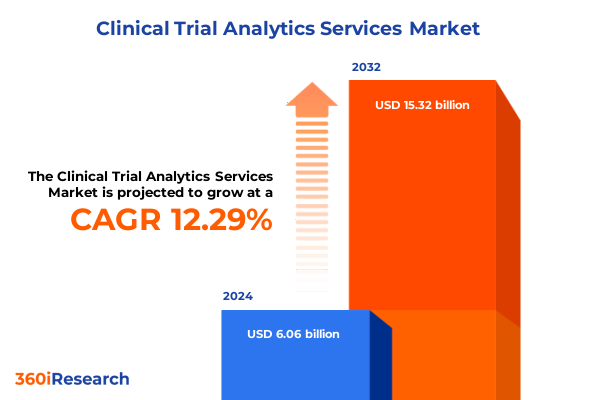

The Clinical Trial Analytics Services Market size was estimated at USD 6.77 billion in 2025 and expected to reach USD 7.56 billion in 2026, at a CAGR of 12.37% to reach USD 15.32 billion by 2032.

Understanding the Evolution of Clinical Trial Analytics Services and Their Critical Role in Accelerating Drug Development and Strategic Decision Making

The realm of clinical trial analytics services has evolved into an indispensable cornerstone for modern drug development, impacting every phase of study design, execution, and evaluation. As pharmaceutical and biotechnology companies seek new avenues to accelerate timelines, mitigate risks, and harness real-world evidence, advanced analytics have emerged as the catalyst for transformative efficiencies. Integrating vast datasets-from patient recruitment metrics to post-market surveillance outcomes-analytics platforms now offer the clarity and precision needed to navigate an increasingly complex regulatory and competitive landscape.

Embracing sophisticated data management and visualization tools enables research teams to detect trends, anticipate challenges, and make evidence-driven decisions in real time. Innovations such as AI-powered predictive modeling and risk-based monitoring services are reshaping traditional methodologies, optimizing resource allocation and enhancing patient-centricity across trial protocols. This shift toward data-driven trial governance not only improves operational agility but also underpins strategic planning, as sponsors leverage analytics to align development portfolios with market needs and regulatory expectations. Building upon this foundation, the subsequent section examines the transformative shifts that are actively reshaping the clinical trial analytics landscape, driving new opportunities and redefining best practices.

Identifying the Transformative Technological, Regulatory, and Strategic Shifts Reshaping the Clinical Trial Analytics Landscape for Enhanced Efficiency

In the past year, the integration of artificial intelligence into clinical trial workflows has accelerated from proof-of-concept projects to enterprise-wide deployments, fundamentally reshaping trial efficiency and decision-making. Generative AI systems now automate protocol document extraction, streamline trial master file generation, and deliver real-time compliance monitoring, reducing manual entry errors and regulatory risks. Experts forecast that by the close of 2025, AI-driven platforms will handle a majority of data curation and analysis tasks, enabling teams to allocate resources toward strategic imperatives and patient engagement initiatives.

Concurrently, decentralized and virtual trial models have gained traction, supported by AI-powered remote monitoring tools and digital biomarkers that enhance diverse patient recruitment and retention. Organizations are integrating real-world evidence analytics into study designs to capture longitudinal patient outcomes outside traditional clinical settings, reflecting a broader transition toward patient-centric research. Predictive analytics are now leveraged to forecast enrollment rates and adverse event probabilities, enabling adaptive trial designs that respond dynamically to interim data signals.

Regulatory frameworks and compliance requirements have also evolved, with guidelines emphasizing data integrity, transparency, and secure data-sharing protocols. Harmonized standards across regions are encouraging the adoption of risk-based monitoring strategies, where centralized analytics drive site selection and monitoring intensity. With these combined technological, regulatory, and methodological shifts, the clinical trial analytics landscape is poised for continued innovation and increased strategic impact.

