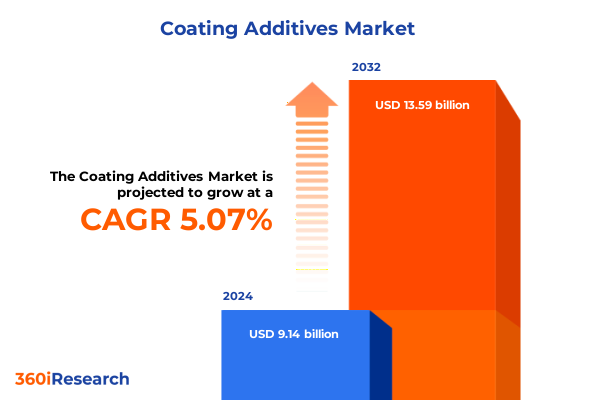

The Coating Additives Market size was estimated at USD 9.58 billion in 2025 and expected to reach USD 10.05 billion in 2026, at a CAGR of 5.10% to reach USD 13.59 billion by 2032.

Unlocking the Foundational Role and Strategic Importance of Coating Additives in Driving Innovation and Durability across Surface Protection Technologies

The landscape of coating additives represents a critical underpinning for modern surface protection technologies, offering manufacturers the tools needed to enhance performance, appearance, and durability in countless applications. These specialized chemical agents are integrated into coating formulations to address specific challenges such as foam control, pigment dispersion, impact resistance, rheology adjustment, and surface wetting. From architectural finishes that resist weathering to industrial paints optimized for high-impact environments, coating additives serve as the silent workhorses that ensure end-product reliability and longevity.

In today’s marketplace, the importance of these functional ingredients is more pronounced than ever. A confluence of factors-including heightened regulatory scrutiny, growing demand for eco-friendly formulations, and the push for digital manufacturing platforms-has elevated the role of additives in driving innovation. Stakeholders across the value chain, ranging from raw material suppliers to applicators, are looking to leverage the latest advancements in additive technology to differentiate their offerings. As the sector continues to evolve, a clear understanding of emerging trends, tariff impacts, segmentation dynamics, and regional variations will prove indispensable for informed strategic planning. This executive summary sets the stage for an in-depth exploration of these factors, equipping decision-makers with a holistic view of the forces shaping the future of coating additives.

Exploring the Rapid Technological Advancements and Sustainability-Driven Transformations Reshaping the Coating Additives Landscape Worldwide

The coating additives industry is undergoing a profound transformation driven by breakthroughs in material science and an accelerating shift toward sustainable practices. Innovations in bio-based chemistries have introduced plant-derived surfactants and polymeric rheology modifiers that meet stringent environmental regulations without compromising performance. Meanwhile, nanotechnology has enabled the development of multifunctional dispersing agents and impact modifiers that deliver superior mechanical stability at significantly lower loading rates, reducing overall formulation costs and environmental footprints.

Equally influential are digital advancements that facilitate real-time monitoring and optimization of additive dosing through smart manufacturing platforms. These Industry 4.0 solutions empower formulators to fine-tune rheological behavior and control pigment dispersion via sensor-integrated mixing systems, thereby enhancing batch-to-batch consistency. At the same time, the adoption of eco-conscious production processes has driven the emergence of solvent-free powder coatings and low-VOC water-borne systems, both of which rely heavily on specialized additives to achieve desired flow and finish characteristics. As these transformative shifts continue to accelerate, companies that proactively adapt their R&D and production strategies stand to capture significant competitive advantage in an increasingly dynamic market.

Analyzing the Comprehensive Effects of 2025 United States Import Tariffs on Supply Chains Innovation and Cost Structures in Coating Additives

In 2025, adjustments to United States import tariff schedules imposed a cumulative effect on key raw materials used in coating additives, notably specialty surfactants, polymeric thickeners, and silicone intermediates. Companies faced elevated costs across multiple supply chain nodes as duties ranging from low double digits to as much as thirty percent were applied to imports from major producing regions. The tariff environment has compelled additive manufacturers to seek alternative sourcing strategies, including nearshoring and local raw material production partnerships, in order to mitigate cost variability and secure supply continuity.

These trade measures have also stimulated innovation as formulators explore domestic feedstock opportunities. By leveraging emerging biopolymers and recycled materials, organizations are offsetting imported raw material expense while reinforcing sustainability credentials. However, the cumulative impact of tariffs has underscored the importance of scenario planning and flexible procurement policies. Companies that have integrated dynamic cost-modeling tools into their finance and operations workflows are better positioned to absorb duty fluctuations without eroding margin. In turn, this adaptability fosters resilience and sets the stage for longer-term investments in advanced additive technologies.

