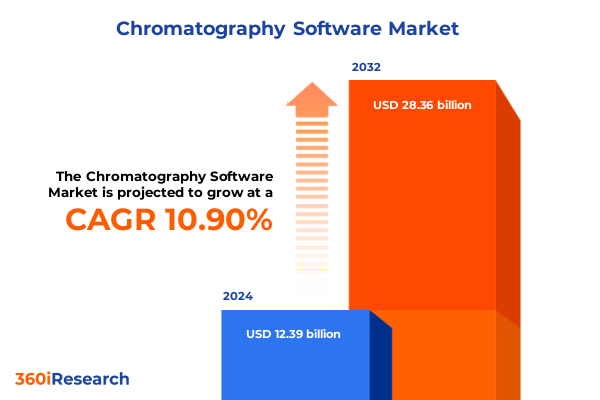

The Chromatography Software Market size was estimated at USD 13.60 billion in 2025 and expected to reach USD 14.93 billion in 2026, at a CAGR of 11.06% to reach USD 28.36 billion by 2032.

A Comprehensive Introduction that Frames the Innovations and Market Drivers Shaping the Evolution of Chromatography Software Solutions

The landscape of analytical science has evolved dramatically, with chromatography software now at the core of extraordinary innovation in laboratories worldwide. Driven by the convergence of high-resolution instrumentation, stringent regulatory frameworks, and an accelerating demand for robust data integrity, modern chromatography informatics platforms have become indispensable for researchers and quality control specialists alike. From drug discovery to environmental monitoring, these systems unify complex datasets, streamline compliance, and enable real-time decision making, thereby transforming traditional analytical workflows into digitally empowered operations. Advances in analytical techniques, the need for greater automation, and rising integration with laboratory information management systems have all contributed to the rapid expansion of chromatography software solutions in both academia and industry

Identifying Transformative Shifts in Technological Capabilities and Digital Integration Redefining Chromatography Software Applications

As laboratories transition from legacy standalone data systems to integrated, cloud-ready platforms, a profound shift is underway in how chromatographic data is acquired, processed, and analyzed. The demand for remote access and collaboration has fueled widespread adoption of cloud-based chromatography software, enabling cross-site project coordination and eliminating infrastructure constraints. Concurrently, integration with artificial intelligence and machine learning technologies is redefining the capabilities of chromatographic data systems, offering automated peak detection, predictive analytics for method development, and enhanced anomaly detection that reduce error rates and accelerate time to result.

In parallel, regulatory mandates under 21 CFR Part 11 and EU Annex 11 have driven laboratories to upgrade to compliant-ready platforms. Enhanced audit trails, electronic signatures, and built-in validation features now underpin every software release, ensuring data integrity and simplifying regulatory submissions. This confluence of cloud migration, AI integration, and compliance-centric design represents a transformational shift that is redefining user expectations and catalyzing the next generation of chromatography software innovation.

Assessing the Cumulative Impact of United States Tariffs Enacted in 2025 on Chromatography Software Supply Chains and Cost Structures

The United States’ tariff landscape in 2025 has introduced new cost considerations for technology-dependent industries, with indirect implications for software and service providers. While tariffs primarily target hardware imports, such as servers and electronic components, software vendors must absorb rising infrastructure costs or pass them to customers through adjusted pricing. Analysts warn that laboratory software providers relying on foreign-manufactured servers and networking equipment could face up to double-digit increases in deployment and maintenance expenses, necessitating strategic supply chain adjustments.

Beyond hardware, the broader high-tech tariff measures have created an environment of uncertainty, prompting some chromatography informatics companies to consider nearshoring data center operations and forging alternative partnerships with domestic hardware manufacturers. This dynamic has accelerated shifts toward hybrid cloud architectures, allowing laboratories to maintain critical on-premise capabilities while leveraging cloud services for scalability and resilience. By proactively addressing these tariff-driven cost pressures, software providers can mitigate financial risk and preserve service levels for end users.