Analyzing the Cumulative Effects of the 2025 United States Tariff Regime on Clinical Trial Analytics Operations, Supply Chains, and Cost Structures

The sweeping tariff regulations enacted by the United States in early 2025 have introduced a new layer of complexity for clinical trial analytics service providers, as elevated import duties impact critical components of the trial ecosystem. A broad 10% global tariff on goods entering the U.S., including active pharmaceutical ingredients, diagnostic devices, and analytical instrumentation, has inflated operational costs and compelled organizations to reevaluate their sourcing strategies. This tariff policy, designed to strengthen domestic manufacturing, has inadvertently driven many sponsors to consider localized supply chains and alternative procurement partners.

Furthermore, targeted Section 301 tariffs have imposed duties of up to 25% on additional medical devices, diagnostics, and laboratory equipment imported from China, amplifying cost pressures for device trials that rely on high-precision imaging and monitoring technologies. These measures have resulted in longer procurement lead times and elevated capital expenditures, prompting service providers to absorb or pass through costs, which could translate into higher trial budgets and extended timelines for sponsors.

While R&D-specific exemptions under Harmonized Tariff Schedule Code 9817.85 shield prototype materials intended exclusively for development and testing, downstream supplies such as lab consumables and patient-facing devices remain subject to duties. As a result, clinical research teams are prioritizing proactive inventory management, negotiating longer-term vendor agreements, and exploring domestic manufacturing partnerships to mitigate supply chain disruptions. The cumulative impact of these tariff policies is driving a strategic shift toward regionalization of trial operations and heightened emphasis on cost containment during study planning.

Uncovering Key Segmentation Insights Across Phases, Services, Treatment Modalities, Therapeutic Specializations, End Users, and Deployment Models

Insight into the clinical trial analytics market is enriched by multidimensional segmentation, beginning with trial phases ranging from early safety assessments in Phase I through long-term surveillance in Phase IV. Each phase presents distinct analytical requirements: early-phase studies demand detailed pharmacokinetic modeling, late-phase trials require comprehensive real-world evidence integration, and post-marketing surveillance emphasizes signal detection and risk-based monitoring to ensure ongoing safety.

Service-based segmentation reveals a diverse portfolio of offerings that encompass critical areas such as data management and integrity services, which form the backbone of trial governance; data visualization and dashboarding platforms that transform raw data into actionable insights; patient recruitment and retention analytics designed to optimize enrollment; portfolio and performance management tools that align resources to strategic objectives; real-world evidence and post-market surveillance services that bridge clinical and commercial data; regulatory compliance analytics to ensure trial adherence; risk-based monitoring methodologies aimed at reducing oversight costs; and statistical analysis and reporting services that validate outcomes and support regulatory submissions.

Treatment type segmentation underscores the varied requirements of device, drug, and procedural trials. Device trials differentiate between diagnostic and therapeutic devices; drug trials navigate the complexities of biologics versus small molecules; and procedural trials, spanning radiological and surgical procedures, demand specialized endpoint analytics. Therapeutic area segmentation focuses on high-priority domains such as cardiovascular diseases, neurological disorders, and oncology, each bringing unique biomarker and endpoint analytics challenges.

End users range from academic institutions-comprising research hospitals and university laboratories-to contract research organizations and pharmaceutical companies, including biotech startups and multinational corporations. Finally, deployment models span cloud-based architectures that enable scalable, real-time collaboration and on-premise solutions favored by organizations with stringent data sovereignty requirements. Together, these segments create a comprehensive framework for understanding market dynamics and tailoring analytics solutions to specific study needs.

This comprehensive research report categorizes the Clinical Trial Analytics Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Phase

- Services

- Treatment Type

- Therapeutic Area

- End User

- Deployment

Distilling Critical Regional Insights to Illuminate Trends, Challenges, and Opportunities Within the Americas, EMEA, and Asia-Pacific Clinical Trial Analytics

Regional dynamics play a critical role in shaping the clinical trial analytics market, beginning with the Americas, which benefit from a mature ecosystem of sponsors, CROs, and technology vendors. North America maintains leadership in analytics innovation, driven by substantial R&D investments, a robust regulatory infrastructure, and extensive real-world data networks that support advanced predictive modeling and risk-based monitoring. Latin American countries are also emerging as sites of choice for cost-effective patient recruitment, leveraging growing infrastructure and favorable regulatory reforms to attract late-phase studies.