Unveiling Critical Market Segmentation Insights Spanning Product Formulation and Application Dynamics Driving Strategic Decision-Making in Coating Additives

The coating additives market is intricately segmented by product type, formulation, and application, each revealing distinct growth drivers and strategic implications. When examining product types, defoamers stand out with subsegments of oil-based, silicone-based, and water-based variants addressing foam control across high-speed mixing and curing processes. Dispersing agents encompass high-molecular weight dispersants, polymeric dispersants, and surfactants that enable uniform pigment distribution in challenging formulations. Rheology modifiers are differentiated into associative thickeners, stabilizers, and thickeners that fine-tune viscosity profiles, while wetting agents include non-silicone and silicone-based solutions that reduce surface tension for improved substrate adhesion.

From a formulation standpoint, powder coatings require durable additive packages resistant to thermal stress, solvent-borne coatings depend on rapid-dry defoamers and levelers, and water-borne systems leverage acrylic and epoxy chemistries with tailored modifiers for flow and leveling. Each formulation category faces unique regulatory and performance thresholds, underscoring the criticality of precision additive design. In terms of applications, architectural coatings segment into exterior decorative and interior decorative finishes where aesthetic and weathering performance is paramount. Industrial coatings span automotive OEM, marine, and packaging segments, each demanding specialized impact modifiers and dispersing agents. Protective coatings, encompassing anti-corrosive and fire-resistant systems, rely on robust additive architectures to deliver long-term substrate protection under extreme conditions. The interplay of these segmentation contours guides investment prioritization, product development roadmaps, and go-to-market strategies.

This comprehensive research report categorizes the Coating Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Application

Diving into Regional Variations and Growth Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Markets For Coating Additives

Regional dynamics in the coating additives sector reveal a tapestry of demand patterns informed by local regulations, end-market maturity, and raw material availability. In the Americas, growth is anchored by robust construction activity and automotive manufacturing in the United States and Brazil, with a growing preference for water-borne coatings driven by stringent VOC guidelines. North American formulators emphasize high-performance rheology modifiers and bio-based surfactants to satisfy both environmental mandates and consumer expectations for durability.

Across Europe, Middle East, and Africa, regulatory frameworks such as REACH and regional emissions targets have catalyzed the shift toward low-VOC solvent-borne and powder systems. Western European markets continue to pioneer next-generation additive chemistries, particularly in fire-resistant and anti-corrosive applications for infrastructure projects. In contrast, Middle Eastern and African markets are focused on supply chain development and localized manufacturing, creating openings for additives tailored to extreme environmental conditions.

In the Asia-Pacific region, rapid urbanization and manufacturing expansion in China, India, and Southeast Asia underpin sustained demand for coating additives. The region’s heavy industrial base drives growth in industrial and protective coatings, while government incentives for domestic chemical production are bolstering local additive suppliers. Meanwhile, emerging economies are increasingly adopting water-borne and powder technologies, signaling a gradual transition from traditional solvent-based formulations to more sustainable alternatives.

This comprehensive research report examines key regions that drive the evolution of the Coating Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning Competitive Strengths and Collaborative Innovations Among Leading Industry Players in Coating Additives

Leading players in the coating additives market are distinguished by their strategic focus on innovation, flexible supply chains, and targeted collaborations. Major multinational chemical companies have bolstered their R&D pipelines through partnerships with specialty raw material providers and university research centers, accelerating the commercialization of bio-based and nanostructured additives. Meanwhile, agile mid-tier innovators have carved out niche positions by offering highly customizable additive packages that cater to unique application challenges, such as low-temperature curing or ultra-high gloss finishes.

Collaborative ventures between additive producers and coating formulators are proving pivotal in co-developing next-generation solutions. These alliances harness shared technical expertise to optimize additive performance in emerging manufacturing processes, including digital inkjet deposition and 3D printing of functional coatings. Strategic acquisitions have also reshaped competitive positioning, enabling companies to enhance their product portfolios and extend geographic reach. Firms that prioritize open innovation frameworks and invest in scalable manufacturing infrastructure are consistently achieving stronger market penetration and sustaining margin premiums.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coating Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Altana AG

- Arkema S.A.

- Axalta Coating Systems, LLC

- BASF SE

- Clariant AG

- Croda International Plc

- Eastman Chemical Company

- Elementis PLC

- Ethox Chemicals, LLC

- Evonik Industries AG

- Global Chemicals Limited

- Harmony Additive Private Limited

- Huntsman Corporation

- IRO Coating Additive Co. Ltd.

- K-TECH (INDIA) LIMITED

- Momentive Performance Materials Inc.

- PPG Industries, Inc.

- Premier Pigments And Chemicals

- R Chemine Products Private Limited

- Rudolf GmbH

- Sherwin-Williams Company

- Solvay S.A.

