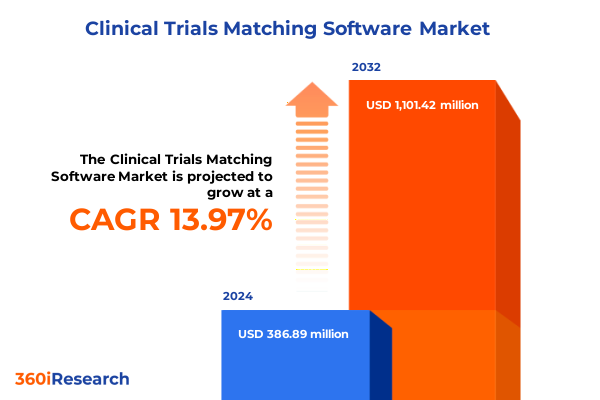

The Clinical Trials Matching Software Market size was estimated at USD 437.53 million in 2025 and expected to reach USD 495.57 million in 2026, at a CAGR of 14.09% to reach USD 1,101.42 million by 2032.

Pioneering Next-Generation Clinical Trials Matching Solutions with Patient-Centric and Trial-Centric Innovations Driving Therapeutic Advancements

The realm of clinical trials matching software has embarked on an era defined by transformative potential, where sophisticated algorithms and rich patient data converge to optimize trial recruitment. As the healthcare ecosystem intensifies its focus on patient-centricity, matching platforms have transcended traditional screening methods, delivering more nuanced and precise candidate identification. This shift is propelled by an imperative to reduce trial timelines, enhance patient diversity, and mitigate costly protocol deviations, thereby fostering a more resilient and responsive research infrastructure.

In this evolving context, software solutions are no longer ancillary but integral to trial success, offering seamless integration with electronic health records and real-time eligibility assessments. These advancements have laid the groundwork for digital-first trial designs, supporting decentralized methodologies and remote monitoring capabilities. Consequently, stakeholders-from clinical research organizations to pharmaceutical powerhouses-are reevaluating their operational paradigms to leverage these intelligent systems.

Ultimately, this introduction underscores the strategic imperative to embrace these next-generation platforms. It frames the discussion of emerging technologies, evolving market forces, and actionable insights that will shape the future of clinical trial recruitment and execution, setting the stage for an in-depth exploration of key trends and recommendations within this report.

Navigating Disruptive Transformations Fueled by AI, Big Data, Blockchain, and NLP to Revolutionize Patient Matching and Trial Optimizations

The landscape of clinical trials matching software has undergone a paradigm shift driven by the rapid maturation of artificial intelligence and machine learning capabilities. These technologies analyze vast troves of patient data to identify nuanced eligibility profiles, significantly improving match rates and reducing recruitment timelines. Big Data Analytics further augments this process by synthesizing structured and unstructured information, delivering insights that empower trial sponsors to make data-driven decisions and forecast enrollment trends more accurately.

Meanwhile, Blockchain architectures are being piloted to ensure data integrity and secure patient consent, cementing trust among stakeholders and safeguarding compliance. Natural Language Processing, working in tandem with AI, deciphers clinical notes and patient narratives to unearth hidden eligibility markers, enhancing patient stratification. Together, these technologies are redefining the way protocols are designed and executed, fostering heightened operational efficiencies.

As these innovations gain traction, they catalyze a shift toward decentralized clinical trials, with matching software at the core of remote patient engagement and monitoring frameworks. This transformation not only accelerates trial timelines but also broadens access to diverse patient populations. By harnessing these disruptive technologies, the industry is poised to overcome longstanding recruitment barriers and unlock new frontiers in therapeutic development.