In Europe, Middle East, and Africa, regulatory harmonization under initiatives such as the EU Clinical Trials Regulation is fostering cross-border collaborations and standardized data-sharing frameworks. Western European markets exhibit strong adoption of decentralized and hybrid trial models, while emerging economies in the Middle East and Africa are investing in digital health infrastructure to support decentralized trials and telemedicine-enabled monitoring. Growth in healthcare IT spending and strategic partnerships with global CROs are enhancing the region’s capacity to conduct complex multicenter studies.

The Asia-Pacific region has ascended as a dynamic hub for clinical development, hosting nearly 40,000 trials across China, India, Australia, Japan, South Korea, and Singapore between 2020 and mid-2025. Governments in APAC are streamlining ethics approvals and incentivizing site readiness, enabling accelerated patient recruitment in oncology and other high-demand therapeutic areas. This robust expansion is underpinned by cost-competitive operations, large treatment-naïve patient populations, and a rapidly modernizing regulatory environment, positioning Asia-Pacific as a critical growth engine for global clinical trial analytics.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Analytics Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies to Highlight Their Strategic Initiatives, Innovations, and Competitive Advantages in Clinical Trial Analytics Services

Leading companies in the clinical trial analytics arena are distinguishing themselves through strategic investments, platform innovations, and robust service portfolios that address evolving sponsor needs. IQVIA continues to leverage its Human Data Science Cloud and Orchestrated Clinical Trials platform to integrate multi-source data, from electronic health records to patient-reported outcomes, enabling sponsors to gain predictive insights that optimize trial design and execution. Recent earnings reports underscore strong demand for these solutions, with Q2 results reflecting a stabilization in biopharma spending and renewed client confidence.

Syneos Health has distinguished its offerings through the Syneos One platform and Trusted Process® methodology, incorporating AI-driven data management workflows and advanced biostatistics capabilities that accelerate time to insight. Parexel’s emphasis on real-world evidence and regulatory advisory services ensures that clients navigate global submission requirements with precision, while ICON’s comprehensive analytics suite integrates risk-based monitoring and adaptive design features that support both early and late-phase development.

Other notable players, including Medpace, Thermo Fisher’s PPD, and Charles River Laboratories, are expanding their analytics footprints through targeted acquisitions and collaborative partnerships, enhancing capacity in specialized domains such as oncology biomarker analytics and decentralized trial operations. Collectively, these companies are driving competitive differentiation through end-to-end analytics ecosystems, where integrated data management, visualization, and reporting tools support seamless decision-making across the clinical lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Analytics Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADM Korea Inc.

- Alcura

- Atorus

- Caidya

- Charles River Laboratories International, Inc.

- Clario

- Clarivate PLC

- CliniMed LifeSciences

- ConcertAI LLC by SymphonyAI Company

- Cytel Inc.

- eClinical Solutions LLC

- Eurofins Scientific SE

- Fortrea Inc.

- Hexaware Technologies limited

- ICON PLC

- Infosys Limited

- Insight Clinical Trial Design & Analysis

- Instem Group of Companies

- IQVIA Inc.

- Laboratory Corporation of America Holdings

- MaxisIT Inc.

- MED Institute Inc.

- Medidata by Dassault Systèmes S.E.

- Medpace, Inc.

- Omega Healthcare Management Services

- OpenClinica, LLC

- Oracle Corporation

- Parexel International (MA) Corporation

- Phygital Insights

- PPD, Inc. by Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Quanticate International Limited

- Revvity, Inc.

- Saama Technologies, LLC

- SAS Institute Inc.

- SG Analytics Pvt. Ltd.

- SGS S.A.

- Signant Health

- SyMetric by Achiral Systems Pvt. Ltd.

- Syneos Health, Inc.

- Veeva Systems Inc.

- Veristat LLC

Delivering Actionable Recommendations to Help Industry Leaders Overcome Challenges and Harness Future Opportunities in Clinical Trial Analytics

Moving forward, industry leaders should prioritize the integration of AI-driven predictive models to refine trial design, anticipating patient recruitment bottlenecks and potential safety signals before they materialize. This will require investment in advanced machine learning frameworks and cross-functional teams that combine domain expertise with data science skills. Moreover, scaling decentralized trial capabilities through secure cloud platforms and digital biomarkers will be essential to broaden patient diversity and enhance trial resilience against external disruptions.

