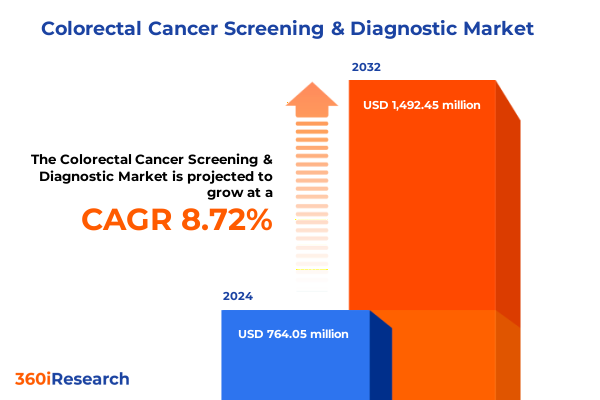

The Colorectal Cancer Screening & Diagnostic Market size was estimated at USD 830.26 million in 2025 and expected to reach USD 904.61 million in 2026, at a CAGR of 8.73% to reach USD 1,492.45 million by 2032.

Setting the Stage for a Comprehensive Exploration of Colorectal Cancer Screening and Diagnostic Market Dynamics and Emerging Priorities

Colorectal cancer remains a leading cause of morbidity and mortality globally, driving an urgent need for robust screening and diagnostic protocols. As clinical guidelines evolve to recommend earlier and more frequent assessments, healthcare providers and payers face mounting pressure to adopt innovative solutions that balance patient comfort, diagnostic accuracy, and cost efficiency. This convergence of clinical necessity and commercial opportunity underscores the critical importance of understanding current market dynamics, technological advancements, and regulatory shifts in colorectal cancer screening.

Within this context, our executive summary delves into the transformative factors shaping the landscape, from breakthroughs in noninvasive tests to the implications of recent tariff adjustments in the United States. Drawing upon extensive primary interviews, secondary sources, and rigorous analytical frameworks, the report offers a concise yet comprehensive foundation for decision-makers seeking to optimize their strategic positioning. By highlighting key growth drivers, segmentation insights, and regional variations, this introduction sets the stage for a holistic dive into the complex ecosystem of colorectal cancer screening and diagnostics.

Unveiling Key Technological and Clinical Breakthroughs Reshaping the Colorectal Cancer Screening and Diagnostic Landscape

Recent years have witnessed a profound shift in colorectal cancer screening paradigms, driven by technological breakthroughs and evolving clinical practices. Artificial intelligence–enhanced imaging now augments the accuracy of colonoscopy procedures, reducing miss rates for adenomas and polyps, while novel blood-based biomarkers demonstrate promising sensitivity for early-stage disease detection. Meanwhile, patient-centric approaches have prioritized minimally invasive options, prompting a surge in multitarget stool DNA testing and liquid biopsy research endeavors.

Transitioning from incremental improvements to paradigm-altering innovations, the industry is also responding to value-based care initiatives that reward preventive interventions. Payers and providers increasingly collaborate to implement risk stratification algorithms that allocate resources to high-risk populations, thereby optimizing screening intervals and reducing unnecessary procedures. Concurrently, regulatory agencies are fast-tracking approvals for home-based and point-of-care diagnostics, aligning incentives toward convenient, accessible screening solutions that maintain stringent performance standards.

Analyzing How the 2025 United States Tariff Measures Are Influencing Supply Chains and Cost Structures in Colorectal Cancer Screening

The imposition of new tariff measures by the United States in early 2025 has introduced a complex layer of cost considerations across the colorectal cancer screening supply chain. Imported endoscopes, imaging equipment components, and specialized reagents are subject to adjusted duties, compelling manufacturers and distributors to reevaluate sourcing strategies and pricing models. As a result, acquisition costs for colonoscopy instruments and FOBT kits have seen incremental upticks, forcing some providers to negotiate longer credit terms or seek alternative suppliers.

With tariffs impacting both consumables and instruments, companies have accelerated efforts to localize manufacturing capabilities. Domestic production of reagents and the assembly of endoscopic hardware have emerged as strategic imperatives to mitigate exposure to fluctuating import duties. In parallel, business leaders are exploring collaborative partnerships with governmental agencies to secure tariff exclusions or downclassifications for critical medical supplies. Ultimately, this tariff environment underscores the need for agile supply chain management and financially prudent distribution frameworks throughout the screening ecosystem.

