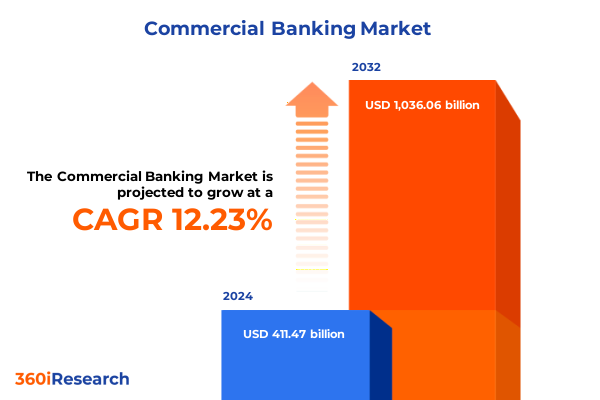

The Commercial Banking Market size was estimated at USD 462.92 billion in 2025 and expected to reach USD 511.17 billion in 2026, at a CAGR of 12.19% to reach USD 1,036.06 billion by 2032.

Pioneering the Future of Commercial Banking Through Strategic Innovation and Resilience in a Rapidly Evolving Financial Ecosystem

The commercial banking sector is undergoing a profound transformation as financial institutions grapple with rapidly shifting customer expectations and intensifying competitive pressures. Advances in digital technology, evolving regulatory frameworks, and the proliferation of data analytics have accelerated the demand for agile and innovative banking solutions. This dynamic environment presents both challenges and opportunities for banks that can seamlessly integrate emerging technologies with traditional service models to deliver differentiated value and foster long-term client relationships.

In this executive summary, we investigate the critical forces reshaping the commercial banking landscape and provide strategic analysis without delving into quantitative forecasts or market sizing. We begin by exploring transformative shifts in customer behavior and technology adoption, then assess the cumulative impact of the United States’ 2025 tariff adjustments on trade finance and cross-border operations. Subsequent sections distill key segmentation insights across product, customer, enterprise size, delivery channel, and industry vertical dimensions, followed by regional performance contrasts and corporate strategies of leading institutions. The report concludes with actionable recommendations for industry leaders and an overview of our robust research methodology. Through this synthesis, decision-makers will gain a clear framework to navigate complexity, optimize resource allocation, and drive sustained competitive advantage.

Uncovering the Transformational Forces Reshaping Commercial Banking as Technological Disruption and Regulatory Evolution Accelerate Growth Trajectories

Commercial banking is experiencing an accelerated wave of transformation driven by the convergence of digital innovation, regulatory evolution, and shifting client expectations. Financial institutions are increasingly adopting artificial intelligence and machine learning to automate credit decisions and enhance risk management, which has improved processing speed and predictive accuracy. Meanwhile, open banking initiatives and API-driven partnerships have fostered ecosystem-based business models, enabling banks to integrate with fintechs and third-party providers in order to deliver a seamless, end-to-end experience for commercial clients.

In parallel, sustainability mandates and environmental, social, and governance (ESG) considerations have redefined capital allocation priorities, prompting banks to develop green financing products and embed ESG metrics into corporate lending frameworks. Regulatory reforms focused on operational resilience, cybersecurity, and data privacy have further reinforced the imperative for robust digital infrastructure and proactive compliance programs. As a result, successful institutions are leveraging cloud migration strategies and cyber-security platforms to maintain business continuity and secure customer trust. Collectively, these transformative shifts are reshaping value propositions, amplifying efficiency gains, and accelerating the emergence of new revenue streams within the commercial banking sphere.

Analyzing the Broad Repercussions of 2025 United States Tariff Adjustments on Commercial Banking Operations and International Trade Dynamics

The United States’ tariff adjustments implemented in early 2025 have exerted a multifaceted influence on commercial banking operations, particularly in the trade finance domain. Increased duties on imported intermediate goods have disrupted global supply chains, prompting import-dependent businesses to seek alternative financing mechanisms to buffer against cost volatility. Commercial banks have responded by enhancing trade finance offerings, including more flexible letters of credit and dynamic hedging solutions, to address shifting collateral requirements and currency risk management needs.