Unveiling Key Segmentation Insights for Chromatography Software Based on Type Application End User and Deployment Models

Insights into market segmentation by type reveal that Gas Chromatography, encompassing both capillary and packed column subtypes, maintains a foundational position in analytical workflows, while HPLC technologies-spanning ion exchange, normal phase, reversed phase, and size exclusion applications-together form the core of liquid chromatographic analysis. Further diversification emerges through Ion Chromatography, essential for trace anion and cation quantitation, alongside Supercritical Fluid Chromatography and Ultra-High Performance Liquid Chromatography, which address demand for faster, higher-resolution separations.

Application-driven segmentation underscores the versatility of chromatography software across academic and research settings, clinical diagnostics, environmental analysis, food and beverage quality testing, petrochemical profiling, and pharmaceutical and biotechnology development. This breadth of uses drives feature innovation, from advanced method development Wizards to specialized compliance modules.

End users, including academic and research institutes, contract research organizations, environmental testing laboratories, food and beverage manufacturers, government and regulatory agencies, and pharmaceutical and biotechnology companies, shape the competitive landscape by demanding industry-grade security, audit-ready reporting, and seamless integration with laboratory information management systems.

In terms of deployment, the choice between cloud-based and on-premise solutions reflects organizational priorities: hybrid, private, and public cloud deployments offer rapid scalability and global collaboration, while enterprise suite and standalone on-premise installations provide maximum control, compliance assurance, and performance predictability.

This comprehensive research report categorizes the Chromatography Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Deployment

- Application

- End User

Revealing Key Regional Insights Based on Market Adoption Trends and Growth Drivers across Americas EMEA and Asia-Pacific

Across the Americas, laboratories benefit from robust pharmaceutical and biotechnology sectors that drive early adoption of sophisticated chromatography software platforms. Regulatory authorities such as the FDA and EPA enforce stringent compliance requirements, encouraging integration of enhanced audit-trail functionalities and electronic signatures within data systems. Furthermore, North America’s strong digital infrastructure and substantial R&D investments foster a culture of innovation, supporting the emergence of AI-driven analytics and cloud-native deployment models that enhance remote collaboration and data-driven decision making.

In Europe, stringent environmental regulations and rigorous pharmaceutical quality standards propel demand for chromatography software solutions tailored to compliance and traceability. Markets in Germany, the U.K., and France lead the region’s growth, supported by government incentives for laboratory automation and digital transformation. Cross-sector collaborations between academia, industry, and regulatory bodies accelerate the development of customizable data management systems that address both laboratory efficiency and the need for secure data governance.

Asia-Pacific represents the fastest-growing region, driven by rapid expansion of pharmaceutical manufacturing, biotechnology research, and food safety testing laboratories, particularly in China, India, and Japan. Government initiatives that promote laboratory digitalization, coupled with an emphasis on drug safety and precision medicine, spur adoption of cloud-based instruments and AI-enabled chromatography data systems. Despite challenges such as varying regulatory frameworks and infrastructure disparities, the region’s commitment to innovation and cost-effective solutions ensures sustained market momentum.

This comprehensive research report examines key regions that drive the evolution of the Chromatography Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Insights into Leading Chromatography Software Providers and Their Strategic Advances in the Market Landscape

Agilent has continued to enhance its OpenLab platform with the release of OpenLab CDS 2.8, which introduces expanded calibration and quantification tools, enhanced data integrity features, and specialized support for biopharma workflows. These improvements streamline workflows for energy, chemical, and pharmaceutical laboratories by optimizing legacy system migrations and integrating advanced compliance safeguards.

Thermo Fisher Scientific’s Chromeleon 7.4 marks a strategic milestone in chromatography data system evolution, consolidating mass spectrometry and chromatography laboratories under a unified, server-based architecture. The update delivers advanced deconvolution support for intact mass analysis, data-dependent acquisition, and targeted library searching, empowering labs to manage complex MS workflows in compliance with regulatory guidelines and secure remote access capabilities.

Waters Corporation has significantly expanded the scope of its Empower software by integrating Multi-Angle Light Scattering (MALS) and differential refractive index detectors from the Wyatt Technology portfolio. This integration enables biopharmaceutical labs to reduce software validation timelines by up to six months, accelerate biotherapeutic peptide and protein analysis by 20%, and streamline compliant data acquisition across critical quality attributes, reinforcing Empower’s status as an industry-leading chromatography data system.