Deriving Critical Insights from Type Product Application and End User Segmentation to Navigate Market Opportunities

Market players must navigate a multifaceted segmentation structure that illuminates nuanced opportunities for product development and commercialization. Screening tests encompass both blood-based and imaging modalities, with colonoscopy, CT colonography, and flexible sigmoidoscopy representing core imaging formats, while fecal immunochemical tests, guaiac-based fecal occult blood screens, and multitarget stool DNA assays lead the stool-testing domain. The ability to align innovations with specific diagnostic pathways-whether enhancing sensitivity in noninvasive stool tests or optimizing visualization in imaging procedures-will be central to capturing diverse clinical segments.

Equally critical is the distinction between consumables and instruments. Kits, reagents, CT scanners, and endoscopes each present unique regulatory and reimbursement considerations. Strategic investments in reagent stability and kit workflow integration can differentiate consumable offerings, whereas advancements in endoscope design and CT scanner software drive competitive positioning on the instrument side. Additionally, application-based segmentation underscores the importance of tailoring solutions to disease monitoring, early detection, and prognosis assessment, with each use case demanding distinct performance benchmarks and clinical validation studies. Finally, end-user segmentation highlights how ambulatory surgical centers, diagnostic laboratories, hospitals, and research institutes require bespoke engagement models, service offerings, and training programs to ensure successful adoption and utilization.

This comprehensive research report categorizes the Colorectal Cancer Screening & Diagnostic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Application

- End User

Assessing Regional Dynamics to Uncover Growth Drivers and Challenges Across the Americas EMEA and AsiaPacific Markets

Regional dynamics play a pivotal role in shaping colorectal cancer screening adoption, with distinct drivers observed across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, reimbursement frameworks and preventive healthcare initiatives have accelerated the uptake of both invasive and noninvasive screening modalities, particularly in urban centers with integrated health systems. Shifting patient preferences toward minimally invasive options have fueled growth in stool-based tests and blood screening platforms.

Conversely, heterogeneous regulatory landscapes across Europe, the Middle East, and Africa have created differentiated market entry timelines. Countries with centralized health technology assessment bodies emphasize cost-effectiveness analyses, leading suppliers to tailor clinical data packages and health economic models. Simultaneously, pockets of unmet need in emerging markets present fertile ground for low-cost screening solutions, especially where infrastructure for advanced imaging remains limited. In the Asia-Pacific region, demographic trends and rising healthcare expenditure are driving rapid expansion of colonoscopy services, while government-led screening programs in select high-burden nations catalyze demand for integrated diagnostic platforms. Across all regions, local partnerships, culturally adapted patient education initiatives, and alignment with public health priorities are essential for sustainable market penetration.

This comprehensive research report examines key regions that drive the evolution of the Colorectal Cancer Screening & Diagnostic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Steering Advances in Colorectal Cancer Screening and Diagnostics

At the forefront of this evolving market are organizations that have demonstrated both innovation and strategic foresight. Leading manufacturers of imaging equipment continue to invest in AI-driven enhancements and ergonomic endoscope designs to differentiate their portfolios. Simultaneously, diagnostics specialists have expanded research pipelines to include novel biomarker panels and personalized risk assessment tools, positioning themselves for high-impact regulatory approvals.

Amidst this competitive milieu, cross-industry collaborations have gained traction as a means to accelerate product development and market access. Partnerships between technology firms, academic research centers, and healthcare providers have yielded integrated solutions that combine advanced analytics with user-centric platforms. Additionally, contract research organizations and service providers have carved out niche roles by supporting clinical trial execution, regulatory submissions, and market access strategies. Ultimately, the success of these companies hinges on their ability to anticipate clinical needs, navigate reimbursement complexities, and scale manufacturing operations in a cost-effective manner.

This comprehensive research report delivers an in-depth overview of the principal market players in the Colorectal Cancer Screening & Diagnostic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Agilent Technologies, Inc.

- Bayer AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Bristol-Myers Squibb Company

- Clinical Genomics Technologies Pty Ltd.

- Eiken Chemical Co., Ltd.

- Epigenomics AG

- Exact Sciences Corp.

- F. Hoffmann-La Roche Ltd.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies, Inc.

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- KARL STORZ SE & Co. KG

- Medtronic PLC

- Merck KGaA

- Myriad Genetics, Inc.