Moreover, tariff-induced price fluctuations across key commodity and manufacturing segments have reverberated through cash management services, with corporates adjusting receivables and payables schedules to manage working capital constraints. Foreign exchange transactions have surged as clients hedge against exchange rate exposure driven by trade imbalances, leading banks to expand digital FX platforms with real-time analytics. Liquidity pressures have also intensified for exporters operating on narrow margins, compelling institutions to offer extended repayment structures and supply chain financing programs. These cumulative impacts underscore the necessity for banks to actively recalibrate product portfolios, deepen risk analytics capabilities, and collaborate closely with treasury teams to sustain transaction flows and margin stability.

Extracting Strategic Insights from Product, Customer, Enterprise Size, Delivery Channel, and Industry Vertical Segmentation Frameworks

A nuanced segmentation analysis unlocks critical insights into the varied commercial banking needs of diverse market cohorts. From a product perspective, cash management solutions continue to serve as the backbone for corporates optimizing liquidity, while demand deposits and time deposits offer distinct yield and flexibility profiles according to treasury objectives. In the lending space, commercial mortgages provide stable, long-dated financing, whereas overdraft and term loan facilities cater to short-term working capital exigencies. Meanwhile, cross-border payments demand robust foreign exchange integration and compliance safeguards, and domestic payment channels prioritize speed and cost efficiency.

Customer typology further refines strategic focus, with large corporate entities requiring bespoke syndicated financing and advisory support, while financial institutions such as banks, insurance companies, and non-bank financial companies rely on interbank lending and treasury settlement services. Government and public sector clients demand sovereign risk expertise, and small and medium enterprises-ranging from micro to medium-seek scalable loan structures and streamlined digital interfaces. Enterprise size segmentation highlights disparities in service customization, as large enterprises gravitate towards integrated global platforms, medium firms balance cost with digital accessibility, and small enterprises prioritize intuitive mobile and online banking channels.

Exploring delivery channels reveals that branches and relationship managers retain importance for complex transactions, whereas automated teller machines and contact centers complement day-to-day operations. The digital channel, subdivided into internet and mobile banking, has emerged as the primary interface for transaction processing and account management. Finally, industry vertical distinctions draw attention to specialized requirements: energy and utilities firms focus on commodity finance solutions; healthcare providers emphasize fund reconciliation; information technology and telecom companies require rapid international settlement; manufacturing enterprises prioritize trade finance; retailers optimize point-of-sale financing; and transportation and logistics operators depend on supply chain liquidity programs. Together, these segmentation layers illustrate the imperative for banks to tailor offerings along intersecting dimensions of product suite, customer profile, operational scale, channel preference, and sectoral dynamics.

This comprehensive research report categorizes the Commercial Banking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Customer Type

- Enterprise Size

- Delivery Channel

- Industry Vertical

Navigating Regional Growth Patterns and Emerging Opportunities Across Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional dynamics in commercial banking are characterized by divergent growth patterns and regulatory environments across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, the continued emphasis on digital transformation has prompted major US and Canadian banks to invest heavily in cloud-native platforms and data analytics capabilities. Latin American markets, driven by financial inclusion initiatives and mobile-led banking adoption, present opportunities for cross-border payment innovations and localized treasury services that address currency fluctuation risks.

In Europe, Middle East & Africa, stringent regulatory reforms such as PSD3 and Basel IV have elevated capital adequacy and operational resilience standards, compelling regional banks to prioritize compliance-driven process automation and real-time reporting solutions. The Gulf Cooperation Council states are expanding trade finance programs tied to infrastructure development, while African markets are witnessing the rise of digital lenders catering to underserved MSME segments through mobile-first applications. Collaboration with fintech startups has become a cornerstone for incumbents seeking to bridge technological gaps and accelerate time-to-market.