To navigate evolving tariff landscapes and supply chain complexities, sponsors must establish regional sourcing strategies and cultivate strategic partnerships with local vendors for critical trial supplies. Early identification of cost drivers and flexible contracting approaches can mitigate budget overruns, while real-time cost analytics embedded within trial management systems enable proactive financial oversight.

Given the regulatory convergence across geographies, adopting a unified compliance analytics framework can harmonize reporting requirements and reduce administrative burdens. Organizations should leverage centralized dashboards that track global site performance, regulatory milestones, and patient safety metrics to ensure alignment with regional guidelines and expedite submission timelines. By embracing these strategic recommendations, industry leaders can enhance trial efficiency, maintain competitive advantage, and deliver innovative therapies to patients more swiftly.

Outlining the Rigorous Multi-Method Research Methodology Underpinning the Analysis of Clinical Trial Analytics Services and Industry Dynamics

The analysis underpinning this report is built on a rigorous, multi-method research methodology designed to ensure depth, accuracy, and relevance. Primary research involved structured interviews and focused briefings with senior executives from leading pharmaceutical companies, contract research organizations, and technology vendors, providing firsthand insights into evolving market dynamics and unmet needs.

Secondary research included a comprehensive review of regulatory guidelines, industry publications, and recent financial reports, combined with an extensive examination of academic and whitepaper literature to validate emerging trends. Proprietary databases and data integration platforms were employed to collate and normalize global trial activity, investment patterns, and technology adoption metrics. Quantitative data were triangulated with expert perspectives to develop robust segmentation frameworks and regional analyses.

This blended approach ensures that the report reflects both empirical data and strategic foresight, offering stakeholders a nuanced understanding of clinical trial analytics services. Methodological safeguards, including cross-validation of sources and iterative hypothesis testing, underpin the credibility of our findings and support informed decision-making across the clinical development lifecycle.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Analytics Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Analytics Services Market, by Phase

- Clinical Trial Analytics Services Market, by Services

- Clinical Trial Analytics Services Market, by Treatment Type

- Clinical Trial Analytics Services Market, by Therapeutic Area

- Clinical Trial Analytics Services Market, by End User

- Clinical Trial Analytics Services Market, by Deployment

- Clinical Trial Analytics Services Market, by Region

- Clinical Trial Analytics Services Market, by Group

- Clinical Trial Analytics Services Market, by Country

- United States Clinical Trial Analytics Services Market

- China Clinical Trial Analytics Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways and Insights to Highlight the Strategic Imperatives and Future Directions in Clinical Trial Analytics

The convergence of technological innovation, evolving regulatory landscapes, and strategic sourcing imperatives is reshaping the clinical trial analytics market. AI and real-world evidence are no longer auxiliary functions but core components of trial design, operational oversight, and post-market evaluation. Regional diversification and tariff-induced supply chain realignments are prompting sponsors to adopt agile, localized strategies that balance cost efficiency with compliance and speed to market.

Robust segmentation across trial phases, service categories, treatment types, therapeutic areas, end users, and deployment models provides a structured lens for tailoring analytics solutions to meet unique trial requirements. The competitive landscape is characterized by companies that excel in integrated analytics ecosystems, combining data management, visualization, and predictive modeling to deliver end-to-end insights.

Leaders who embrace AI-driven decision support, scalable decentralized trial infrastructures, and unified compliance frameworks will thrive in this dynamic environment. As clinical trial analytics becomes ever more strategic, organizations that leverage comprehensive, data-driven insights will accelerate development timelines, optimize resource allocation, and ultimately enhance patient outcomes. These strategic imperatives will define success in the next era of clinical research.

Engaging Decision Makers with a Compelling Invitation to Connect and Secure the Comprehensive Clinical Trial Analytics Market Research Report

To explore the full spectrum of insights, data, and strategic analyses presented in this comprehensive market research report on clinical trial analytics services, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Connect today and secure your copy to empower your organization with the critical intelligence needed to drive innovation, optimize trial performance, and stay ahead of the competition in a rapidly evolving landscape.

- How big is the Clinical Trial Analytics Services Market?

- What is the Clinical Trial Analytics Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?