- Novartis AG

- Novigenix SA

- Olympus Corporation

- Prenetics Global Limited

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Sanofi SA

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Empowering Industry Leaders with Strategic Initiatives to Enhance Market Penetration and Foster Sustainable Growth in Screening

To capitalize on emerging trends and navigate evolving market pressures, industry leaders should prioritize a series of actionable initiatives. First, investing in modular manufacturing capabilities will allow rapid response to tariff-induced cost fluctuations, supporting resilience in procurement and production. Second, embedding artificial intelligence and machine learning capabilities into diagnostic workflows can enhance clinical decision support, reduce variability in interpretation, and facilitate real-world evidence generation.

Furthermore, deepening engagement with payers and policy-makers through proactive health economics research will be critical to securing favorable coverage determinations. Companies should develop comprehensive value dossiers that articulate cost savings from early detection and treatment avoidance. In the commercial realm, prioritizing omnichannel educational campaigns that address patient hesitancy and provider workflow integration will drive greater screening adherence. Finally, forging strategic alliances with regional distributors and health authorities will ensure alignment with local reimbursement criteria and streamline market entry processes, ultimately accelerating reach and impact.

Outlining the Robust Research Approach and Analytical Framework Underpinning the Colorectal Cancer Screening Market Insights

This analysis draws upon a rigorous mixed-method research approach, combining primary interviews with senior executives, key opinion leaders, and clinical experts across diagnostic and endoscopy segments. Secondary research included a comprehensive review of peer-reviewed publications, regulatory filings, and public health databases to validate adoption trends and reimbursement landscapes. Quantitative data were synthesized through structured online surveys targeting end users in ambulatory surgical centers, laboratories, and hospitals to capture utilization patterns and unmet needs.

The report’s analytical framework integrates Porter’s Five Forces to assess competitive intensity, along with SWOT analyses for critical product categories. Tariff impact assessments were conducted via scenario modeling, incorporating historical duty rates and projected policy shifts. Regional market sizing and growth opportunity matrices were derived from epidemiological data and healthcare expenditure forecasts. Finally, triangulation techniques ensured that qualitative insights aligned with quantitative findings, providing robust, actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Colorectal Cancer Screening & Diagnostic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Colorectal Cancer Screening & Diagnostic Market, by Type

- Colorectal Cancer Screening & Diagnostic Market, by Product

- Colorectal Cancer Screening & Diagnostic Market, by Application

- Colorectal Cancer Screening & Diagnostic Market, by End User

- Colorectal Cancer Screening & Diagnostic Market, by Region

- Colorectal Cancer Screening & Diagnostic Market, by Group

- Colorectal Cancer Screening & Diagnostic Market, by Country

- United States Colorectal Cancer Screening & Diagnostic Market

- China Colorectal Cancer Screening & Diagnostic Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Converging Insights to Summarize Key Findings and Chart the Future Trajectory of Colorectal Cancer Screening and Diagnostic Innovations

Bringing together emerging innovations, regulatory developments, and market dynamics, this synthesis underscores the accelerating momentum within colorectal cancer screening. Advances in noninvasive testing and artificial intelligence–powered imaging have broadened diagnostic possibilities, while strategic responses to 2025 tariff adjustments highlight the importance of agile supply chain management. Segmentation insights reveal tailored opportunities across product types, applications, and end-user settings, and regional analyses emphasize the need for culturally and economically sensitive market strategies.

As market leaders refine their approaches, the overarching narrative is one of convergence-where technological progress, policy incentives, and evolving patient expectations align to create a more proactive screening ecosystem. Going forward, success will depend on the ability to translate these insights into practical, scalable solutions that enhance early detection, reduce healthcare costs, and ultimately improve patient outcomes worldwide. This conclusion reinforces the critical value of the research in guiding strategic investments and operational decisions.

Connect with the Associate Director to Secure the Full Report and Accelerate Strategic Growth in Colorectal Cancer Screening

If you are poised to harness the insights detailed in this report and drive your organization to the forefront of colorectal cancer screening innovation, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, today to secure your copy of the full market research report. Engage with a dedicated specialist who is ready to discuss how these findings align with your strategic objectives, customize data presentations to suit your needs, and ensure you have the intelligence required to outperform competitors and capitalize on emerging opportunities. Connect with Ketan now to begin your journey toward informed decision-making that accelerates growth and operational excellence in the rapidly evolving colorectal cancer screening landscape

- How big is the Colorectal Cancer Screening & Diagnostic Market?

- What is the Colorectal Cancer Screening & Diagnostic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?