Structures through 2025 Impact Analysis

The cumulative imposition of United States tariffs through 2025 has materially influenced the cost structure and sourcing strategies for composite can materials. Initial duties levied under Section 301 targeted film and laminate imports, elevating raw material costs and triggering a reassessment of global supply chains. Subsequently, steel and aluminum tariff actions under Section 232 introduced additional complexity for layered composite constructions that rely on metal foil for barrier performance. The layered effect of these measures has placed sustained upward pressure on procurement budgets and driven procurement teams to pursue diversified supplier portfolios.

In response to these tariff escalations, many manufacturers have accelerated investments in domestic production capabilities and local partnerships, thereby reducing reliance on higher-cost imports. This pivot has encouraged innovation in domestically sourced barrier coatings and resin formulations, as well as the exploration of alternative materials that can replicate foil-level protection with lower susceptibility to tariff volatility. While input cost normalization remains a work in progress, the strategic realignment toward regional sourcing has enhanced supply chain resilience and fostered closer collaboration between can converters and material suppliers.

Deep-Dive into Segmentation Revealing How Material Types, Product Classes, Capacity Tiers, Barrier and Coating Innovations Propel Market Transformation

A nuanced understanding of market segmentation reveals the diverse drivers and opportunities within the composite can sector. By material type, industry practitioners navigate choices among composite films, metal foil, paperboard, and plastic laminate-each substrate offering distinct trade-offs in barrier performance, weight, and recyclability. For product type, applications span aerosol packaging that requires high-pressure containment, chemical and lubricant packaging needing solvent resistance, and food and powder storage that demands strict contamination control. Capacity considerations further delineate offerings across up to one liter for personal care and small format beverages, one to two liter and two to five liter tiers favored in foodservice and industrial oils, as well as above five liter variants capacious enough for bulk chemical or lubricant uses.

Manufacturing process segmentation highlights extrusion winding, laminating, pattern winding, and spiral winding as core fabrication techniques, each imparting unique mechanical properties and production efficiencies. Barrier segmentation underscores the role of aluminum foil to achieve impermeable protection, barrier coatings that integrate chemical resistance, metallized film for lightweight shielding, and PET film for clarity and strength. Coating type analysis reveals distinctions among lacquer, plastic laminate, and wax formulations that balance cost, adhesion, and barrier integrity. Closure innovations range from metal ends for robust sealing to peelable lids enhancing consumer convenience, screw caps delivering recloseable functionality, and snap-fit designs facilitating quick access. Finally, end-use segmentation spans food and beverage sectors-encompassing beverages, confectionery, dairy and bakery, and snacks-industrial and chemical arenas such as agrochemicals, lubricants, oils, and paints, as well as personal care and pharmaceutical channels that serve cosmetics, home care, hygiene products, capsules, powders, syrups, and tablets.

This comprehensive research report categorizes the Composite Cans market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Capacity

- Manufacturing Process

- Barrier Type

- Coating Type

- Closure Type

- End Use

Illuminating Regional Nuances across Americas, Europe, Middle East and Africa, and Asia-Pacific Unveiling Critical Drivers and Growth in Composite Can Adoption

Regional dynamics shape not only demand patterns but also regulatory and logistical considerations for composite can stakeholders. In the Americas, robust consumer interest in convenience foods and craft beverages drives significant uptake of printed composite cans, while evolving recycling mandates in key states are accelerating the adoption of recyclable laminates and mono-material constructions. Logistics corridors linking North American production hubs to retail centers benefit from established port and rail networks, enabling efficient distribution despite tariff-related headwinds.

In Europe, the Middle East, and Africa, stringent packaging waste directives and extended producer responsibility frameworks compel manufacturers to innovate with compliant barrier films and mono-layer solutions that simplify end-of-life processing. High-growth markets in the Middle East and North Africa present opportunities for chemical and food-grade composite constructions aligned with local standards, while Europe’s advanced recycling infrastructure encourages research into enhanced barrier coatings compatible with circular economy goals. Across Asia-Pacific, rapid urbanization and rising per capita consumption of packaged goods are driving scale-up of domestic manufacturing capacities, supported by government initiatives to develop local raw material supply chains and reduce dependency on imported substrates.

This comprehensive research report examines key regions that drive the evolution of the Composite Cans market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Competitive Strengths of Leading Composite Can Manufacturers Driving Innovation, Partnerships, and Market Leadership

Leading composite can manufacturers are deploying diverse strategies to strengthen their competitive positions. Some have pursued vertical integration, securing direct ownership of key barrier coating or foil production assets to control costs and quality. Others have engaged in strategic partnerships with film producers and chemical suppliers to co-develop next-generation laminates that deliver enhanced barrier performance with lower environmental footprints. Mergers and acquisitions remain active levers for scale, with top players expanding geographic reach and broadening application portfolios through targeted acquisitions of niche converters and specialty material innovators.

Simultaneously, forward-looking companies are leveraging digital tools to enhance customer engagement, offering online design platforms for brand teams to preview printed can prototypes in virtual environments. Investments in advanced analytics and demand sensing are optimizing production schedules and inventory positioning across multi-site operations. By integrating sustainability metrics into supplier scorecards and publicly reporting progress against emission reduction targets, these organizations underscore their commitment to environmental stewardship, reinforcing brand trust among increasingly conscientious end customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Cans market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Paper Tube Corporation

- Amcor PLC

- Bharath Paper Conversions

- Canfab Packaging Inc.