Across Asia-Pacific, rapid economic expansion and export-oriented manufacturing hubs in China, India, and Southeast Asia have driven robust demand for supply chain finance and structured trade instruments. Regulatory sandboxes in jurisdictions such as Singapore and Australia have fostered pilot deployments of blockchain-based payment corridors, enhancing cross-border transaction transparency. Japan’s traditional banking sector is likewise experimenting with AI-powered credit underwriting to revitalize lending volumes amidst demographic headwinds. Collectively, these regional nuances underscore the importance of adaptive strategies that align with local market drivers, regulatory frameworks, and technological ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Commercial Banking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Pivotal Roles and Strategic Approaches of Leading Commercial Banking Institutions Driving Industry Evolution

Leading commercial banking institutions are distinguishing themselves through strategic initiatives that blend technological innovation with client-centric service models. Global banks such as JPMorgan Chase and Citigroup have established digital innovation hubs to co-develop API ecosystems and real-time payment rails, while also leveraging advanced analytics to refine credit lifecycles and detect emerging risk patterns. These efforts have enabled seamless integration with corporate ERPs and elevated the client experience through predictive cash-flow forecasting tools.

At the same time, European banks like HSBC and BNP Paribas are emphasizing sustainability-linked lending frameworks, embedding ESG performance metrics into interest rate adjustments to incentivize green investments among large corporates and project finance borrowers. Strategic partnerships with renewable energy developers and supply chain stakeholders have amplified their green finance portfolios. In Asia, leading institutions such as DBS and Mitsubishi UFJ Financial Group have prioritized digital-first customer journeys, deploying AI-driven chatbots and machine learning-powered fraud detection to streamline onboarding and safeguard transaction integrity.

Regional champions in emerging economies are also playing pivotal roles. Latin American banks like Itaú Unibanco are harnessing mobile wallet platforms to expand financial inclusion, while Middle Eastern banks such as Emirates NBD are rolling out blockchain-enabled trade finance corridors to reduce settlement times. These corporate strategies demonstrate an industry-wide pivot toward innovation alliances, sustainability integration, and digitally augmented service delivery as the primary engines of competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Banking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Axis Bank Limited

- Bank of America Corporation

- Bank of India

- Barclays Bank PLC

- Central Bank of India

- Citigroup Inc.

- Deutsche Bank AG

- Federal Bank Ltd.

- HDFC Bank Limited

- HSBC Holdings plc

- ICICI Bank Limited

- IDFC First Bank Limited

- IndusInd Bank Limited

- JPMorgan Chase & Co.

- Kotak Mahindra Bank Limited

- Morgan Stanley

- Standard Chartered Bank

- State Bank of India

- The Goldman Sachs Group, Inc.

- Union Bank of India

- Wells Fargo & Company

Formulating Actionable Strategic Roadmaps to Empower Industry Leaders in Harnessing Innovation, Mitigating Risks, and Capturing Emerging Value Streams

Industry leaders must proactively align their organizational roadmaps with the evolving landscape to capture emerging opportunities and mitigate systemic risks. First, prioritizing investments in scalable digital infrastructure and advanced analytics platforms will enable institutions to automate credit underwriting, enhance fraud detection, and deliver personalized financial solutions that anticipate client needs. By fostering cross-functional innovation labs, banks can accelerate proof-of-concept cycles and translate emerging technologies into market-ready products.

Second, integrating environmental, social, and governance criteria into core lending and advisory processes will not only support regulatory compliance but also resonate with investor and stakeholder demands for sustainable finance. Crafting incentive structures such as sustainability-linked pricing models encourages corporate clients to pursue greener initiatives, thus reinforcing loan portfolios with measurable ESG outcomes. Third, forging strategic partnerships with fintech and technology providers can bridge capability gaps, reduce time-to-market, and expand ecosystems for open banking services that facilitate seamless third-party integrations.

Finally, instituting rigorous scenario-planning exercises around geopolitical events and tariff fluctuations equips treasury and risk management teams to dynamically adjust product parameters and collateral requirements. Cultivating talent streams skilled in digital risk analytics and regulatory liaison functions will ensure robust governance and swift adaptation to both market disruptions and compliance mandates. By executing these actionable strategies, commercial banks can strengthen resilience, foster distinction in service delivery, and propel sustainable growth.