- The 3M Company

- The Dow Chemical Company

- The Lubrizol Corporation

- Troy Corporation

- Wacker Chemie AG

Delivering Actionable Strategic Recommendations to Empower Leaders in Enhancing Sustainability Innovation and Operational Excellence in Coating Additives Businesses

To navigate the complex dynamics of the coating additives market and capture emerging opportunities, industry leaders should prioritize a multi-pronged strategic agenda. First, embedding sustainability as a core R&D driver will unlock access to premium market segments and preempt regulatory constraints. This involves investing in bio-based feedstocks, low-carbon production processes, and end-of-life recyclability programs that resonate with environmentally conscious customers.

Second, cultivating supply chain resilience through diversified sourcing and nearshoring initiatives will safeguard against tariff shocks and geopolitical disruptions. Companies should establish agile procurement teams equipped with digital cost-modeling and scenario-analysis tools to rapidly adapt purchasing strategies. Third, fostering co-innovation partnerships with applicators, academic institutions, and technology vendors will accelerate the introduction of disruptive additive solutions, particularly in digital manufacturing and high-performance protective coatings. Fourth, enhancing go-to-market capabilities by leveraging data analytics and targeted digital marketing will sharpen segment-specific messaging and drive faster adoption. By executing these recommendations in concert, decision-makers can reinforce their competitive moats and realize sustainable growth trajectories.

Describing the Rigorous Research Methodology Incorporating Data Collection Analysis Validation and Expert Insights Underpinning the Coating Additives Study

This study integrates a robust mix of primary and secondary research methodologies to ensure comprehensive and reliable insights into the coating additives market. Extensive secondary research was conducted by reviewing industry journals, regulatory filings, company presentations, patent databases, and trade publications, forming the foundation for market structure analysis and trend identification. Concurrently, primary research involved in-depth interviews with senior R&D executives, procurement managers, and technical specialists across the value chain, providing qualitative perspectives on innovation pipelines and supply chain dynamics.

Quantitative data points were validated through triangulation, cross-referencing company-reported sales figures with independent industry databases and government trade statistics to enhance accuracy. A panel of sector experts reviewed preliminary findings in a structured workshop format, offering critical feedback on data interpretation and emerging themes. The research process also incorporated scenario-planning sessions to model the impact of tariff changes and sustainability regulations. Throughout, rigorous quality control measures, including peer reviews and editorial audits, were applied to uphold methodological integrity and ensure that the insights presented are actionable, transparent, and defensible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coating Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coating Additives Market, by Product Type

- Coating Additives Market, by Formulation

- Coating Additives Market, by Application

- Coating Additives Market, by Region

- Coating Additives Market, by Group

- Coating Additives Market, by Country

- United States Coating Additives Market

- China Coating Additives Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Implications to Illuminate Future Directions and Value Creation Opportunities in the Coating Additives Industry

The analysis of the coating additives landscape uncovers several pivotal insights that will shape future industry trajectories. Technological advancements in bio-based chemistries, nanostructured dispersants, and smart manufacturing integrations are redefining performance benchmarks. The 2025 tariff adjustments have prompted supply chain realignment and accelerated investment in domestic feedstock alternatives, highlighting the interconnected nature of trade policy and innovation strategies.

Segmentation analysis reveals that demand for water-borne and powder formulations is rising steadily, especially within architectural and protective coatings, driven by environmental regulations and end-user preferences. Regional dynamics underscore significant opportunities in Asia-Pacific and North America, while Europe leads in high-value, specialized additive chemistries. Competitive analysis indicates that companies prioritizing open innovation, strategic collaborations, and sustainable production stand to secure the strongest market positions.

Looking ahead, stakeholders should focus on cultivating agile operations, deepening cross-sector partnerships, and leveraging digital and data-driven platforms to enhance product development and customer engagement. By synthesizing these findings and translating them into strategic planning, industry participants can navigate uncertainty, drive value creation, and maintain leadership in the evolving coating additives market.

Seize In-Depth Market Intelligence Today Contact Ketan Rohom Associate Director Sales Marketing to Secure Your Coating Additives Market Research Report

To unlock the full breadth of insights and gain a competitive edge in the rapidly evolving coating additives market, reach out today to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive expertise in surface protection technologies and can guide you through how this comprehensive report aligns with your strategic goals. Whether you are seeking to refine your product roadmap, optimize supply chains in light of changing tariffs, or identify high-potential application segments, this research offers the data-driven clarity you need to make informed decisions.

Don’t miss the opportunity to secure the most authoritative analysis available on coating additives. Contact Ketan to discuss customized briefing options, group licensing, and executive summary previews tailored to your organization’s specific interests. Empower your team with actionable recommendations, granular segmentation insights, and region-specific intelligence that will drive sustainable growth and innovation. Get in touch now to transform your strategic planning with the definitive market research report.

- How big is the Coating Additives Market?

- What is the Coating Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?