- Chicago Mailing Tube Co

- Compocan Industries

- Corex Group

- Custom Paper Tubes, LLC

- Eco Canister

- Heartland Products Group LLC

- IPL, inc.

- Irwin Packaging Pty Ltd.

- Kuber Packaging

- Kunert Gruppe

- Marshall Paper Tube Company, Inc.

- Mondi Group PLC

- Pioneer Packaging, Inc

- PTS Manufacturing Co

- Quality Container Company

- Safepack Industries Ltd.

- Shree Umiya Paper Tubes

- Smurfit Kappa SPA

- Sonoco Products Company

- TricorBraun, Inc.

- Trishul Containers

- Valk Industries, Inc.

- Wes-Pac Converting, Inc.

- Western Container Corporation

Formulating Concrete Strategies for Industry Leaders to Elevate Sustainability, Supply Chain Resilience, and Product Differentiation in the Composite Can Sector

Industry leaders should prioritize a multi-pronged approach that begins with the integration of recyclable or bio-based barrier materials into existing production lines, thereby aligning with tightening regulatory requirements and consumer sustainability preferences. Concurrently, forging partnerships with specialized resin and coating suppliers will accelerate the development of low-tariff-exposed formulations, fostering supply chain stability while preserving product quality.

Beyond materials, there is an imperative to harness digital printing capabilities and extend customization services, enabling brands to engage consumers with limited-edition promotions and rapid design iterations. Investing in predictive analytics and real-time monitoring technologies will enhance operational agility, allowing manufacturers to anticipate demand surges, optimize inventory, and maintain tight cost control amid ongoing tariff fluctuations. Finally, embedding sustainability metrics and circularity principles into corporate strategy will differentiate forward-thinking organizations, opening doors to new market segments and reinforcing long-term partnerships with eco-conscious brands.

Detailing Rigorous Research Approaches Combining Primary Interviews, Secondary Data Analysis, and Triangulation to Validate Market Insights

The research underpinning this analysis leverages a dual methodology that combines qualitative insights from in-depth interviews with senior stakeholders across packaging converters, material suppliers, and brand owners, alongside rigorous secondary research drawing on publicly available industry reports, trade association publications, and technical journals. Interview protocols were designed to capture firsthand perspectives on supply chain realignment, material innovation, and regulatory compliance strategies underway within leading organizations.

To validate findings, primary insights were triangulated with quantitative data points extracted from proprietary transaction databases, patent filings, and import-export statistics. This triangulation process ensures that observed trends align with actual market movements, while cross-referencing multiple data sources mitigates the risk of bias. All research steps followed a structured framework encompassing data collection, verification, synthesis, and expert review to produce an authoritative and actionable view of the composite can market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Cans market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Cans Market, by Material Type

- Composite Cans Market, by Product Type

- Composite Cans Market, by Capacity

- Composite Cans Market, by Manufacturing Process

- Composite Cans Market, by Barrier Type

- Composite Cans Market, by Coating Type

- Composite Cans Market, by Closure Type

- Composite Cans Market, by End Use

- Composite Cans Market, by Region

- Composite Cans Market, by Group

- Composite Cans Market, by Country

- United States Composite Cans Market

- China Composite Cans Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Summarizing Key Takeaways and Strategic Imperatives to Guide Stakeholders through Evolving Opportunities and Challenges in the Composite Can Industry

This comprehensive assessment of the composite can industry highlights the interplay between material innovation, regulatory landscapes, and shifting market demands. Key takeaways include the critical role of advanced barrier technologies and digital printing in supporting brand differentiation and shelf appeal, as well as the strategic necessity of supply chain diversification in response to tariff volatility. The segmentation analysis underscores the breadth of application opportunities spanning consumer, industrial, and pharmaceutical end uses, while the regional review illuminates how localized drivers and infrastructure investments influence market dynamics.

Moving forward, stakeholders equipped with a deep understanding of these trends are well positioned to capitalize on emerging opportunities and navigate potential disruptions. By embedding sustainability into product design, optimizing manufacturing footprints, and leveraging data-driven decision-making, organizations can achieve resilient growth and reinforce their competitive edge in the global composite can arena.

Engaging with Ketan Rohom to Unlock Comprehensive Insights and Tailored Strategies That Propel Your Organization Forward in the Composite Can Market

To explore how these comprehensive insights and tailored strategies can be applied to your unique business challenges and growth objectives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. He possesses deep expertise in composite can dynamics and can guide you through the report’s findings to highlight the most relevant opportunities, ensuring you capitalize on emerging trends and mitigate potential risks.

Unlock the full potential of this authoritative analysis to inform strategic decision-making, drive operational excellence, and secure competitive advantage in the rapidly evolving composite can market. Contact Ketan today to discuss customized research packages, volume licensing options, and extended consulting engagements designed to empower your organization’s next steps toward innovation and market leadership.

- How big is the Composite Cans Market?

- What is the Composite Cans Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?