Assessing the Cumulative Ramifications of New Tariff Policies on Clinical Trials Software Infrastructure and Deployment Dynamics Across United States Networks

The introduction of new tariff measures in 2025 has exerted multifaceted pressure on clinical trials software deployment within the United States. Heightened duties on imported IT hardware components have escalated capital expenditures for organizations opting for on-premise installations, prompting a strategic pivot toward cloud-based solutions that mitigate upfront infrastructure costs and offer greater scalability. This reorientation alleviates supply chain disruptions associated with tariff-induced shipping delays, while simultaneously accelerating time-to-deployment for critical matching platforms.

Simultaneously, service providers face incremental costs that can cascade throughout licensing structures and subscription fees, potentially influencing budget allocations for trial sponsors and clinical research organizations. As a consequence, procurement teams are negotiating more stringent service-level agreements and exploring hybrid deployment models to balance compliance requirements with cost efficiencies.

In response, leading vendors are reengineering solution architectures to minimize reliance on tariff-impacted hardware, investing in lightweight edge computing capabilities and containerized deployments that reduce logistical complexity. These adaptive strategies exemplify the industry’s resilience in the face of evolving trade policies, ensuring that trial matching capacities remain uncompromised despite regulatory headwinds.

Unlocking Strategic Advantages Across Software Types, Business Models, Technology Platforms, Therapeutic Domains, Deployment Pathways, and End-Use Verticals

Insight into software type segmentation reveals a clear delineation between patient-centric matching platforms that focus on eligibility and engagement metrics, and trial-centric solutions engineered to optimize protocol-specific criteria and site workflows. A parallel stratification exists in business models, where pay-for-performance offerings tie cost to enrollment success, contrasting with subscription-based structures that provide predictable budgeting and continuous feature updates. Meanwhile, technology segmentation highlights a diverse ecosystem encompassing AI and machine learning engines that drive predictive analytics, big data frameworks handling massive clinical datasets, blockchain ledgers ensuring data provenance, and natural language processing modules that extract eligibility cues from complex clinical narratives.

Therapeutic area segmentation spans cardiovascular, infectious diseases, metabolic disorders, neurological conditions, oncology, and rare disease domains, each presenting unique recruitment challenges and data requirements. Consequently, deployment pathways bifurcate into cloud environments that facilitate rapid scaling and global reach, and on-premise infrastructures that prioritize data sovereignty and compliance alignment. End-use verticals range from clinical research organizations navigating multifaceted trial portfolios to hospitals and academic research centers integrating trials within patient care pathways, medical device firms seeking premarket data, and pharmaceutical and biotechnology companies driving drug development pipelines.

By weaving these segmentation lenses together, stakeholders can pinpoint optimal solution configurations, align vendor partnerships with strategic objectives, and tailor deployment strategies that address therapeutic complexity, regulatory landscapes, and organizational risk appetites.

This comprehensive research report categorizes the Clinical Trials Matching Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Business Model

- Technology Type

- Therapeutic Area

- Deployment

- End-Use

Illuminating Regional Adoption Patterns and Growth Trajectories in the Americas, Europe Mid-East & Africa, and Asia-Pacific Clinical Trials Software Markets

Regional dynamics in the Americas underscore the United States as a launchpad for innovation, supported by robust regulatory frameworks and widespread adoption of electronic health record systems. Canada’s investment in digital health initiatives further amplifies cross-border collaboration, fostering a fertile ground for pilot programs and multi-site studies. Transitioning to Europe, the Middle East & Africa, diverse regulatory environments and data privacy mandates create both hurdles and opportunities; the European Union’s harmonized GDPR structure contrasts with emerging frameworks in Middle Eastern markets, necessitating adaptive data governance strategies while unlocking significant patient pools.

Across Asia-Pacific, rapid digital transformation and government-backed healthcare modernization efforts in countries like China, India, and Australia are driving the uptake of matching software, particularly in decentralized trial models that leverage mobile health technologies. In each region, the interplay of regulatory rigor, technological infrastructure, and healthcare funding mechanisms shapes the trajectory of software adoption. By understanding these regional nuances, vendors and sponsors can calibrate market entry strategies, customize value propositions, and establish partnerships that navigate cultural and compliance intricacies.