Shimadzu’s LabSolutions MD leverages analytical quality by design principles to facilitate HPLC and UHPLC method development through design of experiments workflows. By automating parameter screening for columns and mobile phases, the software accelerates method optimization, reduces experimental iterations, and enhances reproducibility for high-throughput laboratories focused on stringent regulatory and quality control requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chromatography Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Chemistry Development, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Chromperfect Chromatography Software

- Danaher Corporation

- DataApex Ltd.

- eDAQ PTY Ltd.

- Gilson, Inc.

- JASCO Corporation

- KNAUER Wissenschaftliche Geräte GmbH

- Lablicate GmbH

- LECO Corporation

- PerkinElmer, Inc.

- Schlumberger Limited

- Sepragen Corporation

- Shimadzu Corporation

- SRI Instruments

- Sykam GmbH

- Thermo Fisher Scientific Inc.

- Waters Corporation

Actionable Recommendations to Guide Industry Leaders in Optimizing Strategies for Chromatography Software Development and Deployment

Industry leaders should prioritize integration of AI-driven analytics capabilities within chromatography software to deliver automated peak detection, predictive method development, and anomaly recognition that reduce manual intervention and accelerate throughput. By embedding machine learning modules directly into informatics platforms and leveraging open APIs, providers can offer differentiated solutions that address both routine and complex analytical challenges.

Embracing hybrid cloud architectures will enable software vendors to balance the scalability and collaborative advantages of public and private clouds with the performance and compliance needs of on-premise deployments. Labs can then dynamically allocate workloads, optimize costs, and maintain control over sensitive data, ensuring resilience against hardware-related tariff impacts and evolving cybersecurity threats.

To further enhance market positioning, companies should develop modular compliance toolkits that simplify adherence to global regulatory frameworks, including 21 CFR Part 11, EU Annex 11, and emerging data-integrity guidelines. Providing pre-validated templates, automated audit-trail reporting, and seamless integration with electronic lab notebooks and LIMS will empower customers to achieve audit readiness with minimal resource investment.

Detailed Research Methodology Outlining Rigorous Primary and Secondary Research Techniques Supporting the Chromatography Software Report

This research combines primary and secondary methodologies to ensure comprehensive and objective insights. Primary research involved in-depth interviews with laboratory directors, informatics managers, and regulatory experts across pharmaceuticals, environmental testing, and food safety organizations. These interviews captured real-world requirements, emerging challenges, and strategic priorities.

Secondary research encompassed a thorough review of industry publications, peer-reviewed journals, white papers, and market reports, supporting triangulation of data points and validation of key trends. Competitive benchmarking and analysis of publicly disclosed company financials and product roadmaps provided context for vendor strategies and market positioning. Data synthesis employed rigorous quality checks and collaboration with subject-matter specialists to deliver a robust foundation for the conclusions and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chromatography Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chromatography Software Market, by Type

- Chromatography Software Market, by Deployment

- Chromatography Software Market, by Application

- Chromatography Software Market, by End User

- Chromatography Software Market, by Region

- Chromatography Software Market, by Group

- Chromatography Software Market, by Country

- United States Chromatography Software Market

- China Chromatography Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Comprehensive Conclusion Summarizing the Strategic Imperatives and Future Outlook for Chromatography Software Market Stakeholders

The evolution of chromatography software reflects a broader transformation within analytical laboratories toward digitization, automation, and data-centric decision making. As AI-enabled features, cloud-native architectures, and compliance-focused design become standard, vendors and end users alike must embrace change to unlock new levels of productivity and scientific innovation. Strategic investments in advanced informatics, diversified deployment models, and user-centric interfaces will determine the market leaders of tomorrow. Laboratories that adopt these integrated, next-generation solutions will not only ensure data integrity and regulatory compliance but also gain the agility to respond to complex analytical challenges and accelerate time to critical insights.

Unlock Exclusive Chromatography Software Market Insights by Engaging with Ketan Rohom to Propel Your Strategic Growth

To explore the full depth of market trends, strategic insights, and expert analyses in the chromatography software industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report and gain a competitive edge in your decision-making process.

- How big is the Chromatography Software Market?

- What is the Chromatography Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?