Ensuring Rigorous Analytical Integrity with a Comprehensive Research Methodology Integrating Quantitative and Qualitative Approaches

A rigorous methodology underpins the analytical integrity of this report, combining both quantitative and qualitative research techniques to deliver comprehensive insights. The quantitative component draws upon primary data collected through structured surveys with C-suite executives, treasury managers, and trade finance specialists. These instruments were designed to capture perceptions of digital adoption, tariff impact, and service preferences across segmentation dimensions.

Qualitative inputs were obtained through in-depth interviews with industry thought leaders, regulatory authorities, and technology providers to contextualize numeric findings and explore emerging trends in ESG integration, open banking frameworks, and regional regulatory initiatives. Secondary research complemented these efforts by reviewing publicly available financial statements, central bank publications, and policy documents to verify the accuracy of macroeconomic and regulatory observations.

Data triangulation was employed to cross-validate insights across different sources, ensuring robustness and mitigating potential biases. Segmentation frameworks were iteratively refined through statistical analysis to confirm the relevance of product, customer type, enterprise size, delivery channel, and industry vertical categories. Finally, all findings underwent peer review and expert validation to uphold the highest standards of analytical rigor and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Banking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Banking Market, by Product Type

- Commercial Banking Market, by Customer Type

- Commercial Banking Market, by Enterprise Size

- Commercial Banking Market, by Delivery Channel

- Commercial Banking Market, by Industry Vertical

- Commercial Banking Market, by Region

- Commercial Banking Market, by Group

- Commercial Banking Market, by Country

- United States Commercial Banking Market

- China Commercial Banking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Illuminate Strategic Imperatives for Stakeholders Steering the Complex and Dynamic Commercial Banking Sector

The synthesis of transformative forces, tariff implications, and multi-dimensional segmentation reveals a commercial banking landscape defined by rapid technological progression and heightened regulatory complexity. Digital innovation stands as a cornerstone for future competitiveness, requiring institutions to embed analytics and automation within their core operations. Concurrently, the evolving tariff environment underscores the necessity for dynamic risk management and adaptive trade finance solutions that sustain cross-border transactions amidst geopolitical volatility.

Regional analysis highlights the importance of tailoring strategies to local regulatory contours and market maturity levels, while leading corporate practices emphasize the integration of ESG considerations and ecosystem partnerships as drivers of sustainable differentiation. By embracing a client-centric model that leverages digital platforms and green finance instruments, banks can simultaneously meet stakeholder expectations and unlock new revenue avenues.

In conclusion, commercial banks that succeed in orchestrating these strategic imperatives-technology enablement, sustainability alignment, risk agility, and regional customization-will be best positioned to deliver resilient growth and enduring client value. The collective insights presented herein form a cohesive blueprint for stakeholders seeking to navigate the complexities of the modern financial services environment with clarity and conviction.

Engage Directly with Ketan Rohom to Secure Exclusive Insights and Propel Your Commercial Banking Strategy with Our Comprehensive Market Research Report

Engagement with our specialized team offers a seamless path to unlocking transformative insights tailored to your organizational objectives. As Associate Director of Sales & Marketing, Ketan Rohom brings deep commercial banking expertise and a consultative approach that aligns research insights with actionable strategies. Collaborating directly with him ensures personalized guidance through the complexities of market intelligence, enabling you to accelerate strategic decision-making and outperform competitors.

By reaching out today, you gain exclusive access to detailed analysis of tariff impacts, digital innovation trends, segmentation deep dives, and regional performance differentials. Ketan Rohom is ready to facilitate a customized briefing, answer your specific inquiries, and provide an executive overview that highlights the most relevant findings for your priorities. Secure your opportunity to leverage this comprehensive market research to inform critical investments, optimize operational efficiencies, and capture emerging growth opportunities. Contact Ketan Rohom now to elevate your commercial banking strategy with unparalleled expertise and a tailored research solution

- How big is the Commercial Banking Market?

- What is the Commercial Banking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?