This regional intelligence equips decision-makers with the foresight to prioritize resource allocation, engage with local stakeholders, and accelerate time-to-market for innovative matching solutions across global trial landscapes.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trials Matching Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Front-Runners and Innovators Redefining Clinical Matching Software Through Strategic Alliances, M&A, and Technological Leadership Initiatives

Leading companies in clinical trials matching software are distinguished by their integration of advanced analytics, strategic partnerships, and agile product roadmaps. Industry front-runners leverage proprietary AI algorithms and deep learning architectures to refine patient stratification, while emerging innovators differentiate through specialized modules targeting rare diseases or decentralized trial workflows. Collaboration between software vendors and clinical research organizations has intensified, giving rise to joint ventures and alliance-based service bundles that combine technological prowess with domain expertise.

In parallel, mergers and acquisitions have reshaped the competitive landscape, with established life sciences technology firms acquiring niche matching platforms to bolster their end-to-end trial solutions. These consolidation moves streamline interoperability, expand global footprints, and enhance platforms’ ability to integrate seamlessly with electronic data capture, trial management, and pharmacovigilance systems.

Technological leadership is further exemplified by investments in open application programming interfaces, enabling seamless third-party integrations and fostering an ecosystem of complementary tools. By continuously iterating on user-centric design, security protocols, and performance optimizations, these key players define industry benchmarks that others aspire to meet, setting the pace for innovation in patient recruitment and trial execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trials Matching Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advarra, Inc.

- Antidote Technologies, Inc.

- AQ, Inc

- AutoCruitment LLC

- BBK Worldwide, LLC by Publicis Health company

- BEKhealth Corporation

- Belongtail Ltd.

- Carebox Healthcare Solutions, Inc.

- Clara Health by M&B Sciences Inc.

- Clariness GmbH

- Clario

- ClinicalConnection, Inc.

- CSSi

- Deep 6 AI Inc.

- Elligo Health Research, Inc.

- Evidation Health, Inc.

- Formation Bio, Inc.

- HCL Technologies Limited

- HealthMatch Pty. Ltd.

- ICON plc

- Inato

- Inspirata, Inc.

- International Business Machines Corporation

- IQVIA Holdings Inc.

- Lokavant, Inc.

- Medable Inc.

- Medidata by Dassault Systèmes SE

- Medocity, Inc.

- Microsoft Corporation

- Parexel International Corporation

- PatientWing

- Science 37, Inc. by eMed, LLC

- Science4Tech Solutions, S.L.

- Sumatosoft LLC

- Syneos Health, Inc.

- Teckro, Inc.

- Tempus Labs, Inc.

- Trialbee AB

- TrialHub by FindMeCure Ltd.

- Veeva Systems Inc.

- Worldwide Clinical Trials

Formulating High-Impact Strategic Recommendations to Drive Integration, Compliance, and Operational Excellence in Clinical Trials Matching Software Ecosystem

To achieve sustained competitive advantage, industry leaders should prioritize integration of next-generation AI and machine learning capabilities that enhance predictive patient matching and streamline eligibility determinations. Simultaneously, a robust compliance framework must be established, incorporating data privacy regulations across jurisdictions and leveraging blockchain for transparent audit trails. Operational excellence can be attained by adopting modular architectures, enabling rapid deployment and iterative enhancements without disrupting existing workflows.

Strategic alliances with healthcare institutions and technology partners will accelerate clinical validation and foster trust, while open-standards adoption ensures interoperability with a broader ecosystem of digital health solutions. Leaders should also explore outcome-based contracting models, aligning vendor incentives with trial success metrics and demonstrating value through improved enrollment rates and reduced protocol deviations.

By embracing these strategic imperatives, organizations will not only enhance patient engagement and trial efficiency but also position themselves to capitalize on emerging opportunities in decentralized and hybrid trial designs. A proactive approach to technology adoption, coupled with collaborative partnerships and rigorous governance, will be paramount in navigating the evolving landscape.

Detailing Rigorous Multi-Tiered Research Methodology Incorporating Primary Interviews, Secondary Analysis, and Data Validation Protocols

This research employed a rigorous, multi-tiered methodology to ensure the validity and reliability of findings. It began with comprehensive secondary analysis, drawing from peer-reviewed literature, regulatory guidelines, and industry white papers to establish foundational context. Primary research comprised in-depth interviews with senior executives at pharmaceutical companies, clinical research organizations, and software vendors, complemented by expert panels that validated emerging themes and technology trajectories.

Quantitative data were triangulated through surveys administered to trial sites and technology end-users, capturing adoption drivers, implementation challenges, and satisfaction benchmarks. This was followed by data cleansing and statistical analysis, applying normalization techniques to account for regional regulatory variations and therapeutic area differences.

Finally, insights were subjected to quality assurance protocols, involving cross-functional review by clinical operations specialists, data scientists, and regulatory compliance advisors, ensuring that the conclusions reflect practical realities and strategic imperatives. This methodological rigor underpins the credibility of the report’s recommendations and provides a transparent framework for replicability and future updates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trials Matching Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trials Matching Software Market, by Software Type

- Clinical Trials Matching Software Market, by Business Model

- Clinical Trials Matching Software Market, by Technology Type

- Clinical Trials Matching Software Market, by Therapeutic Area

- Clinical Trials Matching Software Market, by Deployment

- Clinical Trials Matching Software Market, by End-Use

- Clinical Trials Matching Software Market, by Region

- Clinical Trials Matching Software Market, by Group

- Clinical Trials Matching Software Market, by Country

- United States Clinical Trials Matching Software Market

- China Clinical Trials Matching Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Comprehensive Insights to Articulate the Strategic Imperatives, Future Trajectories, and Market Evolution Drivers in Clinical Matching Software

This executive summary synthesizes a spectrum of insights that underscore the evolving imperatives of clinical trials matching software. The convergence of advanced analytics, decentralized trial models, and adaptive regulatory landscapes compels stakeholders to reimagine traditional recruitment frameworks and invest in agile, scalable solutions. From leveraging AI-driven patient stratification to mitigating supply chain risks posed by new tariff measures, the strategic trajectory of this market hinges on balancing innovation with operational resilience.

Future trajectories will likely feature heightened interoperability, with platforms integrating seamlessly across digital health ecosystems, and an increased emphasis on patient-centric design that fosters engagement and retention. As therapeutic pipelines expand into complex and rare disease areas, matching software will become indispensable for tailoring trial protocols and ensuring broad demographic representation.

Market evolution will also be influenced by regional regulatory harmonization efforts, driving standardization in data governance and enabling more efficient global trial rollouts. Ultimately, the strategic imperatives articulated herein serve as a roadmap for navigating technological disruption and regulatory complexity, positioning organizations to capitalize on the transformative potential of next-generation matching solutions.

Engage Directly with Ketan Rohom to Unlock Advanced Clinical Trials Matching Software Research Insights and Secure Your Comprehensive Market Analysis Today

To access unparalleled insights that will empower your strategic initiatives in clinical trials matching software, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the comprehensive research findings, ensuring you receive tailored analysis that aligns with your organization’s objectives. Engage directly to explore detailed evaluations of technology advancements, regional dynamics, and competitive intelligence that will inform critical decisions. \n\nDon’t miss the opportunity to leverage cutting-edge market intelligence designed to drive innovation and growth. Connect with Ketan Rohom today to purchase the full market research report and unlock the actionable strategies needed to stay ahead in a rapidly evolving landscape.

- How big is the Clinical Trials Matching Software Market?

- What is the Clinical Trials Matching Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?